In previewing the “green shoots” catalysts to watch for the second quarter after a dismal, for the economy Q1, BofA’s Michael Hartnett listed five key data points which will set the quarterly mood early, and which included US retail sales and manufacturing ISM, South Korean export orders, February German factory orders and, last but not least, China’s manufacturing new orders PMI

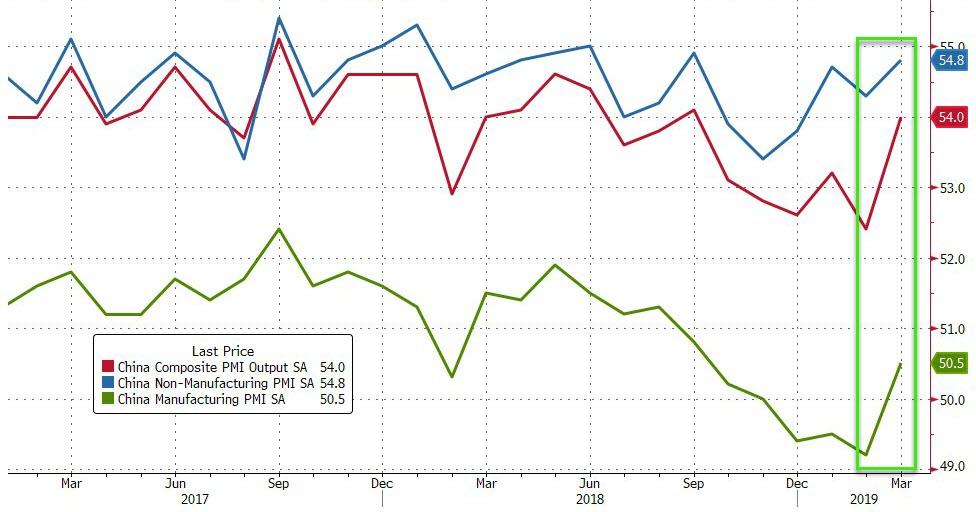

Well, overnight we got the last one when China confirmed prior speculation of a rebound in the economy, when the National Bureau of Statistics reported that China’s manufacturing PMI rebounded strongly from a contractionary 49.2, and printing at 50.5, its first expansion since September 2018, and beating estimates of a 49.6 reading. The non-manufacturing PMI continued its recent improvement, rising to 54.8, also the best reading since last September, as both the services and construction PMIs strengthened, and resulted in the composite PMI rising to 54.0 from 52.4.

Almost all major sub-indexes imply better growth momentum.

- While the production index was 3.2% higher at 52.7, the new orders sub-index was 1.0% higher at 51.6, just why of Hartnett’s 52.0 bullish “green shoot” cutoff. The employment sub-index edged up 0.1% to 47.6 from 47.5.

- More importantly, trade indicators also strengthened – the imports sub-index rose to 48.7 from 44.8, and the new export order went up to 47.1, vs. 45.1 in February. Both trade-related indexes have recovered from the bottom seen in late 2018 and early 2019, but are still below the levels in 2017/early 2018.

- Inventory indicators also rose with the raw material inventories index 2.1% higher at 48.4, and the finished goods inventory index increased by 0.6pp in March to 47.0 (both indicators remain below their long-term averages).

- Price indicators continued to climb – the input price index rose by 1.6% to 53.5, and the output price index was 2.9% higher at 51.4. By enterprise type, data suggest manufacturing PMI went up for medium and small-sized manufacturing enterprises in March and declined for large manufacturing enterprises.

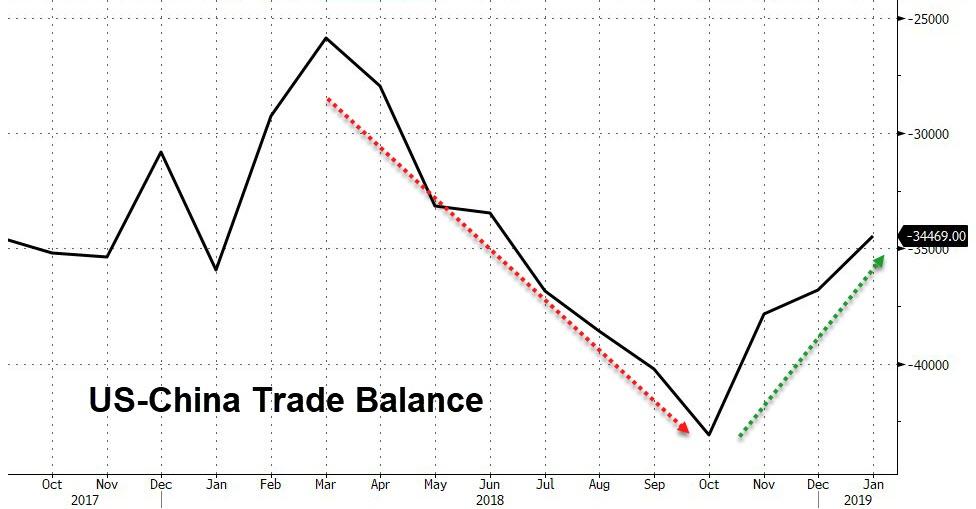

Curiously, the improvement in trade indicators took place even as China’s record trade surplus with the US faded in recent months:

The official non-manufacturing PMI (which according to Goldman Sachs estimates is comprised of the service and construction sectors at roughly 80%/20% weightings) also increased to 54.8 in March vs 54.3 in February. Both services and construction PMIs strengthened. The services PMI edged up by 0.1% to 53.6, and the construction PMI increased 2.5% to 61.7.

What prompted the rebound in the PMI? after an unprecedented credit injection earlier in the year, in addition to better underlying growth momentum, higher commodity prices and Chinese New Year holiday seasonality may have contributed to the rebound according to Goldman Sachs which sees a few factors contributing to a higher manufacturing PMI in March:

- higher commodity prices rose in March which could add upward bias to the manufacturing PMI readings;

- activities resuming after the Chinese New Year holiday could also push up manufacturing PMI in March vs February – in historical years when the Chinese New Year date was similar to this year, March NBS manufacturing PMI rebounded by an average of 1.7% vs February;

- underlying growth momentum may have also improved as the previous policy easing started to show its support to overall economic growth.

On the non-manufacturing side, construction PMI was stronger partially due to the Chinese New Year seasonality, and partially also supported by stronger infrastructure investment activities. Services PMI also improved – logistics, transportation and securities industry activities were strong in March, while real estate activities stayed weak. In sum, NBS PMI data suggest better growth in Q1 compared with Q4 last year.

Whatever the reason behind the rebound, much of its has already been priced in with the Shanghai Composite, the year’s best performing major index, posting nearly double the return of the S&P in the first quarter.

More importantly, with China’s PMI now signalling an key inflection point for both the Chinese and global economy, and the early stages of an economic rebound, the Sunday print will likely serve to push Asian stocks sharply higher on the first day of the quarter.

But the biggest implication from the rebound in Chinese data, is what implications it may have on the ongoing US-China trade negotiations, because as the Global Times’ Editor in Chief wrote overnight, the Chinese are now “less worried” about the trade war, as “they feel the US is not as powerful as they had thought and the impact the trade war has on their life is not that big. This will seriously weaken psychological advantage of US side in trade talks.”

One year since the trade war started, the Chinese have been less worried about it. They feel the US is not as powerful as they had thought and the impact the trade war has on their life is not that big. This will seriously weaken psychological advantage of US side in trade talks.

— Hu Xijin 胡锡进 (@HuXijin_GT) March 30, 2019

To be sure, the (goalseeked) Chinese data will be used by Beijing as a bargaining chip to make more forceful demands in bilateral trade negotiations, as it can now asset that the worst consequences of the trade war are now in the rearview mirror, and as a result US leverage over China’s economy is now declining.

via ZeroHedge News https://ift.tt/2U54dqY Tyler Durden