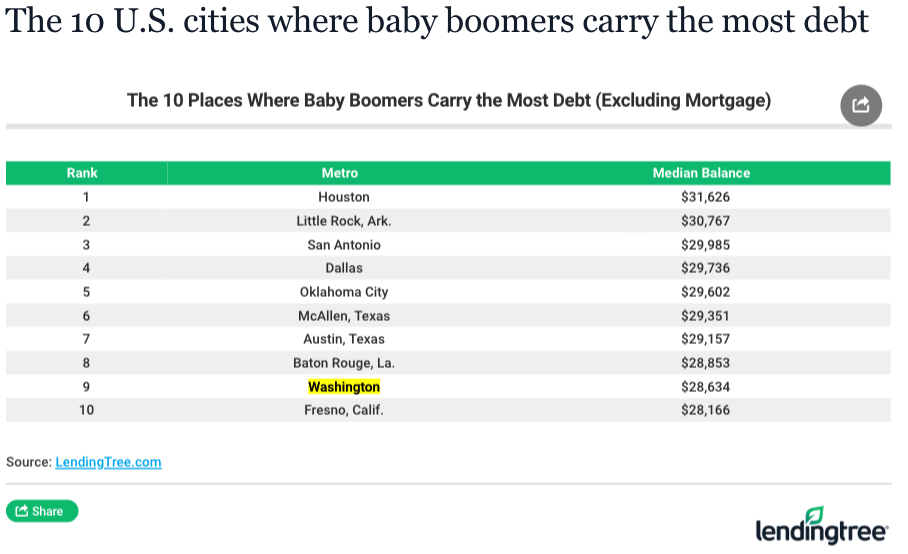

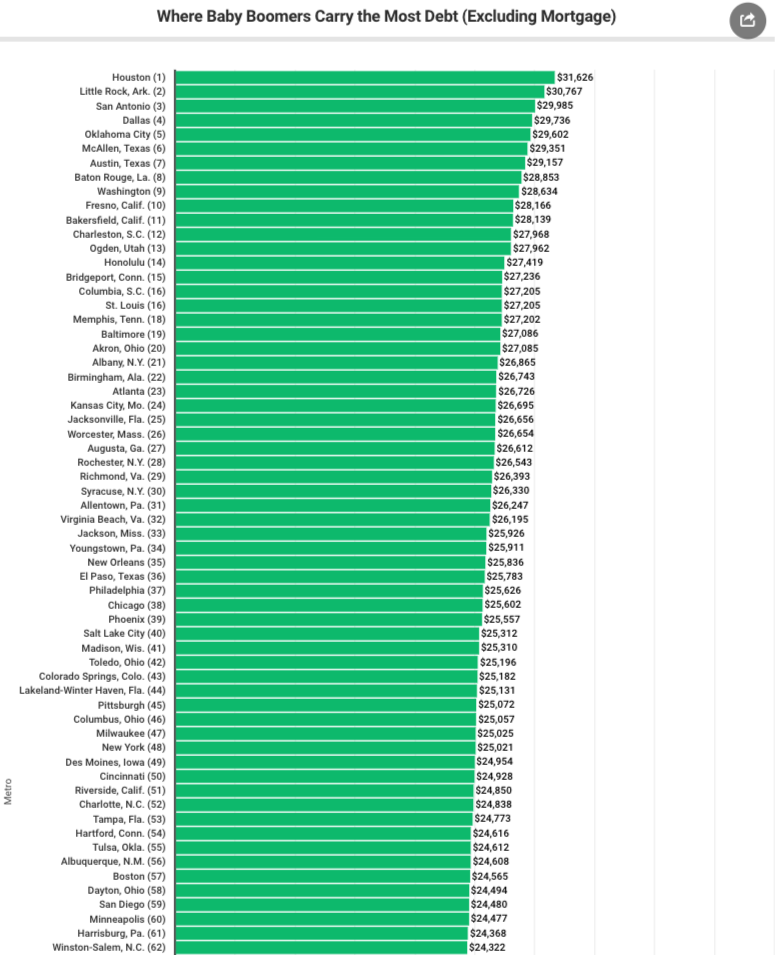

LendingTree, an online lending exchange that connects consumers with lenders, recently published a study on baby boomer finances that found boomers living in Houston, Texas; Little Rock, Arkansas; San Antonio, Texas; Dallas, Texas; Oklahoma City, Oklahoma; McAllen, Texas; Austin, Texas; Baton Rouge, Louisiana; Washington, D.C.; and Fresno, California are burdened with the most debt.

LendingTree researchers used anonymized credit report data of My LendingTree users born between 1946 and 1964 who live in the top 100 metropolitan areas, to determine that this generation owes a median total of $25,187 on non-mortgage debts.

Breakdown of the report:

- Baby boomers in Houston are the most laden with non-mortgage debt, with a median balance of $31,626. On average, 42.9% of that is owed on auto loans and another 33.1% is on credit cards.

- Little Rock, Ark. and San Antonio round out the top three, with median non-mortgage balances of $30,767 and $29,985, respectively.

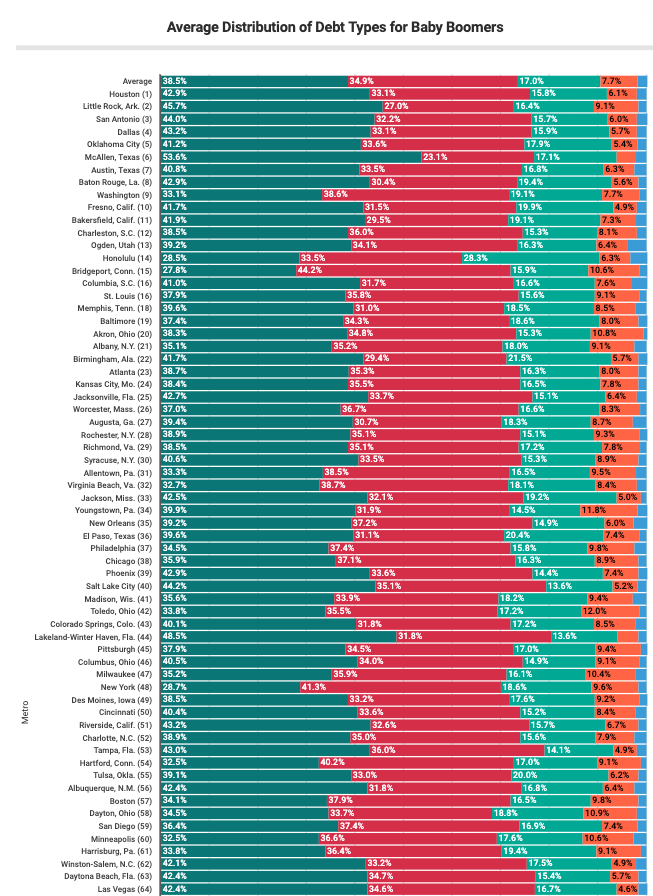

- Auto loans comprise the biggest section of boomer debt, averaging 38.5% of average debt across the 100 metros we reviewed.

- Credit cards represented the next-largest slice of baby boomers’ debt balances, averaging 34.9% across the 100 metros.

- As with our other generational debt studies, Texas rules the top of the list for median balances. Five of the six Texas metros we reviewed fall in the top 10 (El Paso comes in 36th on the list).

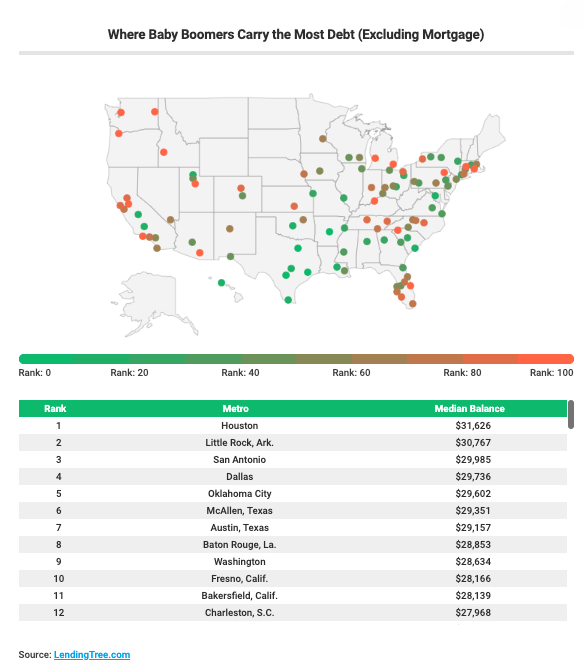

Where baby boomers carry the most debt (ex. mortgages)

Boomers in the top 10 cities owe on average $28,000 in non-mortgage debt, this is about 12% higher than the median total. The composition of this debt is split between auto and personal loans.

About 80% of the top ten cities are located in the South. Five are Texas cities: Houston, San Antonio, Dallas, McAllen, and Austin.

The study revealed that boomers dive deeper into debt when they have auto and personal loans. It suggests that these heavily indebted boomers are more likely to consolidate debt.

An in-depth breakdown of boomer debt balances by account type in the top ten cities:

- Auto loans: The share of boomers’ debt owed on auto loans was the highest in McAllen, Texas. Here, the median debt balance is $29,351, and auto loans make up just over half (53.6%) of baby boomers’ outstanding balances.

- Credit cards: Of the 10 cities where baby boomers have the highest median debt balances, Washington, D.C. is the only place where they have above-average credit card debts. An average 38.6% of the money Washington’s boomers owe was borrowed on credit card, compared with 34.9% across all 100 cities surveyed. The median debt total is $28,634 among Washington’s boomers.

- Personal loans: In half of these 10 cities, the portion of boomers’ balances owed on personal loan debt was higher than the 17.0% average across all 100 cities. Boomers in Fresno, Baton Rouge, La. and Washington owed the most on these types of debt. In each city, boomers owed just under a fifth (about 19%) of their outstanding debt to personal loans, on average.

- Student loans: The high balance boomers owe in these cities is unlikely to be due to student debt, which is unsurprising given that boomers are far past their college-age years. Still, some might still be repaying student debt for themselves or a child, since across all 100 cities student loans account for an average 7.7% of what boomers owe.

Average distribution of debt types for baby boomers:

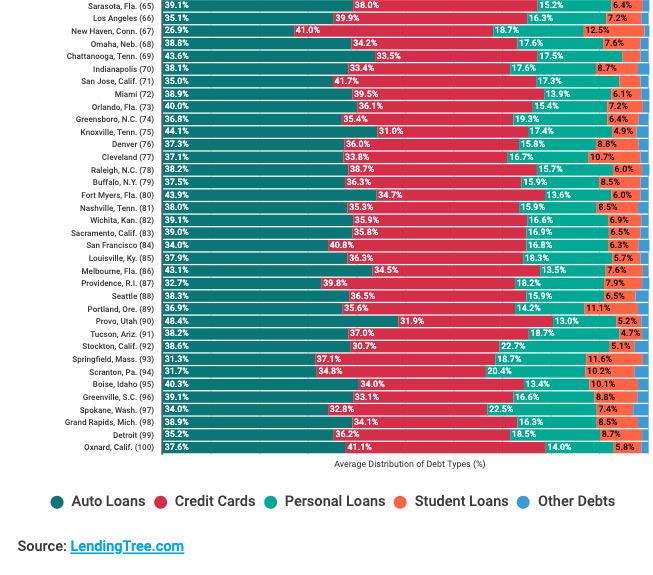

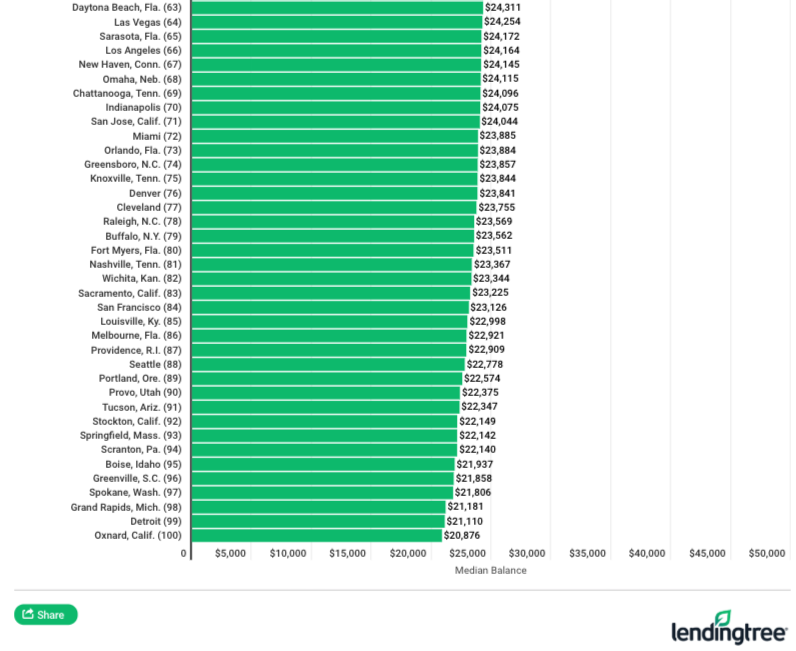

Below are the full rankings of all 100 cities where baby boomers shoulder the most debt:

via ZeroHedge News http://bit.ly/2Xlcbtm Tyler Durden