The Tesla shareholder base has undergone significant changes over the last several months, at the same time the stock has dropped a whopping 38% from its 52-week highs of $387.46. One of the talking points popular among Tesla skeptics remains why such large institutional names and major holders continue to own the stock given the significant shitstorm of events operational challenges the company appears to be facing.

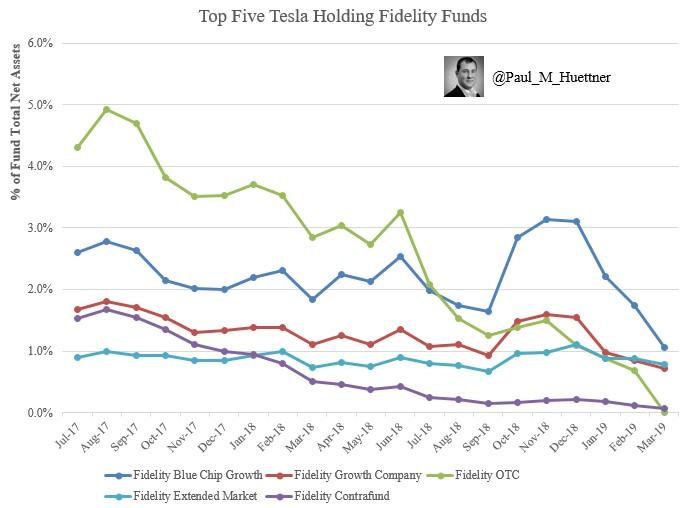

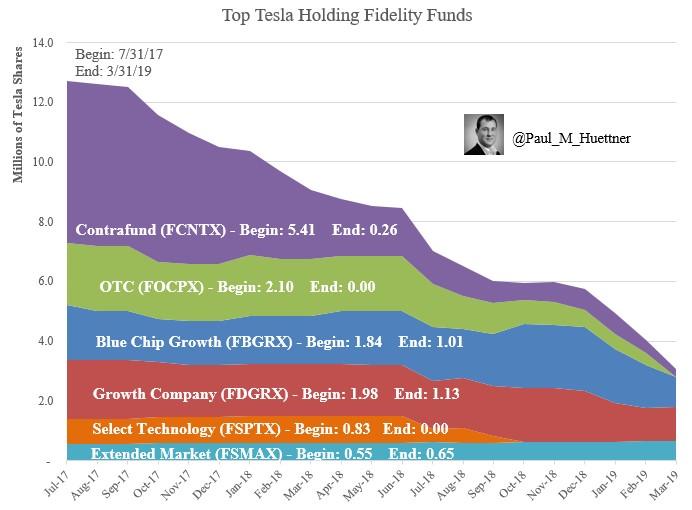

Today, we have slightly more transparency as to how the Tesla shareholder base is “evolving”, thanks to CFA Paul Huettner, who has compiled a chart showing how Fidelity has been the most recent Tesla shareholder to reduce their exposure to the company.

“Fidelity’s big funds sell nearly 1 million shares of [Tesla], 24% of their entire Tesla position in March! That’s 6 million shares, or 66%, in the last year,” he commented on Twitter.

Huettner also points out:

“As a percent of total net assets, [Tesla] is now at a multi-year low. Blue Chip Growth looking like it’s headed for a complete liquidation while OTC is completely out.”

This comes amid a slew of insider stock sales from people like departing Board Member Antonio Gracias and Musk’s longtime lieutenant JB Straubel, who filed a Form 4 just yesterday disclosing stock sales in the $230’s and $240’s.

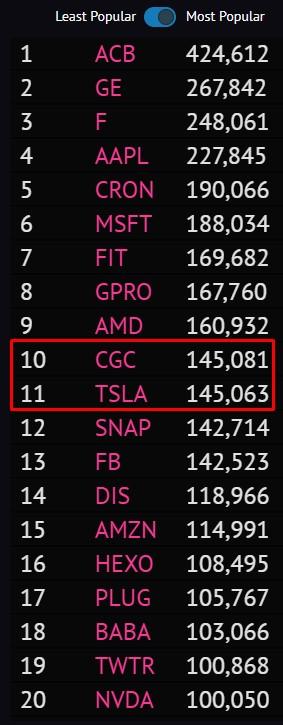

At the same time, according to data from RobinTrack.net that tracks users of the Robinhood app, the number of retail shareholders of the company has continued to rise as the price falls and these institutions spray the bid.

This has helped Tesla move close to advancing on the Robinhood Wall of Shame “leaderboard” from position #11 to #10 in the list of most widely held equities.

As VC entrepreneur and fund manager Josh Wolfe accurately stated:

“The people dumping shares in Tesla are not short-sellers (short interest lower than usual)— but large institutional holders + Tesla Board of Directors members.”

And so while Tesla’s share price over the last couple months has painted an ugly picture, that picture seems to get even less optimistic when one considers that institutional money has been on the offer with mom and pop on the bid.

via ZeroHedge News http://bit.ly/2Lk3SNg Tyler Durden