In a world in which most hedge funds have failed to outperform both their benchmark and the S&P for the past decade (which is understandable when central banks are now activist investors and talk up or buy stocks on every dip, with the BOJ expected to soon be a top-10 holder in over 50% of all Japanese stocks), investors are increasingly dumping the world of ‘alternative investments’, redeeming their funds and choosing the zero cost SPY instead which has forced many of those formerly charging their investors “2 and 20” for the privilege of holding their money, to cut their fees to 1.5% and 15%, 1% and 10%, or even less.

However, while the vast majority of funds do indeed suck especially when compared to the S&P – with most fundamental, value funds a disaster ever since central banks took over in 2009 – a handful of quant, algo and/or HFT funds have posted stellar results year after year, and few more so than that “other” iconic quant shop (the first one being, of course, Renaissance), DE Shaw, which is bucking the trend of cutting fees and starting in 2020, it is reverting to a fee model that it held for the better part of the 2000s, when it charged 3% of assets under management and 30% of profits.

While fees across DE Shaws various funds – which manage a total of $50 billion – tend to be all over the place, the firm’s $14 billion Composite fund, which is closed to new investors, charged a 2.5% management fee and 25% incentive fee, a fee structure that will ramp up to “3 and 30” starting next year.

Historically, as in when they actually generated alpha so prior to 2010, hedge funds charged a 2 per cent annual management fee and 20 per cent of any profits; however in light of their disastrous performance in recent year, only 3% now charge a 2% management fee, and 16% take a fifth of profits, according to Credit Suisse. The average is now just 1.45% and 16.9% respectively, according to the FT, which notes that DE Shaw, founded by the reclusive billionaire computer scientist David Shaw, also cut the fees on its Composite Fund in 2011, from a 3% management fee and a 30% performance fee to a still-high 2.5 per cent and 25 per cent.

The fund is boosting fees amid rising costs for technology and infrastructure and increasing competition for talent. The roughly 1,300-person firm has grown its investment staff by 45 percent over the past five years as investors search for market-beating returns and diversification.

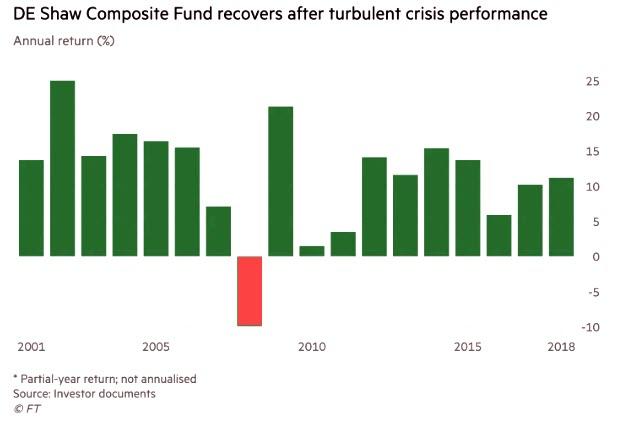

There is another, far implers reason why the Composite fund is ramping up its fee structure: it can, because last year it returned a whopping 11.2% in spite of the market turmoil which let to negative returns for most hedge funds. Furthermore, the Composite Fund has not had a down year since the financial crisis, which was also its only P&L drop this century.

Furthermore, the fact that the fund which was launched in 1988 and among the earliest to use complex mathematical models for trading, is based on a quant architecture is certainly in its favor when most other strategies have failed to generate consistent returns.

“There are powerful trends that are reshaping the industry underneath the surface,” Barclays wrote in a report covering the hedge funds industry earlier this spring, adding that “Strategy-wise, there has been a massive rotation over the past few years away from discretionary strategies and into quantitative ones.”

And, as the FT notes, the industry’s top players are benefiting disproportionately from this, in what analysts have termed a “barbelling” of the asset management ecosystem, where cheap and simple strategies and expensive, high-octane ones enjoy most of the investor demand.

And nowhere is the octane higher than in the systematic, quant world.

While the average hedge fund lost 4.8 per cent in 2018, according to HFR, a researcher, DE Shaw and other big, largely computer-powered “systematic” players managed to profit from the turbulence. Bridgewater’s Pure Alpha returned 14.6 per cent, Renaissance Technologies’ Institutional Equities fund gained 8.5 per cent, and Two Sigma’s Absolute Return and Compass funds rose 11 per cent and 14 per cent respectively.

So for all those fund fundamental managers who get some ideas and decide to follow in DE Shaw’s footsteps, we have one word of advice: don’t, because even though hedge funds are enjoying their best start to a year since 2006, investors i) know this won’t last and as a result ii) yanked another $17.8 billion out in the first quarter. It is diametrically opposite in the world of quant, thought, as several of the biggest quant hedge fund vehicles remain closed to new investors, given that their strategies could splutter if too much money was put to work.

And yes, DE Shaw may also be raising prices simply because quants, unlike traditional financial analysts which can be found a dime a dozen these days, have become exorbitantly expensive: ironically it is no longer financial professionals, but rather rocket scientists, quantum physicists and programmers that control the daily ebb and flow of the market, and as a result have become increasingly important in the money management industry, and form the backbone of people at quantitative investment groups such as DE Shaw. According to headhunters quoted by the FT, a quant with just five years of experience could expect pay packages of at least $300,000 a year, up from about $250,000 a few years ago, while more senior analysts and portfolio managers can expect at least $500,000 and probably well over $1MM.

And that’s why this market no longer makes sense to anyone except, perhaps a math PhD.

via ZeroHedge News http://bit.ly/2XtQOpA Tyler Durden