Authored by Ben Hunt via EpsilonTheory.com,

This Is Water

There are these two young fish swimming along and they happen to meet an older fish swimming the other way, who nods at them and says “Morning, boys. How’s the water?” And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes “What the hell is water?”

David Foster Wallace (2005)

It’s the perfect description of a Zeitgeist … the water in which we swim.

We can’t see it. We can’t hear it. We can kinda sorta feel it, if we focus really hard, but only kinda sorta. All the same, because it’s part of a social system and not a physical system, WE create it. Not in a conscious fashion. We can’t set out to create a Zeitgeist.

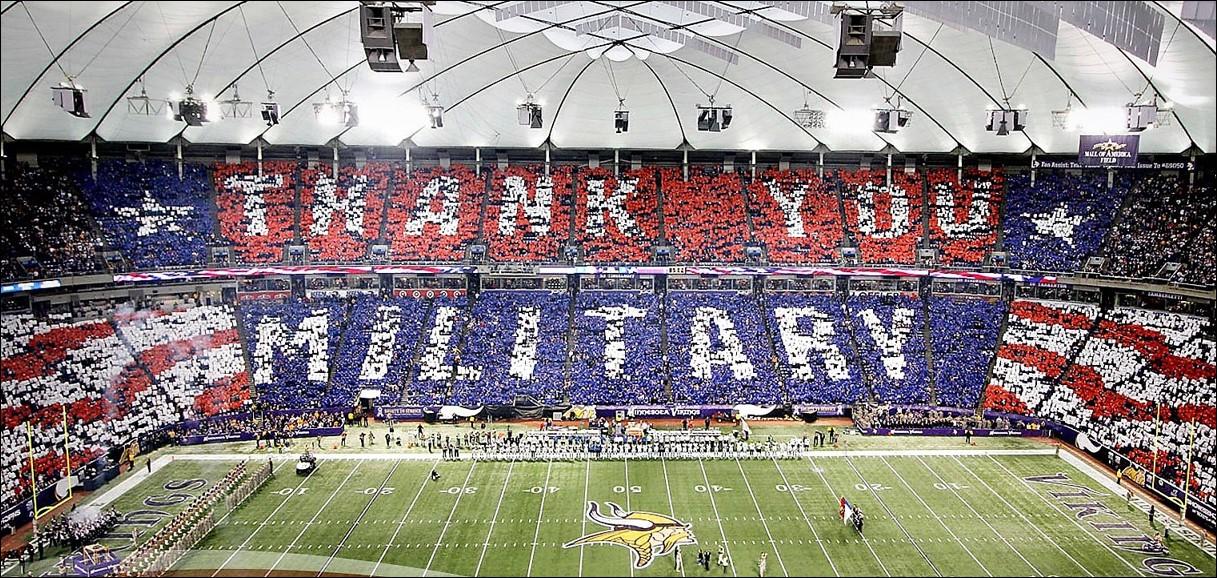

It’s like a stadium crowd holding up cards for the TV audience. They can’t see the picture they’re making … they have no idea what it looks like or what their role in its making might be. But they’re told/asked to do it. So they do.

THIS is a Zeitgeist.

What’s the matter, Ben? You got a problem holding this card up over your head? It’s for the troops. You support the troops, don’t you? Don’t you?

Yes, I support the troops. And yes, I have a problem with this.

Why? Because I don’t trust the State and the Oligarchy to use the common knowledge of “support for the troops” – the crowd watching the crowd express a public act of allegiance to the military, so that everyone knows that everyone knows that yes, it is right and proper to support the troops – for the right reasons.

Instead, I suspect that they will use my voluntary “support” (hey, no one forced you to hold up that card) to justify things like … oh, I dunno, a trillion dollars wasted and 2,000 kids dead to fight a war in freakin’ Afghanistan. Because, you know, otherwise “the terrorists win”. Otherwise we lose “credibility”. JFC.

It’s exactly the same thing with capitalism.

In exactly the same way that all of us sit in our citizenship stadium and get nudged to hold up a card creating a common knowledge display of “Yay, military!”, so do all of us sit in our investor stadium and get nudged to hold up a card creating a common knowledge display of “Yay, capitalism!”.

What’s the matter, Ben? You got a problem holding this card up over your head? It’s for capitalism. You support capitalism, don’t you? Don’t you?

Yes, I support capitalism.

AND I have a problem with holding up this card.

You should, too.

Because we can’t trust the State and the Oligarchy to use our support for the right reasons.

In You Are Here, I wrote that the investment Zeitgeist is changing in three ways.

- Deflationary expectations, now 40+ years old, are becoming inflationary expectations.

- Cooperative and multi-play games in both international politics and domestic politics, now 70+ years old, are becoming competitive and single-play games.

- Modern capital markets, now 150+ years old, are becoming political utilities.

Time to add a fourth.

- Capitalist productivity, now 200+ years old, is becoming capitalist financialization.

What is financialization?

Financialization is profit margin growth without labor productivity growth.

That sounds like a small thing, but I tell you it is EVERYTHING.

-

Financialization is squeezing more earnings from a dollar of sales without squeezing at all, but through tax arbitrage or balance sheet arbitrage.

-

Financialization is the zero-sum game aspect of capitalism, where profit margin growth is both pulled forward from future real growth and pulled away from current economic risk-taking.

-

Financialization is the smiley-face perversion of Smith’s invisible hand and Schumpeter’s creative destruction. It is a profoundly repressive political equilibrium that masks itself in the common knowledge of “Yay, capitalism!”.

-

Financialization is a global phenomenon. In China, it’s transmitted through the real estate market. In the US, it’s transmitted through the stock market.

-

Financialization is the zombiefication of an economy and the oligarchification of a society.

Here’s the foundational chart for these strong words.

source: Bloomberg

This is a 30-year chart of total S&P 500 earnings divided by total S&P 500 sales. It’s how many pennies of earnings S&P 500 companies get from a dollar of sales … earnings margin, essentially, at a high level of aggregation. So at the lows of 1991, $1 in sales generated a bit more than $0.03 in earnings for the S&P 500. Today in 2019, we are at an all-time high of a bit more than $0.11 in earnings from $1 in sales.

It’s a marvelously steady progression up and to the right, temporarily marred by a recession here and there, but really quite awe-inspiring in its consistency. Yay, capitalism!

It’s a foundational chart for this note because I believe that the WHY of earnings margin growth in the 1990s and early 2000s is fundamentally different than the WHY of earnings margin growth since then.

WHY do we get three times as much in earnings out of a dollar of sales today than we did 30 years ago, and twice as much than we did 10 years ago?

The common knowledge answer is technology!.

By which I mean that the common knowledge answer is the meme! of technology as opposed to any actual technology. By which I mean that we can’t exactly say why technology would improve earnings margins and efficiency over the past decade, but we believe it MUST be technology. Somehow. Of course it’s technology. Everyone knows that everyone knows that it’s technology that makes anything in the world more efficient. So we mumble something-something-technology whenever anyone asks a question like this. And yes, This Is Why We Can’t Have Nice Things.

Here, hold this card up over your head. It’s for technology and progress. You support technology and progress, don’t you? Don’t you?

I used to believe this, too. I used to believe that corporate management was getting better and smarter over time, that they were making constant process improvements and technology-based productivity enhancements to squeeze more and more profits out of the same sales dollar.

And I think this used to be true. I think that during the 1990s and early 2000s – the so-called Great Moderation of the Fed’s Golden Age – when we actually had significant advancements in labor productivity year after year after year, corporate management was, in fact, able to drive earnings margins higher for the right reasons. I think the driver of profit margin growth over this period was actual technology, as opposed to the meme of technology!.

But I don’t believe this is true anymore. I don’t believe that technology and productivity advancements have been responsible for earnings margin improvements for the past decade … for some years before the Great Financial Crisis, in fact.

Here, take a look for yourself.

See, the Fed was convinced that an easy money policy would lead to corporate management investing more in technology and plant and equipment … you know, all of those things you need to drive productivity. All of those things you need to drive a 1990s style recovery, with earnings margin accretion for the right reasons.

Instead, corporate management followed the Zeitgeist.

They always do. It’s the smart move.

This is a chart of Labor Productivity growth in the US for the past 30 years. It’s how much more stuff we make or services we provide from a unit of labor. It’s how much we’re growing for the right reasons, by applying capital investment in plant and equipment and technology to work smarter and more efficiently. It’s how we generated earnings efficiency and margin growth for the right reasons in the 1990s and early 2000s. It’s how we’ve been reduced to squeezing tax policy and ZIRP-supported balance sheets for earnings efficiency ever since.

This chart IS the failure of monetary policy for the past decade.

This chart IS the zombiefication and oligarchification of the US economy.

Why do I rail at the Fed? THIS.

Trillions of dollars in QE, and all we got for it was this lousy t-shirt. Yes, I’m going to get this productivity chart put on a t-shirt.

The reason companies aren’t investing more aggressively in plant and equipment and technology is BECAUSE we have the most accommodative monetary policy in the history of the world, with the easiest money to borrow that corporations have ever seen. Why in the world would management take the risk — and it’s definitely a risk — of investing for real growth when they are so awash in easy money that they can beat their earnings guidance with a risk-free stock buyback? Why in the world would management take the risk — and it’s definitely a risk — of investing for GAAP earnings when they are so awash in easy money that they can hit their pro forma narrative guidance by simply buying profitless revenue? Why in the world would companies take any risk at all when the Fed has eliminated any and all negative consequences for playing it safe?

That’s from Gradually and Then Suddenly, written in July 2017. It’s worth your time.

What’s changed since I wrote that note is that the barge of monetary policy, both in the US and everywhere else in the world, has done a 180 and is now chugging back down the easing river. No central bank in the developed world is looking to tighten today, and if anything we’re on the cusp of fiscal policies like MMT, or at least trillion dollar deficits forever and ever amen, to accelerate the shift in the modern Zeitgeist towards fiat EVERYTHING.

This is not a mean-reverting phenomenon.

This doesn’t get better going forward. It gets worse.

But wait, there’s more…

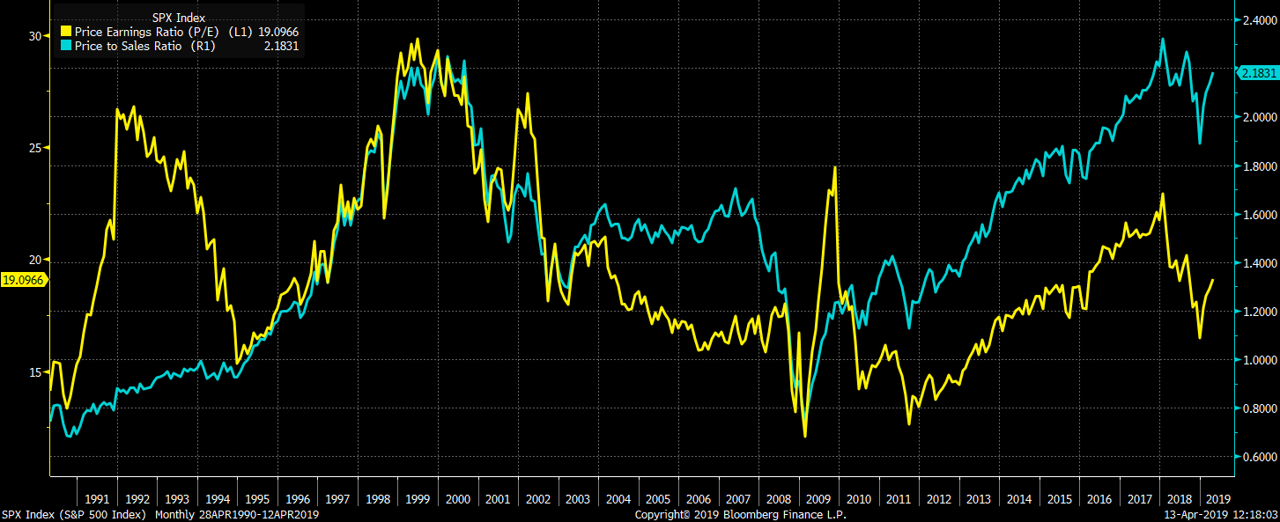

source: Bloomberg

This is a chart of the S&P 500 price-to-earnings ratio in yellow, the belle of the narrative ball, together with its forgotten cousin, the price-to-sales ratio in blue.

When we grow profits through productivity growth – when our “supply” of earnings is directly connected to the same operations that generate sales – P/E and P/Sales multiples go up and down together. When we extract excess earnings through financialization – when our “supply” of earnings increases for no operational reason connected with sales – the P/E multiple becomes depressed relative to the P/Sales multiple. As the kids say, it’s just math.

Why is this important? Because a P/E multiple deflated by financialization doesn’t mean what you think it means.

How many times in the past ten years have you heard that the market is not expensive on a valuation basis? And what you’ve heard is right, as far as it goes.

Because the market narrative of valuation is completely dominated by the vocabulary of earnings, not the vocabulary of sales.

Sure, the S&P 500 P/Sales ratio is near an all-time high, but who cares about that? The S&P 500 P/E ratio today is right at 19 … neither crazy low nor crazy high … and we ALL care about that. But here’s the thing:

Without financialization, my guess is that the S&P 500 P/E ratio today would be 28.

Good luck selling that to a value investor, Wall Street.

Here, hold this card up over your head. It’s for value and a reasonable earnings multiple. You support value and a reasonable earnings multiple, don’t you? Don’t you?

But wait, still more…

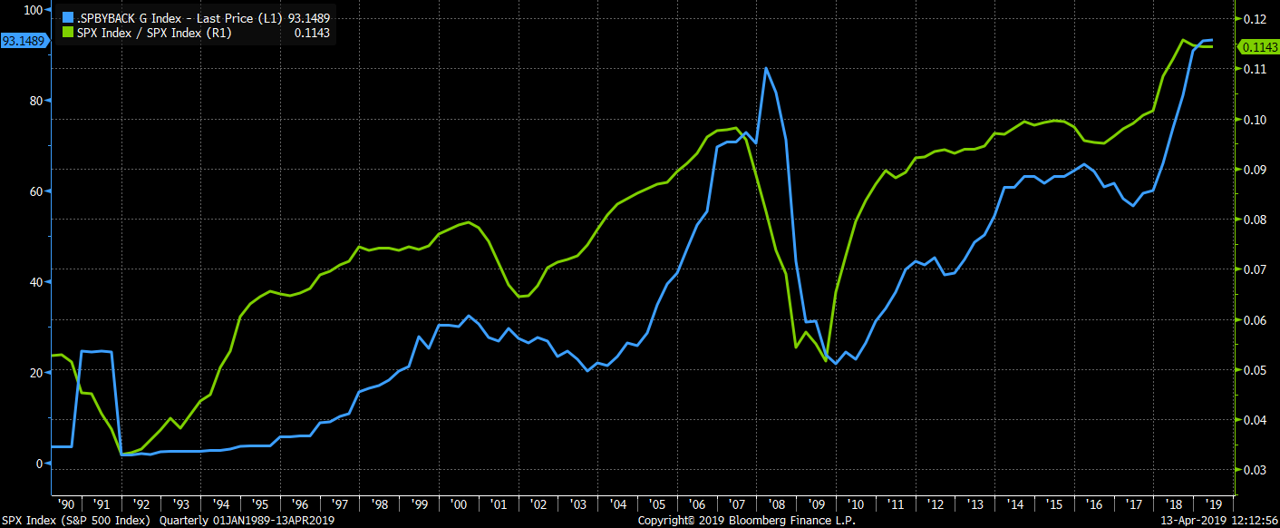

source: Bloomberg

This is a chart of S&P 500 buybacks per share (in blue) imposed over the ratio of S&P 500 earnings-to-sales in green. You’ll see that share buybacks spike after profit margins spike. You’ll see that share buybacks spike before and during recessions.

When do stock buybacks accelerate dramatically?

In 2006 and 2007, when management is rolling in record profits and profit margins, despite meager productivity growth.

In 2018 and 2019, when management is rolling in record profits and profit margins, despite meager productivity growth.

This is not an accident.

Here’s the past five years so you can see the temporal relationship more clearly.

source: Bloomberg

Stock buybacks are what you DO with the excess earnings you’ve made from financialization.

Why? Because stock buybacks are part and parcel of the financialization Zeitgeist. They’re part and parcel of the tax-advantaged issuance of stock to management, which is then converted into tax-advantaged income for management through stock buybacks.

Here, hold this card up over your head. It’s for alignment of interests between management and investors. You support alignment of interests between management and investors, don’t you? Don’t you?

-

What does Wall Street get out of financialization? A valuation story to sell.

-

What does management get out of financialization? Stock-based compensation.

-

What does the Fed get out of financialization? A (very) grateful Wall Street.

-

What does the White House get out of financialization? Re-election.

-

What do YOU get out of financialization?

You get to hold up a card that says “Yay, capitalism!”.

So what do we DO about this?

I’ve got three answers, one for your life as an investor, one for your life as a citizen, and one for your life as a human being.

As an investor, my answer is this: Adapt.

How? First read this.

And then take this to heart.

-

What are the Narratives I am being told?

-

What are the Abstractions presented to me?

-

What are the Metagames I am playing?

-

What are the Estimations shaping my outcomes?

-

Am I acting to promote Reciprocity?

-

Am I acting in a way that reflects my Identity?

Why? Because Clear Eyes, Full Hearts, Can’t Lose.

As a citizen, my answer is this: Resist.

How? First read this.

And then take this to heart.

-

Take back your vote.

-

Take back your distance.

-

Take back your data.

As a human being, my answer is this: Find your pack.

We’re all little fish.

We’re all swimming in the same smiley-face authoritarian waters of “Yay, military!” and “Yay, capitalism!”.

I tell you, brothers and sisters, we’re all we’ve got.

But I also tell you, we are all we need.

Yours in service to the pack. – Ben

via ZeroHedge News http://bit.ly/2PijGOO Tyler Durden