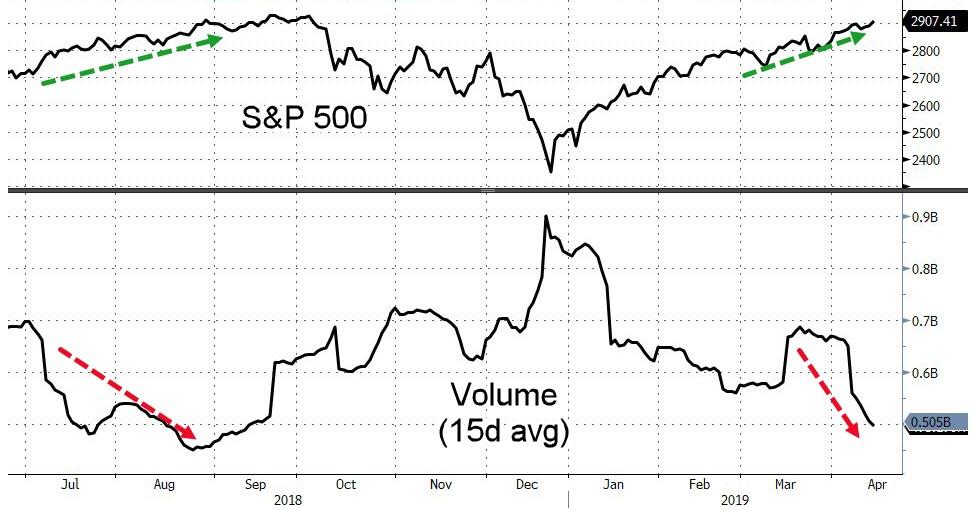

As Stocks rise, Volumes slide…

Trade appropriately…

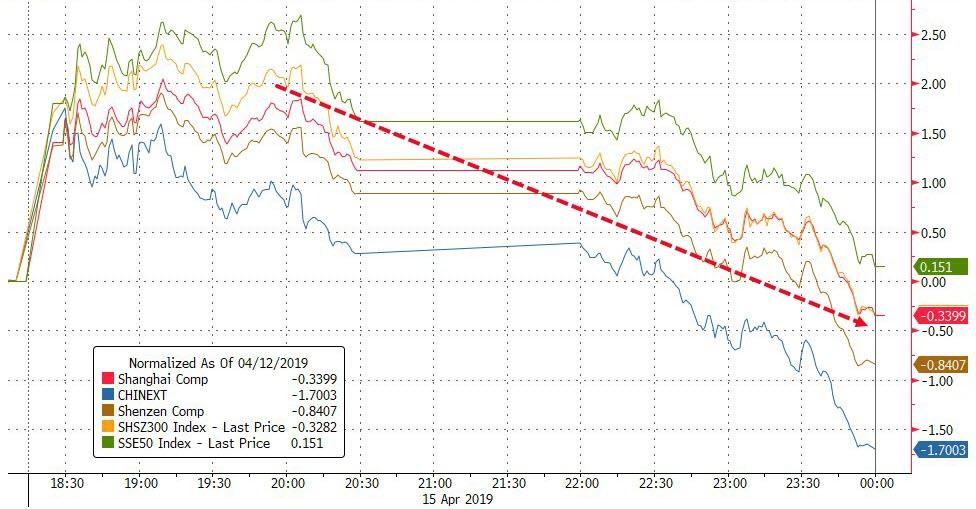

China was ugly overnight with ChiNext down once again…

Europe ended the day practically unchanged after a solid open for Italy and Spain…

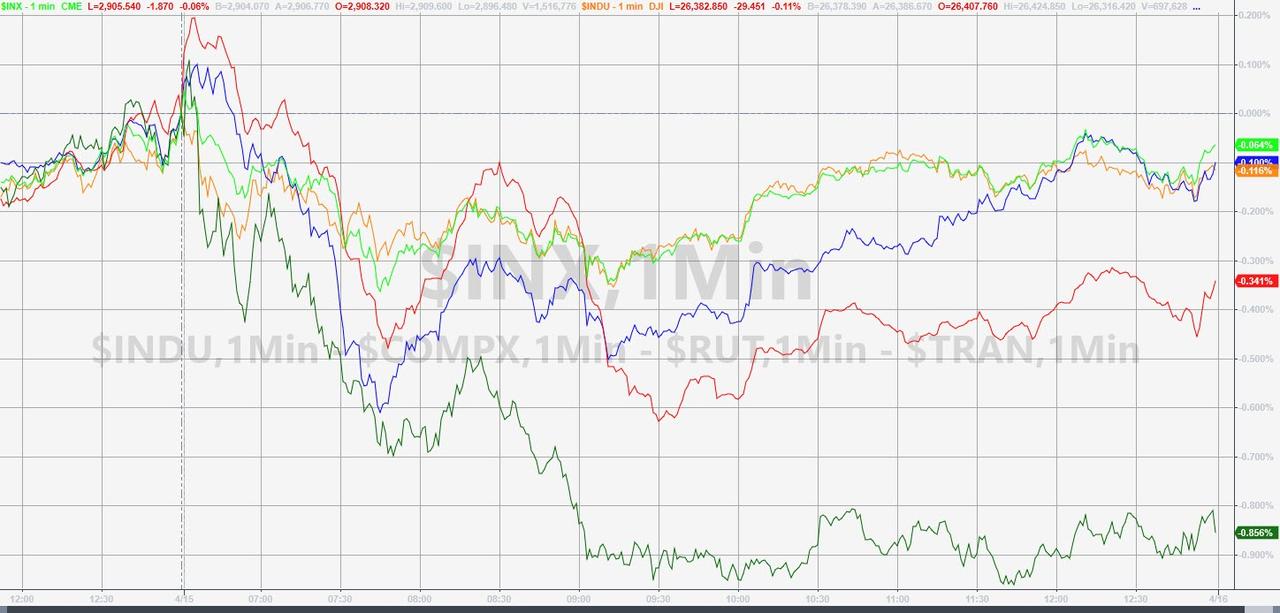

US markets more mixed with Small Caps and Trannies worst. S&P, Dow, and Nasdaq all levitated back towards unch in the last hour…

Goldman’s results disappointed, erasing all of Friday’s gains and the rest of the banks slumped…

And judging by the yield curve, financials still have a long way to go…

After tagging an 11 handle on Friday, VIX bounced up to 13 intraday before leaking lower…

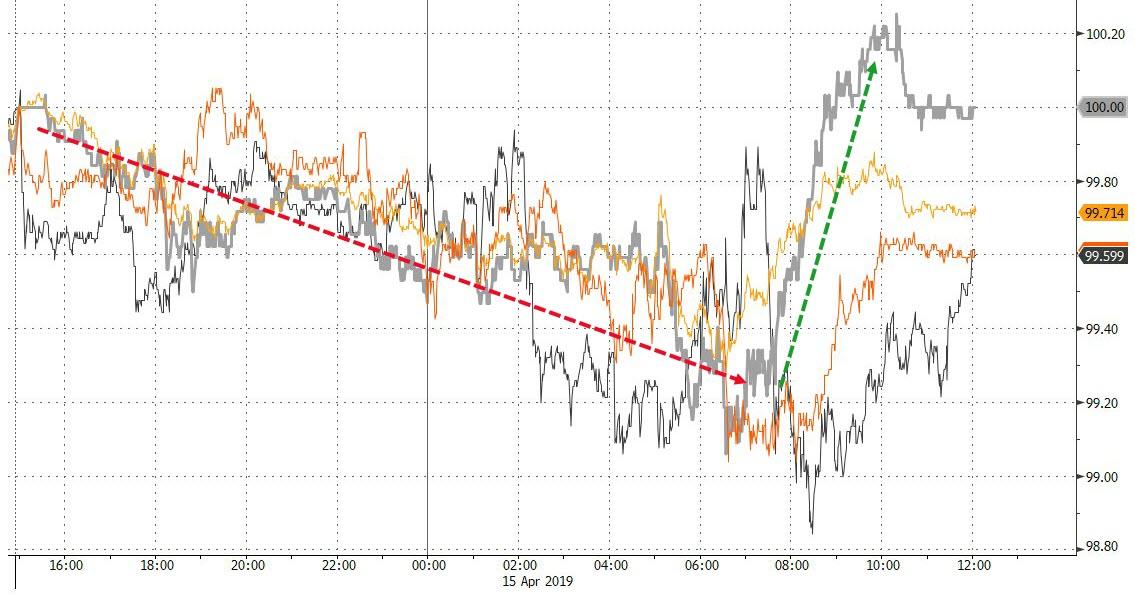

Treasury yields edged lower today – in a tight range – after Friday’s surge…

Having blow above 2.50% on Friday, 10Y Yields drifted very modestly lower today…

Following Friday’s slump, the dollar index rebounded notably today, seemingly bid as US markets opened…

And while VIX was flashing an 11 handle – FX Vol collapsed to a 5 year low…

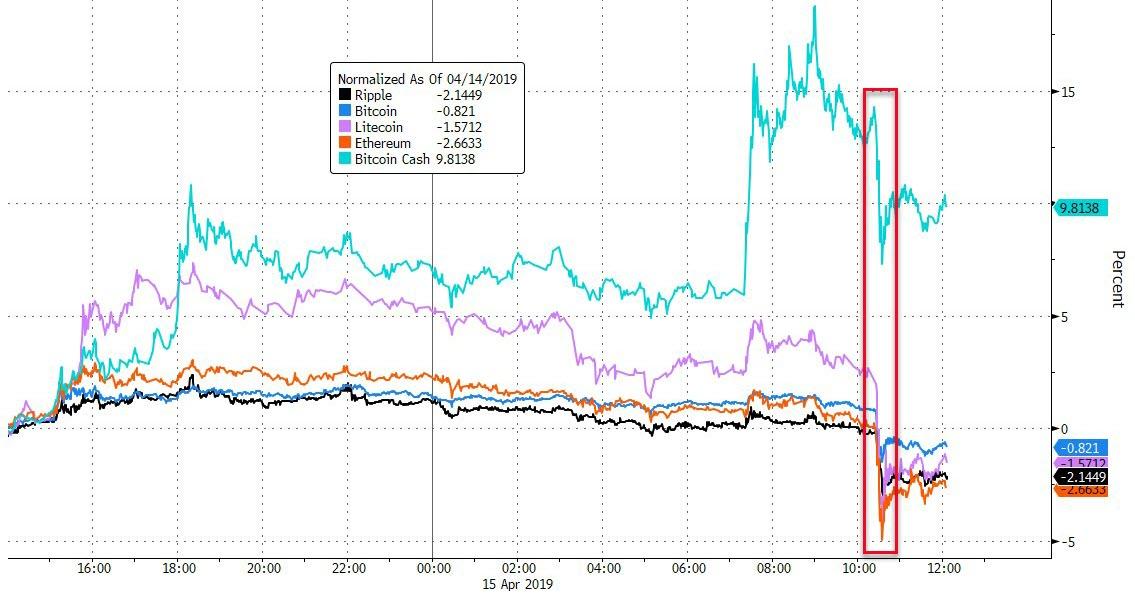

Cryptos suddenly lurched lower as Bloomberg reported on algos gone wild…

Which sent Bitcoin down to $5000, before bouncing back…

Commodities drifted lower for most of the last 24 hours, rebounding after US markets opened with silver ending best – unchanged…

Gold remains below $1300…

Finally, US Macro data is at its weakest since July 2017 as Chinese macro data surges to its best since May 2018 – but we have seen this kind of sudden divergence before…

Don’t forget though – its not the economy, it’s central banks stupid!

via ZeroHedge News http://bit.ly/2UjXV25 Tyler Durden