Following the multiple Boeing 737 MAX crashes, analysts were very closely watching what Boeing would report for its Q1 earnings, and more importantly what it would forecast for the rest of the year. Moments ago Boeing did not disappoint, or rather it did, when it reported an across the board miss with both revenues and EPS coming in far below expectations and profits tumbled, while as a result of the limbo left in the aftermath of the 737 MAX fiasco, the company announced it would suspend it annual forecast while putting its stock buyback on indefinite hold.

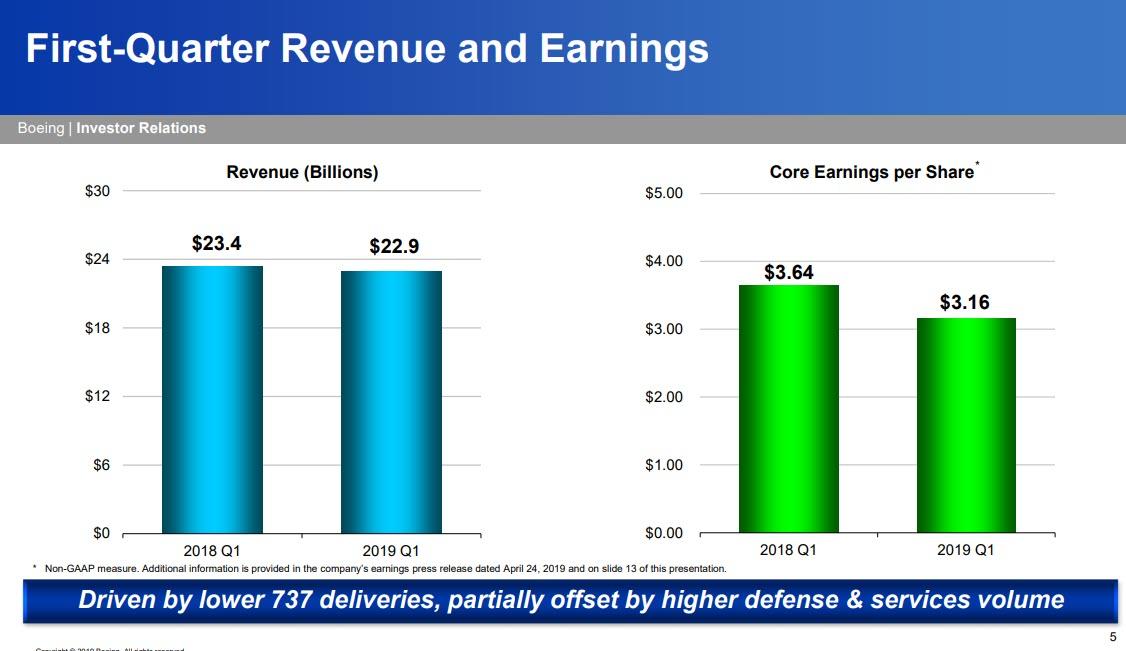

First, the numbers:

- Q1 EPS of $3.16, down 13% from the $3.64 a year ago, and missing expectations of $3.25

- Q1 revenue of $22.9 billion, down 2% from $23.4 billion a year ago, and below the $23.1 billion consensus

- Q1 core operating earnings $2 billion, down 21% from $2.5 billion Y/Y

- Q1 core operating margin 8.7%, down from 10.7% Y/Y

- Q1 operating cash flow $2.79 billion, down from $3.13 billion Y/Y

- Q1 free cash flow $2.29 billion, down from $2.74 billion Y/Y

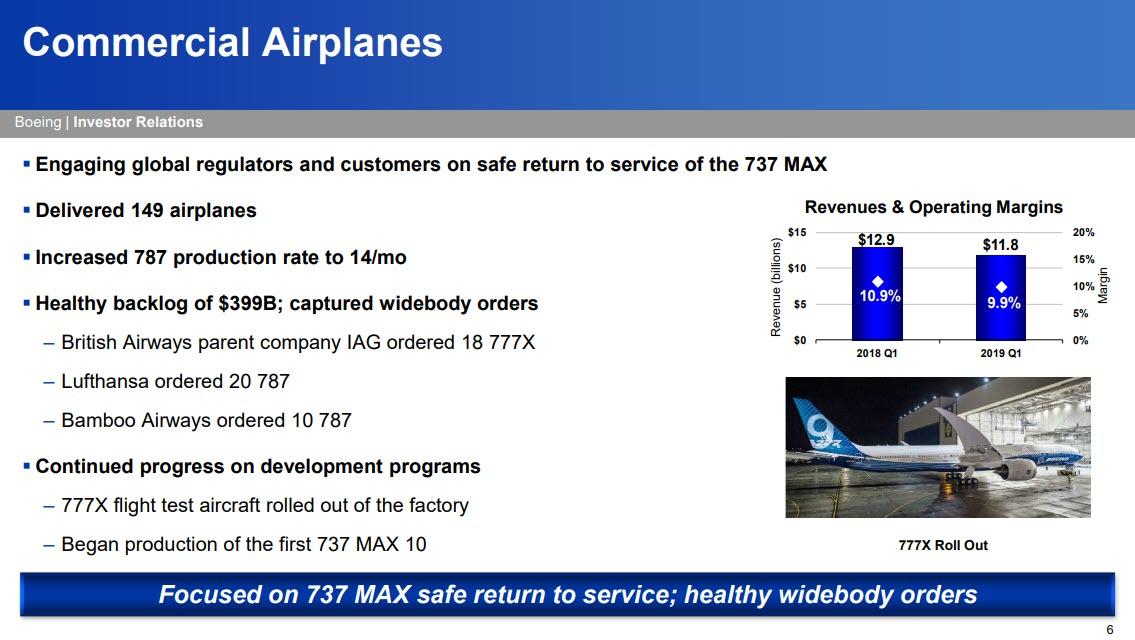

First-quarter revenues at Boeing’s all important commercial aircraft division which was directly impacted by the 737 MAX crash fell by more than $1Bn, to $11.8Bn from $12.9Bn last year.

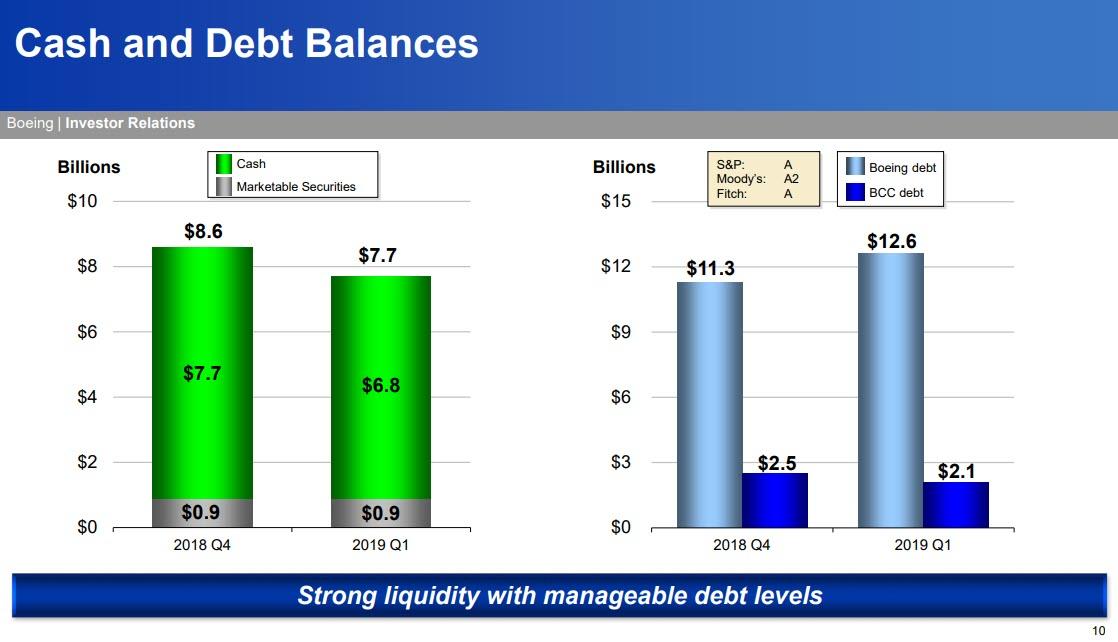

The company was quick to point out that “cash and marketable securities of $7.7 billion provide strong liquidity” – almost as if someone is suddenly worried about its liquidity – even as debt rose $13.8 billion to $14.7 billion in the quarter ended March 31.

Another liquidity punchline: Boeing reported that it had repurchased 6.1 million shares for $2.3 billion in the quarter, all of which occurred prior to mid-March. CNBC added that as a result of the ongoing challenges the company had put all stock repurchases on hold for the time being.

And while the historical data were dismal at best, missing across the board, what was even more troubling is that while analysts were hoping for some much needed guidance, they won’t get it as Boeing suspended its annual forecast, stating that new guidance would be issued at “a future date”, which as Bloomberg said was “an expected but nonetheless startling decision that underscores the magnitude of its current crisis.”

The company also said that the prior guidance was withdrawn as it “does not reflect 737 Max impacts,” which is disappointing as just 3 months ago the company predicted record performance this year of as much as $111.5 billion in revenue and $17.5 billion in operating cash flow. Not any more.

Not long after his Twitter apology, CEO Dennis Muilenberg had this to say in the earnings release: “Across the company, we are focused on safety, returning the 737 MAX to service, and earning and re-earning the trust and confidence of customers, regulators and the flying public. As we work through this challenging time for our customers, stakeholders and the company, our attention remains on driving excellence in quality and performance and running a healthy sustained growth business built on strong, long-term fundamentals.”

While the Max’s indefinite grounding drags on, Boeing’s management team is focusing on conserving cash and tamping down costs. The company has temporarily slowed its 737 final assembly line by 19 percent to build only 42 planes a month, the first such factory slowdown since the Sept. 11 terrorist attacks disrupted air travel in 2001, according to Bloomberg.

And with little guidance to work on, investors will now look to the company’s conference call at 1030am ET for information into Boeing’s strategy for dealing with the financial aftermath of a global grounding that has already lasted six weeks.

Curiously, despite the dismal results and the buyback suspension, Boeing shares acutally rose to $377.47 before the start of regular trading in New York as investors apparently were cautiously optimistic on the complete lack of guidance.

via ZeroHedge News http://bit.ly/2GEcQjZ Tyler Durden