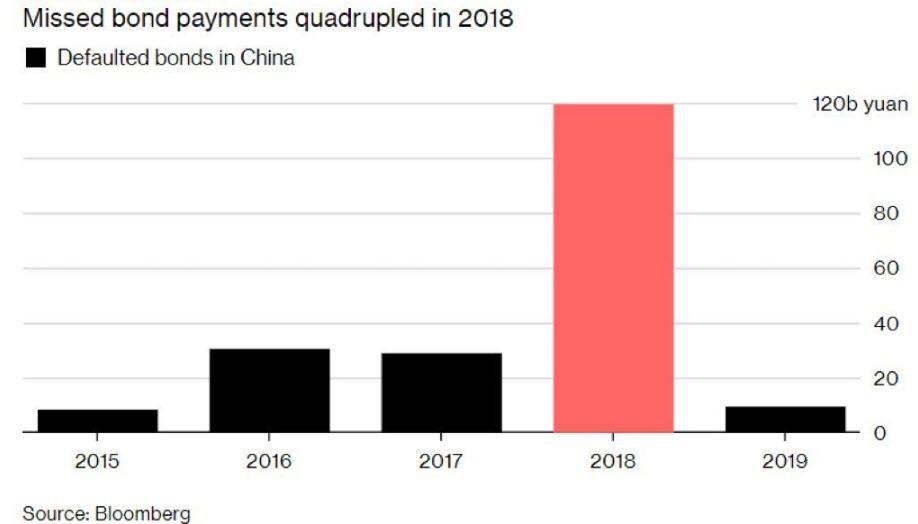

Ever since Beijing allowed private Chinese companies (even certain state-owned enterprises) to officially fail for the first time in 2016, and file for bankruptcy to restructure their unsustainable debt loads, it’s been a one-way street of corporate bankruptcies, one which we profiled last June in “Is It Time To Start Worrying About China’s Debt Default Avalanche“, and which culminated with a record number of Chinese onshore bond defaults in 2018, as a liquidity crunch sparked a record 119.6 billion yuan in defaults on local Chinese debt in 2018.

However, whereas for much of 2018 Chinese defaults affected largely less meaningful companies with little to no systemic impact, in 2019 the defaults started hitting dangerously close to the beating heart of China’s massive, $40 trillion financial system (roughly three times China’s GDP). As we reported back in February, a giant Chinese borrower missed its payment deadline when Wintime Energy – which in 2018 became the latest Chinese bond defaulter as the coal miner failed to pay scheduled interest – didn’t honor part of a restructured debt repayment plan, setting the scene for even more corporate defaults, and as Bloomberg put it, “underscoring the risks piling up in a credit market that’s witnessing the most company failures on record.”

Then, earlier this week, a unit of China’s infamous conglomerate, HNA Group, defaulted on a loan it took out just seven months ago, the latest in a string of missed payments that threaten to complicate the embattled Chinese conglomerate’s restructuring. As Bloomberg reported, lenders to CWT International Ltd., a Hong Kong-listed unit of HNA which is still struggling to cope with its debt after embarking on more than $25 billion of asset sales since 2018 unwinding the biggest global acquisition binge in modern Chinese history, said they would seize most of the company’s assets – including CWT’s stake in a logistics unit, properties in the U.S. and U.K., and golf courses in China – unless CWT makes good on payments tied to a HK$1.4 billion ($179 million) loan taken out in September.

Fast forward to today when China’s default tsunami may be about to claim its biggest and most visible casualty yet.

As Bloomberg reports, a debt crisis at one of China’s most well-known private conglomerates entered a new stage Thursday, when the company said cross-default clauses had been triggered on dollar bonds worth $800 million.

The company in question, China Minsheng Investment Group, also dubbed “China’s JPMorgan” is one of the largest private investment conglomerates in China, and had 232 billion yuan in total debt and 310 billion yuan of assets as of June 2018, according to Shanghai Brilliance Credit Ratings.

Minsheng first made the news in early February when it failed to make a Feb. 1 bond payment to creditors after a 3 billion yuan note had matured on Jan. 29. Since then its financial troubles have only escalated, and this week it appears that the company is preparing for a full-blown bankruptcy after it appointed Kirkland & Ellis as legal adviser, according to a Hong Kong stock exchange filing, which also noted that banks have set up a creditor’s committee to try to stabilize the company, a traditional step that precedes a debt-to-equity restructuring.

The cross default comes after CMIG’s problems spread to its affiliate Yida China Holdings, making some of the developer’s debt immediately payable, and causing a chain reaction back to the parent company’s own securities.

In many ways, Minsheng’s growing troubles were easy to anticipate: since its establishment in 2014, CMIG has spent more than $4 billion on investments and amassed about $35 billion of liabilities as of September.

“CMIG’s debt crisis will worsen as creditors will seek to freeze more assets if it defaults on onshore publicly offered notes,” said Chen Su, a bond portfolio manager at Qingdao Rural Commercial Bank Co. The problems won’t be resolved unless CMIG finds more willing investors, he said.

And since “more willing investors” are unlikely to emerge, CMIG’s liquidity – and solvency – crisis will only get worse, as reflected in the price of CMIG’s dollar bonds due in August, which last traded at around 40 cents on the dollar.

As it scrambles to shore up liquidity, CMIG said it has reached an agreement with holders of a privately placed note to extend the payment date to April 19, i.e. today, from April 8. Meanwhile, the company at the center of the cross-default crisis, Yida China, saw its credit rating was cut to CCC from CCC+ at S&P late Thursday, which said the company may face a liquidity crunch in the next 12 months, given the overhang of debt repayable on demand.

While it remains to be seen if CMIG can negotiate an out of court deal with its creditors, a default would likely harm investor sentiment toward future offerings from privately-held and unrated issuers, according to Patrick Liu, chief executive officer of Admiralty Harbour Capita. Still, given the relatively small amount of CMIG’s outstanding dollar bonds, with some backed by letters of credit, there will be limited impact on the offshore market, he added.

CMIG is the brainchild of Dong Wenbiao, the former chairman of China’s largest non-state bank who’s known as the “godfather’’ of the nation’s private sector. Billing the company as a Chinese version of JPMorgan Chase & Co., Dong convinced 59 non-state companies to join forces as the company’s founding shareholders. The company’s funding eventually dried up as its investments struggled and shadow banks pulled back because of tighter regulation and slowing economic growth, according to Bloomberg.

“Solving CMIG’s debt problem will hinge on its onshore creditor committee, and this may not be fully addressed soon,” said Shen Chen, a partner at Shanghai Maoliang Investment Management. There appears to be little synergy between the company’s various holdings, and finding investors willing to pay for its assets at a good price while taking on a huge debt load will be challenging, Shen said.

The default of CMIG notwithstanding, and despite Beijing’s attempt to stimulate and stabilize the economy once more (by injecting an unprecedented amount of debt into the economy, which will likely result in even greater defaults down the line), signs of corporate stress are spreading. Citic Guoan Group, a state-linked conglomerate, was downgraded on Wednesday after fresh asset seizures, helping trigger a plunge in its listed unit’s shares. Tewoo Group earlier this month sought support from lenders to extend its debt amid a credit squeeze.

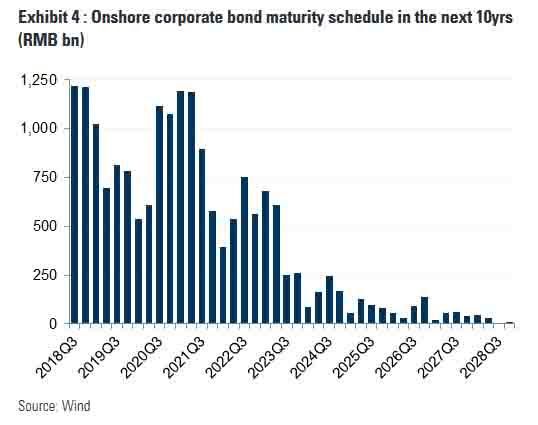

Worst of all is what is coming down the line: here, as Bloomberg notes, bonds from at least 44 Chinese companies totaling $43.7 billion face imminent repayment pressure. Looking further out, it gets even worse, as China’s corporate bond maturity schedule is staggering with trillions in bonds set to mature in coming quarter, assuring even more defaults to come.

The “market is clearly pricing in a lot of credit differentiation as access to refinance remains firmly shut for certain issuers yet widely open for others,” JPMorgan’s Anne Zhang said recently. “Defaults will become more frequent yet more idiosyncratic.”

In conclusion, should the defaulting dominoes accelerate or take down a particularly large piece, China’s leadership will have to make a big decision: let the deleveraging process take place, even as it increasingly threatens financial stability, or once again step in and confirm to the world that there is no centrally planned financial system quite like a Chinese financial system which in just the first three months of 2019 injected well over $1 trillion in total financing in the Chinese economy, assuring that when the next downturn does hit, the resulting debt crisis will be unlike anything ever seen.

via ZeroHedge News http://bit.ly/2Iw8kpO Tyler Durden