Lyft’s calamitous IPO, which will likely be remembered as the most botched tech debut since Facebook’s 2012 IPO glitchfest, has already devolved into an acrimonious flurry of litigation.

Executives at the ride-share startup – who are clearly suffering from ‘sellers remorse’ after succumbing to the lofty promises made by deal-hungry syndicate banks hoping for a piece of the offering – have threatened to sue Morgan Stanley over unconfirmed rumors that the bank (an Uber underwriter) took advantage of Lyft’s sloppy S-1 drafting to market a short-selling product designed to circumvent the lockup period. By creating an ‘out’ for early Lyft investors and anyone holding restricted shares, the bank may have ironically, and perhaps inadvertently, helped crash the debut, as Lyft has quickly become a short-seller’s favorite.

Unwilling to pass up a shot at a free lunch, it appears that investors who bought into the IPO, who have been saddled with double-digit losses, believe that profits are their god-given right, and have become such sore losers that when confronted with the fact that sometimes there are consequences for taking risk, their first response is to file a lawsuit.

To wit, Bloomberg reported Thursday that Lyft has been sued by investors who claim the ride-sharing company lied in its prospectus, overstating its market position and neglecting to disclose that it was about to recall 1,000 bikes in its ride-sharing program.

Two separate class-action complaints against Lyft, as well as its officers and directors and underwriters, were filed Wednesday in state court in the company’s hometown, San Francisco.

[…]

The investors claim Lyft was exaggerating in its prospectus when it said its U.S. market share was 39 percent. In both suits, the plaintiffs also dinged the company for failing to tell investors that it was about to recall more than a 1,000 of the bikes in its ride-share program.

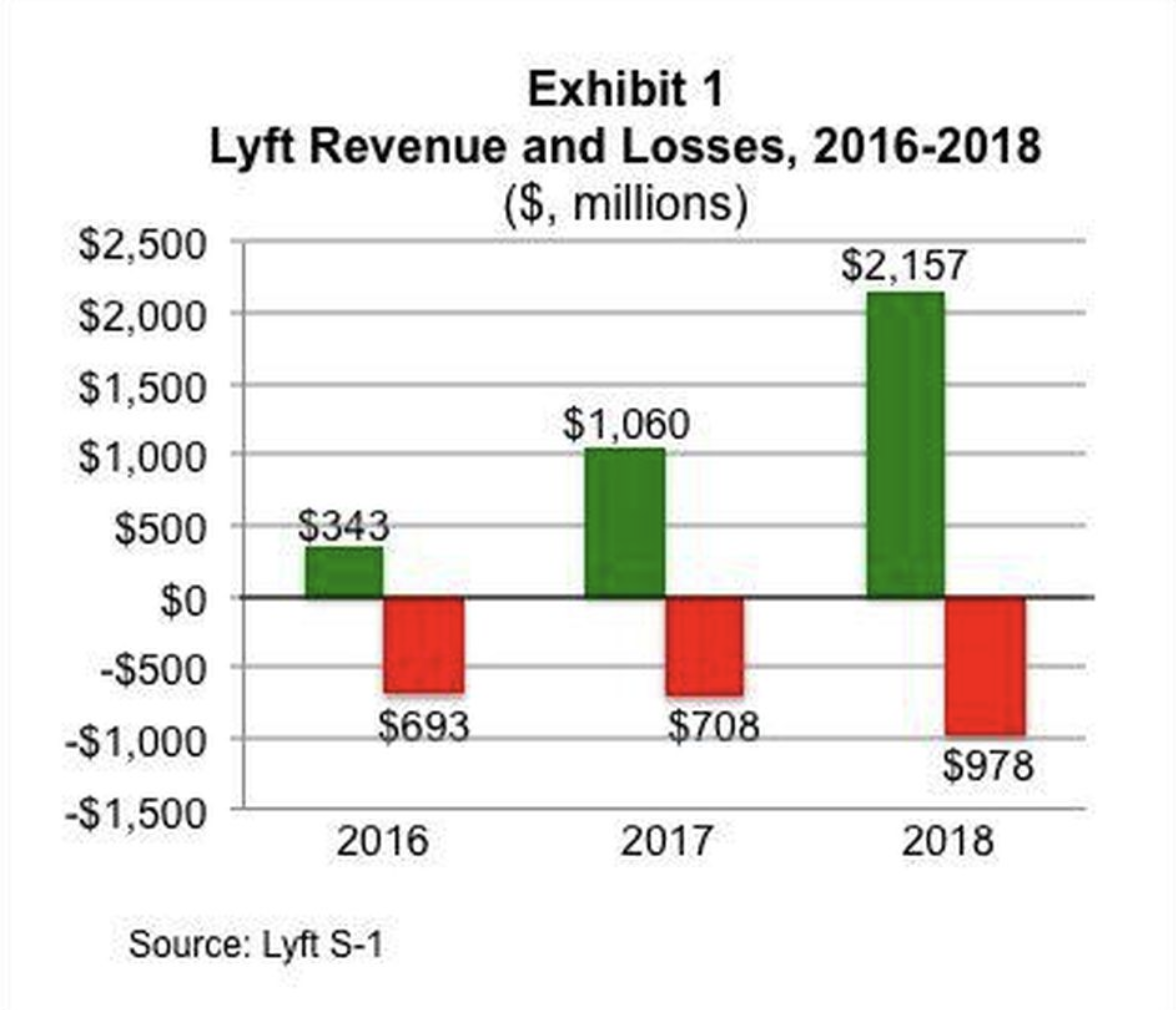

According to its prospectus, Lyft had a 40% of the ride-sharing market as of the end of last year. Its revenue has swelled to $2.16 billion for 2018, double the previous year and up 528% from $343 million in 2016. But its losses have widened, climbing to $911 million for 2018, from $688 million in 2017 and $682 million in 2016.

But of course these damning fundamentals, and the fact that the company has no clear path to profitability, and likely won’t break even for nearly 10 years, shouldn’t be blamed for Lyft’s lackluster performance. After all, when has an inability to make money stopped Silicon Valley startups from achieving sky-high valuations based almost entirely on hopes that they will one day exercise monopolistic pricing power after achieving so much market share by undercutting competitors into oblivion. It’s just not fair!

via ZeroHedge News http://bit.ly/2XlhYPx Tyler Durden