Earnings (dramatically weaker), macro (two-year lows), funding markets (IOER), bonds (yields tumbling), and FX (chaos) – but stocks are at record highs – so everything is awesome, right?

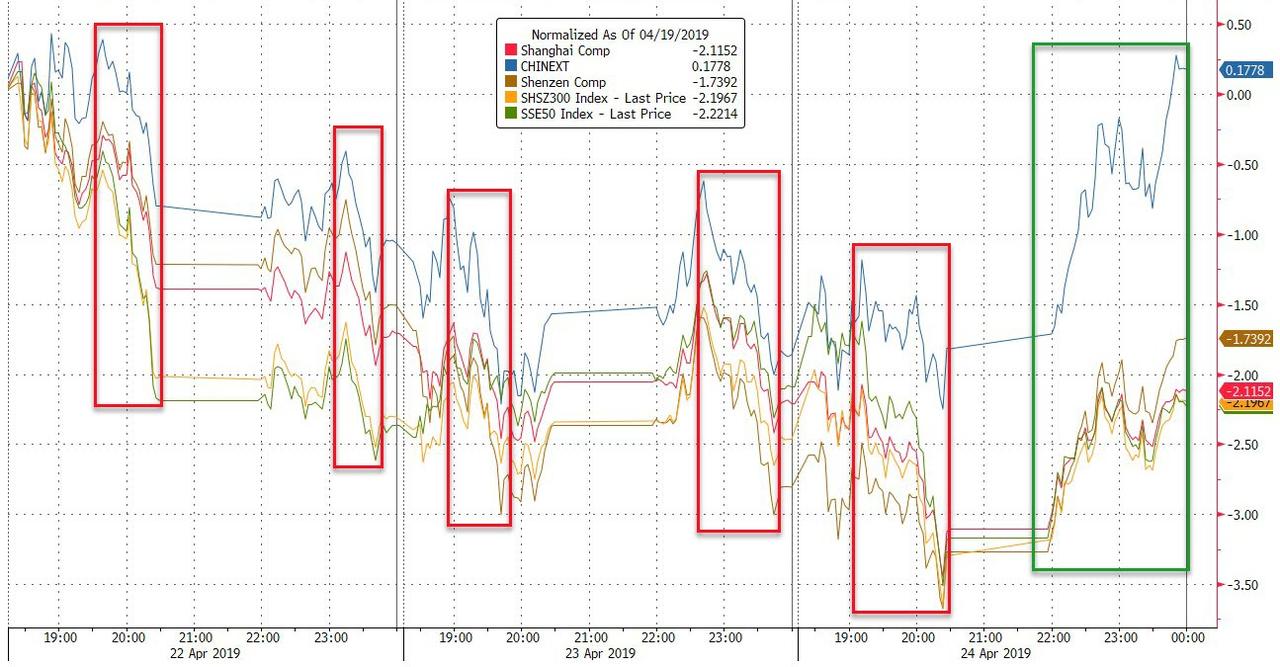

After two dismal days (and a rough morning session), The National Team steeped in to rescue Chinese stocks from their worst run this year…

Europe continues to be mixed with Germany leading and the periphery lagging…

Trannies and Small Caps managed gains today (another short-squeeze) as The Dow, S&P, and Nasdaq trod water…

Nasdaq 100’s first losing day in 8 days.

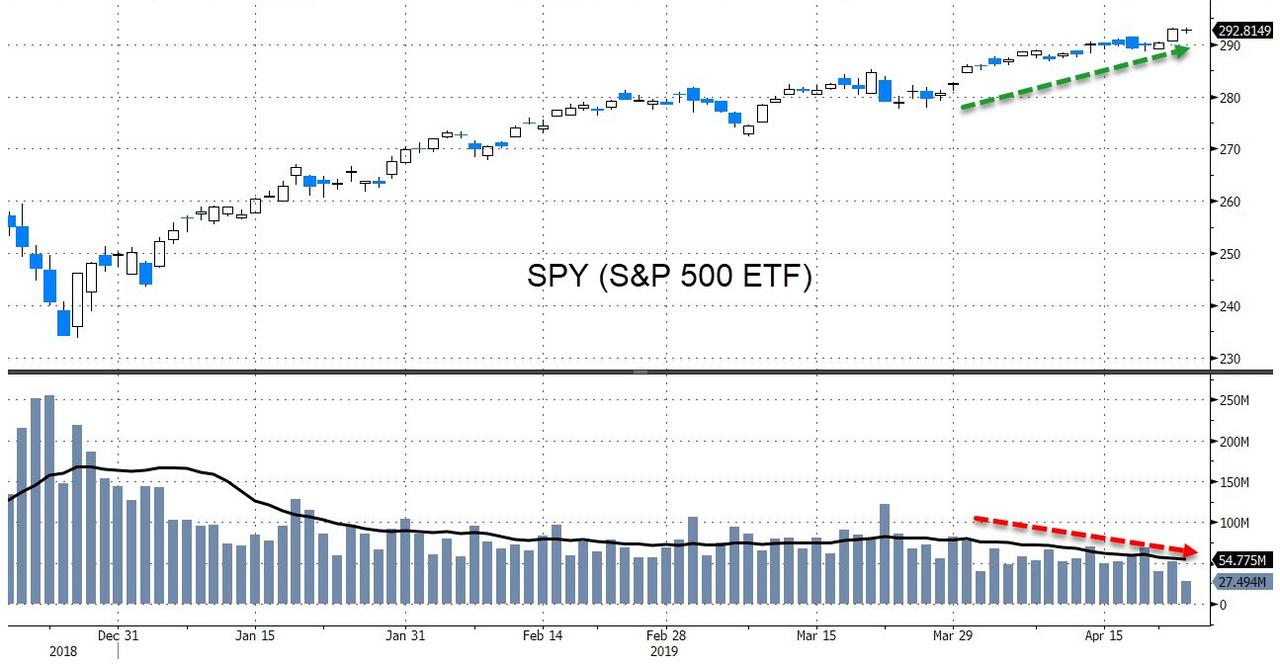

Volume remains dismal…

Today is the 78th trading day of the year, SPY volume has exceeded 100MM only 10 days so far, 13% of all days. Through 78 trading days in 2018, SPY volume exceeded 100MM 39 times, 50% of all days.

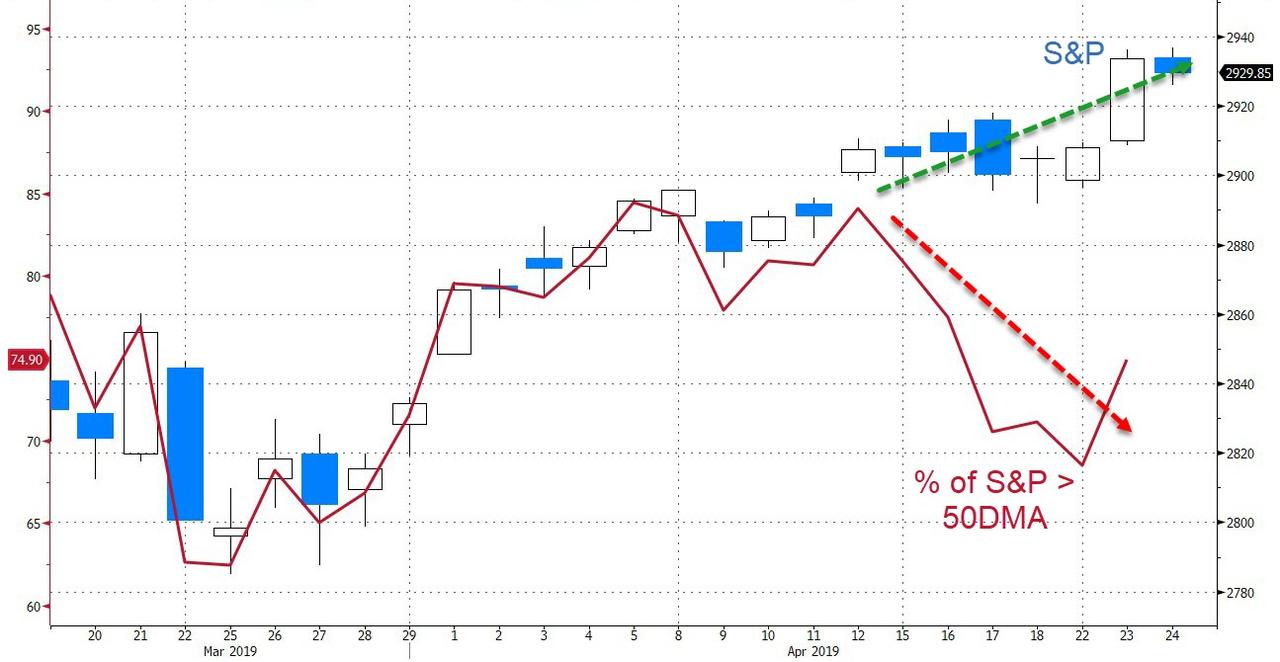

And as the S&P hovers at its record highs, it seems not many of its components are playing along…

In fact:

Just learned that the SPX is at all-time highs but only 13 stocks in the index are at all-time highs

— GreekFire23 (@GreekFire23) April 24, 2019

And breadth remains notably weak in this last panic-bid…

As big tech valuations soared to near record highs, decoupling from the broader market…

A lot of which is thanks to the surge in Semis… as their earnings expectations have collapsed…

Don’t forget: “Semis don’t sell other semis” as the algos refuse to acknowledge TXN’s warnings and bid SOX to a new record high.

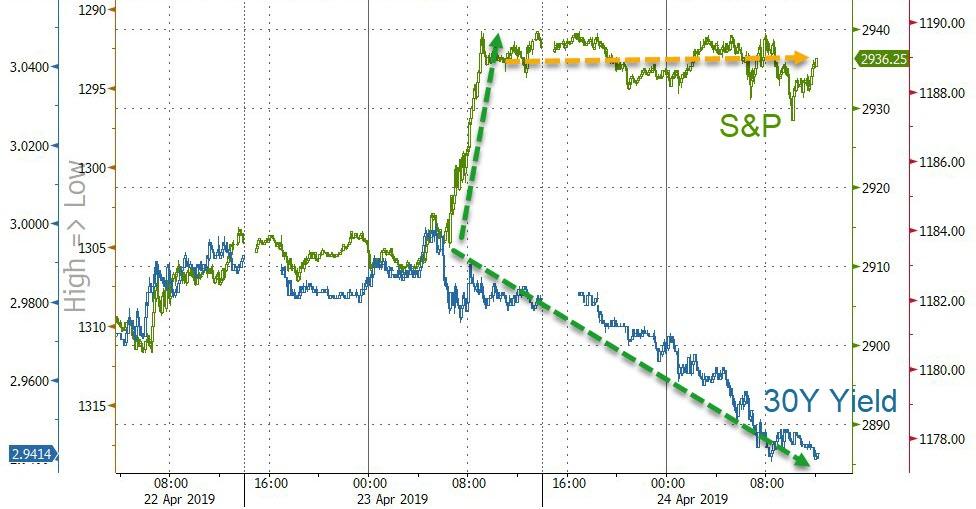

Stocks and bonds decoupled dramatically today…

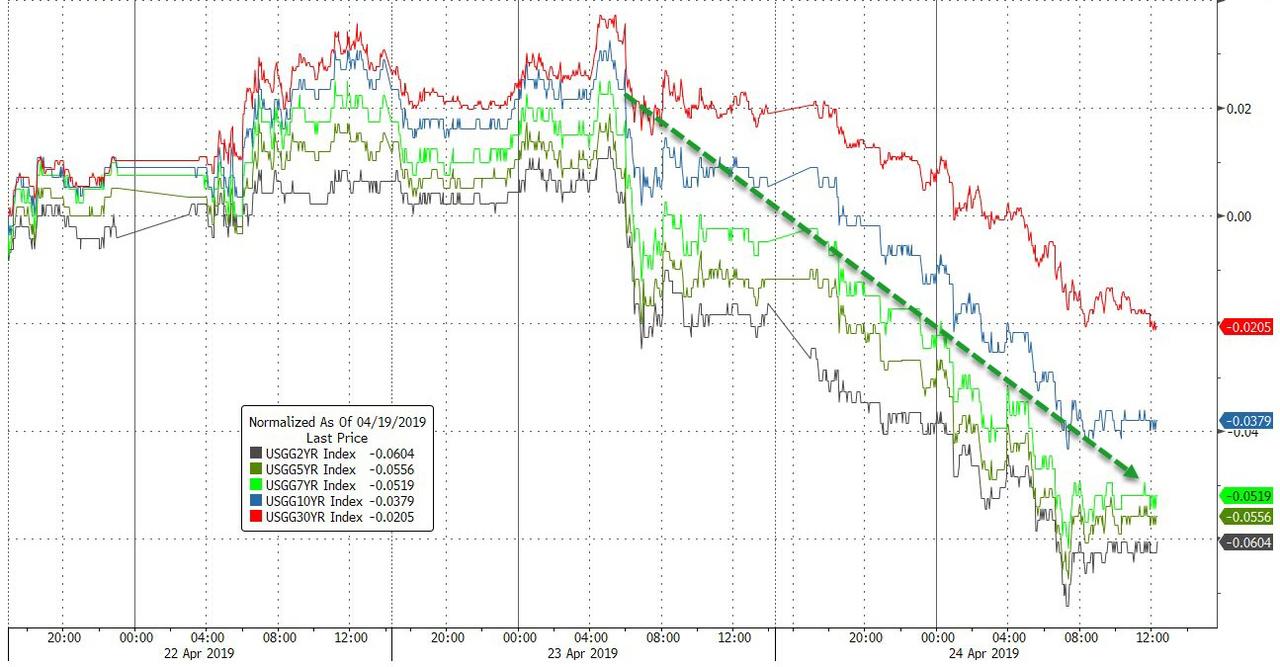

With the entire curve now lower on the week, led by the short-end…

With 30Y Yield tumbling to 10-day lows after tagging 2.999% yesterday…

The yield curve has hit a critical resistance level once again…

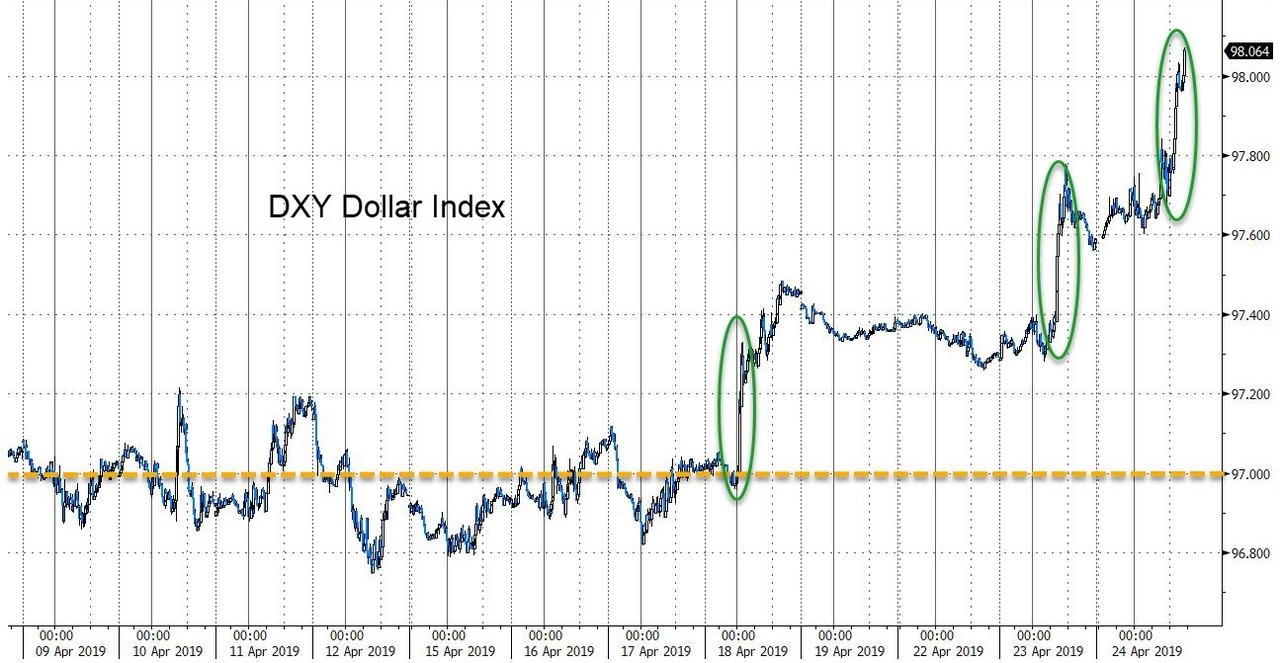

The Dollar Index extended gains today, pushing DXY to its strongest since May 2017…

After hovering around 97.00, DXY has burst higher in the last 5 days…

Yen tumbled below the recent 112.00 support level – to its weakest since 12/20/18..

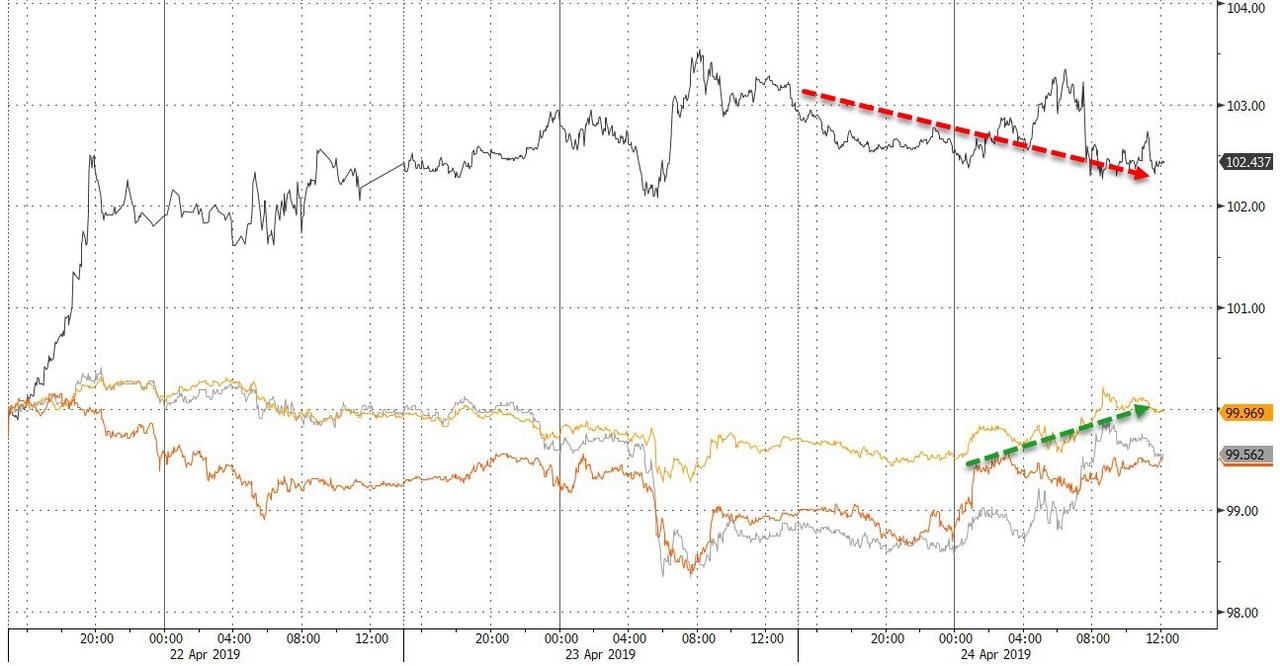

Emerging Market FX plunged to its weakest since the start of the year…

Led by Argentina, South Africa, Turkey, and – rather shockingly – Aussie Dollar…

As the peso closed at a record low today…

Cryptos suffered two legs down overnight and weakened in the US session…

Silver and Gold managed gains today in the face of dollar strength as WTI slipped lower on inventory data…

Despite the dollar surge, gold also rallied on the day…

Finally, we note that as stocks hit a record high, positioning in risk-off assets (TSYs, Gold, and VIX) has not bought into the rally…

Trade accordingly.

via ZeroHedge News http://bit.ly/2L1mwJP Tyler Durden