2018 ended on an optimistic note for retailers with strong consumer spending “data” and what was widely considered to be an unexpected comeback for many brick and mortar stores. While that may have been fun while it lasted, the carnage and pressure on the retail sector has once again been ramped backed up, resulting in a breakneck pace for store closings to start 2019.

In a start to the year that can only be described as absolutely demoralizing for the industry, 5,994 stores have closed in the US so far this year, which is already more than last year‘s total of 5,864, according to Real Deal and WSJ. And retail sales have begun falling again recently, down 0.2% in February from a month earlier, after being up 0.7% in January. Retail sales fell 1.2% in December.

Mall vacancy rates ticked up in the first quarter to 9.3% from 9% in the fourth quarter of 2018.

Ana Lai, an analyst at S&P Global Ratings said: “I don’t think malls are out of the woods yet.”

S&P still has a negative outlook on the United States retail sector overall and predicts that roughly 12 of the 136 retailers that it rates will wind up defaulting this year. This is an astonishing four times the average annual rate.

And as retailers continue to struggle, mall owners are also facing financial difficulties. Some malls have even pushed back their opening dates. For instance, the opening of the American Dream retail and entertainment center in the Meadowlands in New Jersey, which was originally supposed to open in the spring, has already been pushed back to late summer. The Empire Outlets shopping center on Staten Island is now scheduled to open in May, after it was initially planned to open last fall.

Finally, one of the country’s largest malls, Destiny USA in Syracuse, recently saw its mortgage taken over by a special servicer. And even though the mall owner, Pyramid Management Group, says that it is trying to discuss an extension, the servicer is expecting a default from the owner in June.

A Pyramid spokesperson said:

“Destiny USA has experienced tenant closures, just as other properties across the country have on the brick and mortar front. We have and will continue to fill those spaces with new and exciting uses as we work to ensure the health, vibrancy and longevity of the center.”

Just four months into 2019, we have already seen bankruptcies or store closings from companies like Payless Shoesource, Gymboree and Charlotte Russe.

UBS has estimated that another 75,000 stores will have to close by 2026 if online retail continues to rise from its current 16% market penetration to its expected 25%.

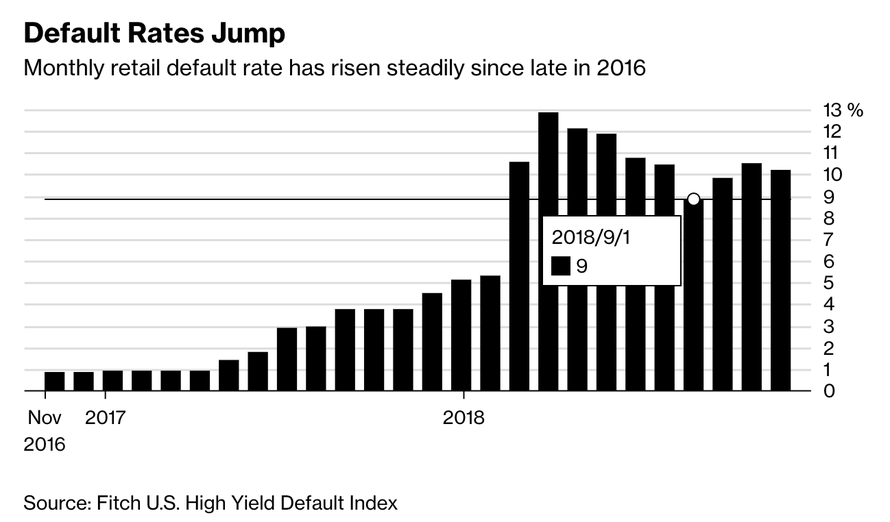

We documented in early March when major chains such as Gap, JCPenney, Victoria’s Secret and Foot Locker all announced massive closures, totaling more than 465 stores over the course of just 48 hours. Back in February, we noted that default rates on retail junk bonds had risen to 10.2% as of December, according to Fitch Ratings, more than double the level from the same period in 2017.

via ZeroHedge News http://bit.ly/2VNk4Y9 Tyler Durden