With MSCI World down another 2% today, adding to the losses from last week, trade turmoil has wiped around $3.5 trillion in market cap (down $1 trillion today) from global stocks. Not a fleshwound…

China’s Friday afternoon panic-bid from The National Team gave way overnight

Europe was also ugly, led by Germany, as Trump’s auto-tariff deadline looms…

US equities were ugly as China retaliation struck (what a shock)…erasing all the post “constructive” bounce and then some

On the cash side, The Dow dropped over 700 at its worse but some jawboning from Mnuchin and Trump lifted stocks off their lows…

All major US equity indices are back below key technical levels.

S&P ETF (SPY) has seen outflows every day this month (on pace for its worst month of outflows since March 2018 in the middle of ‘volmageddon’)…

Uber

Humor?

Some Goldman Clients to Get Uber Stock at 40% Discount: WSJ

Or they can just wait 2 days and buy it there in the open market

— zerohedge (@zerohedge) May 8, 2019

FANG stocks were smashed lower today…

As was AAPL…

Biotechs (with Mylan and Teva crushed on price collusion allegations)

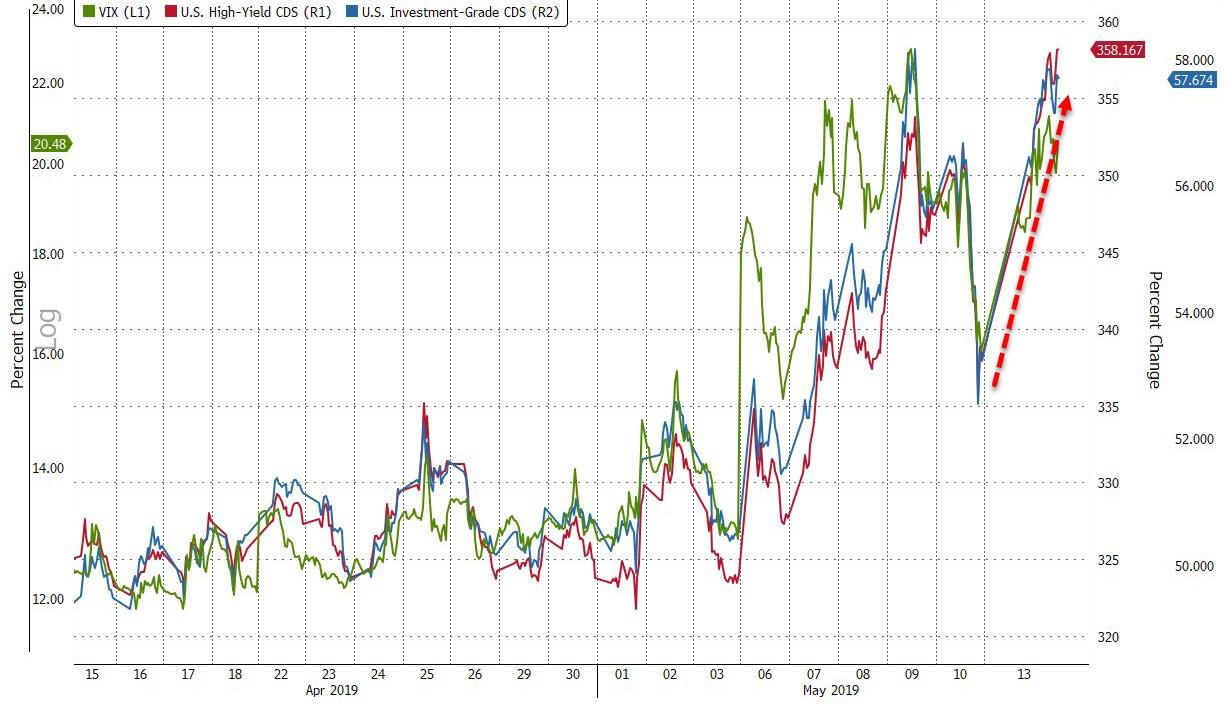

VIX and Credit spreads blew out wider today…

Treasury yields tumbled on the day…

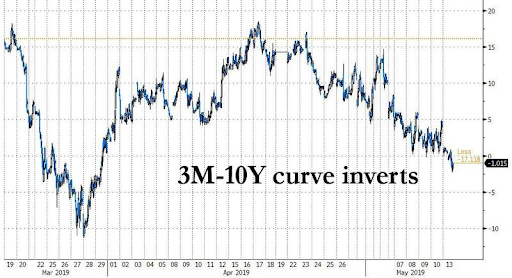

Yield curve inverted

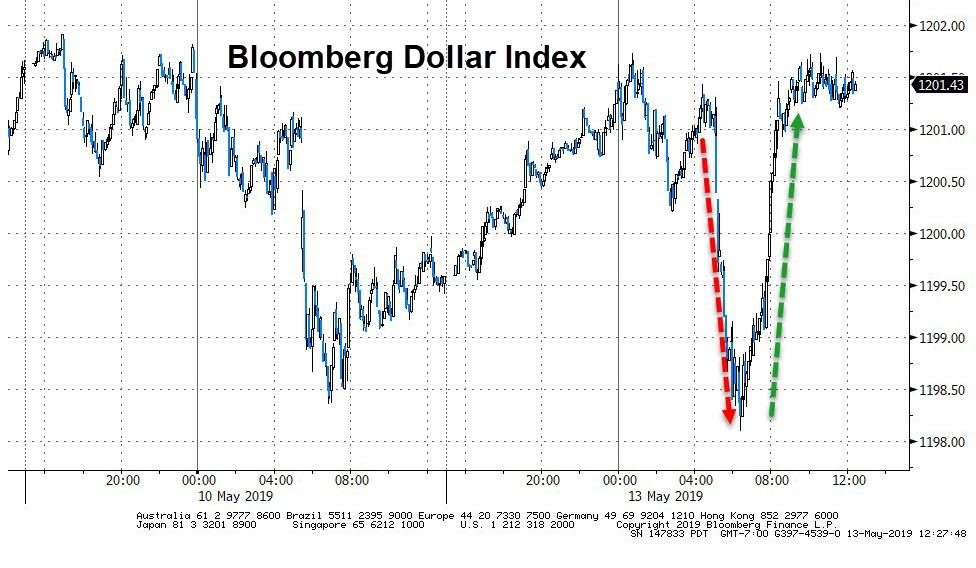

Big round trip in the dollar…

Cryptos continued to soar since Friday’s close…

With Bitcoin nearing $8000 as Yuan plunged…

Gold spiked above $1300 today…

Oil prices initially popped on Iran tensions but faded as trade worries weighed…

Hogs were limit down to 8-week lows…

Finally, all this happened as expectations for 2019 action by the Fed plunged to 41bps of rate-cuts!!

via ZeroHedge News http://bit.ly/2Q0uDVM Tyler Durden