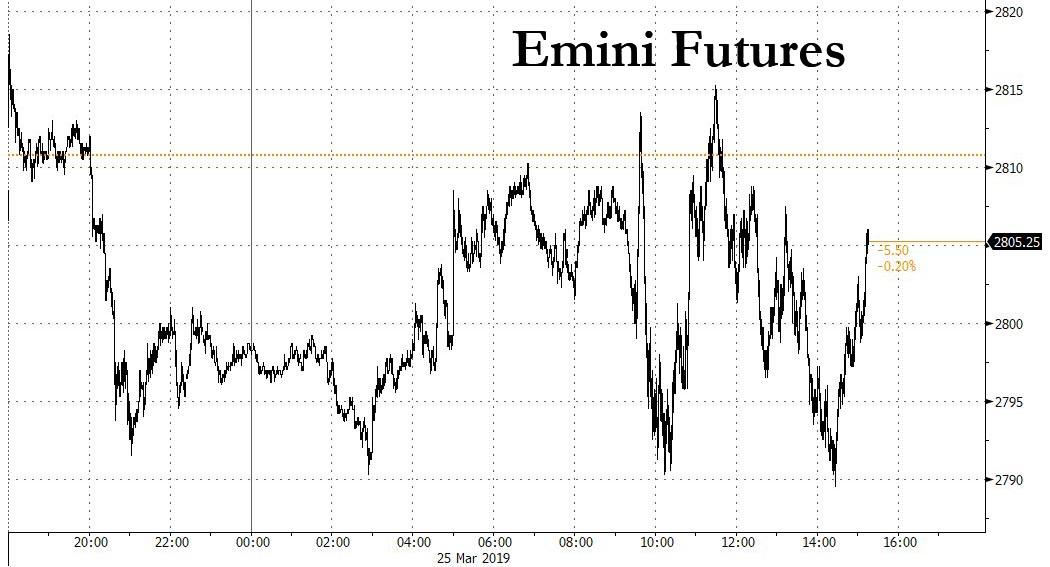

On the same day the MSCI Asia index posted its worst daily drop for 2019 as Asian markets caught up with Friday’s US pounding, it was another ugly day for US stocks which spent most of the day in the red, with the S&P breaching the 2,800 support level, although the Emini failed to drop below 2790 which has emerged as a new key resistance level.

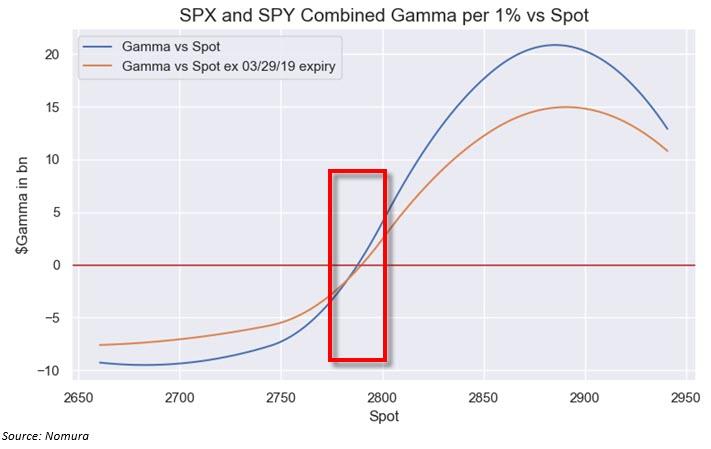

One possible reason for the solid defense: as Nomura’s Charlie McElligott explained earlier, if and when the S&P dips below the “gamma” threshold sell level which is around 2777, both dealers and CTAs would see a pick up in selling, which would then make the market new “default” direction lower and potentially leading to a retest of the December lows.

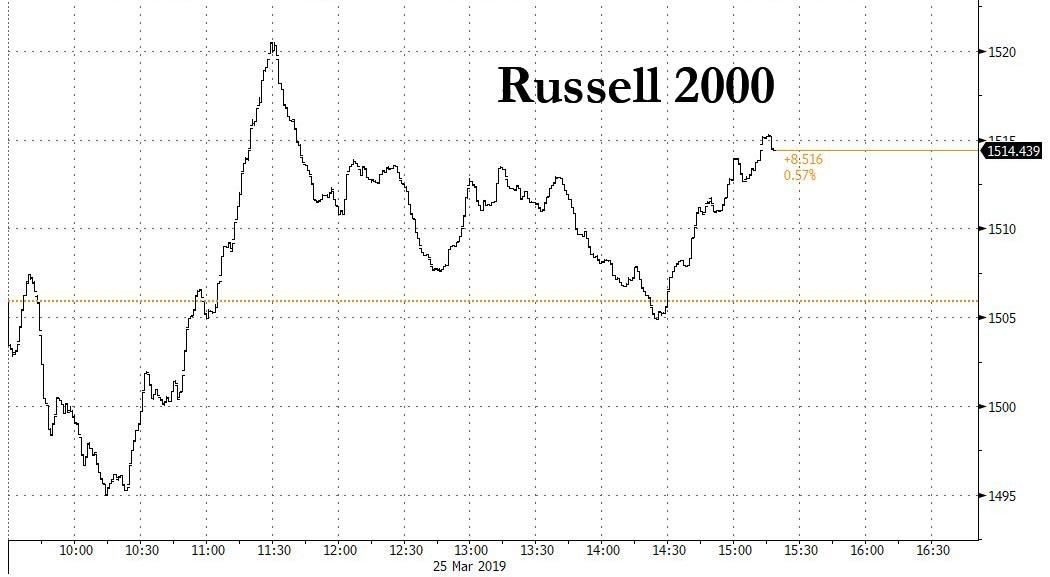

Curiously, despite the Russell 2000 CTAs, which as McElligott noted earlier are currently 50.4% long, and would sell and flip to short under 1536.21 to get to -100% short, the small-cap index held on, and after some initial weakness, managed to stage a sharp rally into the European close, and successfully remained in the green as institutional buying appeared to offset systematic selling.

The Nasdaq closed just barely in the red, and even though most FAANG stocks were green, Apple disappointed, sliding after its major new services unveiling – including a new credit card, streaming video and a video game offering – disappointed traders, with the stock closing 1.3% lower.

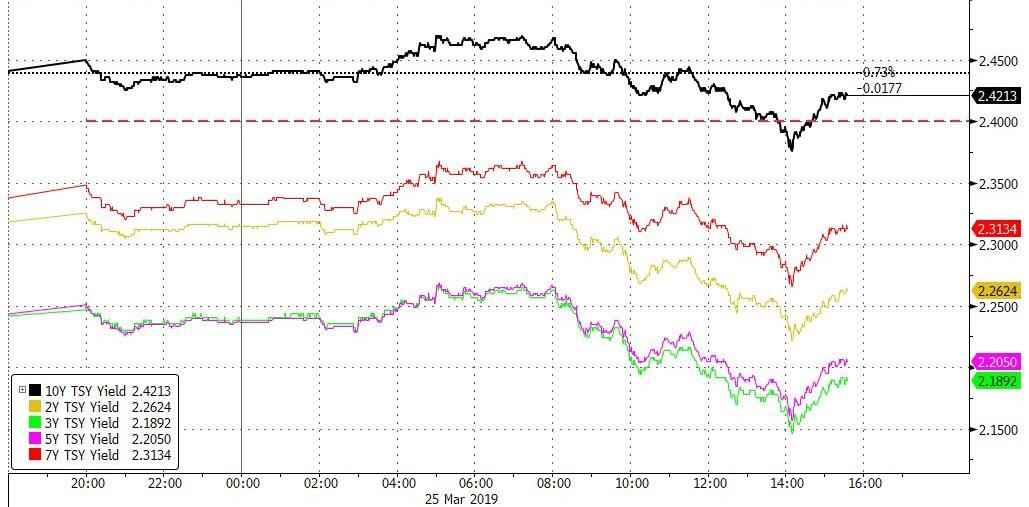

But despite the sharp, if contained gyrations in US equities,the big action was in rates, where earlier today the 10Y yield plunged to the lowest level since 2017 shortly after 2pm, sliding below the effective fed funds rate of 2.40%, only to stage a modest rebound into the close.

Earlier in the session, Australia’s 10-year bond yield dropped to an all-time low and Japan’s hit the lowest since September 2016.

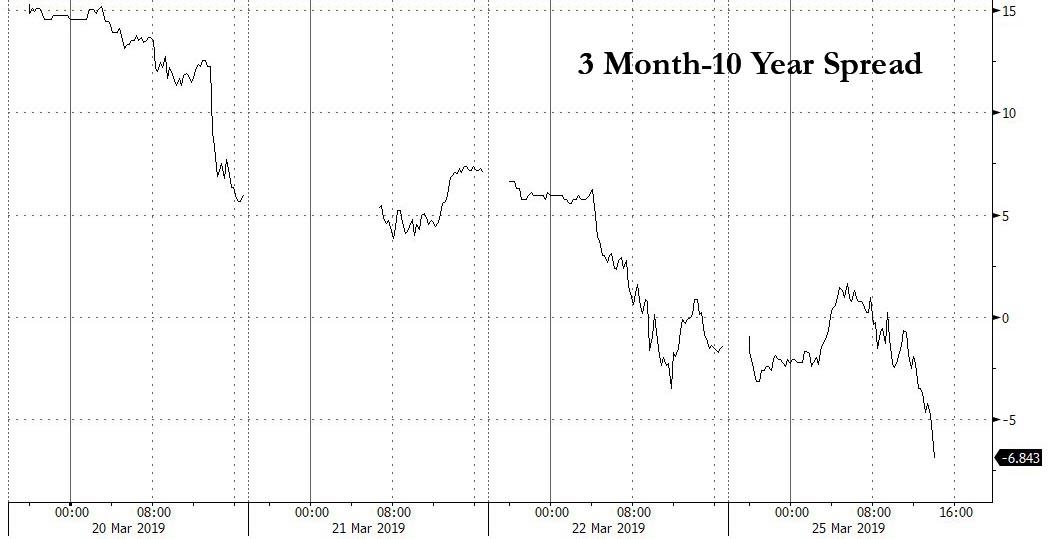

More concerning was the ongoing slide in the 3 Month-10 Year spread – the Fed’s favorite recession indicator – which briefly plunged as much as -7bps before recovering the drop to just -3bps.

It wasn’t clear what precipitated today’s aggressive buying across the curve, although according to Bloomberg’s Edward Bollingbroke, a reason for the move may have been convexity flows (as convexity hedging occurs as mortgage rates fall, making borrowers more likely to refinance; higher expected prepay rates reduce MBS duration, which portfolio managers can then offset via receiving in swaps. It was also a driver behind Friday’s Treasuries rally).

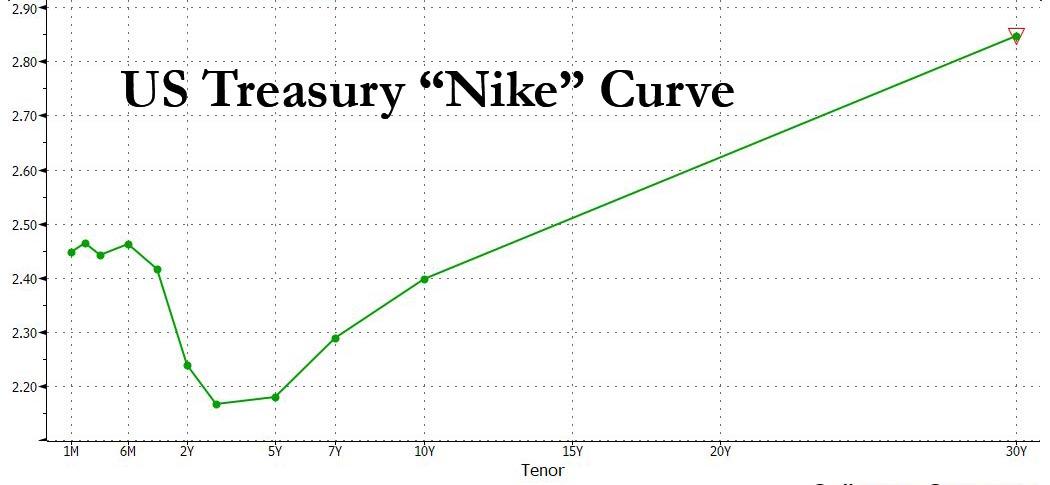

Whatever the reason for the aggressive purchases, the US Treasury “curve” is now anything but…

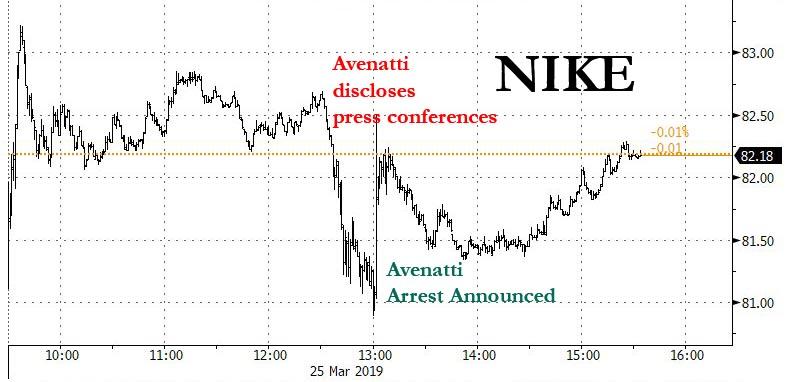

… and in fact looks like the infamous Nike swoosh, which itself was in the news today when it first Tumbled after Michael Avenatti tweeted he would hold a presser exposing criminality at the sport shoemaker, then quickly rebounded on news that the “creepy porn lawyer” had hoped to extort millions of dollars from the company, only to be arrested shortly after his tweet in the latest vindication for Donald Trump.

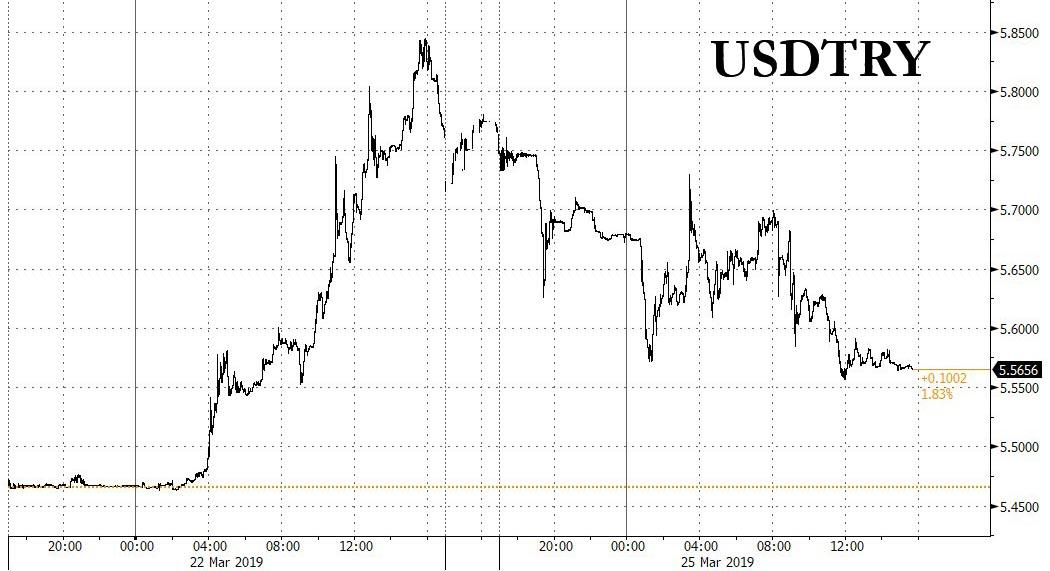

There were far less fireworks in the FX space today: after plunging the most since last summary, on Monday the turkish lira staged a powerful bounce as the USDTRY tumbled the most in almost a year, one day after Turkey threatened to probe JPM for its short lira recommendation and warned manipulators it would go after them personally.

The pound retreated as May said she doesn’t yet have enough support to put her Brexit deal to a vote in Parliament and will continue to try to convince MPs to back it. As lawmakers try to take control of the process, she’s wielding the threat of a long extension if her deal isn’t passed.

Meanwhile, the British pound retreated after fluctuating in early trading in the latest daily stop hunt, as Theresa May said she doesn’t yet have enough support to put her Brexit deal to a vote in Parliament and will continue to try to convince MPs to back it. As lawmakers try to take control of the process, she’s wielding the threat of a long extension if her deal isn’t passed. Yet while a plunge in the sterling would be welcome for May to reinforce the gravity of the situation, FX traders are increasingly ignoring the latest day to day developments in the neverending saga and instead focused on inflicting max pain to both longs and shorts.

Looking ahead the question is: will Asia continue its selling as the US bond market now screams global recession, and will the S&P finally breakdown as it breaches the next support level of 2,777 and if so, will it retest the December lows over 400 points lower, as so many bears have recently predicted.

via ZeroHedge News https://ift.tt/2FDU0rN Tyler Durden