As one of the most visible market success stories of the past decade (a period during which its shares climbed +5,000%), Netflix’s staggering success has made it the most visible example of how Silicon Valley’s pixie dust can blind investors to time-tested fundamentals like, say, a company’s prospects for ever turning a profit.

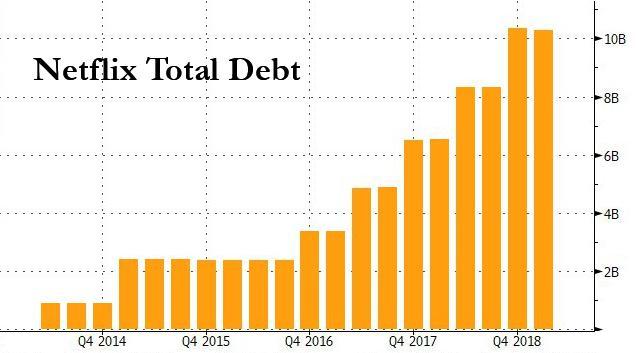

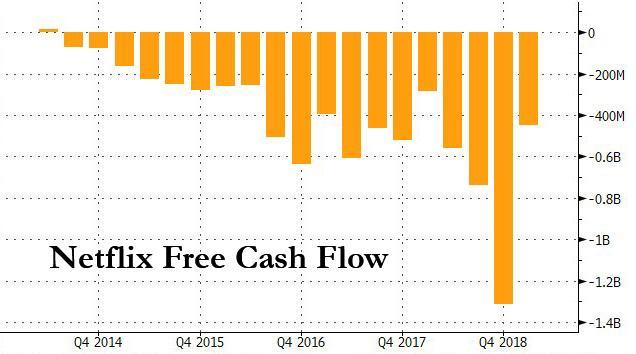

Maybe it’s due to naivety, or Buffett’s ‘invest in what you know’ maxim taken to an extreme, but investors’ unwillingness to acknowledge Netflix’s rapidly growing debt pile (soon to be more than $12 billion following the company’s latest oversubscribed bond offering, something that has become a bi-quarterly ritual for the streaming giant)…

…and its 21 consecutive quarters of negative FCF…

…has flummoxed the company’s detractors, including professional tech analysts (as one leaked email recently shared by Business Insider revealed).

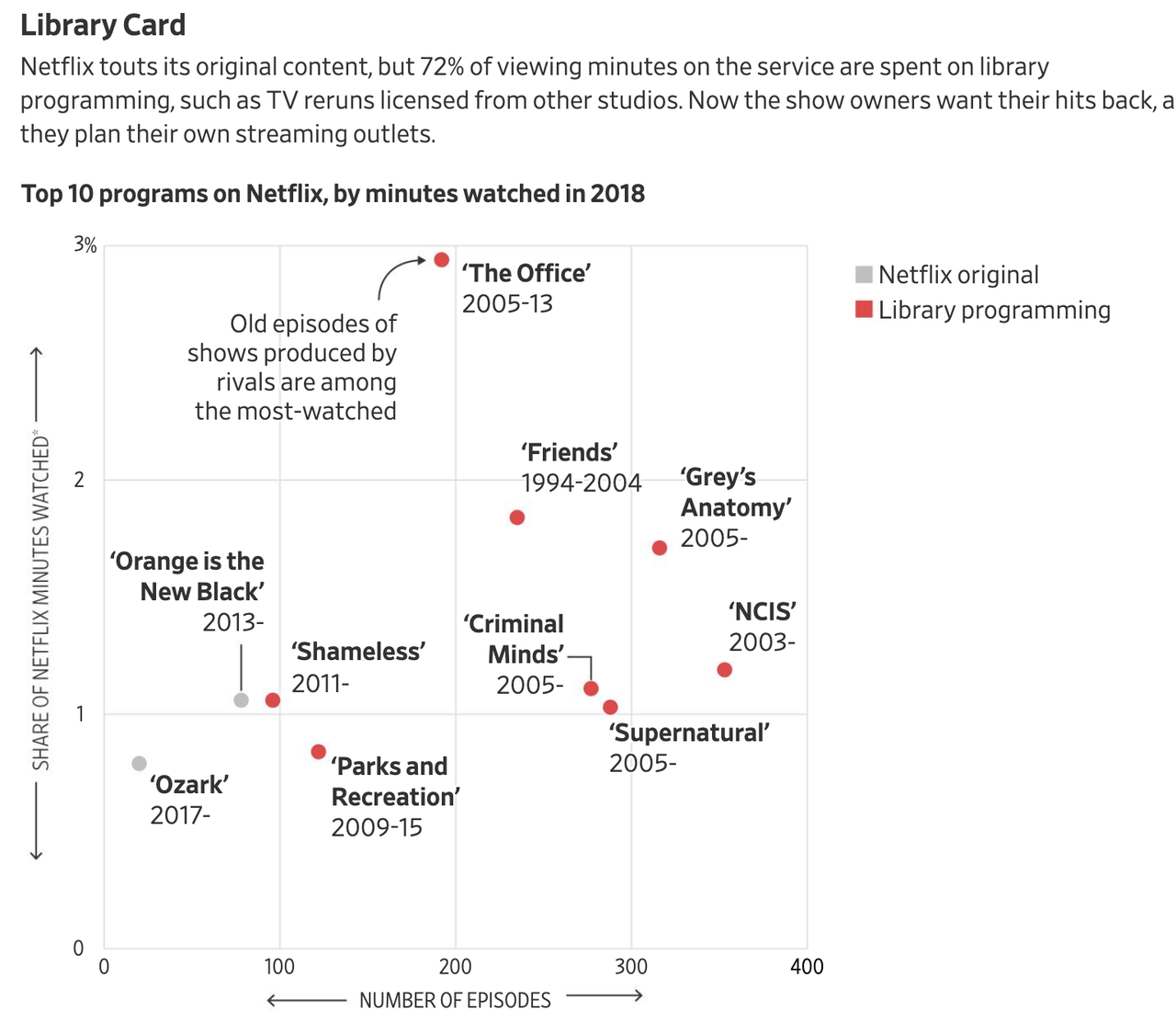

But that could soon change. Because, for the first time, the Wall Street Journal has revealed just how dependent Netflix is on licensing deals to supply its subscribers with content they actually want to watch.

And now that many of the companies that have been licensing this content are now preparing to launch streaming services of their own, Netflix could be headed for a crisis that could soon cost it its position as the streaming market leader, at which point, we imagine, its extremely precarious balance sheet will become almost impossible to ignore.

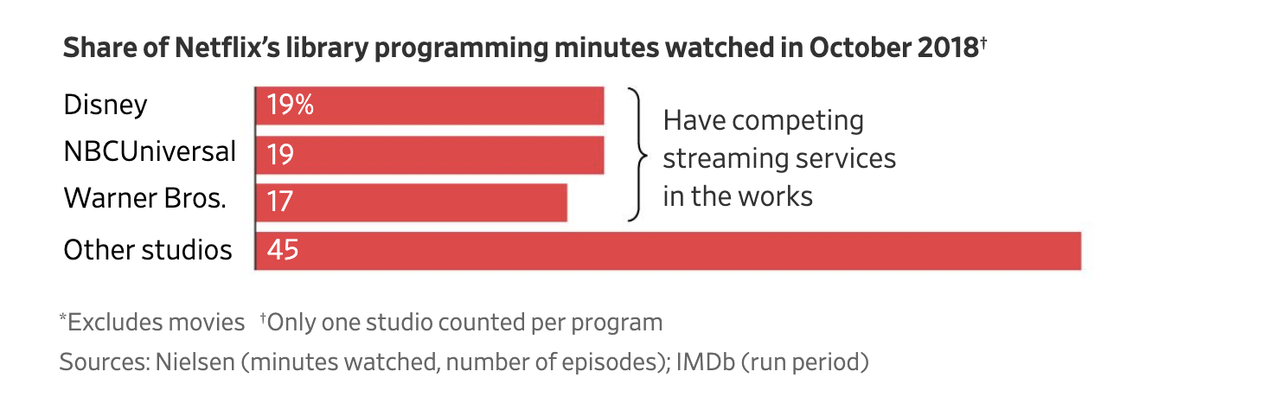

Three companies that are preparing to launch streaming platforms of their own account for 40% of viewing minutes on Netflix. And should they decide not to renew their licensing deals, Netflix could lose most, if not all, of its most popular shows.

According to WSJ, Netflix could lose its most popular show – NBC’s “The Office” – as soon as 2021. Netflix viewers watched 52 billion minutes of the Office last year, accounting for roughly 3% of Netflix’s aggregate streaming time.

NBCUniversal, which owns the show, licensed reruns of the comedy to the streaming-video giant years ago. Now NBCUniversal is launching its own streaming service, and has begun internal discussions about removing “The Office” from Netflix when the contract expires in 2021, according to people familiar with the situation.

This is about to become a recurring headache for Netflix.

Three of its biggest programming suppliers—AT&T Inc.’s WarnerMedia and Walt DisneyCo. in addition to Comcast Corp.’s NBCUniversal—are entering the streaming-video arena. After licensing content to Netflix for years, happy to cash its checks, they are looking to take their hit content back to feed their own platforms.

Netflix has an air of invincibility in the entertainment world, with a huge audience, a hefty war chest and a sizzling stock. But the moves by its Hollywood rivals are a gathering threat, raising the prospect the service could lose some of its most-watched programming or have to pay a steep price to keep it.

The three companies launching new streaming services have created TV shows and movies that make up nearly 40% of the viewing minutes on Netflix, according to data compiled and analyzed for The Wall Street Journal by Nielsen.

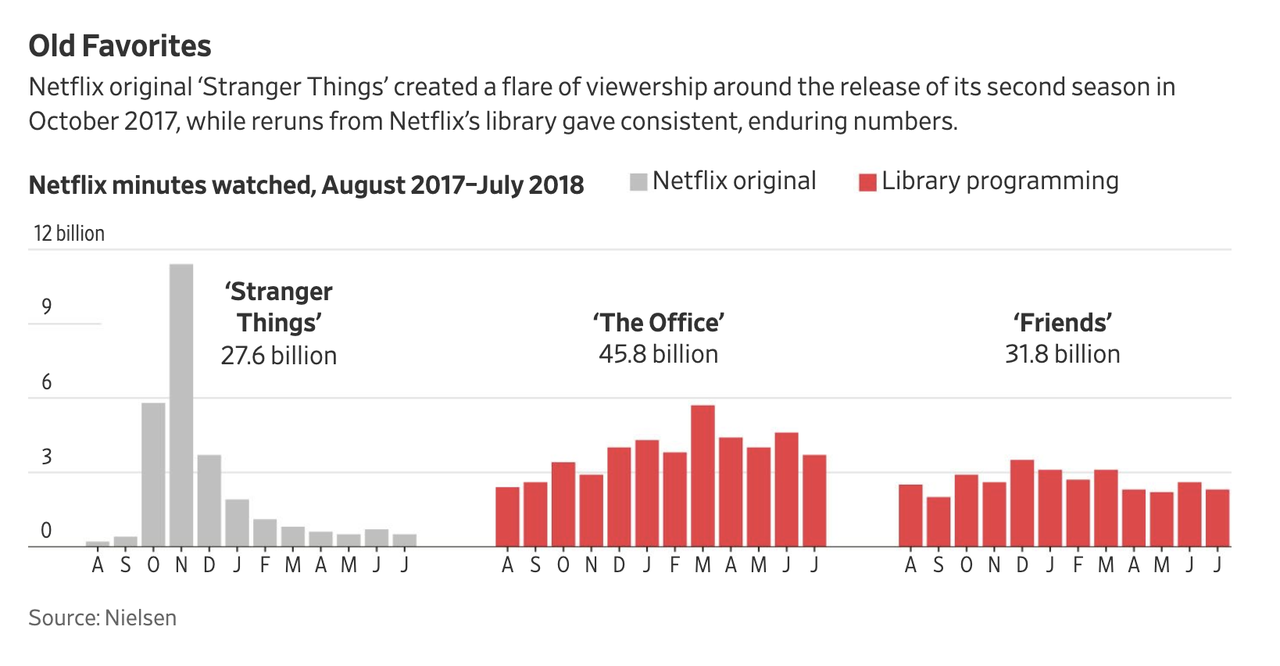

Netflix’s reliance on outside content is undoubtedly the company’s biggest vulnerability. Only two of its top ten most watched shows are original productions. Licensed content accounts for 70% of viewing minutes on Netflix’s platform, according to WSJ and Nielsen.

Already attuned to how vital some of this content is for Netflix, some studios are already turning the screws. WarnerMedia charged Netflix a staggering $100 million just to keep the entire library of the 90s hit sitcom “Friends” on its platform. Soon, Netflix might need to rethink its demands that it receive ‘exclusive’ rights to all the licensed content appearing in its library.

Of course, Netflix has been preparing for the day when external studios refuse to continue licensing their content – that’s long been its argument for pouring so much money into original programming. In 2019 alone, the company plans to spend $12 billion on original content. But the point that WSJ is trying to make is it looks like that day might arrive sooner than the company had anticipated. And furthermore, while Netflix has long argued that its original content is what drives subscriptions, the numbers revealed by WSJ appear to prove that this simply isn’t true.

Instead, Netflix’s flood of original programming could be having the opposite of its intended effect, as one Nielsen analyst argued.

Brian Fuhrer, senior vice president of product leadership at Nielsen, said sometimes viewers are overwhelmed by a sea of options. “When you open a drawer and you have all these shirts to wear, but you have this one broken-in comfortable sweatshirt, you tend to grab that,” he said. “That’s what people are doing with programming.”

Meanwhile, younger viewers who never saw old shows such as “The Office” on regular television treat them like new programming.

And though viewership of original content tends to surge around the release of hits like ‘Stranger Things, these bumps are rarely sustained.

Put another way, for every smash hit like “Stranger Things” or “The Crown,” Netflix produces 20 original shows that almost nobody watches. These phenomenon was grist for one of SNL’s better sketches in recent memory.

With more streaming offerings to choose from, producing must-watch original content will be crucial for Netflix’s original survival. But unlike Disney, which has decades of experience in the content realm, and has a deep bench of popular movies and shows, the more money Netflix pours into original content, the worse every new batch of shows and films seems to get.

via ZeroHedge News http://bit.ly/2UVC3zi Tyler Durden