And just like that, the panicked freakout over tumbling interest rates around the globe is over with calm returning to global markets as a steadier day for Europe and Asia’s markets and a rebound in bond yields helped ease nerves after a jarring few days dominated by recession worries.

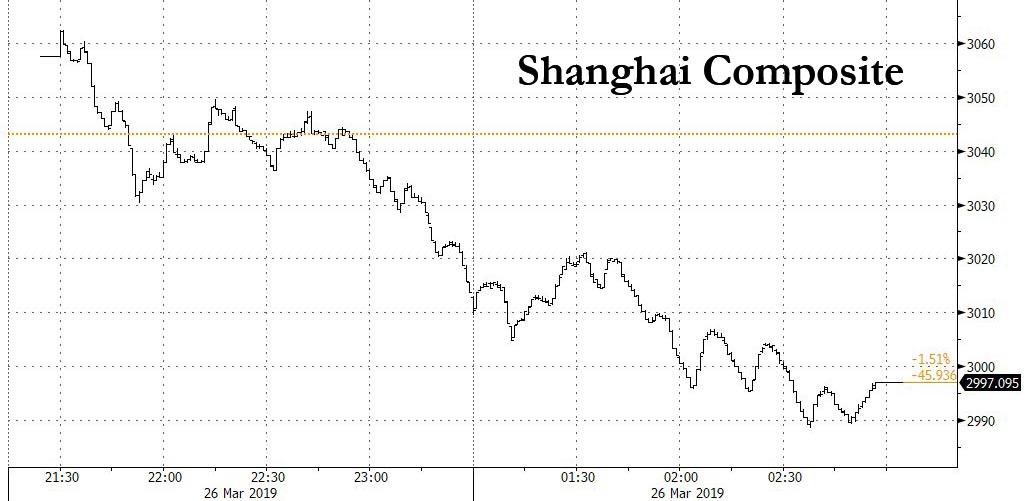

Even as over $10 trillion in global debt now carries a negative yield, a sense of optimism swept across global markets with S&P futures climbing sharply on Tuesday, following a rise in European and Asian shares even as Chinese stocks posted another steep, 1.5% drop, pushing the Shanghai Composite below 3,000 for the first time in two weeks.

Yields on US Treasuries rose across the curve after the 10Y yield closing below the effective fed funds rate of 2.4% on Monday, although the spread between three-month and 10-year rates remained in negative territory. The 10Y shed 5 basis points on Monday and a whopping 17.5 basis points since the Federal Reserve last week ditched projections for raising rates this year.

Meanwhile, fed funds rate futures are now fully factoring in a rate cut later this year, with about an 80 percent chance of a move priced in by September.

“The U.S. yield curve continues to invert,” said Michael Every, Hong Kong-based senior Asia-Pacific strategist at Rabobank. “This is not a healthy sign, as bond-market watchers should know and equity-market obsessives should rapidly learn.”

Equities took the modest rebound in stride, as futures on the Dow Jones, Nasdaq and S&P 500 indexes all advanced, and gains in healthcare companies helped the Stoxx Europe 600 into the green. The bond markets remained the main focus though: 10-year German government bond yields remained below zero as European bonds tracked Treasuries lower and the euro edged up against the greenback.

Earlier in Asia, the MSCI index of Asia-Pacific shares rebounded 1% after losing 1.4% in the previous session, though there were some eye-catching moves. Japan’s Nikkei jumped 2.1% after recording its biggest drop since late December on Monday; the Topix Index jumped more than 2.5 percent, a day after it had its biggest slide this year, helping MSCI Asia Pacific index rise one percent; even the Kospi eked out a 0.3% gain despite a profit warning from Samsung. Meanwhile, the selling in China continued, with the Shanghai Composite dropping below 3000 for the first time in 2 weeks.

India jumped over 1 percent whereas China’s blue-chip CSI300 index dropped more than 1 percent as trade war worries remained. The Aussie 10-year yield nudges three basis points higher after printing record low 1.75% in early trading, meanwhile JGB futures extend losses after uninspiring 40-year bond auction. Emerging-market currencies were steady as shares edged up.

“The world is looking to fade the risk aversion caused by the inversion of the (U.S.) yield curve,” said SocGen’s Kit Juckes, adding that it was anyway difficult to position for a hypothetical recessions.

Sure enough, as Reuters notes, investors have been spooked by sharp falls in U.S. bond yields and an inversion of the U.S. Treasury yield curve, widely seen as an indicator of an economic recession.

Going back to bonds, the US Treasury Department will sell $113 billion in coupon notes this week, including $40 billion in two-year notes on Tuesday, $41 billion in five-year notes on Wednesday and $32 billion in seven-year notes on Thursday. Investors will also be watching Fed policymakers scheduled to speak on Tuesday.

With bonds now signalling a recession, the outcome of trade talks between America and China and any developments in Britain’s tortuous exit of the European Union could help determine sentiment from here. “It’s premature to talk about the yield curve meaning that we have to go into recession,” Philip Wyatt, a Hong Kong-based economist for UBS Group AG, said on Bloomberg Television. “It’s possible for the long end to run too far, too fast,” he said of U.S. Treasuries.

In overnight central bank news, Fed’s Rosengren (voter, hawk) said returning Fed assets to pre-crisis levels is not desirable nor feasible and that the balance sheet is likely to grow, while he added that it may be important to increase share of Treasury bills as well as lower duration of balance sheet more quickly. Furthermore, Rosengren noted that Fed pause is the responsible action to do now and that the dot plot is not a promise of policy direction which depends on changes to the economy. Separately, Fed’s Harker said he was not supportive of the December move and reiterates that he is in wait and see mode, favoring at most one hike this year and one in 2020.

In the currency market, the Bloomberg dollar index marginally stronger while the euro stood firm at $1.1305, having gained a tad on Monday after Germany’s IFO Institute said its business climate index rose to 99.6, beating a consensus forecast of 98.5 and ending six consecutive months of decline. The dollar was 0.6 percent higher versus the yen at 110.42 yen, having hit a 1-1/2-month low of 109.70 on Monday, while British pound was barely budged at $1.3180 after lawmakers voted late on Monday to wrest further control of the Brexit process from Prime Minister Theresa May.

“We expect EUR/USD to stabilize around the current level of 1.13 and see a limited downside for the rest of week,” said currency strategists at ING.

Among commodities, oil prices hovered below their recent four-month peaks, as the prospect of tighter U.S. crude supply was offset by concerns about a slowdown in global economic growth. U.S. crude futures traded at $59.55 per barrel, up three-quarters of a percent on the day but below Thursday’s $60.39, which was its highest level since mid-November. Brent futures were up 0.7% as rising tension in Venezuela threatened to further curb supplies from the holder of the world’s largest crude reserves.

Gold retreated for the first time in three days, down a third of a percent at $1,317.60 having hit a one-month high of $1,324.60 on Monday.

Housing starts and Conference Board Consumer Confidence readings are due. Scheduled earnings include Carnival and IHS Markit

Market Snapshot

- S&P 500 futures up 0.2% to 2,813.25

- STOXX Europe 600 up 0.1% to 374.87

- MXAP up 1% to 159.86

- MXAPJ up 0.3% to 523.41

- Nikkei up 2.2% to 21,428.39

- Topix up 2.6% to 1,617.94

- Hang Seng Index up 0.2% to 28,566.91

- Shanghai Composite down 1.5% to 2,997.10

- Sensex up 0.5% to 37,982.27

- Australia S&P/ASX 200 up 0.07% to 6,130.59

- Kospi up 0.2% to 2,148.80

- German 10Y yield rose 0.3 bps to -0.025%

- Euro down 0.05% to $1.1306

- Brent Futures up 0.5% to $67.56/bbl

- Italian 10Y yield rose 5.3 bps to 2.148%

- Spanish 10Y yield rose 0.7 bps to 1.108%

- Brent Futures up 0.5% to $67.56/bbl

- Gold spot down 0.4% to $1,316.81

- U.S. Dollar Index up 0.04% to 96.60

Top Overnight News

- U.K. Parliament seized control of the Brexit process from Prime Minister Theresa May and will now seek to decide how Britain exits the European Union. In a vote late Monday, the House of Commons split 329 to 302 to schedule votes on a series of alternative strategies, potentially including a second referendum

- A global rush to buy sovereign debt kept on going in Treasuries Monday, with bond traders increasing wagers that the Federal Reserve will have to cut interest rates later this year. Overnight index swaps showed 25bps worth of easing are expected by the central bank’s October meeting

- The next step in Attorney General William Barr’s work on the Mueller report is deciding just how much of it to release, and one person is likely to get a big say in the answer: President Donald Trump

- Oil rebounded along with global markets as pessimism over the global growth outlook eased a little, and rising tension in Venezuela threatened to further curb supplies

- The global iron ore market will get a glimpse of how dire the supply situation looks when Vale addresses analysts this week for the first time since the fatal dam disaster in January in Brazil

- U.S. President Donald Trump and a key ally, Senate Judiciary Chairman Lindsey Graham, said Monday that after Robert Mueller closed his Russia probe, they want an investigation of the investigators

- Federal Reserve Bank of Boston President Eric Rosengren still thinks the central bank’s next move for interest rates is more likely to be a hike than a cut. He just won’t be surprised if that turns out wrong

- Euro-area banks will know by June how generous the terms of the European Central Bank’s new loans are going to be, according to Governing Council member Olli Rehn

- Turkish authorities have made it virtually impossible for foreign investors to short the lira. The overnight swap rate for the currency blew out by a whopping 73 percentage points to 96.34 percent on Monday, as offshore funds clamoring to close out long-lira positions failed to find counterparties, according to two people with direct knowledge of the matter

Asian equity markets were mostly higher as the region took the consolidation on Wall St as a cue to pick itself up from the prior day’s sell-off. ASX 200 (+0.1%) was choppy as weakness in energy, tech and financials off-set the strength in miners, while Nikkei 225 (+2.1%) outperformed on bargain hunting after the prior day’s 3% drop and its worst performance YTD with Tokyo sentiment also boosted by currency weakness and reinvestment buying heading into ex-dividend day tomorrow. Hang Seng (-0.2%) and Shanghai Comp. (-1.5%) both began higher, although sentiment in the mainland eventually deteriorated after another PBoC liquidity drain and amid tentativeness ahead of upcoming blue-chip earnings including the Big-4 banks later this week with the industry anticipated to post slower profit growth for a 5th consecutive year. Finally, 10yr JGBs were lower with demand subdued amid the heightened risk appetite in Tokyo and following the mixed results in the 40yr auction.

Top Asian News

- Once-in-Century Rain Hits Australia as Ports Return After Storm

- Citigroup Faces Fine for Allegedly Manipulating JGB Futures

- Election Cash Splash Spurs Southeast Asia’s Biggest Economy

- Ocado Says Coles Deal to Be Earnings Negative in Current Year

Major European indices are slightly firmer [Euro Stoxx 50 +0.3%] roughly in-line with how they started the session, in-spite of indices drifting somewhat into mixed/negative territory not long after the open. In a similar pattern, after opening the session all in the green, major sectors are now mixed, with some mild outperformance seen in Energy names. The FTSE 100 (+0.3%) is firmer, boosted by the likes of Ocado (+4.3%) after signing a deal with Australian supermarket chain Coles at the top of the index alongside housing names such as Persimmon (+2.3%) and Fresnillo (+1.2%) after positive broker moves. However, the FTSE 100’s gains are hampered by the significant underperformance seen in Ferguson (-9.0%) shares after the Co. warned that FY profit will be towards the lower end of expectations. Other notable movers include, Airbus (+2.4%) after reports just before 16:00GMT yesterday that they had secured an order from China at which Co. shares moved higher and Boeing shares saw some negativity. Subsequently, further details have emerged that the deal is for 300 jets with an estimated value of around USD 35bln; which is almost double the level that had been indicated by French President Macron in 2018. Elsewhere, Rolls Royce (-1.8%) who are in negative territory after being reiterated underweight at Morgan Stanley. Of note for tech names Samsung Electronics (005930 KS) guides Q1 earnigns to be lower than market expectations. For reference Co. shares closed around 0.6% lower.

Top European News

- Bang & Olufsen Shares Slump as Turnaround Efforts Stall

- Credit Suisse Raises Miners to Overweight on China Economy Play

- Intesa Considers Strategic Options for Unlikely-to-Pay Loans

- Pound Volatility Curve Stays Inverted on Various Brexit Options

In FX, the USD remains rangebound and mixed vs G10 counterparts, as the DXY pivots the 96.500 level with technical resistance capping the upside along with month end rebalancing signals pointing to moderate to modest selling vs several major currencies. However, the Buck is also underpinned ahead of 96.000 amidst relative weakness elsewhere, such as the Yen on improving or more stable risk sentiment, Pound on Brexit and Kiwi pre-RBNZ.

- JPY – As noted above, an upturn of recovery in risk appetite has prompted an unwind in safe-haven premiums to the detriment of the Yen in particular, and after recent strengthening through 110.00 vs the Usd the headline pair has now rebounded quite markedly through the big figure and a Fib at 110.23 to trip some stops on the way to 110.42. Note, a hefty 1.8 bn option expiry between 110.10-15 for today’s NY cut appears safe at the current juncture.

- NZD/GBP – Also back under pressure vs the Usd having forged gains on the back of better than forecast NZ trade data in the case of the Kiwi and for Sterling the latest vote in UK Parliament that effectively takes the onus away from PM May in terms of the next Brexit steps. Nzd/Usd is hovering around 0.6900 vs circa 0.6925 at best overnight, while Cable retreated from around 1.3225 to a 1.3160 base again (virtually matching Monday’s low) before rebounding firmly over 1.3200 handle to 1.3250. Note, next up for the Kiwi is March’s RBNZ policy meeting (full preview flagged on the headline feed and within the Research Suite), while the Pound remains hostage to Brexit and will be eyeing Wednesday’s indicative votes.

- AUD/CAD/EUR – All nudging new or nestling near highs vs the Usd, as the Aussie extends above 0.7100 with some favourable tailwinds via the Aud/Nzd cross that has rebounded firmly over 1.0300 amidst the aforementioned pre-RBNZ Kiwi caution. However, Aud/Usd still has some way to go from 0.7135 to arouse any expiry related interest from 1 bn rolling off from 0.7145 to 0.7150. Meanwhile, the Loonie is trying to extend gains above 1.3400 against the backdrop of firm oil prices and news that China has lifted some bans on Candian canola imports, and the single currency is sitting above 1.1300, albeit tight.

- EM – A more stable session so far for the TRY and some outperformance vs regional peers as the Lira continues to pare recent heavy losses, albeit due to intervention or various forms of capital repatriation and amidst further spikes in money market rates. Usd/Try currently near the middle of a 5.4660-5.5925 band. Elsewhere, Eur/Huf is also midway between trading parameters (316.80-00) ahead of a widely anticipated NBH rate hike

- New Zealand Trade Balance (Feb) M/M 12M vs. Exp. -200M (Prev. -914M, Rev. -948M). (Newswires) New Zealand Exports (Feb) 4.82B vs. Exp. 4.70B (Prev. 4.40B, Rev. 4.33B) New Zealand Imports (Feb) 4.80B vs. Exp. 4.90B (Prev. 5.32B, Rev. 5.28B)

In commodities, a firm rebound in the energy complex with WTI and Brent futures advancing further above USD 59.00/bbl and USD 67.50/bbl respectively as global growth pessimism takes a back seat (for now) and risk appetite takes the wheel. OPEC+ members are said to be planning the next JMMC meeting on May 19th after cancelling their April assembly before OPEC+ convenes on June 25-26. ING argues that the cancellation of the April meeting could suggest that the members “are not in agreement to extend the current deal”, set to last until the end of H1 2019. Analysts at ING also speculate that if this is the case, then it is likely that Russia believes an extension is not needed. Nonetheless, traders will be eyeing the usual API crude inventory release later today (2030 GMT/1530 ET) as a fresh catalyst. Elsewhere, metals are relatively mixed with gold (-0.6%) shedding recent gains amid the broad risk appetite whilst copper prices are supported for the same reason. Back to precious metals, UBS raised its 6 and 12-month silver forecasts, both to USD 16.30/oz from USD 15.50/oz and USD 16.00/oz respectively. BHP expects to resume loading iron ore ships at Port Hedland on Tuesday and ramp up output over the approaching days, while it found no major damage from the recent cyclone.

Looking at the day ahead, there are quite a few releases, with a possible highlight being the Conference Board’s consumer confidence reading for March, along with the Richmond Fed’s manufacturing index. In addition, we’ll get February’s data for housing starts and building permits, along with the FHFA’s House Price Index for January. In terms of central bank speakers, we’ve got the Fed’s Harker, Evans and Daly all speaking today, along with the BoE’s Broadbent.

US Event Calendar

- 8:30am: Housing Starts, est. 1.21m, prior 1.23m

- Building Permits, est. 1.31m, prior 1.35m

- 9am: FHFA House Price Index MoM, est. 0.4%, prior 0.3%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.3%, prior 0.19%

- S&P CoreLogic CS 20-City YoY NSA, est. 3.8%, prior 4.18%

- 10am: Richmond Fed Manufact. Index, est. 10, prior 16

- 10am: Conf. Board Consumer Confidence, est. 132.5, prior 131.4

DB’s Jim Reid concludes the overnight wrap

We’re back to Brexit being at the top of the agenda again after a brief interlude as the UK government lost another vote in the House of Commons last night (329-302), with three ministers breaking ranks and resigning to support the amendment. MPs supported the measure put forward by the Conservative backbencher, Sir Oliver Letwin, which allows MPs to take control of the parliamentary timetable away from the government tomorrow, thus allowing Parliament to hold a series of ‘indicative votes, where MPs could vote on a range of Brexit options. After the vote, the government released a statement criticizing the “dangerous, unpredictable precedent” set by the vote, but nevertheless pledged to work with parliament to achieve a reasonable outcome. The statement called for “realism” moving forward and, in her comments to parliament, May referenced a second referendum or an election as potential options. Uncertainty looks set to continue. Sterling is trading weak (-0.08%) this morning.

Oliver Harvey published a helpful explainer overnight titled Brexit: indicative votes. What are they and can they be implemented? (click here ). The seven principal options that have been proposed would be: 1) May’s deal, 2) revocation of Article 50, 3) a second referendum, 4) May’s deal plus a customs union, 5) May’s deal, a customs union and membership in the single market, 6) a free trade agreement, or 7) no-deal Brexit. There is uncertainty as to how the votes could be structured and whether the government would even implement them. So Oli’s base case remains for a general election, but there are many possible permutations discussed in his note.

Mrs May earlier said that the government won’t implement parliamentary votes that contradict manifesto commitments which is pertinent as both the Conservative and Labour manifestos in 2017 committed to leaving the Customs Union and Single Market. So if she is true to her word this could again create fresh gridlock and increase the risk of fresh elections where new manifestos could be created. Nevertheless, May left open the possibility of a third meaningful vote in the coming days, saying that “I continue to have discussions with colleagues across the House to build support, so that we can bring the vote forward this week, and guarantee Brexit.”

Sterling weakened yesterday (-0.10% versus the dollar) but did rally a bit as Parliament took control. Meanwhile ten-year gilt yields (-2.8bps) closed below 1% for the first time in 18 months. When it comes to the curve, attention has focused on the US, but it’s worth noting that the UK’s 2s10s curve has flattened to its lowest level since September 2008, reaching 34.5bps yesterday.

US markets ended the session close to flat, with the S&P 500 and NASDAQ shedding -0.08% and -0.07%, respectively, and the DOW gaining +0.06%. That’s only the eighth day this year when the S&P and DOW moved in opposite directions. The yield curve gave a similarly unclear signal, as the 3m10y and the 3m (18 month forward) vs 3m flattened further into inverted territory, by -2.3bps and -9.4bps to -3.6bps and -35.3bps respectively, while the 2s10s actually steepened by 3.6bps to 15.5bps. That puts the main measure of the yield curve right back in the center of its year-to-date range of between 19.9bps and 11.8bps, with a year-to-date average of 16.0bps. The curve has steepened another basis point this morning with US 10yr and 2yrs up 4bps and 3bps respectively.

Yesterday’s steepening was driven by a big rally in two-year treasuries, where yields fell -6.3bps to their lowest level in almost a year at 2.2499%. The market is pricing in an ever more aggressive timeline of Fed rate cuts, with a full 25bps cut now priced by the end of this year, and a second cut priced by next August. Before last week’s Fed meeting, a cut was not fully priced until the end of 2020.

European equity markets lost further ground yesterday, with the Stoxx 600 (-0.45%) down for a fourth consecutive session. The declines were spread across the continent, with the FTSE 100 (-0.29%), CAC 40 (-0.10%) and the DAX (-0.11%) all closing lower. In sovereign bond markets, 10yr bund yields briefly got altitude sickness and climbed back above zero after a stronger IFO survey but fell again to close down by -1.2bps on the day to reach -0.028%. Peripheral yields went in the opposite direction though with ten-year yields in Italy (+5.3bps) Spain (+3.2bps) and Portugal (+3.4bps) all higher yesterday. The flight to safety also supported gold (+0.67%), which rose for a second consecutive session.

Asian markets are trading mixed this morning with the Nikkei (+2.09%) leading the advancers. The Hang Seng (+0.11%) and Kospi (+0.29%) are also up while the Shanghai Comp (-0.99%) is down. Elsewhere, futures on the S&P 500 are +0.34%. Oil prices are higher this morning (WTI +0.73% and Brent +0.19%) on rising tensions in Venezuela which threaten further curbs to supplies as the US warned Russia not to intervene in the Latin American nation. Separately, Samsung Electronics issued a warning today suggesting it would report disappointing financial results in 2019 due to slumping prices for chips and LCD screens, in another sign of slowing demand for smartphones and other gadgets. The stock is down -0.55% this morning after falling -2.26% yesterday.

In other news, the US House Democrats have now formally requested that Attorney General William Barr should hand over the Special Counsel Robert Mueller’s report to Congress by April 2. The Democratic chairs of six House committees said in a letter to Barr yesterday that the attorney general’s four-page summary of the Mueller report “is not sufficient for Congress, as a coequal branch of government,” to examine President Donald Trump’s conduct.

In data, the German Ifo business climate survey for March came in above expectations at 99.6 (vs. 98.5 consensus). The uptick from February’s revised 98.7 reading puts an end to six successive monthly declines, offering some indication that the German economy could be stabilising. Moreover, the expectations reading (95.6) and the current assessment reading (103.8), both rose from the previous month. However, some caution is warranted as the Ifo readings contradict the message from last Friday’s PMI readings, where the German manufacturing, services and composite readings all fell in March compared to February. The data certainly is conflicting at the moment. The euro appreciated slightly against the dollar after yesterday’s release but ended close to flat at +0.10%.

Other data of note yesterday included the Chicago Fed National Activity Index, which fell to -0.29 in February from an upwardly revised -0.25 in January. However, this was above expectations for a -0.38 reading. Meanwhile, the Dallas Fed Manufacturing Activity index fell back, coming in at 8.3 (vs an expected 8.9 and below last month’s 13.1), and the new orders index fell to 2.4, the lowest level in over two years.

We also had a number of central bank speakers yesterday. From the ECB, Executive Board member Coeure said that “I don’t think that we’ve been to the limit of what we can do” at a discussion in Lisbon. Elsewhere, Patrick Harker, the Philadelphia Fed President, said in a speech in London, that his “current view is that, at most, one rate hike this year, and one in 2020, is appropriate, and my stance will be guided by data as they come in and events as they unfold.” Regarding the US economic outlook, he said that “on balance, the potential risks tilt very slightly to the downside, but I emphasize the word ‘slight.’ I still see the outlook as positive, and the economy continues to grow in what is on pace to be the longest economic expansion in our history.” That’s broadly consistent with his prior comments and our economists have him penciled in as one of the four FOMC members who still expect a hike this year.

Turning to the day ahead, this morning we’ll get the GfK consumer confidence reading for Germany, while from France there’ll be the final GDP reading for Q4, along with March’s manufacturing and business confidence. In the US, there are quite a few releases, with a possible highlight being the Conference Board’s consumer confidence reading for March, along with the Richmond Fed’s manufacturing index. In addition, we’ll get February’s data for housing starts and building permits, along with the FHFA’s House Price Index for January. In terms of central bank speakers, we’ve got the Fed’s Harker, Evans and Daly all speaking today, along with the BoE’s Broadbent.

via ZeroHedge News https://ift.tt/2OtF2ID Tyler Durden