Call us old-fashioned, but when we see a new financial product aimed at providing ease-of-access to a complex derivative exposure based on a trend that has been in place since the financial crisis, we get a little nervous.

The last few years have seen retail and pro investor alike ride a wave of central bank money supply down the volatility-curve – to a point where once again speculative positioning in near a record short in VIX (equity volatility)…

The last few months have reassured many that all is well as both equity and credit risk have collapsed as the central bankers stepped in to save the world again…

And so, it appears that the compressed nature of equity volatility and the over-crowded positioning has prompted some to seek more complex ways to express their view that central bank put strikes are just below the market… shifting their attention to credit volatility bets.

Tabula Investment Management is behind the London-listed fund, offering traders a fresh way to bet against gyrations in the global credit cycle on the heels of dovish central banks and the Goldilocks-lite economy. As Bloomberg notes, the 50 million euros ($56 million) product, ticker TVOL, aims to deliver steady gains so long as markets demand a higher cushion for price swings on speculative-grade debt compared with what comes to pass, or the volatility-risk premium.

“The premium available has been relatively persistent over the last 10 years,” Michael John Lytle, chief executive of Tabula, said in an email.

Lytle adds that credit offers an additional return over equity in this strategy (due mainly to liquidity – or lack of it):

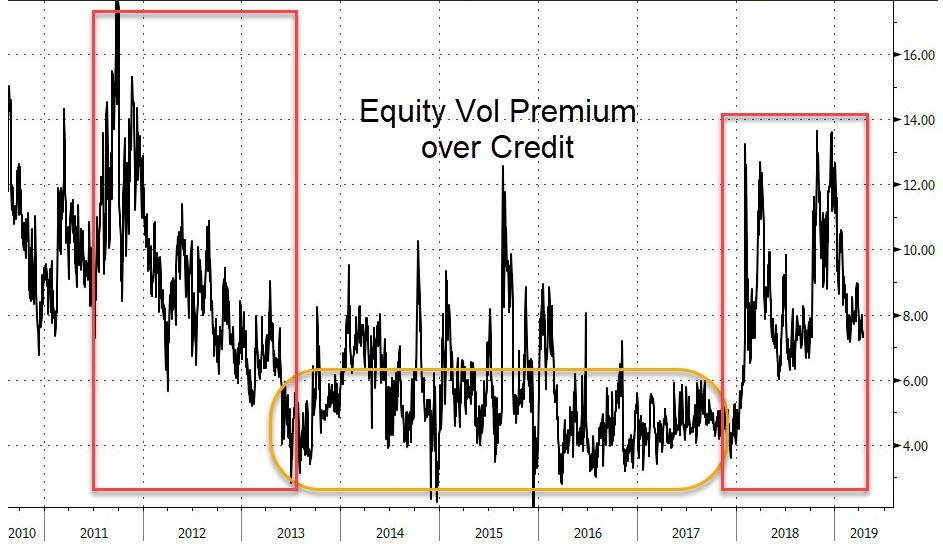

“Most of the time it has also been larger in credit than in equity.”

However, those dislocations can happen (has everyone forgotten about the XIV debacle?) and notably, for now, credit vol is relatively low compared to equity vol (red boxes below).

Bloomberg points out that the Tabula product tracks a JPMorgan Chase & Co. index that simulates the returns of selling a so-called options strangle on a pair of credit-default-swap indexes referencing high-yield markets.

The market-neutral strategy will make money as long as the swaps swing less than the expectations embedded in the price of the options. The risk, as in all short-vol trades, is that a volatility eruption will leave sellers holding the bag.

At Credence Capital Management, Yannis Couletsis sees “potential” in the ETF but limited trading volumes could make selling the fund “strenuous if trying to get out on a nervous day,” he said.

With shares initially priced at 10,000 euros each, the product is principally aimed for professionals, we suspect retail will be unable to resist the roll over time.

Of course, the last few months have reassured the gamblers that picking up pennies in front of a steamroller is well worth the risk… but the yield curve signal suggests Minsky will be proved right once again – so do you feel lucky?

The simple question to all these carry trades is this – can central banks keep this up forever?

What could go wrong?

via ZeroHedge News http://bit.ly/2Dp1oXv Tyler Durden