Following a couple of quiet weeks – if not in earnings which peaked last week when a third of the S&P reported – markets face what DB’s Craig Nicol calls a star-studded lineup of events this week, which should reignite a bit of newsflow into markets again, and perhaps even give volatility some of the old Night King treatment and rise from the dead.

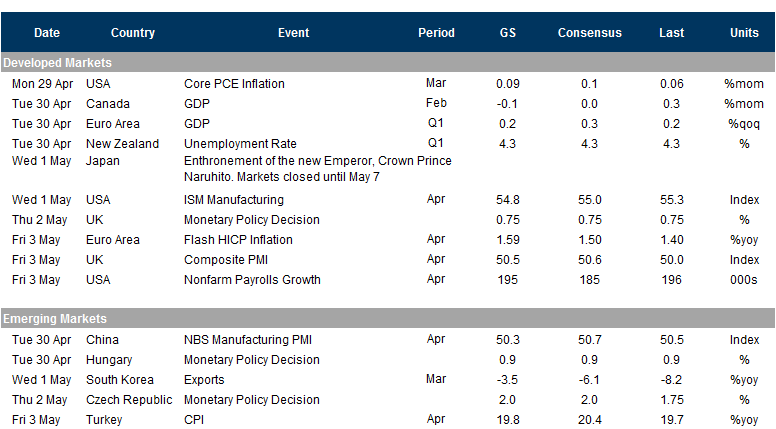

We’ve got Fed and BoE meetings, a huge slew of data including payrolls, PMIs, US and European inflation and the latest growth data in Europe. If that wasn’t enough we’ve also got US-China trade talks resuming, and another packed week of earnings on both sides of the pond.

Going down the list, on Tuesday US Trade Representative Lighthizer and Treasury Secretary Mnuchin are due to travel to Beijing to continue with another round of trade talks. The latest suggestion was that both sides were working to reach a draft agreement for some time in May with talks next week covering “trade issues including intellectual property, forced technology transfer, non-tariff barriers, agriculture, services, purchases and enforcement”. Chinese Vice Premier Liu He is then expected to travel to the White House May 8th. So the intensity of these meetings should ramp up next week should both sides adhere to aiming for a draft agreement in the coming weeks.

The Fed takes center stage on Wednesday, and with policy expected to be kept on hold for the near term, the focus will instead be on the committee’s assessment of recent data, which will include today’s Q1 GDP print. The Fed may also announce a “surprise” IOER cut as a result of the persistence of the EFF above the ceiling of the interest rate corridor. The minutes to the March meeting suggested that uncertainty about the causes of muted inflation pressures remain a source of Fed unease. With inflation failing to hold at the Fed’s target level, officials’ views on inflation will be closely scrutinized.

Next week is also another busy one for earnings with 166 S&P 500 companies due to report. The notable ones include Google on Monday, Apple, ConocoPhillips, General Electric, General Motors, McDonalds and Pfizer on Tuesday, Kraft Heinz on Wednesday, and DowDupont on Thursday. As of last night we’ve had 218 companies report with 166 beating on earnings but just 116 on sales. It’s worth noting that we’re also due to get numbers from Merck, GlaxoSmithKline, BNP, Lloyds, Royal Dutch Shell and BP in Europe too.

The data highlight next week comes on Friday when we get the April employment report in the US. The market consensus is for a 181k payrolls reading which follows 196k last month. The unemployment rate is expected to hold at 3.8% while earnings are expected to show a solid +0.3% mom rise. That would push the annual rate up to +3.3% yoy and therefore just one-tenth below the February highs. Prior to that we’ll get to test the US inflation pulse with the March PCE data on Monday. The consensus is for a +0.1% core deflator reading however base effects are expected to lower the annual reading to +1.7% yoy.

As well as that we’ve also got the April PMIs around the world to look forward to next week. It will start with China on Tuesday when we get the official manufacturing, services and composite PMIs, then we’ll get Japan’s manufacturing PMI on Wednesday along with the UK and the US. The April ISM manufacturing for the US is also out on Wednesday where the consensus is for a modest decline from 55.3 to 55.0. We’ll then get the Caixin PMI in China on Thursday along with the final manufacturing PMIs for Europe. As a reminder the flash Euro Area reading improved 0.3pts to 47.8 albeit with Germany at 44.5 and sub-50 readings for France (49.6) and Italy (47.6).

In Europe we’ll also get the advance Q1 GDP reading for the Euro Area on Tuesday. The market consensus is for +0.3% qoq, a view shared by our European economists who also note that risks are tilted towards +0.4% based on recent hard data. However they also note that a positive GDP surprise has to be put in context given that it would likely be due to transitory factors and the underlying momentum of the economy is likely weaker. Also out on the same day are Q1 GDP readings for France, Italy and Spain.

As well as growth data we’ll also get the latest April CPI readings in Europe. The broad Euro Area reading is due Friday (+1.0% yoy for the core expected) and country level readings are due in France, Spain, Italy and Germany on Tuesday. Elsewhere, the BoE meeting on Thursday is not expected to produce any policy changes. However it will be the first opportunity to see how the BoE will approach the six-month Brexit extension, and markets will be on the watch to see if a rate hike for later this year is left on the table. It will also include the latest GDP and CPI forecasts.

Meanwhile, it’s another light week for central bank speakers however we do have the Fed’s Evans, Clarida, Williams and Bowman speaking on Friday. The former is speaker at a NABE forum in Stockholm while the latter three all speak at the Hoover Institute Policy Conference which will likely be closely followed. The BoE’s Carney and Ramsden are also due to speak on Monday and Tuesday respectively while the ECB’s Guindos is due to speak on Wednesday and Praet and Nowotny on Thursday. Finally, other things to keep an eye on include the conclusion of talks between Abe and Trump at the White House tomorrow, Merkel and Macron hosting a meeting of leaders from Serbia and Kosovo on Monday, Salvini and Orban meeting in Budapest on Monday to discuss a potential EU parliament alliance, the expiration of US waivers on purchases of Iranian oil on Thursday, and the EU’s Tusk speaking on Friday

Summary of key events in the week ahead:

- Monday: The data highlight comes in the afternoon in the form of the March PCE report in the US, and personal income and spending data. Prior to that data in Europe includes March M3 money supply and April confidence indicators for the Euro Area. In the US we’ll also get the April Dallas Fed survey. Away from the data, BoE Governor Carney is due to speak in London. Earnings highlights include Google.

- Tuesday: The early focus will be in China where early in the morning we’ll get the official April PMIs. In Europe we follow with Q1 GDP in France, Italy and the Euro Area, along with preliminary April CPI figures for France and Germany. The US data highlights include Q1 ECI, the February S&P CoreLogic house price index data, April Chicago PMI, March pending home sales and April consumer confidence. Meanwhile BoE Deputy Governor Ramsden is due to speak in London. It’s busy for earnings with Apple, ConocoPhillips, General Electric, General Motors, McDonalds and Pfizer all due to report. Trade talks between the US and China also resume.

- Wednesday: The outcome of the FOMC meeting in the evening is the day’s highlight. Prior to that we’ll get the final April manufacturing PMI for Japan and the UK, along with March money and credit aggregates data in the latter. In the afternoon we’ve got the April ADP employment change print due along with the final April manufacturing PMI, April ISM, March construction spending and April vehicle sales. Meanwhile, ECB Vice President Guindos and BoE Court Chair Fried are due to speak, while earnings include Kraft Heinz.

- Thursday: The main focus should be the final April manufacturing PMIs due out in Europe, and the Caixn manufacturing PMI in China. We’ve also got a BoE meeting, while data in the US includes claims, Q1 nonfarm productivity and unit labour costs, and final March durable and capital goods orders. DowDupont is the earnings highlight.

- Friday: All eyes will be on the April employment report in the US during the afternoon. Prior to that we also get the final April services and composite PMIs in the UK, March PPI for the Euro Area and April CPI for the Euro Area. The March advance goods trade balance, March wholesale inventories, final April PMIs and April ISM non-manufacturing are all due out. Meanwhile, the Fed’s Evans is due to speak at the NABE International Forum in Stockholm and, while Clarida and Williams are both due to speak at the Hoover Institute Policy Conference.

And visually, courtesy of Amplify:

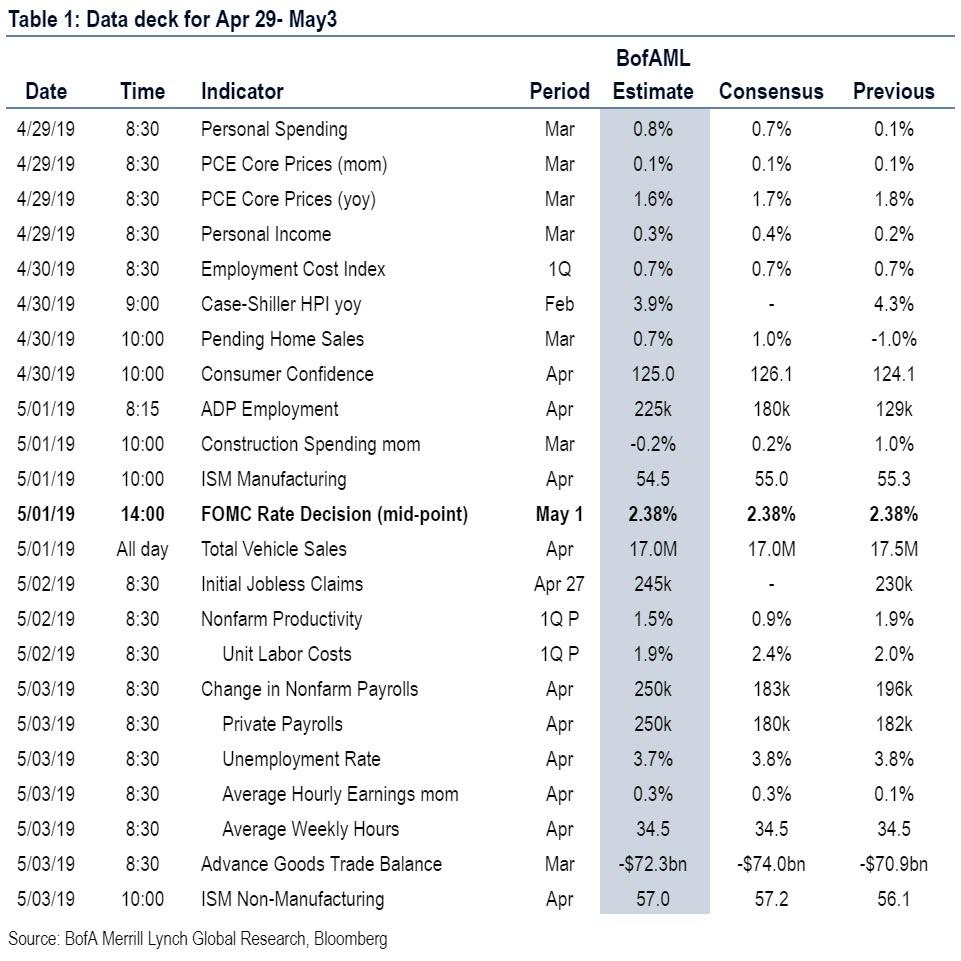

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing report on Wednesday and the employment report on Friday. In addition, the May FOMC statement will be released on Wednesday at 2:00 PM ET, followed by Chairman Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials on Friday.

Monday, April 29

- 08:30 AM Personal income, March (GS +0.4%, consensus +0.4%, last +0.2%); Personal spending, March (GS +0.5%, consensus +0.7%); PCE price index, March (GS +0.24%, consensus +0.3%); Core PCE price index, March (GS +0.09%, consensus +0.1%); PCE price index (yoy), March (GS +1.52%, consensus +1.6%); Core PCE price index (yoy), March (GS +1.58%, consensus +1.7%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose 0.09% month-over-month in March, or 1.58% from a year ago. Additionally, we expect that the headline PCE price index increased 0.24% in March, or 1.52% from a year earlier. We expect a 0.4% increase in personal income in March, along with a 0.5% increase in March personal spending, in part reflecting a rebound in March retail sales. PCE price index, February (GS +0.11%); Core PCE price index, February (GS +0.07%); PCE price index (yoy), February (GS +1.33%); Core PCE price index (yoy), February (GS +1.67%)

Tuesday, April 30

- 08:30 AM Employment cost index, Q1 (GS +0.8%, consensus +0.7%, last +0.7%); We estimate the employment cost index rose 0.8% in Q1 (qoq sa) as wage pressures continue to firm. However, we note the risk that the seasonal factor revisions may weigh on reported growth. The preliminary reading of our 2019Q1 wage tracker—which distills signals from several wage measures—stands at 2.9% year-over-year, down from 3.4% in 2018Q4, but up from 2.7% in 2018Q1.

- 09:00 AM S&P/Case-Shiller 20-city home price index, February (GS +0.3%, consensus +0.3%, last +0.1%); We estimate the S&P/Case-Shiller 20-city home price index increased 0.3% in February, following a 0.1% increase in January. Our forecast of a solid increase largely reflects the appreciation in other home prices indices such as the CoreLogic house price index in February.

- 09:45 AM Chicago PMI, April (GS 58.5, consensus 59.0, last 58.7); We estimate that the Chicago PMI edged down further in April, following a 6.0pt decline in March. The index appears elevated relative to other manufacturing surveys, suggesting some scope for catch-down.

- 10:00 AM Pending home sales, March (GS +1.5%, consensus +0.9%, last -1.0%); We estimate that pending home sales increased by 1.5% in March based on firmer regional home sales data, following a 1.0% decline in February. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

- 10:00 AM Conference Board consumer confidence, April (GS 127.0, consensus 126.1, last 124.1); We estimate that the Conference Board consumer confidence index rebounded by 2.9pt to 127.0 in April, reflecting the continued increases in equity prices.

Wednesday, May 1

- 08:15 AM ADP employment report, April (GS +190k, consensus +180k, last +129k); We expect ADP payroll employment growth rose to 190k, reflecting a decline in jobless claims and the pickup in lagged payroll growth—an input in the ADP model. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 10:00 AM ISM manufacturing index, April (GS 54.8, consensus 55.0, last 55.3); Our manufacturing survey tracker — which is scaled to the ISM index — declined by 1.1pt to 53.9, reflecting weaker manufacturing surveys in April. Following a 1.1pt increase in March, we expect the ISM manufacturing index to decrease by 0.5pt to 54.8 in April.

- 10:00 AM Construction spending, March (GS flat, consensus +0.2%, last +1.0%); We estimate construction spending slowed to flat in March following the previous month’s gain, with scope for a decline in private residential construction but gains in public construction spending.

- 02:00 PM FOMC statement, April 30 – May 1 meeting; As discussed in our FOMC preview, we do not expect a change to the funds rate. In the May statement, we expect the Committee to acknowledge firmer growth (to “solid”) but softer inflation data since the March meeting. Chairman Powell’s press conference is likely to see questions on the threshold for rate cuts as well as the latest thinking on the Fed’s framework.

Thursday, May 2

- 08:30 AM Nonfarm productivity (qoq saar), Q1 preliminary (GS +1.5%, consensus +1.5%, last +1.9%); Unit labor costs, Q1 preliminary (GS +1.8%, consensus +2.1%, last +2.0%): We estimate non-farm productivity rose 1.5% in Q1 (qoq ar), above the trend achieved on average during this expansion. This reflects strong business output growth in Q1 partially offset by moderate growth in average hours worked. We expect Q1 unit labor costs—compensation per hour divided by output per hour—to rise by 1.8% as a result of moderate productivity growth in the quarter.

- 08:30 AM Initial jobless claims, week ended April 27 (GS 195k, consensus 220k, last 230k); Continuing jobless claims, week ended April 20 (last 1,655): We estimate jobless claims fell to 195k in the week ended April 30 following volatility in the prior week likely related to the Good Friday holiday. The claims reports of recent weeks suggest that the pace of layoffs remains low and falling.

- 10:00 AM Factory Orders, March (GS +1.6%, consensus +1.4%, last -0.5%); Durable goods orders, March final (last +2.7%); Durable goods orders ex-transportation, March final (last +0.4%); Core capital goods orders, March final (last +1.3%); Core capital goods shipments, March final (last -0.2%): We estimate factory orders increased by 1.6% in March following a 0.5% decline in February. Durable goods orders increased in the March advance report, driven primarily by an increase in aircraft orders.

- 5:00 PM Lightweight Motor Vehicle Sales, April (GS 16.9m, consensus 17.0m, last 17.5m)

Friday, May 3

- 08:30 AM Nonfarm payroll employment, April (GS +195k, consensus +185k, last +196k); Private payroll employment, April (GS +190k, consensus +180k, last +182k); Average hourly earnings (mom), April (GS +0.2%, consensus +0.3%, last +0.1%); Average hourly earnings (yoy), April (GS +3.2%, consensus +3.3%, last +3.2%); Unemployment rate, April (GS 3.8%, consensus 3.8%, last 3.8%): We estimate nonfarm payrolls increased 195k in April, as fundamentals suggest job growth remains solid, but winter storms in the Midwest likely weighed on growth in weather-sensitive industries. While we believe trend job growth has slowed from its +223k average monthly pace in 2018, further declines in jobless claims (-19k on average during the payroll month) and the resilience in employment components of business surveys suggest that the underlying pace remains well above-potential. We estimate the unemployment rate was unchanged at 3.8%. While continuing claims have declined significantly, we believe this in part reflects the reversal of residual seasonality effects unique to that series that boosted claims in the early months of the year. Finally, we estimate average hourly earnings increased 0.2% month-over-month (+3.2% yoy), reflecting unfavorable calendar effects.

- 08:30 AM U.S. Census Bureau Report on Advance Economic Indicators; Advance goods trade balance, March (GS -$71.3bn, consensus -$73.8bn, last -$72.0bn): We estimate that the goods trade deficit declined slightly to $71.3bn in March, as outbound container traffic rose and inbound traffic fell in the month.

- 10:00 AM ISM non-manufacturing index, April (GS 57.1, consensus 57.0, last 56.1): Our non-manufacturing survey tracker increased by 1.4pt to 56.8 in April, following mixed-to-firmer regional service sector surveys. We expect the ISM non-manufacturing index to increase by 1.0pt to 57.1 in the April report.

- 10:15 AM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will give a speech at a National Association of Business Economics conference in Stockholm.

- 11:30 AM Fed Vice Chairman Clarida (FOMC voter) speaks: Federal Reserve Board Vice Chairman Clarida will speak on monetary policy strategies at a conference at Stanford University. The event will be live streamed.

- 01:45 PM New York Fed President Williams (FOMC voter) speaks: Federal Reserve Bank of New York President John Williams will speak in a moderated discussion on monetary policy rules and the lower bound at a conference at Stanford University. The event will be live streamed.

- 03:00 PM Fed Governor Bowman (FOMC voter) speaks: Federal Reserve Board Governor Michelle Bowman will moderate a discussion on Milton Friedman and the history of monetary policy rules. The event will be live streamed.

- 07:45 PM Fed Presidents Bullard (FOMC voter), Daly (FOMC non-voter), Kaplan (FOMC non-voter), and Mester (FOMC non-voter) speak: Federal Reserve district bank presidents Bullard, Daly, Kaplan, and Mester will participate on a moderated panel discussion on monetary policy strategies. The event will be live streamed.

Source: DB, Amplify, Goldman, BofA

via ZeroHedge News http://bit.ly/2IYGbY9 Tyler Durden