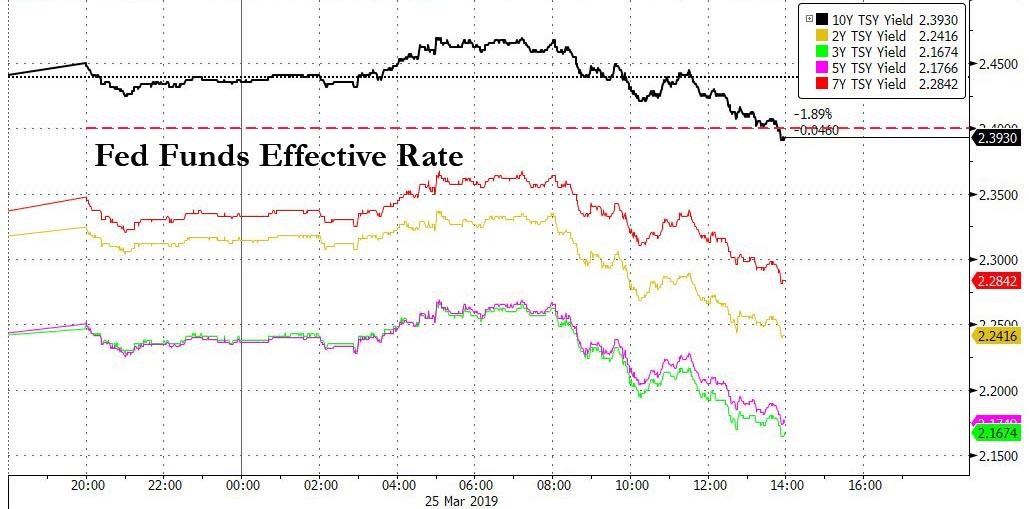

Traders are watching in horror as the yield curve just took another sharp leg flatter as a sudden bout of 10Y buying sent the 10Y yield sharply below 2.40%, which as a reminder is the effective Fed Funds rate, meaning the curve is now inverted through the 10Y point: as shown in the chart below, all coupon tenors from 2Y to 10Y are now below the rate guaranteed by the Federal Reserve.

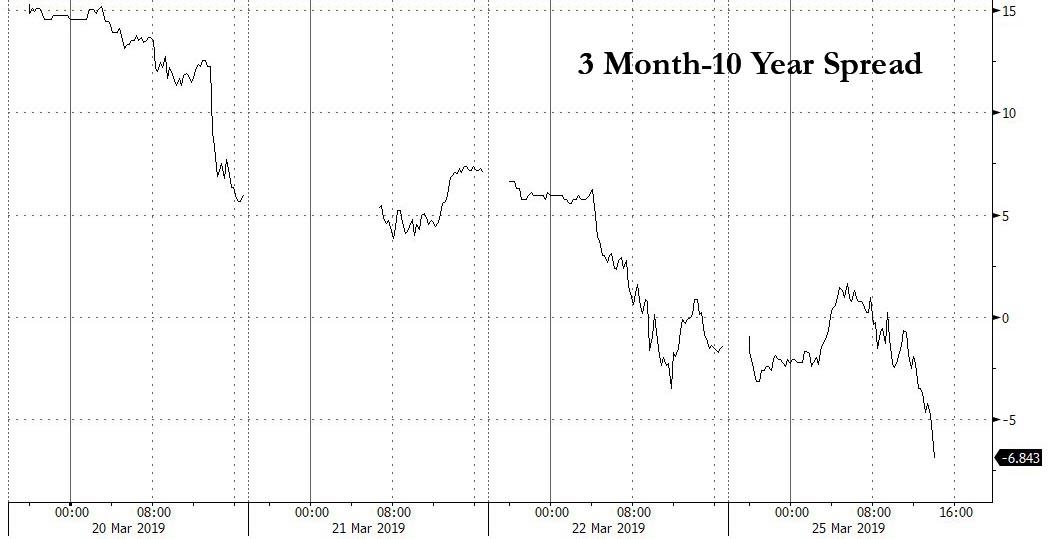

Meanwhile, the Fed’s favorite recession indicator – the spread between the 3 Month Bill and the 10Y Treasury – has plunged further into negative territory, and at last check had dropped as low as -7bps, as the next US recession is now barrelling toward the US.

Not surprisingly these recession alerts have hit risk assets, with stocks sliding as sentiment turns increasingly sour, not helped by Apple’s announcement that it will compete not only with banks, with the launch of its Apple Card 3% cash back, no fee credit card, but also with gaming stock companies which plunged after Apple unveiled a new arcade and gaming service, and lastly hitting Roku and Netflix as Apple discusses its “new” TV App which will offer HBO, Showtime and Starz on demand.

The fear of course is that with Apple now encroaching on several key “service” markets, this will lead to another bout of deflation as a new scramble to gain and preserve market share will take place as company after company slashes costs to remain competitive with the world’s most valuable company.

via ZeroHedge News https://ift.tt/2U4XjBv Tyler Durden