With short interest now at 60+% of its float, Lyft has swiftly become a byword for disastrous post-IPO performance by overvalued tech ‘unicorns’. But the ride-sharing app’s steep drop from the highs reached on the day of its debut hasn’t stunted the market’s insatiable appetite for the next big lossmaker.

Pinterest has priced more than $2 above the high end of its range ahead of its market debut on Thursday, even as it is forced to share the spotlight with Zoom Video Communications, a company that provides remote conferencing services that has also bears the distinction of being a profitable business.

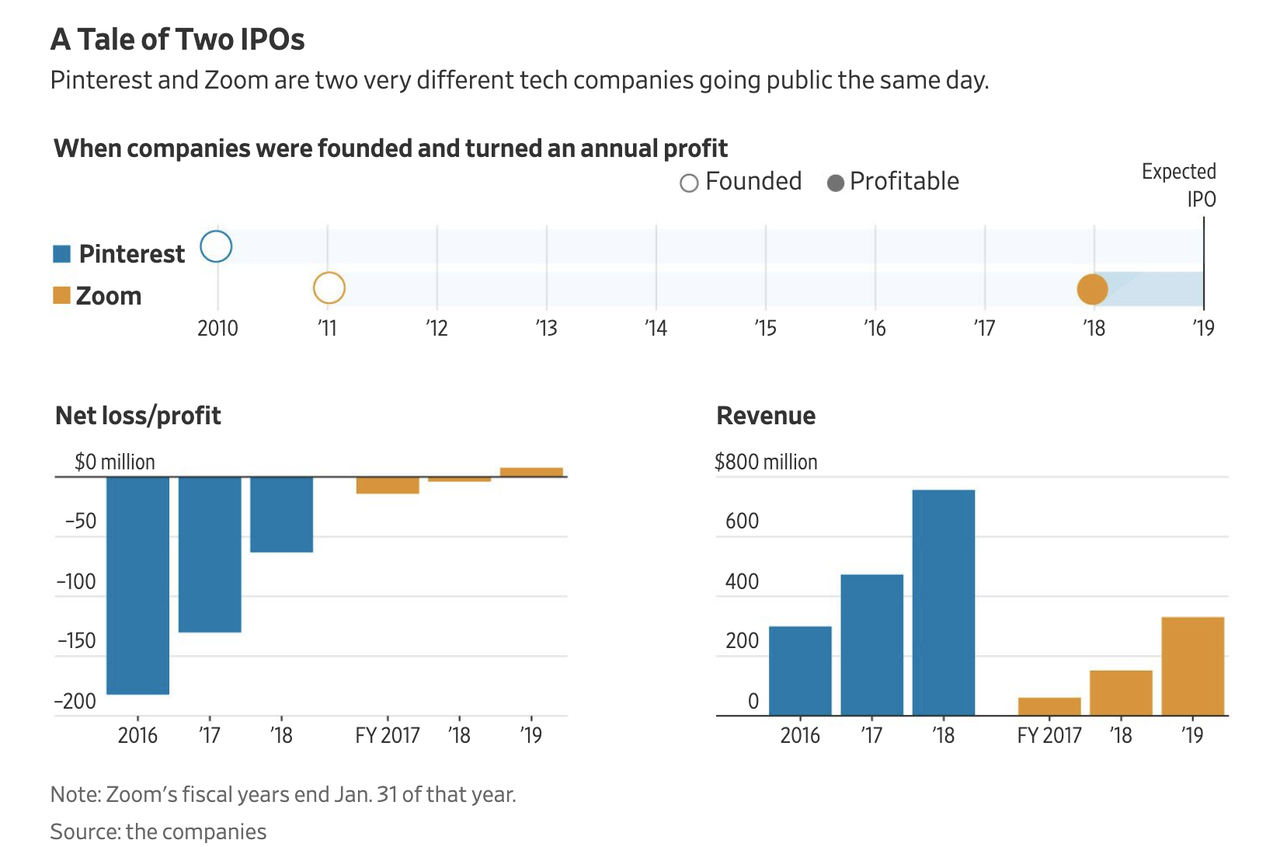

Zoom, whose shares priced at $36 apiece, also generated robust demand. Its bankers raised the expected price range on Tuesday, then its shares priced $1 above that range on Wednesday, valuing Zoom at $10 billion, which, amusingly, is well below Pinterest’s $12.6 billion. Both on a fully diluted basis. Moreover, Pinterest reportedly took a ‘conservative’ tack on its pre-IPO valuation, according to WSJ, even as Pinterest executives sped up the timetable for the IPO to take advantage of a ‘hot’ market.

Lyft shares have been slaughtered – they’re trading 17% below the IPO price – as analysts published a series of downbeat reports (which only confirmed what the market was already telling us).

However, Pinterest boosts one material advantage over Lyft on the basis of fundamentals (so far as those still matter, anyway). While it’s still making losses, those losses are at least narrowing. Though its advertising dependent model still risks comparisons to floundering Snapchat. Meanwhile, Zoom recently became profitable, and its revenues are rapidly growing.

For its fiscal year ending in January 2017, Zoom reported revenue of roughly $61 million. A year later, that more than doubled to over $150 million, then more than doubled again in the year ending January 2019. Its profitability is rare among the recent slew of technology companies coming to the public markets with steep losses.

Pinterest is also growing at a fast clip. And while it isn’t yet profitable, its annual losses are narrowing. Revenue in 2018 totaled $756 million, up from $473 million a year earlier. The company’s net loss narrowed to $63 million in 2018 from $130 million in 2017. Some bank analysts have estimated revenues will grow 30% to 35% in 2019, one person familiar with the matter said.

But as Pinterest struggles to boost its share of the global advertising pie, the comparisons to Snap appear inevitable. The company’s only hope to avoid a similarly disastrous post-IPO streak appears to be keeping its valuation ‘restrained’ – even as some argue that Pinterest might be positioned to better monetize its advertising business.

Despite Pinterest’s efforts to distance itself from the label of a “social media company”, analysts say it can be a useful benchmark for valuation. According to James Cordwell, an analyst at Atlantic Equities, Pinterest is worth as much as Snap, about $16 billion, and could be much more.

“The ability to monetize that audience is much higher,” Cordwell said of Pinterest before the pricing. “When you’re at Snap you’re in the business of communicating with friends or wasting time; when you’re going to Pinterest there’s high purchasing intent: you’re planning something, looking for a product. That’s exactly what advertisers are looking for.”

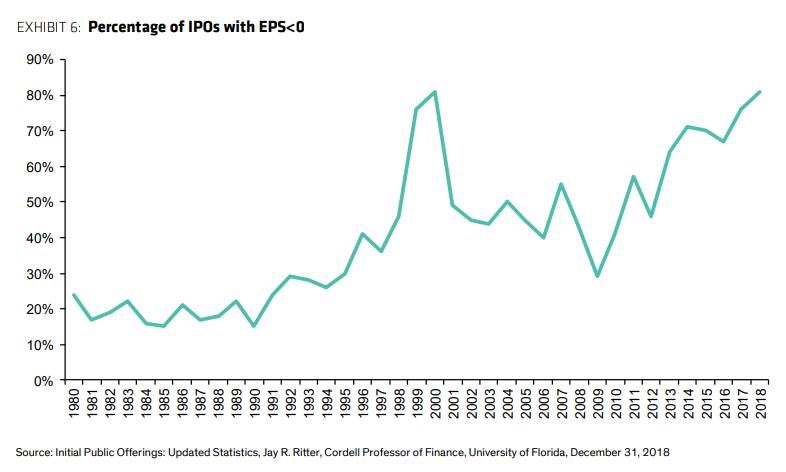

But as investors prepare for Pinterest’s market debut, they’ll be trying to parse what Pinterest’s performance might mean for the next round of unicorns, including Palantir, Slack and the long-awaited debut of uber-lossmaker Uber, particularly as the share of loss-maker debuts has risen to its highest level since the tech crash.

But if the Pinterest offering does go sideways, buyers can always blame the investment banks selling the stock for any “mistakes made”, and seek recourse for their losses in the courts.

via ZeroHedge News http://bit.ly/2UG0pgl Tyler Durden