Authored by Masanari Takada, Nomura Tokyo,

“FOMO” in global and US equity: Market heading for a cooling-off period?

US stock markets were closed on Friday, leaving CTAs and other speculative investors with little to do. We expect the sustainability of the long-running rally in US equities and global equities to be tested this week (starting 22 April). Market participants motivated by “FOMO” – the fear of missing out – seem to have already priced in various pieces of good news concerning US trade policy and the global economy that have yet to materialize. Of course, the market could continue to see support from hopes for forecast-beating US corporate earnings and chase-buying by CTAs, but if global stock market sentiment follows the typical historical pattern we have observed, we see a strong likelihood of market euphoria giving way to a cooling-off period at the end of April into the first half of May.

Fig. 1: Global equity market sentiment index since 2018 [Nomura estimates]

Note: The equity sentiment index is calculated by the Nomura Macro and Quant Strategy teams, based on a series of relevant market data. Source: Bloomberg, Nomura

Global equity sentiment index seems to have levelled-off.

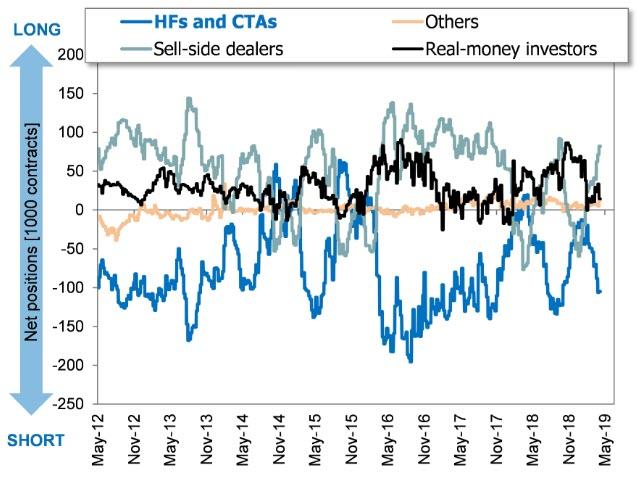

Discretionary investors and “JOMO”: Will FOMO give way to JOMO?

If such a market cool-down does come about, we would expect global stock markets to look directionless for a while. However, we do think that global macro HFs, equity L/S funds, and other such discretionary players might swing to buying stocks once they have determined that the market is no longer overheated. Discretionary players have largely stayed out of the present stock market rally, and if anything have been steadfastly cautious. In doing so, they may be following a strategy that ultimately keeps them out of a bull trap while giving them an opportunity to eventually buy a dip. What discretionary players may be feeling, then, is the joy of missing out (“JOMO”).

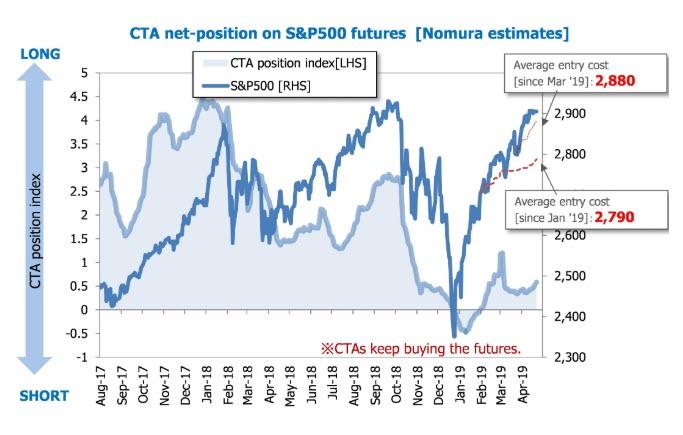

CTAs’ “chase-buying” has moderately accelerated.

Fig. 2: CTA position on S&P500 futures [Nomura estimates]

Note: CTAs’ positions are estimated by Nomura Macro and Quant Strategy’s CTAs tracking model, not actual data. Source: Nomura

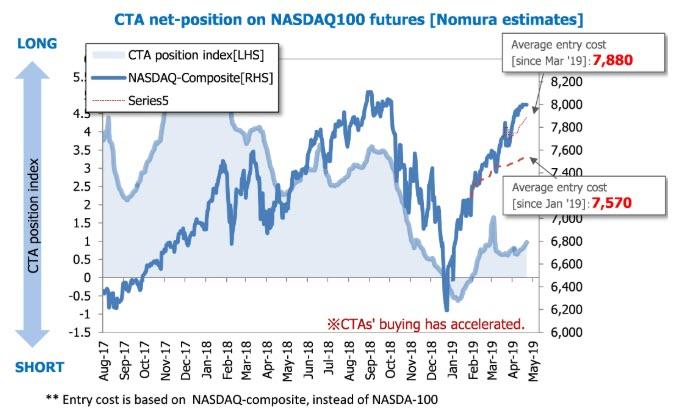

Fig. 3: CTA position on NDX futures [Nomura estimates]

Note: CTAs’ positions are estimated by Nomura Macro and Quant Strategy’s CTAs tracking model, not actual data. Source: Nomura

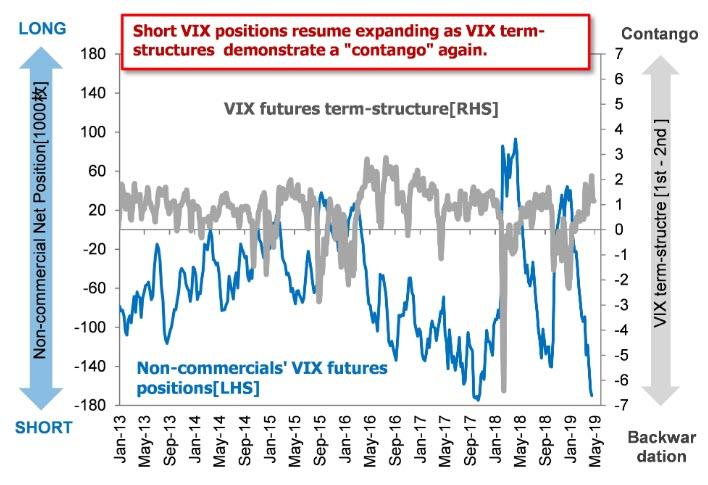

VIX futures: Speculative investors have added shorts further.

Speculative traders’ net short position in VIX futures has grown to 169,000 contracts as of 16 April. This exposes the fragility of the miniscule rise in the VIX. A jump in the VIX now would presumably prompt systematic traders to buy VIX futures to cover their short positions, but we think that the scale and longevity of such buying would depend to a great extent on whether the VIX futures term structure remains in contango. If the market were to stay in contango even after an upward leap in the VIX, then we would expect a swift influx of shorts from players looking to sell the rally, in which case the rise in VIX futures could quickly evaporate.

Speculative Investors have added short position on VIX futures.

Fig. 4: CFTC weekly report of speculative investors’ net-position on VIX futures market

Source: CFTC, Bloomberg, Nomura

DM government bond futures: Will CTAs’ deleveraging process continue?

Rates markets were also becalmed on Friday by the closure of major markets for the holiday. The lack of liquidity left algo players and other speculators unable to trade much even if they had wanted to. We suspect that CTAs began in earnest to take profits on their long positions in DM government bond futures late last week (through 18 April), but from the other direction, the market found support from contrarian buying by fundamentals-oriented investors and other players. Caught in a tug of war, major markets’ government bond futures prices fluctuated in both directions. Changes in supply-demand along these lines were a deciding factor in the performance of Euro-Bund futures, JGB futures, and Australia’s CGB futures last week, and the UST futures market was ultimately pulled along for the ride.

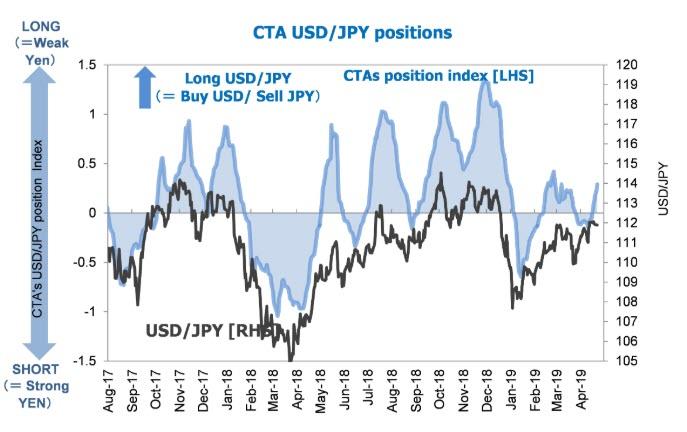

USD/JPY: CTAs have built net-long position on USD/JPY

In FX markets, the DXY plateaued at around 97.4. Global macro HFs moved to clear out their USD short positions. CTAs, meanwhile, continued to add to their long USD positions. CTAs have been steadily if mutedly building up their long position in USD/JPY. However, the accumulation of a long position in USD/JPY by CTAs at this time strikes us as being mostly a seasonal phenomenon.

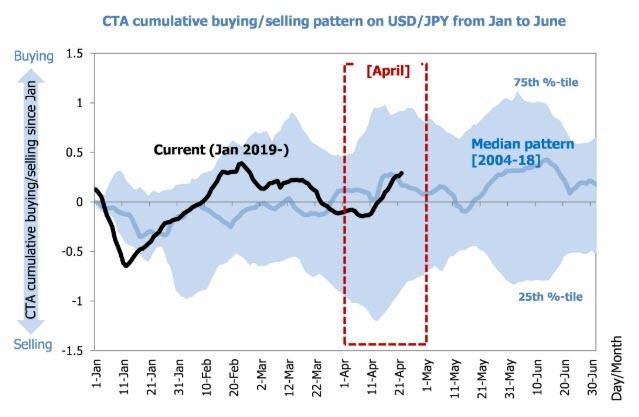

CTAs have added longs on USD/JPY, as the April seasonal pattern suggests.

Fig. 5: CTA position on USD/JPY and April pattern of CTAs’ USD/JPY buying/selling [Nomura estimates]

Note: CTAs’ positions are estimated by Nomura Macro and Quant Strategy’s CTAs tracking model, not actual data. Source: Nomura

Precedent says that when CTAs expand their net long position USD/JPY in early April through mid-month, they tend to then sell to lock-in profits on those positions in late April and into the first half of May.

Liquidity in trades involving the yen will presumably dip as Japan enters a 10-day holiday period, but we see a risk of the yen appreciating a bit as a result of CTAs closing their long positions in USD/JPY, by as much as perhaps ¥2.5 against the dollar (going by the amount of yen buying that would result from the closing out of CTAs’ existing net-long positions in USD/JPY).

via ZeroHedge News http://bit.ly/2XygAJw Tyler Durden