Venmo is ramping up its collection efforts on users that owe the company money due to transactions “going awry”, according to a new Wall Street Journal article.

The company is now threatening users who carry negative balances with debt collectors. The company also recently amended its user agreement to allow it to seize users’ PayPal accounts in order to collect money it is owed. The company says it can refer customers to collections for amounts as high as $3000 and as low as $7.

In December, the company put in its user agreement that it may “engage in collection and other efforts to recover [money owed to Venmo] from you.” Venmo is telling its delinquent users that by “not paying, you run the risk of being reported to a collection agency.” The company didn’t comment to the WSJ about the number of times it will warn a user about collections, nor did it comment about how many times it actually follows through on collection threats.

“These changes, which have been a PayPal policy for a while, are a result of our efforts to drive policy consistency across platforms,” a Venmo spokeswoman said.

The difficulty in turning Venmo into a profit center for PayPal is a microcosm of the larger problem banks face with trying to make finance quicker, yet still profitable.

Over the past year and a half, PayPal has rolled out several different attempts to try and monetize Venmo better, including debit cards and allowing people to buy online using the service. Venmo is on pace to bring in more than $200 million in revenue in 2019, according to CEO Dan Schulman’s comments on a January conference call.

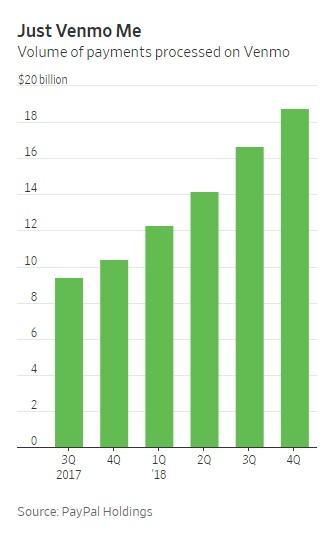

The majority of the $62 billion in volume Venmo processed last year came from transfers where Venmo charges no fees and bears the cost to process them. As money transfers to and from Venmo accounts instantly, and it sometimes can take a day or two for banks to catch up, people can wind up owing Venmo money, resulting in them having a negative account balance.

The article also highlights a couple named Jordan and Emily Cole, who wound up getting scammed out of $281 for concert tickets they tried to buy off of Craigslist. Despite the seller never delivering the tickets, going silent and absconding with their money, Venmo said they were on the hook for the money. After about a month, they got a letter from Venmo’s collections department.

“We sympathize that you were a victim of a scam. But you do make these transactions at your own risk and Venmo is not liable or responsible for any loss that comes from violating our user agreement,” the company wrote to the Coles.

After Mr. Cole spoke to Wells Fargo, PayPal and (more importantly, we’re sure) a reporter about their story, Venmo dropped its demands.

via ZeroHedge News https://ift.tt/2FysKvF Tyler Durden