Authored by Steven Englander via Standard Chartered,

Investors haircut FOMC projections

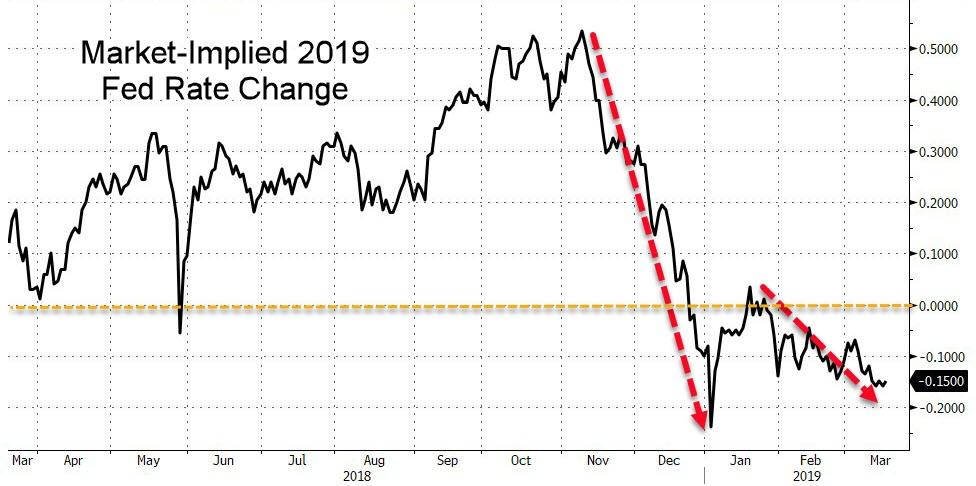

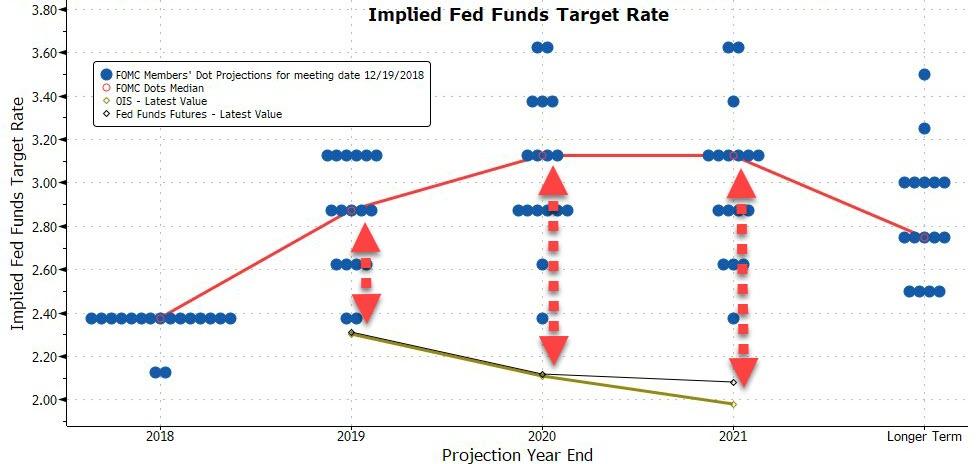

End-2019 Fed funds expectations have dropped 22bps since the last FOMC, so investors will likely expect a significantly more dovish tone. We think shifting to one hike each in 2019 and 2020 is roughly neutral for investors.

One + one would convey to the market that the FOMC expects future hikes to be isolated and limited, in line with being ‘data dependent’. In the context of largely positive growth and inflation forecasts, two isolated hikes would be optimistic but not aggressively hawkish. One + one would continue the downward trend in projected Fed hikes.

We expect initial market uncertainty over whether one + one is sufficiently dovish relative to market expectations. This one + one scenario would leave the peak FOMC projection about 50bps higher than the current level of Fed funds, but we think investors see the FOMC projections as fair-weather expectations, corresponding to, say, the 80th percentile of optimism, not a median or probability-weighted outcome. We think a 50-60bps haircut to the FOMC projections looks about right in market terms. Our economists think the Fed may de-emphasise the dots, but it is unlikely that it will cancel the projections without prior notice.

By contrast, shifting to a single hike in 2019 and none in 2020 would be unambiguously dovish, despite suggesting rates that are higher than current levels. The market focus would be on the Fed confirming rates are close to a peak. From the investor viewpoint, the indication of a peak would be a signal that the Fed was pretty sure it was close to neutral and risk to policy rates was skewed to the downside.

The one + zero rate-hike projection would probably be accompanied by lower estimates of equilibrium unemployment and policy rates. This would be a powerful signal that FOMC participants have shifted their underlying view of inflation dynamics to the downside and they see only a modest risk that rates would go much higher. Lowering inflation projections in this scenario is unambiguously dovish, but keeping them unchanged is not necessarily hawkish. The Fed may want to signal that a small overshoot is desired.

From the markets’ perspective, the one + zero (and much less likely, zero + zero) scenario would likely push US and global yields even lower. Investors would probably see only a modest chance of even a single hike and split the remaining probability between flat and one or more instances of easing. The equities higher trade is most clear. Bond yields would probably go lower, but there is a floor to rates unless the economic data deteriorates enough to justify raising the probability of easing. The USD would fall sharply in the first instance versus both G10 and EM FX but a strong equities bounce could moderate the impact. A sustained USD slide may require a combination of further US economic weakness and some indication of emerging recovery abroad.

Given the shift in Fed rhetoric and market pricing, staying at two + one would be very hawkish. Investors discount the dot plot projections, but would be concerned that the shift in narrative was not visible in the projections. Two projected hikes in 2019 would suggest that the Fed would either be expecting a hike in June or two hikes in a row in H2-2019. Investors would see that as suggestive that FOMC members were seeing a pause, but not an end, to the hiking cycle.

This hawkish perception would probably persist even if the FOMC dropped the 2020 hike, because the two 2019 hikes would suggest stronger determination on a hiking sequence than recent comments suggest. Investors would put more emphasis on the two hikes than on the subsequent pause. Whereas one + one is likely to be seen as isolated and tentative, two + zero would be seen as pretty committed to at least one hike in 2019 – and if it is certain the Fed wants to hike in 2019, how can investors be confident hiking will be done in 2020?

The Fed has sent clear signals that it intends to finish balance-sheet reduction in 2019. Investors have stopped worrying about balance-sheet shrinkage as a major risk to money-market rates and long-term yields. Provided the Fed does not surprise on the hawkish side, for example, by continuing the current pace of shrinkage all the way to year-end and then stopping, or shifting to an all Treasury bill portfolio, investors would be satisfied, in our view.

Questions that will likely be asked of Fed Chair Powell are:

(1) whether the Fed will shift to a price-level target or another alternative to inflation targeting plus modern monetary theory (MMT),

and (2) the Fed’s view on MMT.

Showing a leaning towards a price-level target would be market moving, as it would suggest greater tolerance for an overshoot in this cycle, even if the discussion formally referred to future monetary policy. We think the Fed will ultimately opt for the Bernanke proposal, but for now the market view will be that if the Fed is pointing to future efforts at making up past inflation shortfalls, it is likely tolerant of overshoots in the current cycle as well (see Fed comments feed long-term investor dovishness).

The Fed’s view on MMT is likely to be unfavourable, given that MMT pretty much implies a money-printing, rubber-stamping Fed that would lose its pre-eminence in policy making. However, the Fed is unlikely to want to preclude fiscal policy from having a role in any major future slowdown, as it easy to question whether even a price-level-targeting Fed could generate enough stimulus to offset a major shock. In the framework of a press conference, making the case for fiscal expansion as a ‘sometime, but not all the time’ macro tool could be tricky.

via ZeroHedge News https://ift.tt/2Cm2P8r Tyler Durden