While the stock market bubble for China’s locals may be a long way from bursting, with Shanghai margin debt still soaring by the day as more and more Chinese investors park cash into the best performing (for now) stock market of the year…

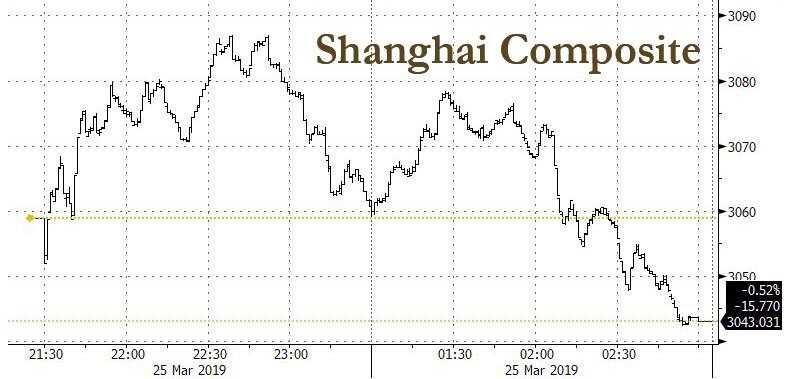

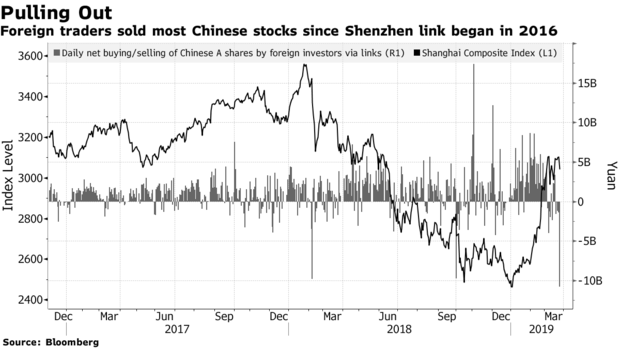

… foreign investors have seen, and had, enough, and on Monday, as Chinese stocks slumped, foreigners dumped the most Chinese shares on record via stock trading connects as they steered away from risk and the country’s benchmark index fell below the key 3,100 level.

According to Bloomberg calculations, overseas investors sold a net of 10.8 billion yuan ($1.6 billion) of mainland shares Monday, the biggest single-day sale since the second exchange link with Hong Kong opened in December 2016, as the Shanghai Composite joined a global rout on growth concerns, sliding 2%.

“Investors tend to be more risk-averse after recent data showed signs of economic slowdowns in major economies,” KGI Asia’s Ben Kwong told Bloomberg. “They’d sell high-risk assets such as Chinese equities. Some investors would lock in profits after such a big rally to avoid uncertainties.”

And, as the chart above shows, they clearly are doing so.

The question is whether they will continue to do so: even after Monday’s loss, the Shanghai Composite Index remains 22% higher in 2019 and is the best performing major index worldwide.

Alas, if historical precedent serves, this outperformance will not continue: foreign investors have had a history of successfully timing exits. As Bloomberg notes, the last two times they dumped a similar amount of Chinese shares via the exchange links, the Shanghai gauge dropped at least 7% over the following days.

via ZeroHedge News https://ift.tt/2CF8Ygb Tyler Durden