Authored by Charles Hugh Smith via OfTwoMinds blog,

There is a name for this institutionalized, commoditized fraud: moral decay.

Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It’s hard to keep current…), and we’re suitably indignant when non-partisan corruption is discovered in supposed meritocracies such as the college admissions process.

But we’re less adept, it seems, at discerning systemic moral decay, which infects the very foundations of the economy and society.

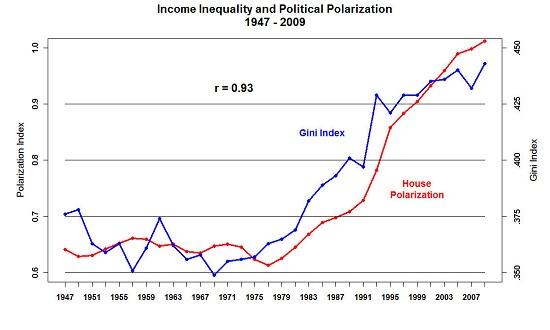

Consider America’s favorite pastime, corrosive partisan politics. This distemper is often traced back to (surprise!) extreme partisans, but as the chart below shows, political partisanship has risen in near-perfect correlation with wealth-income inequality, which it itself the hallmark of deeply systemic corruption, as the system is rigged to benefit the few at the expense of the many. (Chart courtesy of Slope of Hope.)

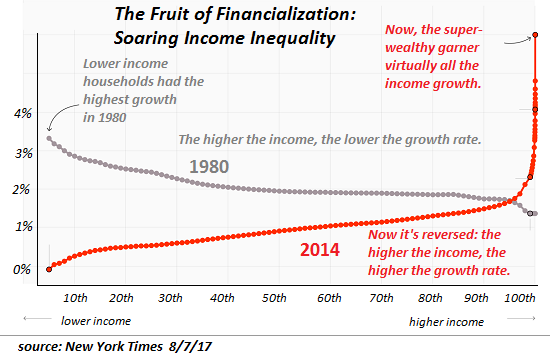

There’s a phrase that describes a socio-economic system becoming the means for personal aggrandizement at the expense of civil society itself: moral decay.How else can we describe a system whose inputs and processes are rigged so the output is the vast majority of all income gains flow to the top 0.1%? (See chart below.)

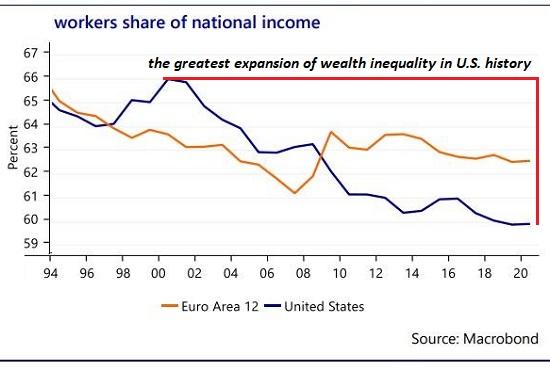

When a socio-economic system institutionalizes the extralegal privileges of wealth and power, that is moral decay. When government only responds in ways that first serve the interests of entrenched insiders, that is moral decay. When the financial system is rigged to sluice income and wealth to the top of the wealth-power pyramid while stripmining the productive class below via inflation and taxes, that’s moral decay. (See chart below of workers’ share of the national income.)

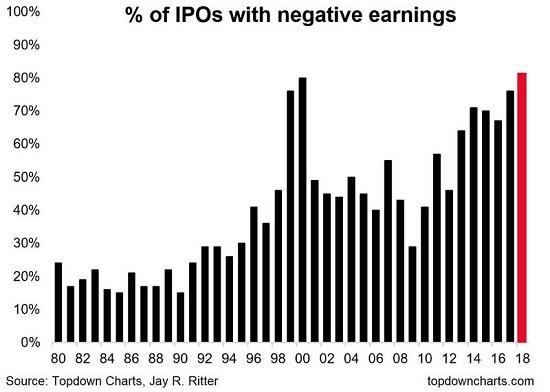

What are initial public offerings (IPOs) of unprofitable Unicorns but a form of institutionalized, commoditized fraud based on the sale of worthless securities to greater fools who are gambling that a second wave of even greater fools will pay a premium to gamble that the worthless shares can be sold to a third wave of supremely greater fools?

There is a name for this institutionalized, commoditized fraud: moral decay.

What are stock buy-backs but a form of institutionalized, commoditized fraud in which insiders borrow vast sums to reduce the number of shares outstanding to boost the per-share profits and hence the valuation of their portfolios and stock options? How does civil society benefit from this hyper-financialized concentration of wealth and thus political power?

There is a name for this institutionalized, commoditized fraud: moral decay.America is fatally riddled with institutionalized moral decay, and so are the competing powers of the EU, Japan, Russia and China.

Moral decay is the only possible output of systems that place the accumulation of personal wealth and political power above all other civic and economic values. When every system is nothing but a means to institutionalize and commodify fraud and extralegal privilege, there is no saving such a perversely asymmetric system from internal collapse.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com. New benefit for subscribers/patrons: a monthly Q&A where I respond to your questions/topics.

via ZeroHedge News http://bit.ly/2GxO3y8 Tyler Durden