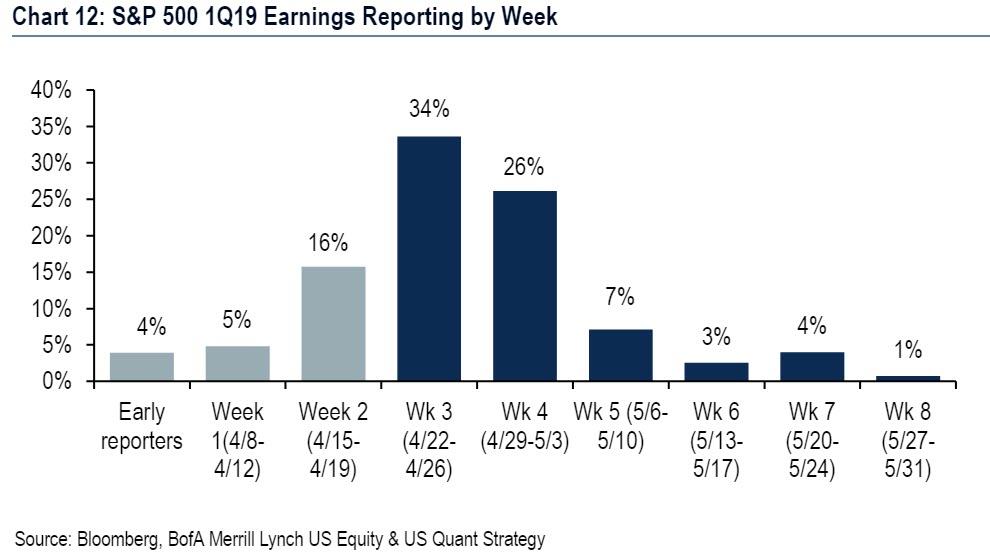

With the bulk of S&P companies set to report this week, the core of earnings season is upon us, and the “moment of truth” for US corporations – as Morgan Stanley dubbed it – is about to be revealed…

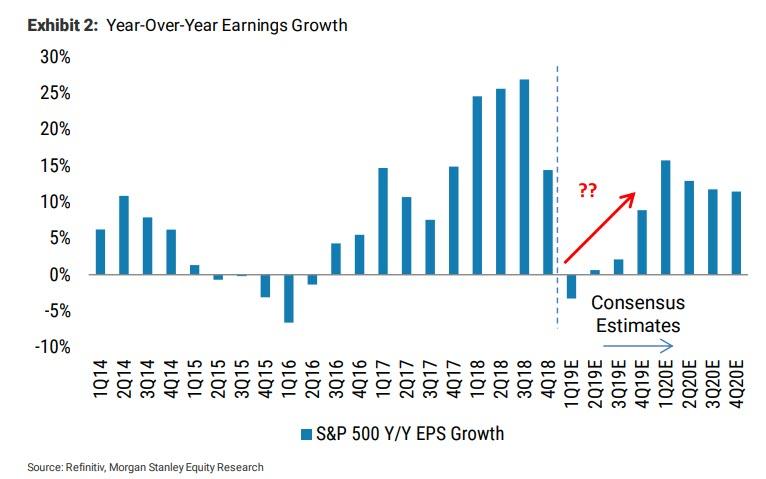

… and we don’t mean the actual earnings: we already know that Q1 earnings will be the worst in three years, with EPS set to drop by about 2% even as revenues grow by about 6%.

Instead, as Morgan Stanley’s Mike Wilson said two weeks ago, it is all about the guidance since S&P 500 1Q estimates are now very achievable, having fallen close to 10% over the past 9 months, with corporate margins the big wildcard.

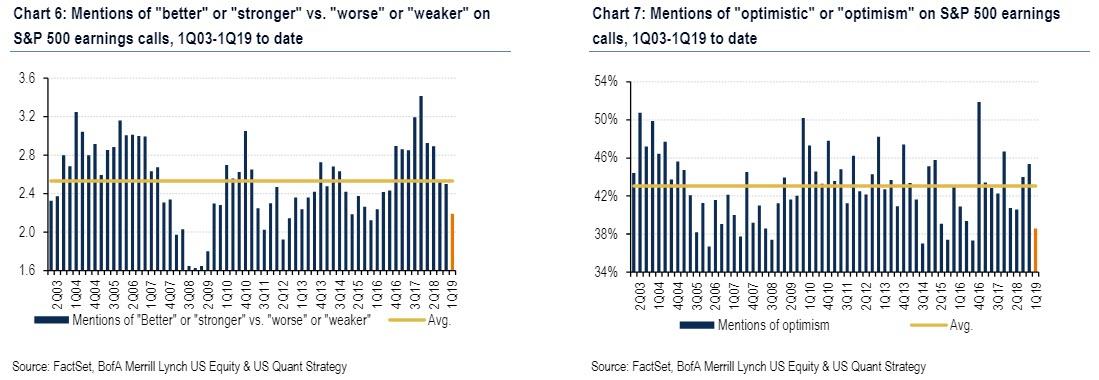

And unfortunately, as Bank of America points out in its latest weekly earnings tracker, by this one critical measure, earnings season is shaping up to be a disaster. While it is the case that only a handful of companies have reported so far, guidance instances so far have been very disappointing: indeed, the handful of guidance instances from companies reporting so far have largely been split between in-line with or below-consensus.

Case in point, for companies that have reported so far, commentary on earnings calls has continued to suggest slowing trends: mentions of “better” or “stronger” vs. “worse” or “weaker” are tracking the lowest since 1Q16, while mentions of “optimism” are also waning, and are so far the lowest since 4Q16, as shown in the chart below.

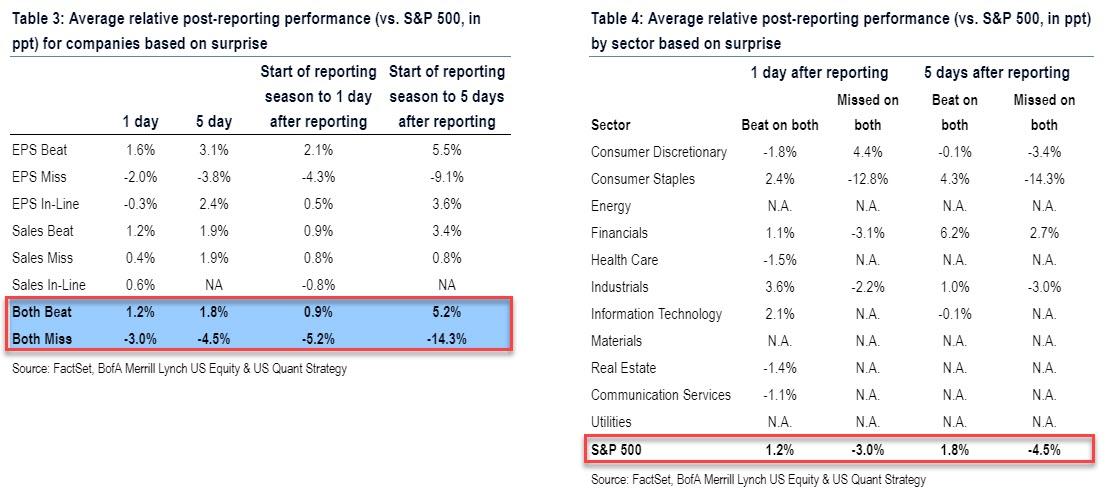

What is also concerning is that while the average S&P EPS change for Q1 has been posting a modest improvement, the ratio of above- vs. below-consensus guidance has weakened over the past several months as it typically does in 1Q when management sets a low bar; And while BofA notes that it will be watching for any shift upward this earnings season as this could be a positive catalyst for the market, the market is far less forgiving and unlike last quarter, traders are penalizing missing companies far more than they are rewarding “beaters.”

Recall, that in the midst of the biggest market rally in decades, during the Q4 earnings season in February, we noted that the euphoric market has had the best price reaction to negative EPS surprises in year. Well, 3 months later the picture has flipped by 180 degrees, and as Bank of America notes, price reactions to results have been far more skewed to the downside so far.

Indeed, EPS and sales beats have outperformed the S&P 500 by 1.2ppt on average the next day, below the long-term average of 1.6ppt, while misses have underperformed by 3.0ppt, more than the historical average of 2.4ppt.

One explanation is that given how dramatically estimates had come down heading into the quarter, misses may be more scarce (and thus drive a bigger reaction) than beats. Another, and more likely, explanation is that the market is priced beyond perfection, and with stocks soaring 25% into the first earnings recession since 2016, even the smallest reminder that the rest of the year could be just as ugly as Q1 in terms of corporate profits and that traders have gotten way ahead of themselves in timing an inflection point, could be the catalyst that finally kills the rally that started when Steven Mnuchin called the Plunge Protection Team, and brings out the sellers in size, as algos retest what the strike price on the “new and improved” Fed put is ahead of the next recession.

Meanwhile, if the early guidance companies are disclosing is accurate – and nothing short of disastrous- it is only a matter of time before the selling pressure drowns out the buybacks, gamma imbalanced dealers, short coverers and the BTFDers, and the next leg lower finally arrives.

via ZeroHedge News http://bit.ly/2IOhNYV Tyler Durden