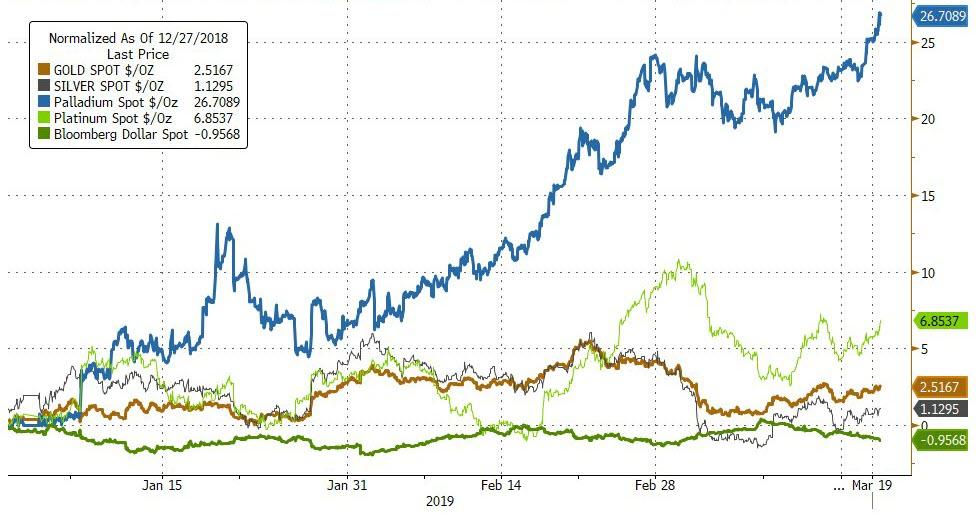

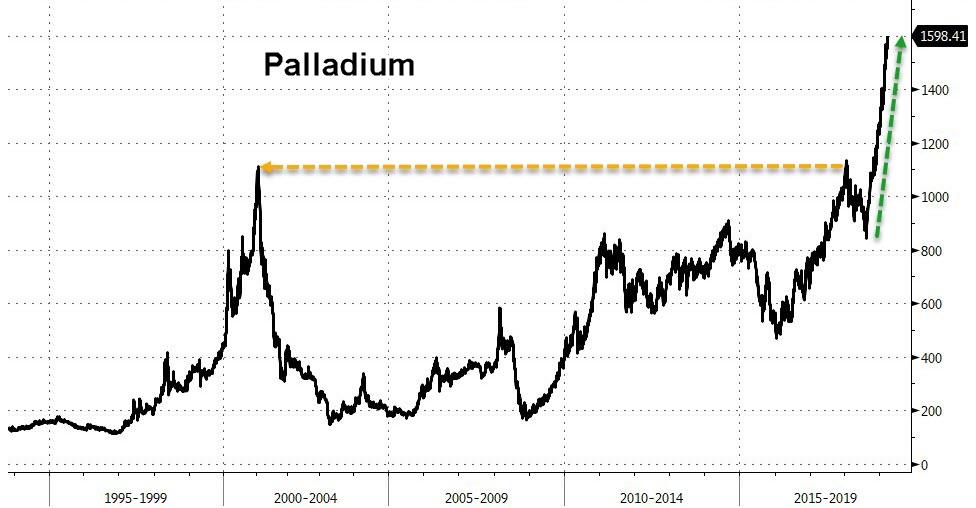

Palladium soared to a new record high over $1600 an ounce overnight, up 27% year-to-date, as global supply concerns dominate slumping-auto-demand fears.

Palladium has become the precious-est of precious metals in 2019…

Up a stunning 89% from its August 2018 dip lows…

Even as auto sales in key markets slow around the world, Bloomberg reports that demand for the metal – mainly used in auto catalytic-converters in gasoline vehicles – has remained robust as manufacturers scramble to get hold of palladium to meet more stringent emissions controls, particularly in China.

“Though there are concerns that auto sales are falling, the supply deficit problem is offsetting it,” said Ajay Kedia, director at Kedia Commodities in Mumbai, adding the market is highly overbought.

The metal’s rally is even stirring debate about whether automakers can make the switch to cheaper platinum to help control their costs.

“We remain bullish on palladium since the physical palladium market remains tight and it will take years to substitute,” analysts at Citigroup Inc. wrote in a March 19 report.

“However, at these higher prices we are acknowledging the increase in downside risks relating to potential substitution headlines.”

However, it is the supply-side of the equation that warrants more geopolitically-relevant analysis as Reuters reports that Russia is mulling a ban on the export of precious metals scrap and tailings to promote domestic refining of the materials.

“The market is in uncharted territory and on the fundamental side the ban from Russia has supported the prices,” Kedia added.

More than 80% of palladium comes as a byproduct from nickel mining in Russia and platinum mining in South Africa, so supplies depend on the extraction level in other minerals, and more specifically, Russia was responsible for around 21% of total palladium exports in 2017 by value.

With the price of palladium skyrocketing, that’s led to a rise in brazen thefts of catalytic converters, the Wall Street Journal reports. A Toyota Prius converter has about 2 grams of harvestable palladium, which can fetch about $450 at a scrapyard.

“We’ve had three different sets of parking lots hit, and they usually get four or five vehicles each time,” police Lt. Chuck Nagle in Vestavia Hills, Ala., told the WSJ.

“They’re usually taking them out of state and getting anywhere from $150 to $200 at a clip. … They’re not selling the part. They’re selling the metal.”

So with Putin cornering the palladium market (a precious metal 30 times more rare than gold), sending the price explosively higher, one wonders just what would happen if China chokes up supply of the rare earth metals that are so critical to much of America’s military-industrial complex?

via ZeroHedge News https://ift.tt/2uoiNuJ Tyler Durden