NIRP is back.

On Friday, when Germany reported disastrous mfg and service PMI prints, the 10Y German Bund finally threw in the towel, with the yield sliding back under zero for the first time in three years. When that happened, and when the 3M-10Y yield curve inverted in the US right around that time, just over $400 billion in global debt changed the sign on its yield from positive to negative.

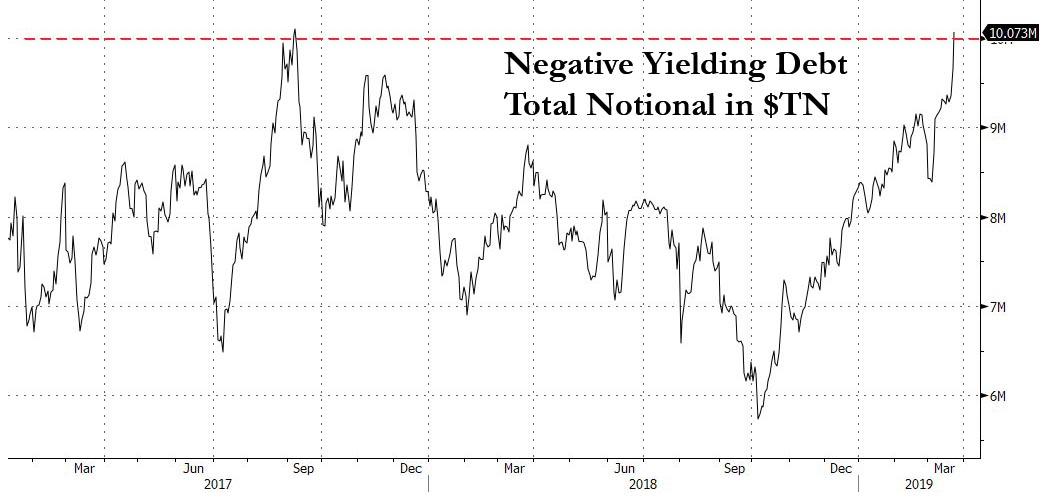

As a result, the total notional of global negative yielding debt soared on Friday, rising above $10 trillion for the first time Since September 2017, and which according to Bloomberg has intensified “the conundrum for investors hungry for returns while fretting the brewing economic slowdown.”

Paradoxically, the amount of negative-yielding debt has nearly doubled in just six months, and confirms that the global asset bubble is back because as Gary Kirk, a founding partner at London-based TwentyFour Asset Management, said “money managers face increasing pressure to reprise the yield-chasing mentality synonymous with quantitative easing.”

“This obviously tempts those investors holding cash to move along the maturity curve — or down the rating curve — to seek yield, which is once again becoming a scarce commodity,” he said. “It’s a classic late-cycle conundrum.”

Despite the Fed’s renewed herding of investors into the riskiest assets, Kirk is so far “resisting the temptation” to snap up longer-dated credit obligations that will be the first to default when the next recession hits, and prefers duration bets in interest-rate markets.

Others won’t be so lucky: as we noted last Friday, the ‘reverse rotation’, or flood into fixed income instruments, is accelerating and fund flows confirmed the fresh panic for yield just as the specter of QE4 returns as investors in the latest week parked $6.6 billion into investment-grade funds, $3.2 billion into high-yield bonds and $1.2 billion into emerging-market debt, according to EPFR data.

“The extraordinary abrupt end to central bank hiking cycle + Fed paranoia of credit event is uber-bullish credit & uber-bearish volatility,” BofA’s Michael Hartnett wrote on Thursday night.

Meanwhile, negative yields mean that investors will lose money just by holding bonds to maturity, and are merely hoping that the Fed’s insanity will push prices even higher, allowing them to sell to other panicked bond investors at even lower yields down the road, which wouldn’t be that difficult if a global depression emerges, resulting in negative growth and/or outright deflation. But – as Bloomberg notes- along the way, risk assets may be entering the danger zone.

“We’ve never seen monetary easing so long, so broad, so big,” William Blair’s Brian Singer told Bloomberg. “What’s happened after every significant period of accommodation is a reckoning. This time the bubble is lower-rated credit and illiquid private assets.”

How or when this bubble ends remains unclear; one thing is certain: when Ben Bernanke said in 2014 that there will be no rate normalization in his lifetime, he was – perhaps for the only time in his career – correct.

via ZeroHedge News https://ift.tt/2U41NZ2 Tyler Durden