As the American equity market roars back toward its all-time highs, a majority of the millennial generation is probably learning the true meaning of FOMO, because as study after study has showed, those who came of age immediately before, during and after the financial crisis were so scarred by the experience that they refused to ever buy in to the equity market. Overall, equity ownership among American adults remains 8% below its pre-crisis levels.

Of course, the factors behind the millennial generation’s inability to accumulate wealth are myriad: Stagnant wages, crushing student loan debt and widening inequality are just a few reasons why the savings rate among those under the age of 35 is basically nil. And when they do invest, they appear doomed to repeat the mistakes of the not-too-distant past, favoring get-rich-quick bubble plays like marijuana stocks and bitcoin over blue-chip stalwarts like Apple.

But while most would probably chalk millennials’ aversion to investing up to the fact that they don’t have any savings or income to spare, one recent study suggested that even if they had the money, they wouldn’t put it in stocks.

Lexington Law, a firm that offers services to help people fix their credit, asked 1,000 millennials how they would invest $10,000 if they had it to spare.

Nearly half – 46% – said they wouldn’t put the money in stocks.

Only one in three respondents said they would rely on a financial advisor, reflecting a distrust of financial ‘professionals’ that has lingered since the crash.

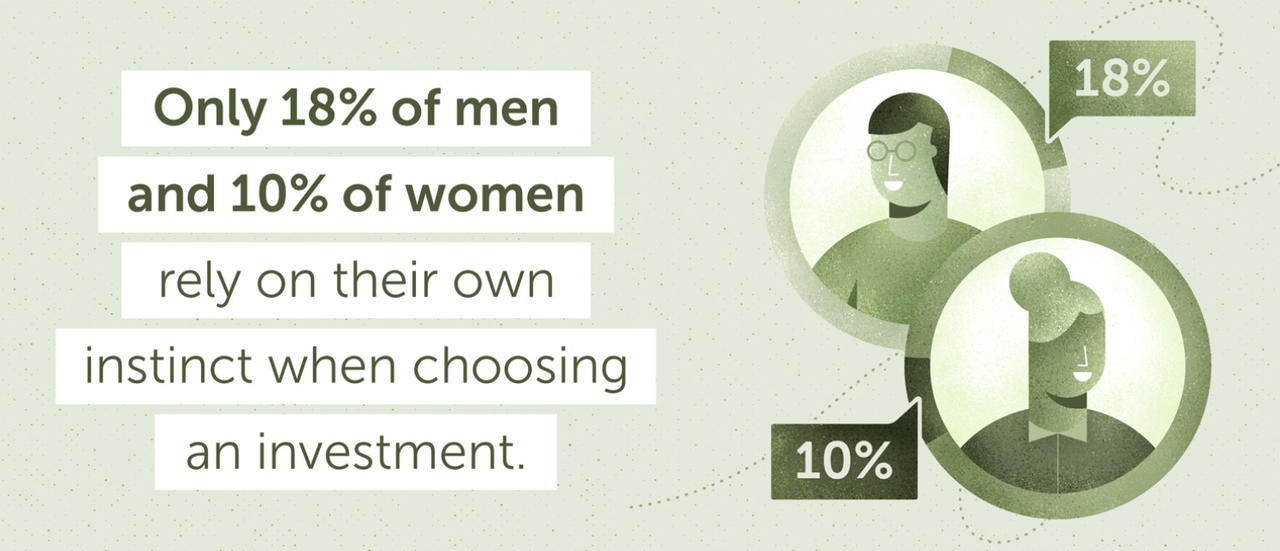

And although a slightly higher percentage of men than women said they would rely on their own advice, most expressed a lack of confidence in their investing acumen that was reflective of their lack of acumen.

As the study’s authors argued, this distrust in the financial system isn’t terribly surprising.

Considering the effects of the last market crash, it’s not terribly surprising that 46 percent of adults aged 25 to 34 said they wouldn’t invest in the stock market. Many of the financial institutions that played a role in the last recession continue to operate as investment banks today. Though employment and wages are up, the crisis hasn’t been forgotten.

We wonder if their attitudes would be different if Congress and the Fed didn’t step in to bail out banks and the wealthy while leaving average working Americans to shoulder the brunt of the consequences?

via ZeroHedge News http://bit.ly/2XjgxRM Tyler Durden