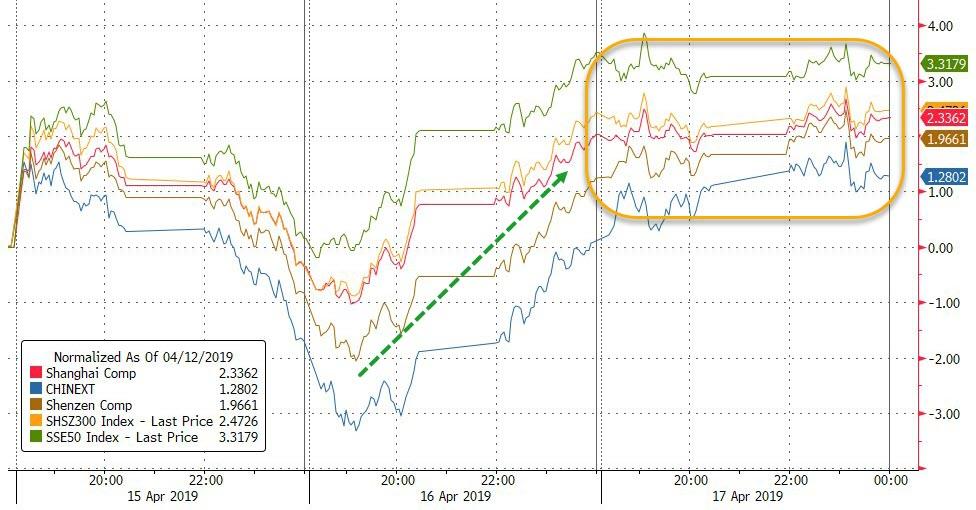

Positive (well managed) data from China overnight was met with a yawn by equity investors…

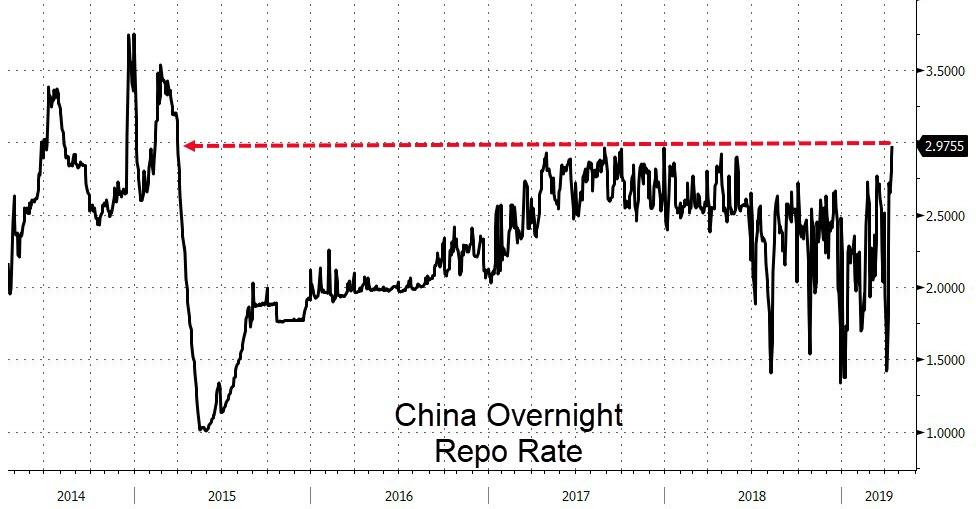

But the Chinese money markets are starting to get spooked…

European markets rallied, led by DAX again…

With the US economic data dumping near two-year lows…

Bonds & Commodities seem in agreement on the state of play…

But stocks disagree…

And Nasdaq 100 hits a new record high as earnings tumble…

Mission Accomplished indeed…

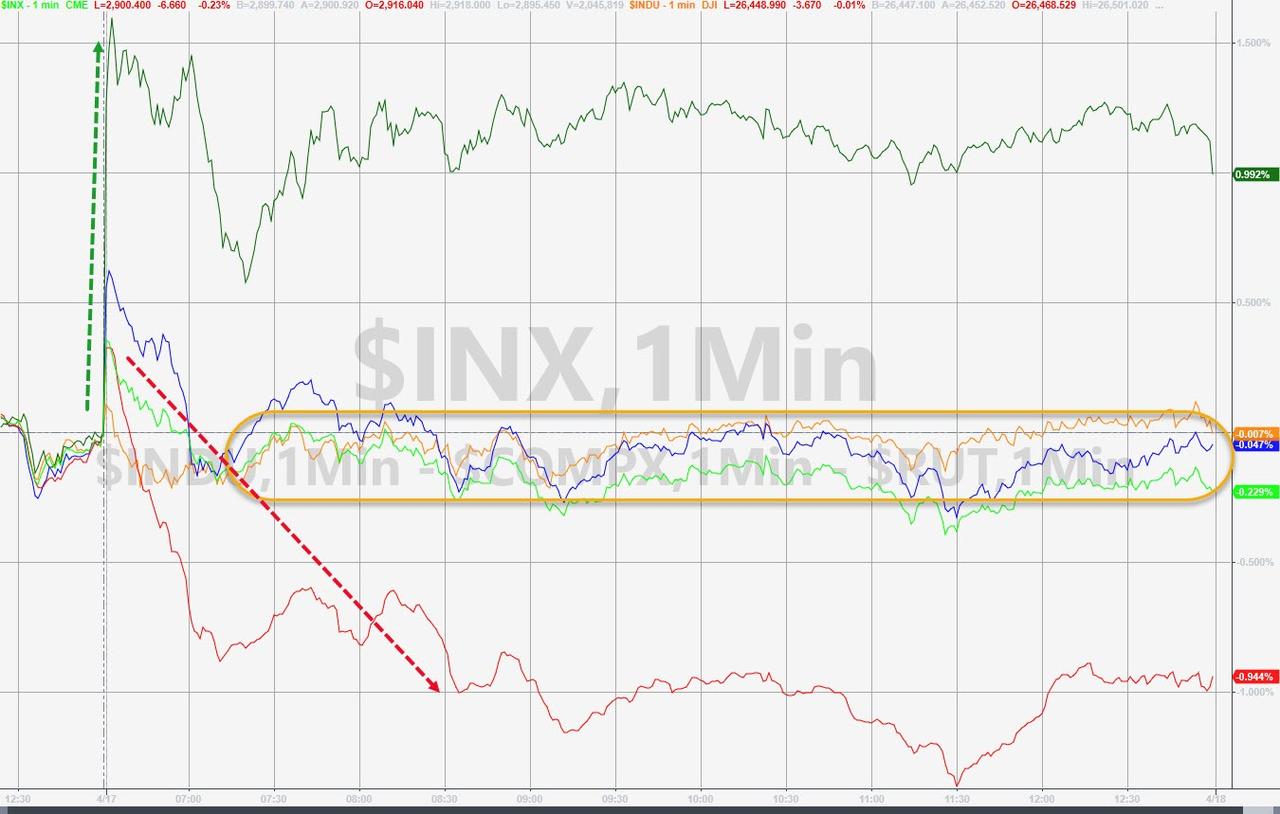

While Trannies were best, Small Caps stumbled today as The Dow, S&P, and Nasdaq traded in an extremely narrow range…

QCOM continued to explode higher – breaking the 2014 highs before sliding back…

Which lifted Semis to a new record high…

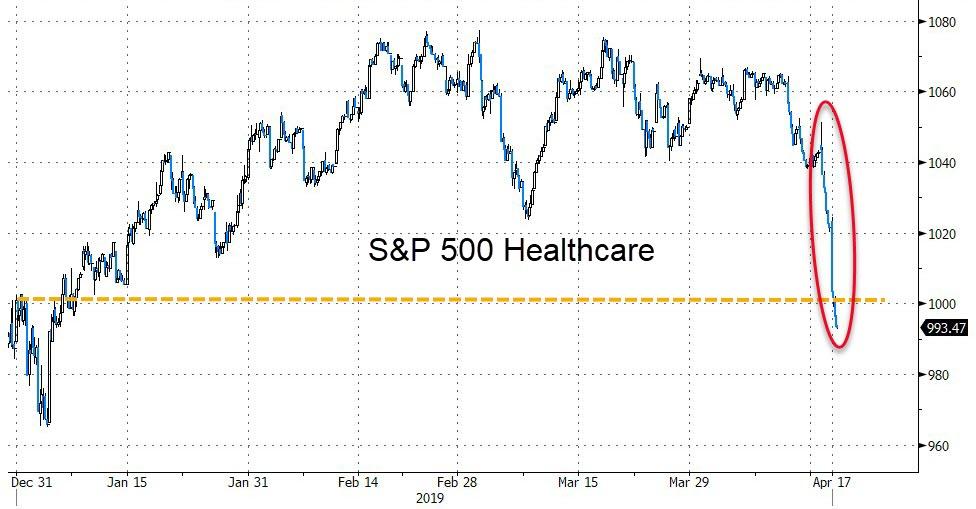

Healthcare stocks were hammered for the second day – the biggest 2-day drop since mid-December’s crash began – erasing the YTD gains…

FANG Stocks were weaker today

VIX Flash-crashed before the cash market open and pushed above 13.00 intraday…

Treasury yields were practically unchanged on the day, despite some intraday swings…

30Y Yields briefly pushed above 3.00% but could not hold it…

97.00 remains the magic number for DXY Dollar Index…

Cryptos were mixed today with Bitcoin and Ether higher but Bitcoin Cash sliding…

WTI rolled over today but copper gained as PMs limped lower…

Despite a crude draw and production cut, WTI fell back below $64…

Gold fell back to its lowest since Xmas Eve…

Finally, don’t forget, that which can’t last forever, won’t!

Because it’s not different this time…

“You have meddled with the primary forces of nature, Mr Beale, and I won’t have it! Is that clear?”

via ZeroHedge News http://bit.ly/2DirYBA Tyler Durden