Submitted by Almost Daily Grant’s

Motley Crew

Asset prices are off to the races, as the S&P 500 logged a 13% gain through March 31, the best quarterly showing since the summer of 2009. Credit has likewise marched higher, with the Bloomberg Barclays High Yield Index jumping 7.3%, the steepest quarterly rise since 2003, while the Markit iBoxx Leveraged Loan Total Return Index rose by 4.8% for its best quarter since 2010.

The Fed’s dovish swivel figures prominently in the bull move in credit, as interest rate futures now expect rate cuts instead of further tightening and the “QT” asset run-off is set to end in six months. At the same time, loan defaults reached a seven-year low in March as the post-2009 economic expansion is now three months shy of a record length.

A mismatch between new supply and demand also helps. Junk bond volumes tallied $59 billion in the first quarter, down 5.5% year-over-year and the slowest pace of issuance since 2016. On the loan side, new volume fell to $85.2 billion in the first quarter, down a hefty 68% year-over-year according to data compiled by Bloomberg.

That dearth of supply has further tilted the balance of power in favor of the borrowers. On March 22, the Financial Times reported on the “near-total control” of sellers in the leveraged loan market, a development raising “concerns that a borrower could load up on more debt, extract cash from the company or seek expensive acquisitions.” Even the sharp downdraft seen at the end of 2018 has done little to level the playing field. An unnamed fund manager told the FT that “we were hoping there would be an improvement [in terms for investors] after December’s volatility, but that doesn’t seem to be the case.”

Last Thursday a report from Moody’s Investor Services noted “unprecedented flexibility” on the part of borrowers to make investments free of obligations to maintain certain leverage levels, as well as an “aggressive use of investment capacity” that allows issuers to shift assets beyond creditors’ reach, leaving investors “in uncharted territory.” Indeed, Moody’s determines that 2018 saw the weakest credit agreement protections on record, a fact that bodes ill for recoveries when the cycle turns.

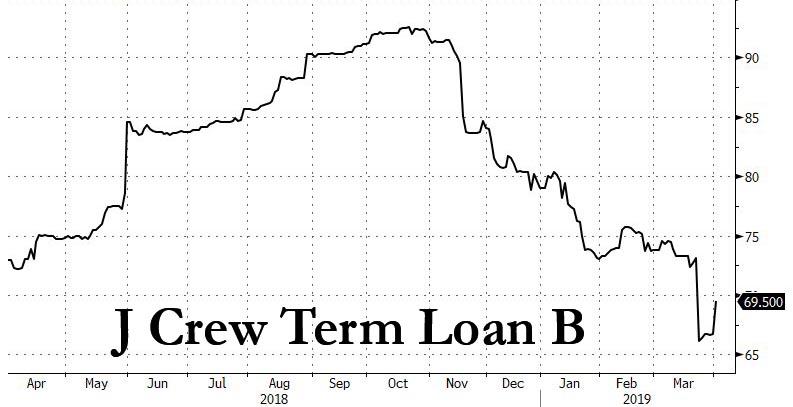

On that score, a prominent cautionary tale finds itself back in the news. On Thursday, the J. Crew Group, Inc. term-loan B fell to 66 from 92 as recently as Oct. 22, 2018, after the fashion retailer reported a full-year adjusted EBITDA decline of more than 50% with cash on hand dropping to $25.7 million at the beginning of February from $107 million a year earlier. The company, taken private in 2011 by Leonard Green & Partners, L.P. and TPG Capital, earned the ire of creditors in 2017 by transferring $250 million worth of intellectual property to a foreign subsidiary (out of the grasp of supposedly-senior bondholders) and then issuing $250 million in fresh debt backed by the same IP.

A slightly different saga featuring private-equity owned PetSmart, Inc. continues to unfold. In April 2017, PetSmart bought online pet supply company Chewy, Inc. for $3.35 billion. Just over a year later, PetSmart transferred a chunk of Chewy’s equity to an unrestricted subsidiary, out of the reach of the company’s creditors. Those jilted bondholders sought legal recourse against PetSmart for alleged “fraudulent” behavior, claiming that PetSmart was already out of compliance with a fixed-charge coverage ratio test. On Thursday, a federal judge ordered the company to turn over documents related to the transfer of Chewy equity. A day later, Bloomberg reported that PetSmart creditors rejected the company’s offer to add new investor protections in return for dropping their litigation. PetSmart’s term loan reached a post-2017 high of 89 cents on the dollar Friday, potentially indicating that the lawsuit is gaining traction.

More recently, the March term loan and senior note offering financing the $10 billion leveraged buyout of Johnson Controls International plc’s car-battery unit represents another measuring stick. After analyzing the senior notes documentation, credit research firm Covenant Review called those covenants “extremely aggressive and containing numerous flaws.” Features that might make creditors cringe include “wildly off-market” compliance calculations that “arbitrarily” exclude various borrowings, as well as a “phony” test that could overlook additional debt used to fund such restricted payments and the ability to “transfer unlimited IP to unrestricted subsidiaries and other entities.” What’s more, so-called add-backs to EBITDA give “the company credit for expected revenues that have not yet been (and may not be) earned.”

As issuers continue to push the envelope, the cycle continues to age. In a March 4 interview with Bloomberg, Carlyn Taylor, global co-leader of corporate finance and restructuring at FTI Consulting, predicted that a spike in defaults is on the way, sooner or later:

The expansion is pretty long in the tooth and there’s definitely a lot of buildup. The activity level of restructuring is rising, maybe not at the rate of bankruptcies, but the pipeline of companies we think are going to end up in restructuring, based on metrics that we analyze, that volume has gone up. And we’re so busy, which we don’t think is just market share, because we think our competitors are also very busy.

via ZeroHedge News https://ift.tt/2Ut0vqs Tyler Durden