WTI surged once again to its highest settlement price in over six months (even as the dollar spiked) as Saudi Arabia was said to be tentative about raising output to mute the impacts of American sanctions against Iran.

“It’s been made clear that Trump is very serious about enforcement of the sanctions,” said said Tyler Richey, co-editor at Sevens Report Research in Palm Beach Gardens, Florida. “The question is how much will their exports fall versus how much and how quickly can Saudi Arabia and other producers increase?”

American pressure on Iran’s exports won’t work, Iranian Oil Minister Bijan Namdar Zanganeh told his parliament. “We will act wholeheartedly to break the U.S. sanctions,” he said.

But for now, all eyes are on inventories…

API

-

Crude +6.86mm (+500k exp)

-

Cushing -389k

-

Gasoline +2.163mm (-1.82mm exp) – first build in 10 weeks

-

Distillates -865k (-712k exp)

After last week’s surprise crude draw, expectations were for a modest build in the last week but API reported a much bigger than expected rise in inventories of 6.86mm… Gasoline also surprised with a sizable build – the first in 10 weeks

WTI hovered around $66.30 ahead of the inventory data and kneejerked lower

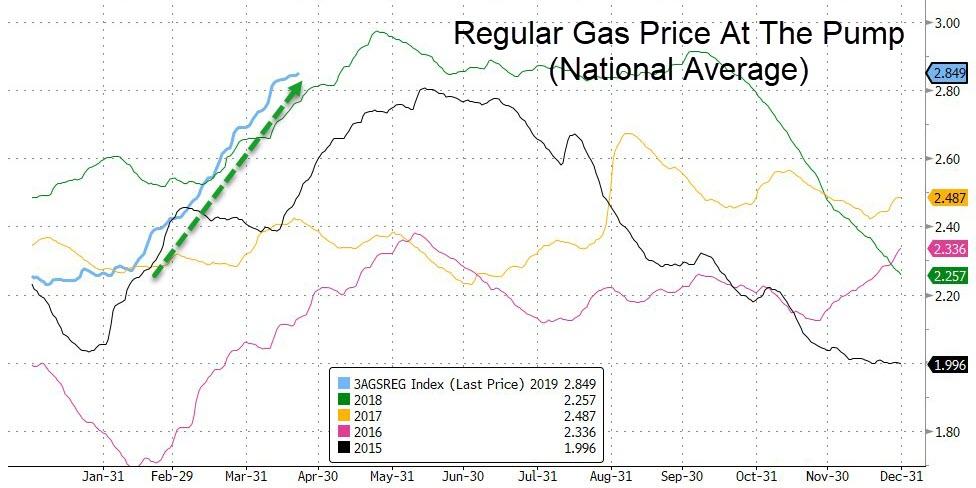

How long will Trump stand for soaring gasoline prices? Prices at the pump are the highest since 2014 for this time of year…

via ZeroHedge News http://bit.ly/2PoXkLP Tyler Durden