With the S&P trading not far from its all time highs, conventional wisdom would suggest that actively managed asset managers and hedge funds have never had it easier to attract outside capital. Unfortunately for the actively managed community, in a world in which central banks have made all risks redundant (and staked their credibility and reputation on overturning the business cycle while assuring no more bear markets) alpha generation has become virtually impossible and as a result, last week Hedge Fund Research reported that new hedge fund launches have sunk to their lowest level since the start of the century as untried managers struggled to attract capital in 2018, a year of widespread disappointment for investors in the asset class.

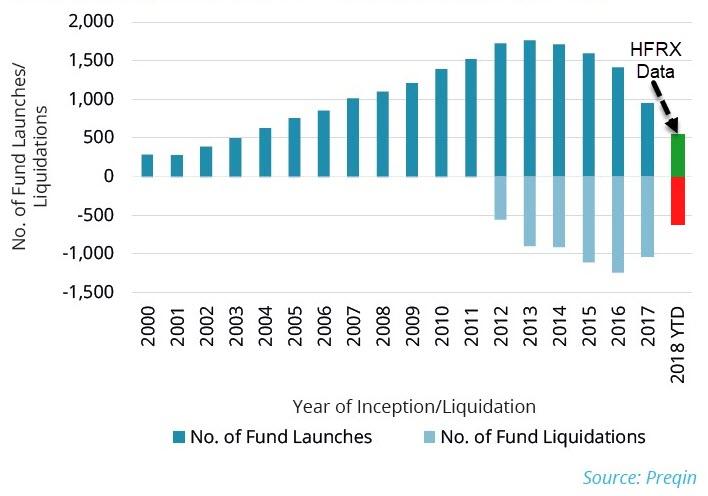

How bad is it? In 2018, just 561 new hedge funds were launched, the lowest number since 2000 while total fund liquidations surpassed new launches for the second year in a row.

Meanwhile, average hedge fund management fees remained at the lowest level since HFR began publishing these estimates in 2008, while the average incentive fee fell slightly from the prior quarter. The average management fee remained unchanged at an estimated 1.43 percent, while the average incentive fee fell narrowly by -3 bps to 16.90 percent.

But while US-based fund managers have nothing but stingy LPs and performance fee misery to look forward to, in China – where a new stock market bubble has been forming since the start of the year, just three years after the last bubble burst – it’s never been easier to raise capital.

In fact, as Bloomberg reports, it took just 10 hours for a star Chinese stock picker to attract more than 70 billion yuan ($10 billion) of orders for his new firm’s debut mutual fund, yet another sign of the frothy investor exuberance in the world’s best-performing (for now) equity market.

The fund, which will invest 60% to 95% of its assets in equities, is the manager’s first offering since he left Orient Securities Asset Management Co. after two decades at the state-backed money manager.

According to Bloomberg, Shanghai-based Foresight Fund, managed by Chen Guangming, said on Friday that it stopped accepting client subscriptions after blowing past its 6 billion yuan fundraising target…. in less than half a day! While the fund didn’t disclose the amount of orders it received, people familiar with the matter said they topped 70 billion yuan, including about 20 billion yuan via China Merchants Bank Co.’s fund distribution platform.

The “panic” capital allocation will hardly come as a surprise: investors have piled into China’s $7.2 trillion stock market this year, propelling the Shanghai Composite Index to a 24% gain following encouragement from the government, and buoying an asset-management industry that many see as the last big frontier for international firms like BlackRock and Vanguard. While Chinese policy makers have generally been supportive of the inflows, they would prefer to avoid a repeat of the speculative frenzy that fueled the nation’s 2015 equity boom and bust.

It may, however, be too late as the rush into Chen’s Foresight Fund suggests overshooting is a risk.

Of course, there may be another, simpler reason for the frenzy to allocate capital to Chen: he may be the closest thing China has to a superstar fund manage; one of his old funds has gained about 700% since May 2009, trouncing a 32% increase for the Shanghai Composite over the same period.

The Foresight Fund’s successful debut was driven by a “highly shrewd” sales and marketing campaign that made smart use of social media and will become a case study for international managers seeking to roll out products in China, Z-Ben Advisors, an asset-management research firm, wrote in an emailed note on Friday. BlackRock, Vanguard and JPMorgan Chase & Co. are among global firms that have pursued a bigger presence in China’s asset-management industry after regulators loosened foreign ownership rules.

Of course, there is such a thing as being a too successful trader in China: recall that back in 2016, China’s “Warren Buffett” was arrested on charges of manipulating securities market and inside trading after posting unprecedented gains. Then again, that was after the bubble burst and the government needed a scapegoat; which is why if we were Chen, we’d be nervous – he is now the public face of the latest stock market bubble, which like all bubbles before it, will end in tears.

Until then, however, any “up and rising” US-based hedge fund managers who have found little success in capital raising on US soil may want to try their luck in Shanghai.

via ZeroHedge News https://ift.tt/2WoHG54 Tyler Durden