On Monday night, the Securities and Exchange Commission responded to Elon Musk’s “contempt” defense, shredding Musk’s arguments and making it clear that the regulatory agency will not back down in its attempt to get Musk held in contempt of court following a February tweet regarding Tesla’s production guidance.

Musk had argued against the contempt of court motion days ago, with his well-paid lawyers bizarrely calling it an “unconstitutional power grab”. Musk’s lawyers argued, on his behalf, that production numbers – the lifeblood of the company’s relationship to Wall Street – were immaterial, also claiming that the Tweet “dutifully complied with the [settlement] Order”.

The SEC made it clear in their response that they saw things very differently. They eviscerated the argument that production numbers were somehow not material, arguing:

“Musk’s recognition of the significance of Tesla’s vehicle production forecasts to investors is evidenced by the frequency with which he and Tesla highlight such forecasts in their public statements. For years and continuing through the company’s most recent earnings release, Tesla and Musk have prominently featured vehicle production forecasts in their public communications, including Tesla’s investor letters, Musk’s tweets, and the company’s filings with the SEC.

While some companies emphasize forward-looking guidance on financial metrics such as revenue and earnings per share, Tesla often highlights guidance regarding expected production rates and deliveries. Given this focus on Tesla’s production capabilities, Musk cannot credibly argue that his statement, as Tesla’s CEO, that the company ‘will make around 500k’ cars in 2019 could not have reasonably contained information material to Tesla and its investors.”

The SEC continued, referring to Musk’s Tweet as “reckless conduct” and calling it “stunning” that Musk had not sought pre-approval for a single Tweets about Tesla since his settlement forcing him to do just that:

“The pre-approval requirement was designed to protect against reckless conduct by Musk going forward. It is therefore stunning to learn that, at the time of filing of the [contempt] motion, Musk had not sought pre-approval for a single one of the numerous tweets about Tesla he published in the months since the court-ordered pre-approval policy went into effect. Musk reads this Court’s order as not requiring pre-approval unless Musk himself unilaterally decides his planned tweets are material. His interpretation is inconsistent with the plain terms of this Court’s order and renders its pre-approval requirement meaningless.”

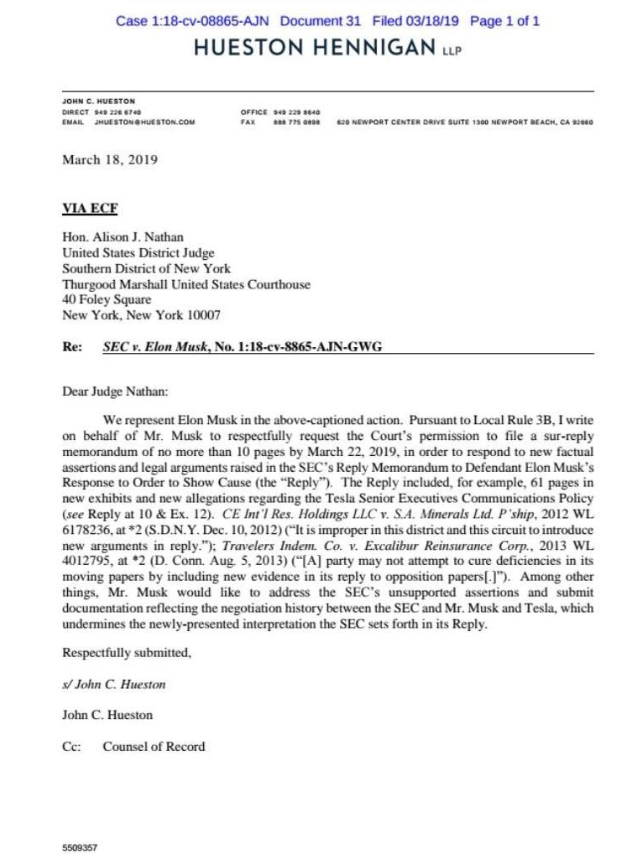

The SEC did not request specific relief in its brief. Before the night was over on Monday, a letter from Musk’s attorneys hit the docket, requesting the court’s permission to file a sur-reply by March 22 to respond to the SEC as all signs point to Musk wanting to continue his fight, head on, with the regulatory agency.

The SEC has been looking to hold Tesla CEO Elon Musk in contempt for breaching a court ordered settlement that Musk slithered away with as a result of his fraudulent tweet from last summer claiming he had funding secured for the buyout of Tesla at $420 per share. After the SEC alleged that a recent Tweet from February 19 was in violation of Musk’s court order to have his social media posts pre-approved by a lawyer, Musk responded to the SEC action in late February by calling the agency “embarrassing”.

The SEC FOIA experts at Probes Reporter said that the agency’s contempt motion response shows that they are “playing for keeps” and will “crush Musk if needed”.

The pressing danger for Tesla is @elonmusk’s blatant contempt for and insults aimed at the SEC. The insults, while petulant, are mostly noise. But the SEC views Musk’s defiance as a challenge to its very authority. They’re playing for keeps and will crush Musk if needed. $TSLA

— Probes Reporter® (@probesreporter) March 19, 2019

The rest of Twitter, as usual, was vocal in its response to the filing.

Musk demands that Judge Nathan allow him to make a further mockery of the court $tsla pic.twitter.com/ParXjQDSr9

— EVent Horizon (@evdefender) March 19, 2019

Lmao watching this Theranos @HBO documentary; this is def the $TSLA prequel.

— Sergeant Major (@samanjar3d) March 19, 2019

Thread re: the SEC reply to @elonmusk’s reply.

THE SEC IS NOT FUCKING AROUND, BRO.

— The Smartish Guy In The Room (@stagnantshares) March 19, 2019

Wow. The SEC absolutely destroys every single argument that Musk made in his show cause argument with ease. I can’t wait to see Musk get the book thrown at him. D&O bar should absolutely be the outcome – seems clear by the SEC’s language that they’ve had enough of Musk. $TSLA

— Pivotal Capital (@Pivotal_Capital) March 19, 2019

future inmate returning to scene of crime … like right at this exact moment $tsla pic.twitter.com/AAuQaDKewo

— EVent Horizon (@evdefender) March 19, 2019

“The SEC requests that this court hold Musk in contempt and impose an appropriate remedy to ensure future compliance,” the filing concludes.

At this point, the ball is in the court of U.S. District Judge Alison Nathan, who has the authority to issue additional legal remedies such as additional fines and officer/director bars.

You can read the SEC’s full reply brief here.

via ZeroHedge News https://ift.tt/2OaK1Oc Tyler Durden