Stocks may be tumbling but for some bulls today is just another day, with little to worry about: after all, the circular nature of today’s Fed “reaction function”, means that the more stocks drop as traders price in a “nuclear trade war” with China, the more likely the Fed is to ease financial conditions, and either cut rates or go QE4. Canaccord’s chief market strategist Tony Dwyer encapsulated this take best earlier today when he tweeted that he “just called my mortgage company to ask if they have tightened lending standards. He literally started laughing and said “no we are easing them.” Rates are tanking and the 2/10-yr US Treasury curve is steepening. Sticking with our 2950 SPX target for this year and 3350 next.”

Just called my mortgage company to ask if they have tightened lending standards. He literally started laughing and said “no we are easing them.” Rates are tanking and the 2/10-yr US Treasury curve is steepening. Sticking with our 2950 SPX target for this year and 3350 next.

— Tony Dwyer (@dwyerstrategy) May 13, 2019

While normally Tony would be correct – after all, year after year we have seen the Fed step in just as stocks threatened to tumble and enter a bear market, most recently in December – this time there is a problem.

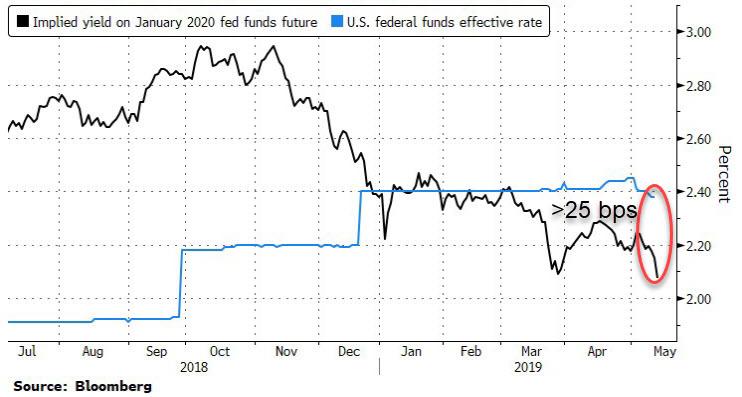

The problem is that stocks are plunging, with the S&P down 2.5% today, even as rate cut odds are soaring, and according to Bloomberg, the rate on the January fed funds futures contract has moved to a level that implies the central bank’s benchmark will fall to 2.075% by the end of 2019. Since this is more than 25 basis points below where the effective fed funds traded on Friday, it confirms that traders are now fully pricing a quarter-point reduction and then some… and it’s not enough to stabilize stocks. Indicatively, the implied rate on the contract ended last week at 2.15%.

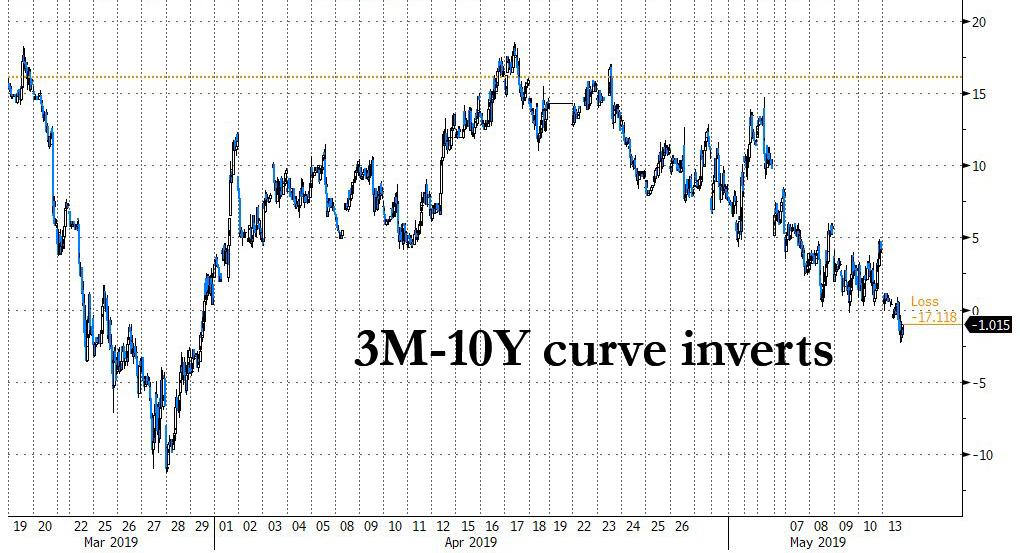

Today’s surge in rate cut odds is surely driven by the plunge in risk assets, the result of China launching retaliatory tariffs on American imports, a sharp escalation in the ongoing trade war, which in turn is raising fresh concern about economic growth, prompting the 3 Month -10 Year yield curve to inverted again for the first time since late March, and once again signalling that a recession is imminent.

The problem, as noted above, is that due to the reflexive nature of the market, rate cuts alone have historically been sufficient to push stocks higher. Which means that the market now demands at least two rate hikes by the end of 2019 to rebound. That… or more QE.

The other problem, as we will discuss shortly in a subsequent post, is that with tariffs set to surge, the immediate consequence will be sharply higher prices on a majority of consumer goods, which in turn will send CPI higher, and may prevent the Fed from hiking. In fact, if prices jump enough, Powell may have to cut again. In other words, one can argue that while China will be hurt far more than the US from the trade war escalation, if China meant to punish Trump by not only crushing stocks, but keeping them low, it did precisely what it should have.

And now the question is what is the new and revised “Powell Put”, i.e., how much more does the S&P have to fall before the Fed start jawboning about an imminent rate cut. Just a few more 700-point Dow down days shoudl do it.

via ZeroHedge News http://bit.ly/2Q0FA9L Tyler Durden