Three days after we listed “five reason for the weakness of the Argentina economy“, the market is officially freaking out about the country which for much of the past year has been a ward of the IMF (again), and on Wednesday, investors pounded the ARS (that would be Argentina’s currency), and pummeled the country’s debt as the looming presidential election prompted fears Argentina is heading for its third default in less than two decades.

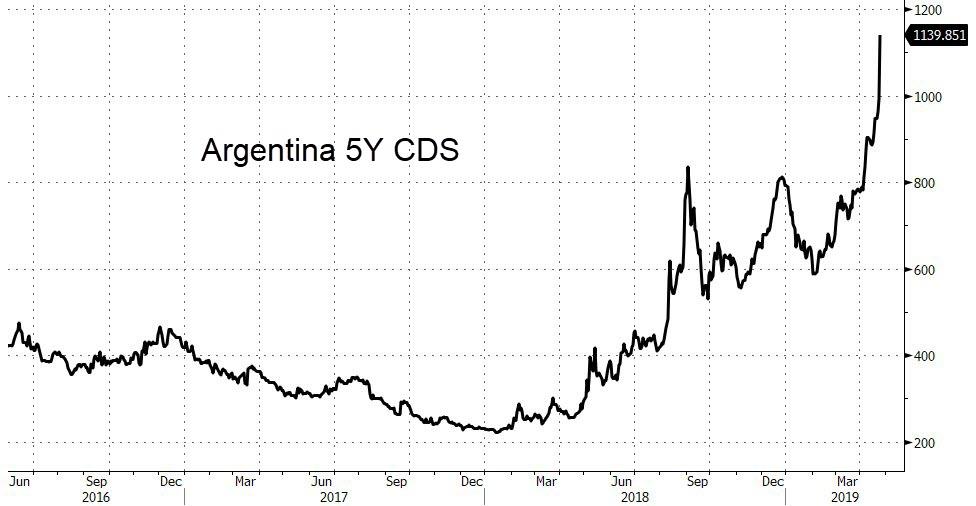

Argentina 5 year CDS soared more than 200 bps today alone, to a lifetime high of 1140bps, sending the probability of a default over that period to more than 50%, up more than 100% from 22.7% one year ago…

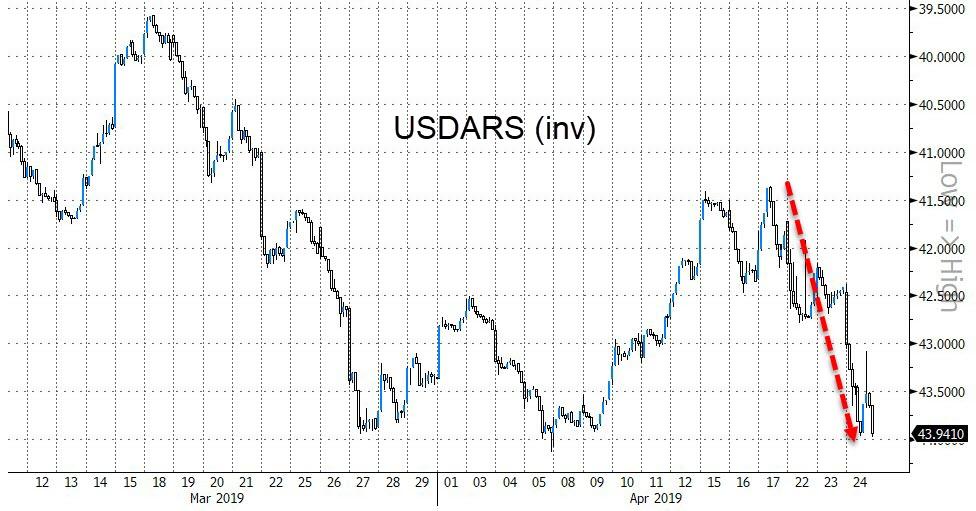

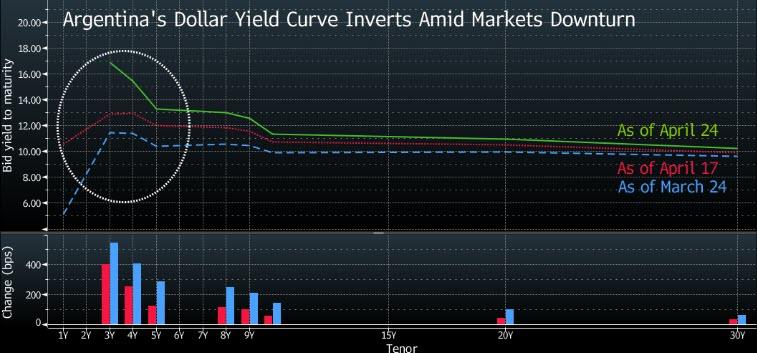

… while Argentine bond spreads over Treasuries rose 84 bps, the second day of gains, to 944 basis points as 2Y bonds are exploding 350bps wider, as the aptly titled ARS, or Argentine Peso, crashes 3.5%, dropping to a fresh lifetime low.

While Argentina’s economic troubles have been widely known for a long time – and certainly since the IMF launched the biggest ever sovereign bailout in history last summer when it handed Argentina a record $56 billion credit line, hoping to succeed where it failed previously – what has sparked the latest panic is fear that President Mauricio Macri will not be re-elected as he tumbles ahead of October’s election, with the economy enduring the second recession of his presidency.

That, in turn, has opened the door to a possible return of former President Cristina Fernandez de Kirchner (aka CFK), whose policies of tax and spend are blamed by some for the country’s frequent economic crises. Of course, recent hyperinflation of 55% – which has nothing to do with CFK – has not helped ease the market’s nerves.

“It clearly seems the election is slipping away from Macri,” said Alberto Ramos, head of Latin America research at Goldman Sachs. “There’s increasingly less guarantee that policy continuity will be maintained after the election, and that makes markets nervous.”

What makes today’s selloff especially troubling is that it takes place even with the IMF’s credit line in place and Argentina sporting a relatively healthy $76.7 billion in reserves at the central bank.

Some analysts attributed Wednesday’s selloff to comments made by Juan Germano, head of Argentine polling firm Isonomia. In a radio interviewWednesday, Germano said a recent poll Isonomia conducted showed Kirchner winning in a potential runoff vote against Macri. Germano, who does polling for the government and private clients, cautioned that it was early to draw conclusions on the data.

Macri’s approval rating stabilized in April, while a runoff vote against Fernandez is too close to call, according to a separate poll published Monday by Buenos Aires-based consulting firm Elypsis. While only 28 percent have a positive image of Macri, Fernandez is seen positively by 44 percent of Argentines, the survey showed.

Yet while the Argentine CDS market appears to have already given its verdict on what the future holds, pricing in odds of just more than 1 in 2 of a default in 5 years, bond and currency traders will have more difficulty finding an equilibrium level amid growing odds of President Cristina Fernandez de Kirchner returning to the presidency.

Bloomberg notes that while the peso has depreciated significantly throughout the year, the level it may reach in case of a peronist’s win in the October election is completely clouded. The reason: during Kirchner’s term, Argentina didn’t even have a floating currency market, so any attempts to discount a CFK future appear doomed. Still that is not preventing traders from trying: “44/USD doesn’t have a Kirchner victory priced in. We have a view that 48 would be a signal for a Kirchner win,” said Brendan McKenna, a strategist at Wells Fargo. Market’s base case scenario is still a Macri’s victory even though his odds are deteriorating recently.

Alberto Ramos, head of Latin America research at Goldman Sachs, has different view. For him, investors are “already pricing in less than 50% odds for Macri” as it clearly seems the election is slipping away from President’s hands due to negative activity, according to Bloomberg.

Morgan Stanley, meanwhile, takes the other side of the trade arguing that the “base case scenario is policy continuity ahead of October 27 elections”, even though lack of clarity with short-term scenario led him to recommend staying neutral in Argentina.

To be sure, CFK is doing all she can to reclaim the presidency, and this week released an autobiographical book called “Sincerely,” further raising her profile ahead of the vote.

Summarizing the market’s violent move on Wednesday, Greg Lesko, a money manager at Deltec Asset Management in New York, said that “it’s all about inflation and Macri’s prospects in the fall. Inflation is staying stubbornly high, which hurts Macri’s chances. The election is seen as a binary.”

The biggest losers from today’s rout? Those who bought Argentina’s 100 Year bond issued in 2017, which fell 2.3 cents today to a record low…

… while the 2021 dollar bond, the first to mature after October’s election, is yielding a record high of 17.41%.

via ZeroHedge News http://bit.ly/2ZwkPqT Tyler Durden