It’s that time of year again… but this one may be ‘different‘.

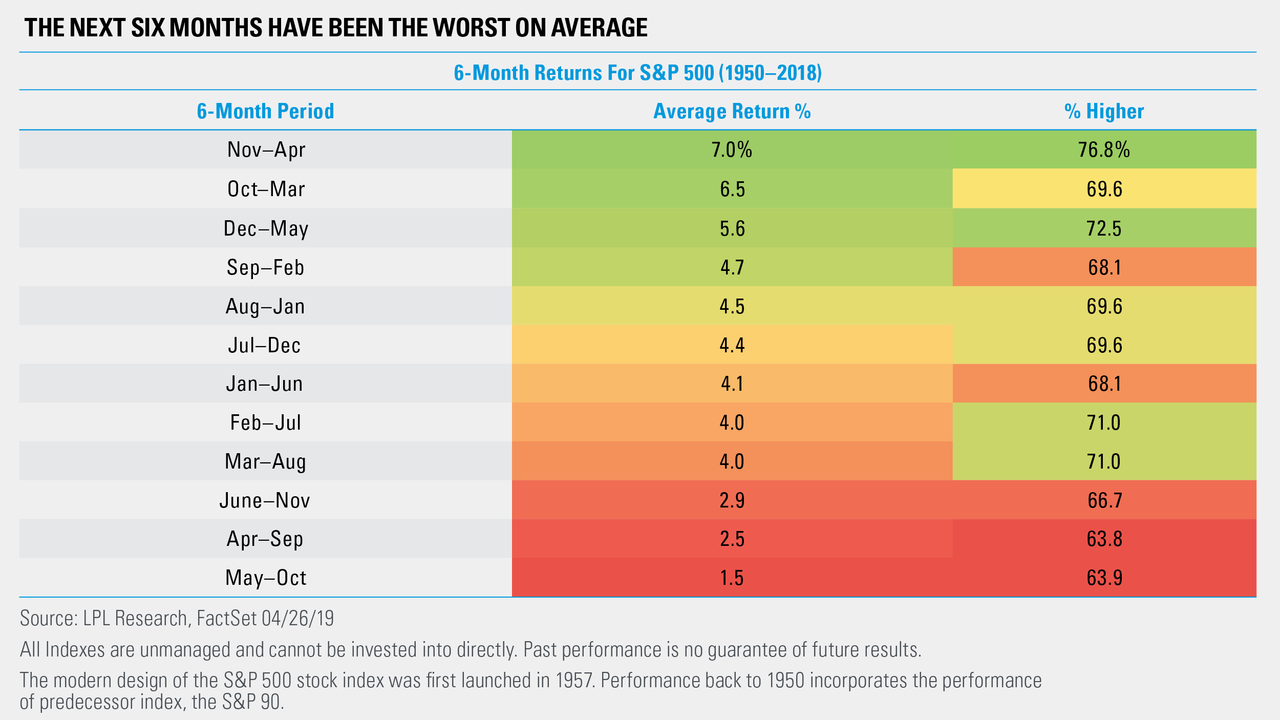

Confirming the old axiom to “sell in May and go away,” LPL Financial notes that the next six months have historically been the worst for stocks (seasonally-speaking).

However, in recent years that saying has not held well for investors.

“Stocks have actually risen over this dreaded six-month stretch in six of the past seven years, while the S&P 500 Index has gained in May six consecutive years,” explained Senior Market Strategist Ryan Detrick. “Blindly going to cash and waiting until after Halloween to re-invest hasn’t been the most profitable strategy lately.”

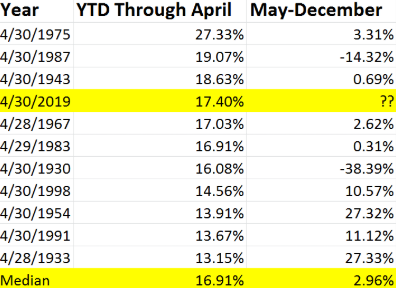

However, as Bloomberg’s Ye Xie notes, 2019 has been different. The S&P’s 17.3% gain in 2019 through the end of April makes it the fourth best start to a year in history.

And, that may be a bearish signal.

Because historically when the January-April return exceeds 15%, the performance for the rest of the year is paltry at best and, at times, a disaster.

The table above compares the best performing January-April periods and the returns afterwards.

While this may sound too naïve to be scientific, it does show there’s some legitimacy to the “Sell in May” axiom under certain circumstances.

Let’s see if history repeats itself.

via ZeroHedge News http://bit.ly/2WoE9Vb Tyler Durden