Three weeks ago, when Turkey was scrambling to defend the lira ahead of local municipal elections, a potentially destabilizing event which saw significant selling of the currency (and which ended up badly for Erdogan’s ruling party, which lost historic control of the two most important cities, Ankara and Istanbul), we reported that the Turkish central bank had burnt through at least a third of its foreign reserves in March in an effort to stem a plunge in the lira, in a repeat of the crisis that engulfed the lira last summer and triggered a blast of inflation and the first recession in a decade, while “putting the country on path to a full-blown currency and funding crisis.”

And despite what was clear continued central bank defense of the Turkish lira since then, Turkey’s official reserves actually appeared to rise, in what was meant to telegraph confidence in the currency and give the impression that the currency was stable without continued central bank support.

There was just one problem: the central bank appears to have been if not lying, then grossly misrepresenting the true state of the country’s foreign reserves .

As it turns out, Turkey has been pulling a financial trick popularized by China’s central bank for the past several years, and according to the FT, the country’s central bank was propping up its foreign currency reserves with billions of dollars of short-term borrowed money, “raising fears among analysts and investors that the country is overstating its ability to defend itself in a fresh lira crisis.”

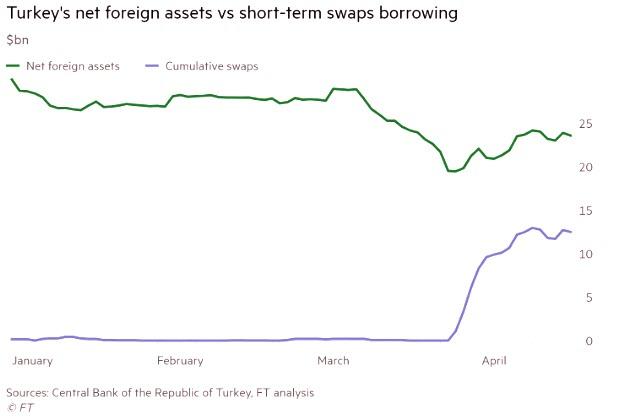

After tumbling from a recent high of $34 billion to $25 billion at the end of March, Turkey reported that the net foreign reserves held by the central bank stood at $28.1 billion in early April — a sum which the FT notes was already believed to be inadequate because of Turkey’s heavy need for dollars to cover debt and foreign trade. But what the Financial Times uncovered is that this total was “enhanced” by a surge in the use of swaps, or short-term borrowings, since March 25. Stripping those swaps out, the total is an alarmingly low $16 billion, an amount which could be depleted in just months, if not weeks, especially if the news of the CB’s plunging reserves creates a self-fulfilling prophecy in which lira holders rush to convert their currency before the central banks runs out of dollars.

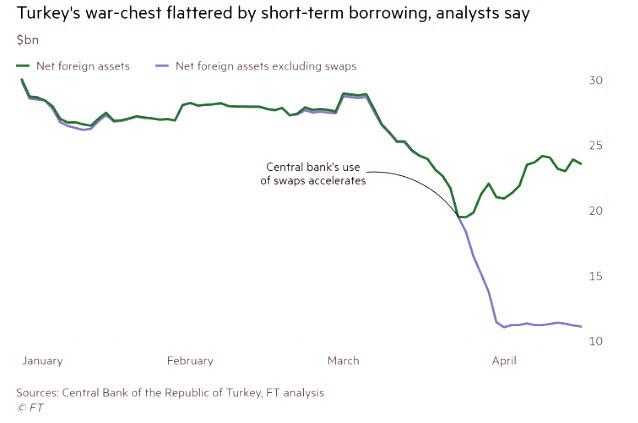

The chart below shows two sets of numbers: Turkey’s true net foreign reserves, and the number that the central bank had used for public consumption, one that include the nominal amount of swaps.

Confirming the FT’s analysis, a former senior official at Turkey’s central bank, who did not wish to be named (as it would mean an instant prison sentence by the country’s executive president), said the extra dollars had been borrowed, not earned. “This is not an orthodox [approach to] central bank reserve build-up.”

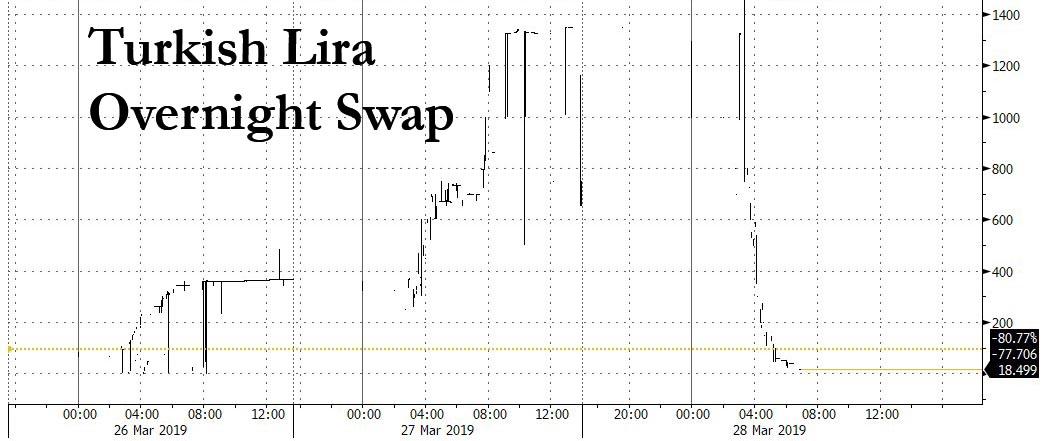

To be sure, the Turkish currency market has been a fiasco for the past month: at the end of March, just days ahead of the elections, Turkey pulled another familiar Chinese trick, when in an attempt to crush speculators and lira shorts, it briefly pushed up its overnight swap rates to 1350%, a level which resulted in swift condemnation from the international finance community which was furious at the ridiculous tricks pulled by the Erdogan government.

Then, once the central bank realized it couldn’t keep swap rates at stratospheric levels for long, it decided to change its approach, and opted to lie about its reserve situation instead. Starting roughly around the time the overnight swap rate collapsed back to normal on March 28…

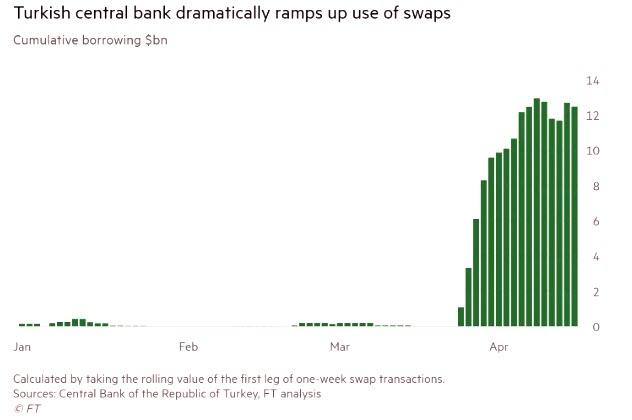

… the central bank’s use of swaps exploded, rising from virtually nothing to as much as $13bn by April 8, and a sharp increase from January 1 — March 25, when borrowing never exceeded $500m, according to the central bank’s own figures. And as one would expect, when adding the impact of the swaps, the bank’s reserve figures started to climb again… but as shown in the top chart, the real number excluding the borrowings, was far lower.

What exactly are these swaps? Stated simply, this is money that Turkey borrowed from the country’s commercial banks, which just so happens, are flush with dollars after individuals and companies flocked to hard currency as a haven.

For those following the fund flows, this circular arrangement was a delightfully Machiavellian construct by Erdogan: first, as a result of its collapsing reserves, the central bank prompted fears among the local population that its funding situation was unsustainable, forcing a surge in lira to dollar conversions among the local population (and foreign speculators). However, since the dollars that were received following the conversion were parked with the local banks, the central bank had easy access to use them – in the form of swaps – and as it received more dollars from the commercial banks, it not only could defend the lira further, using the people’s money against them, but also misrepresent the true level of its net foreign reserves!

To be sure, if and when this check kiting scheme was exposed, it would lead to even greater panic as a second wave of lira selling would ensue, as not only was the true level of reserves lower, but the central bank was in effect leveraging commercial banks’ own dollar holdings in its defense of the currency. In doing so, if and when this valiant defense – which most likely will culminate with another IMF bailout – fails, then the commercial banks would go down too, as bank clients, realizing all their dollar deposits had been quietly carted over to the central bank, would be, how should we say it… furious.

This also explains why, as the FT further note, “five other investors and analysts who have closely studied the bank’s activities in recent weeks spoke on condition of anonymity to the FT about their concerns over the reserves. Several of them were fearful of speaking out on the issue after Turkish regulators launched probes into JPMorgan last month over its advice to clients to sell the lira.”

Investors said they were worried about this practice of using one-week currency swaps, in which liras are exchanged for US dollars with local banks with an agreement to later reverse the transaction. They believe that this borrowing has flattered the central bank’s reserves data.

Some investors argue that the borrowed money should be stripped out of net foreign reserve data, leaving a remaining sum that is well below $20bn.

Responding to the FT, the central bank reluctantly confirmed that dollars borrowed in the first part of these transactions are added to the balance sheet. The obligation to later repay the dollars is recorded as an “off balance sheet item”, which is precisely why Turkey is doing this entire scheme to make its reserves appear far greater than they are in reality.

Naturally, the use of such reserve-masking swaps “sharpened fears that began to gather last month that the bank was burning through its hard currency to hold the lira steady in the run-up to local elections on March 31. The central bank declined to comment on whether it has intervened in this way.”

The impact of the swaps transactions is most vividly illustrated in the central bank’s daily balance sheet, which contains figures for foreign assets and liabilities that have been intensely scrutinised by analysts in recent weeks. Another way of representing the chart up top, net foreign assets — calculated by subtracting the bank’s foreign liabilities from its assets and converting into dollars — have risen and fallen in parallel with the amount borrowed through swaps. The net foreign assets figure — a proxy for how much assets Turkey has to continue defending the onslaught of lira sellers — slumped by $9.4bn between March 6 and March 22 to $19.5bn, the lowest level on a US dollar basis since 2007.

Where things get interesting is what happened next: by April 5, the net reserve figure had swelled to $23.6BN, boosted by an increase in swaps. However, excluding swaps, net foreign assets have stood at less than $11.5bn during the entire month of April, down from $28.7bn at the start of March on the same basis.

In other words, Turkey is officially misrepresenting its current reserves by as much as 100% just to give the impression that it can continue defending the lira, when in reality is it using the same dollars that the local populace had converted into dollars as part of their flight away from the lira.

The condemnation from the analyst community was brutal: Piotr Matys, an emerging market currency strategist at Rabobank, said the use of swaps seemed to be “some sort of window dressing” to create the impression of higher reserves.

Furthermore, it is very likely that Turkey was using these very swaps to support the lira. The central bank did not directly respond to an FT question about the use of funds, nor to a question about whether it used measures to prop up the currency since March 31 elections. However, it did say a variety of factors could account for the shifting total.

With little left in its defense, the central bank has demanded that analysts are wrong to focus on a net international reserves figure that is published once a week, and instead stressed that international reserve adequacy measures used the gross figure to test a country’s preparedness. And while Turkey’s gross foreign reserves stood at around $77BN in the first week of April, that number too is irrelevant considering the elephant in the room which we discussed last summer: Turkey has $177bn in short-term external debt coming due in the next 12 months; it has nowhere near the funds to repay it, virtually assuring some form of default is inevitable.

“There’s a general unease about what’s going on behind the scenes,” said Tim Ash, an emerging markets strategist at BlueBay Asset Management. A lack of transparency was undermining the bank’s already fragile credibility, he warned.

“The bottom line is that they don’t have enough, whether it’s net or gross,” Ash added. “Everyone in the market knows that Turkey doesn’t have enough foreign currency reserves to mount a sustained and credible defence of the lira.”

The only question is when will the price of the lira, which at the current level of 5.75 vs the dollar is wildly overvalued, start reflecting Turkey’s dismal situation.

via ZeroHedge News http://bit.ly/2DjoI9b Tyler Durden