Long the subject of guesswork and speculation, Saudi Aramco, the state-controlled oil giant that’s responsible for roughly 10% of the world’s oil production, has for the first time ever opened its book to investors as it prepares to launch a $10 billion bond offering.

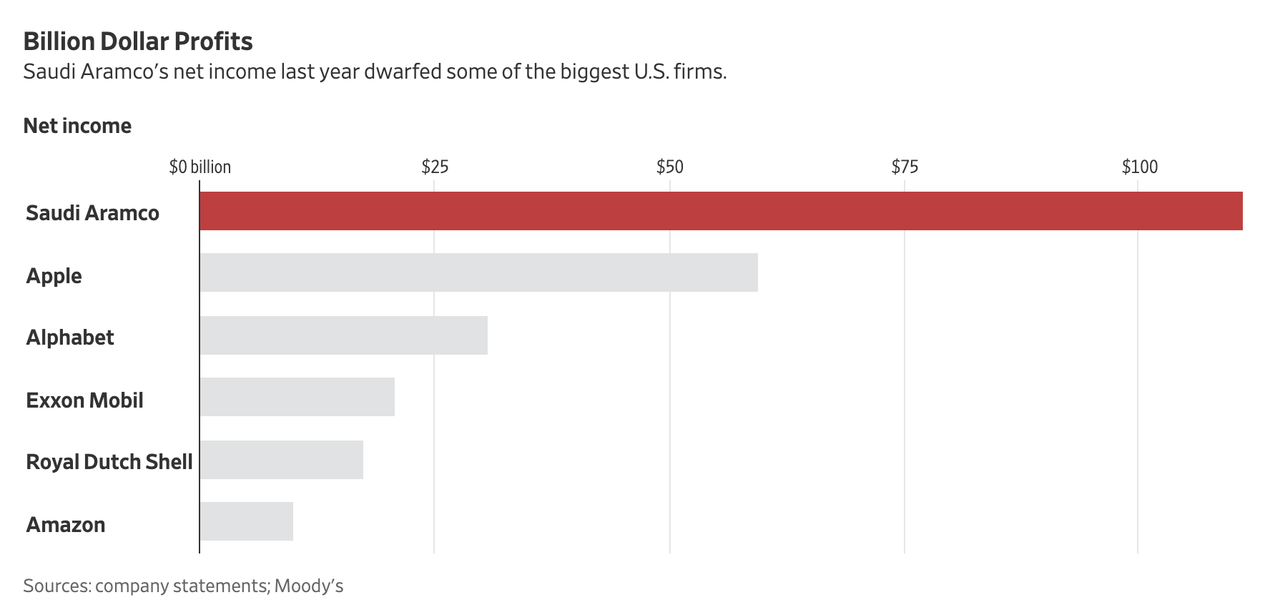

And the three years’ of financials confirmed what many have long suspected: Aramco’s profits beat out tech giants like Apple and publicly-traded rivals in the energy space like Exxon-Mobil and Royal Dutch Shell, establishing the energy behemoth as by far the world’s most profitable company. In 2018 alone, Aramco’s profits exceeded $110 billion on $360 billion in revenue. That’s nearly double Apple’s $60 billion profit, and five times Shell’s ($23.9 billion). Thanks to the surge in oil prices last year, Aramco’s net income climbed by 50% from $75.9 billion in 2017.

Last year, the company earned more than Alphabet, Apple and Exxon combined.

The revelations come courtesy of Moody’s Investors Service and other ratings firms, which released the results as part of its credit rating analysis for the upcoming bond offering. Moody’s attributed Aramco’s profitability to its sheer size and access to some of the world’s largest oil and gas reserves, per WSJ. Furthermore, the prospectus for the bond offering, which included three years’ worth of financials, showed the company’s operating profit, before interest and tax, was $212 billion.

“Aramco’s scale of production in combination with its vast hydrocarbon resources is a very strong competitive advantage,” Moody’s said.

Aramco produced, on average, 13.6 million barrels a day in 2018, three times Exxon Mobil’s 3.8 million barrels.

One key takeaway from the prospectus is just how dependent Aramco’s profits are on oil price swings (though that shouldn’t come as much of a surprise). It’s net profit in 2016, when oil prices were mired near their lowest levels in more than a decade, was just $13.6 billion.

Aramco has hired JPMorgan and Morgan Stanley to manage its first debt offering, with its pre-offering roadshow beginning n Monday in at least eight cities across the US, Europe and Asia, according to WSJ. Investment bank Lazard has also been hired as an independent adviser on the bond sale.

Despite the company’s immense profitability, ratings agencies were reluctant to give it one of the top two ratings because of the control of the Saudi state, which heavily taxes the company. As the Financial Times pointed out, Aramco doesn’t generate as much cash per barrel as its publicly traded rivals.

Rating agencies Moody’s and Fitch assigned the state oil company ratings of A1 and A+ respectively in line with the Saudi state, reflecting its close ties to the kingdom that has long relied on the world’s largest oil producer to fuel its public funds. But Saudi Aramco’s finances also show the state’s reliance on the company means it does not generate as much cash per barrel as non-state peers, with the tax take from the kingdom meaning it generated approximately $26 a barrel last year compared to $38 a barrel for Royal Dutch Shell and $31 a barrel for France’s Total. In 2018 Saudi Aramco generated $224bn of earnings before interest, tax, depreciation and amortisation.

Fitch noted its “high production, vast reserves, low production costs and very conservative financial profile” would give it a standalone rating of AA+, but said it would cap its rating at A+ due to the links between the company and the sovereign and the influence the state has on the company through regulating the level of production, taxation and dividend. Similarly, Moody’s said that while Saudi Aramco has many characteristics of a Aaa-rated corporate – such as minimal debt relative to cash flows, large scale of production, market leadership and access in Saudi Arabia to one of the world’s largest hydrocarbon reserves – its final rating was restrained to A1 “because of the close interlinkages between the sovereign and the company.”

The proceeds from Aramco’s first bond offering in international markets will be used to finance its planned acquisition of Sabic, the Saudi state-held industrial chemicals giant. Incidentally, the publication of Aramco’s financials could help whet investors’ appetite for shelved stock offering, where the kingdom had planned to float 5% – or some $100 billion, depending on the exact valuation – of the company’s shares

Read the prospectus below:

FULL DOCUMENT: The prospectus of Saudi Aramco’s first ever foray into the international bond market, with information until now considered secret in the kingdom. https://t.co/THD99WxTY4 #OOTT #oil #SaudiArabia pic.twitter.com/KEX2V81b05

— Javier Blas (@JavierBlas) April 1, 2019

via ZeroHedge News https://ift.tt/2JUlQ8d Tyler Durden