Authored by Lance Roberts via RealInvestmentAdvice.com,

Since the beginning of 2019, the market has risen sharply. That increase was not due to rising earnings and revenues, which have weakened, but rather from multiple expansion. In other words, investors are willing to pay higher prices for weaker earnings.

The issue, of course, is that while it may not seem to matter in the short-term, valuations matter a lot in the long-run.

I know what you are thinking.

“There is NO WAY cash will outperform stocks over the next decade.”

I understand. After a decade-long market advance, it’s hard to fathom a period where stocks fail to perform. However, despite what you have been told, this time is not different, valuations do matter, and “no,” Central Banks do not have it all under control. (In reality, the Federal Reserve are the “Firemen” in Fahrenheit 451.)

While the media is rife with historical references about why you should only “buy and hold” investments over a 100-years, they tend to ignore the measures which dictate 5, 10, and 20-year investing cycles which have the greatest impact on most Americans.

Let me explain that.

Unless you have contracted “vampirism,” then you do NOT have 90, 100, or more, years to invest to gain “average historical returns.” Given that most investors do not start seriously saving for retirement until the age of 35, or older, they have about 30-35 years to reach their goals. If that period happens to include a 12-15 year period in which returns are flat, as history tells us is probable, then the odds of achieving their goals are severely diminished.

What drives those 12-15 year periods of flat to little return? Valuations.

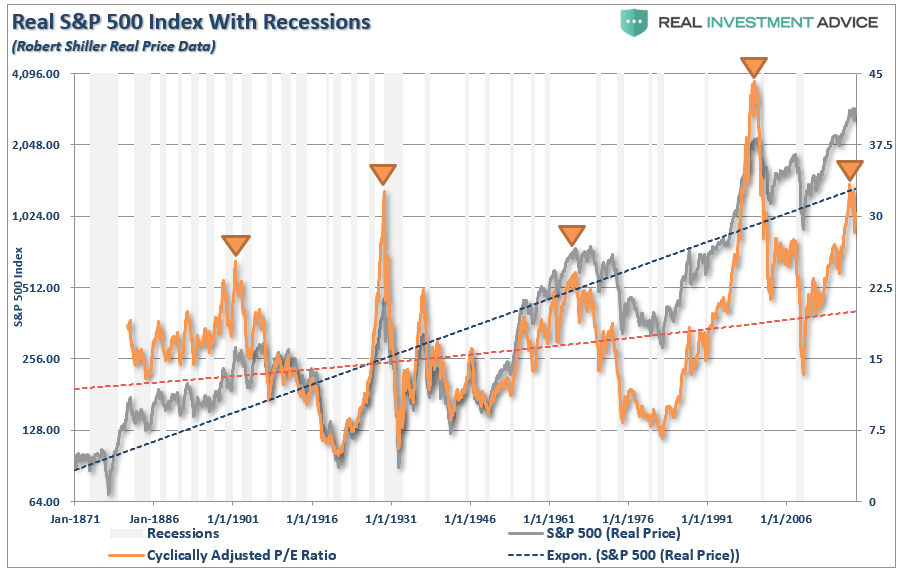

Despite commentary to the contrary, the evidence is quite unarguable. As shown in the chart below, the cyclical nature of valuations and asset prices is clear.

Not surprisingly, valuations are linked to future returns. This is as it should be, and why Warren Buffett once quipped:

“Price is what you pay. Value is what you get.”

This is why over rolling 10- and 20-year periods you have stretches where investors make little or no money.

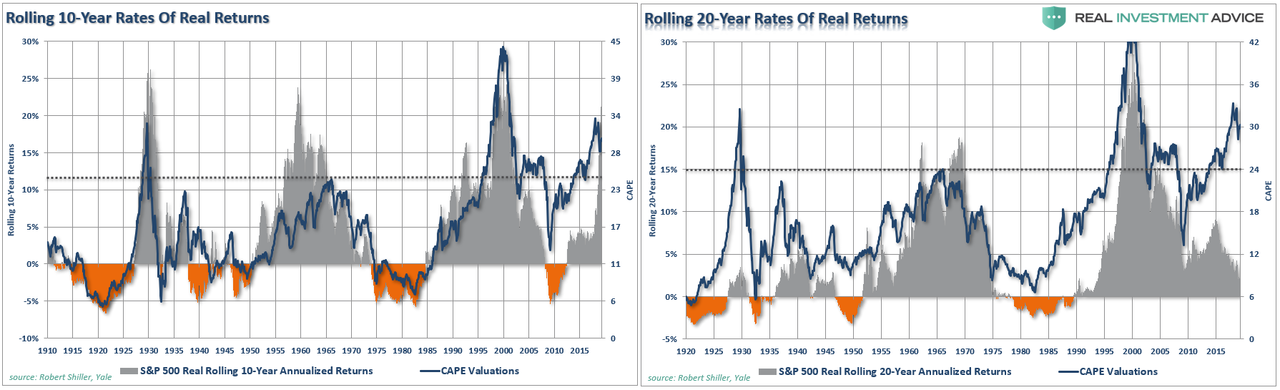

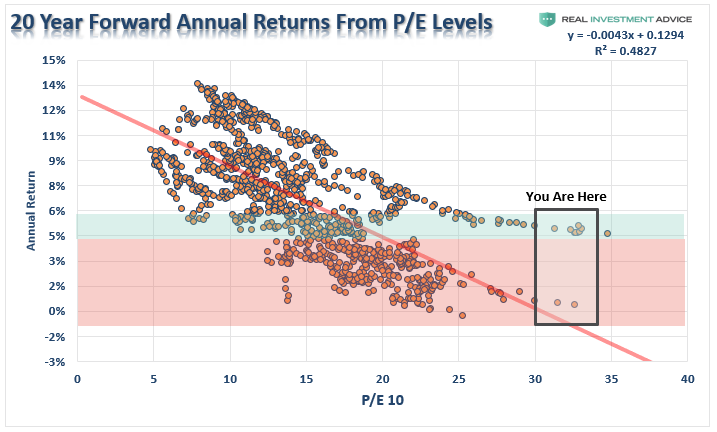

Just remember, a 20-year period of one-percent returns is indistinguishable from ZERO with respect to meeting savings goals. One great thing+ about valuations, such as CAPE, is that we can use them to form expectations around risk and return. The graph below shows the actual 20-year annualized returns that accompanied given levels of CAPE.

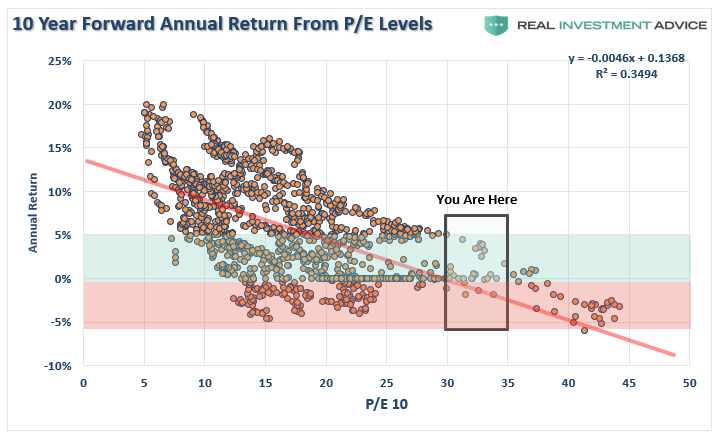

20-years is a long time for most investors. So, here is what happens to returns over a 10-year period from 30x valuations as we have currently.

Again, as valuations rise, future rates of annualized returns fall. This is math, and logic states that if you overpay today for an asset today future returns must, and will, be lower.

I know. Ten years is still long. How about 5-years?

We can reverse the analysis and look at the “cause” of excess valuations which is investor “greed.” As investors chase assets, prices rise. Of course, as prices continue to rise, investors continue to crowd into assets finding reasons to justify overpaying for assets. However, there is a point where individuals have reached their investing limit which leaves little buying power left to support prices. Eventually, prices MUST mean revert to attract buyers again.

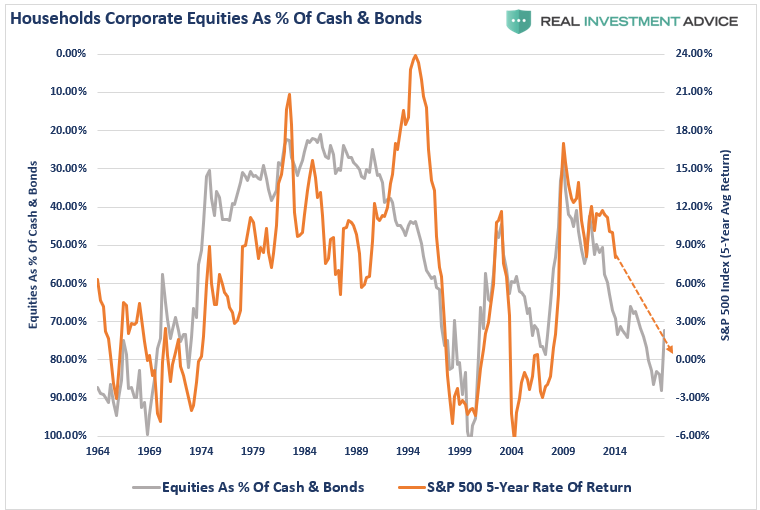

The chart below shows household ownership of equities as a percent of household ownership of cash and bonds. (The scale is inverted and compared to the 5-year return of the S&P 500.)

Just like valuation measures, ownership of equities is also at historically high levels and suggests that future returns for equities over the next 5, 10, and 20-years will approach ZERO.

No matter how you analyze the data, the expected rates of return over the next decade will be far lower than the 8-10% annual return rates currently promised by Wall Street.

Every Year Won’t Be Zero

This is where things get confusing.

When you discuss a decade, or more, of near-zero returns it does NOT mean that every year will be ZERO.

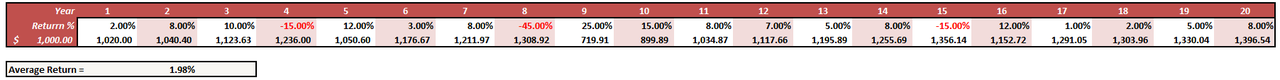

During that period there is going to strong up years, an extremely bad year or two, then some more good years. In the end you average annual return for the past decade will be close to zero. (Here is an example of how that plays out.)

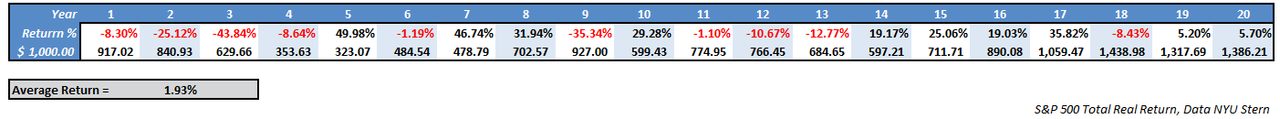

Or here is how it played out the last time we ran a large national debt, had high starting valuations, and had just finished a period of excessive investment accumulation. (1929-1948)

This is because there are only two ways in which valuations can revert to levels where future returns on investments rise.

- Prices can rapidly decline, or;

- Earnings can rise while prices remain flat.

Historically, option #2 has never been an outcome.

Michael Lebowitz explained why this is the case for our RIA PRO members (Try FREE For 30-days)

“The all-important link between stock prices, economic and productivity growth, and true corporate earnings potential are being ignored. Stock prices and many other investment asset prices are indirectly supported by the actions and opinions of the central banks. Investors have become dangerously comfortable with this dubious arrangement despite the enormous market disequilibrium it is causing. History reminds us time and again that a state of disequilibrium is highly unstable and will ultimately revert to equilibrium – often violently so.”

The Real Value Of Cash

For most of the last decade, the mantra was “T.I.N.A. – There Is No Alternative” because cash in the bank yielded ZERO.

Today that is no longer the case with money market yields now pushing 2%, or more, in many cases. Nonetheless, the belief was ingrained into the current investing generation that “cash” is a “bad” investment.

I do agree that if inflation is running higher than the return on cash, then you do lose purchasing parity power in the short-term. However, there is a huge difference between the loss of future purchasing power and the destruction of investment capital.

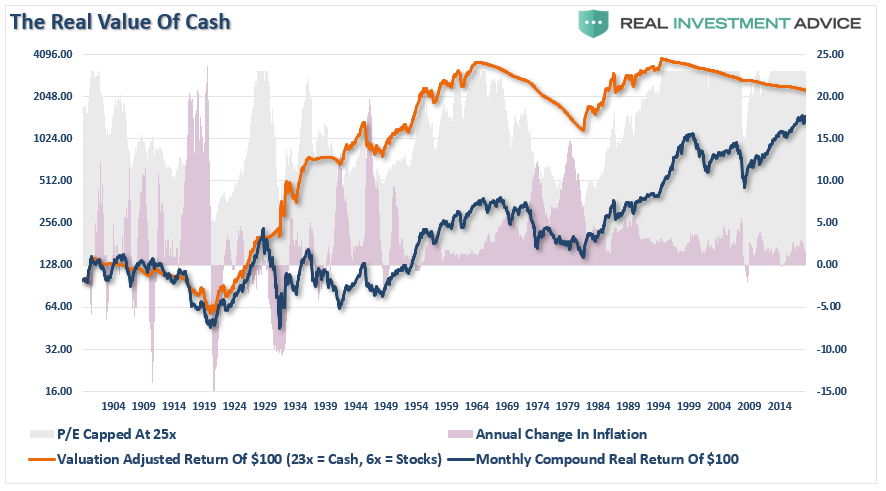

The chart below shows the inflation-adjusted return of $100 invested in the S&P 500 (using data provided by Dr. Robert Shiller). The chart also shows Dr. Shiller’s CAPE ratio. I have capped the CAPE ratio at 23x earnings which has historically been the peak of secular bull markets in the past. Lastly, I calculated a simple cash/stock switching model which buys stocks at a CAPE ratio of 6x or less and moves to cash at a ratio of 23x.

(I would never recommend actually managing your portfolio this way, but this is for illustrative purposes.)

I have adjusted the value of holding cash for the annual inflation rate which is why during the sharp rise in inflation in the 1970’s there is a downward slope in the value of cash. While the value of cash is adjusted for purchasing power in terms of acquiring goods or services in the future, the impact of inflation on cash as an asset concerning reinvestment may be different since asset prices are negatively impacted by spiking inflation. In such an event, cash gains purchasing power parity in the future if assets prices fall more than inflation rises.

While cash did lose relative purchasing power, due to inflation, the benefits of having capital to invest at low valuations produced substantial outperformance over waiting for previously destroyed investment capital to recover.

We can debate over methodologies, allocations, etc., the point here is that “time frames” are crucial in the discussion of cash as an asset class. If an individual is “literally” burying cash in their backyard, then the discussion of loss of purchasing power is appropriate. Alternatively, if the holding of cash is a “tactical” holding to avoid short-term destruction of capital, then the protection afforded outweighs the loss of purchasing power in the distant future.

8-Reasons To Hold Cash

Over the last 30-years, I have that while a “rising tide lifts all boats,” eventually the “tide recedes.” I made one simple adjustment to my portfolio management over the years which has served me well. When risks begin to outweigh the potential for reward, I raise cash.

The great thing about holding extra cash is that if I’m wrong I make the proper adjustments to increase risk in portfolios. However, if I am right, I protect investment capital from destruction and spend far less time “getting back to even” and spend more time working towards my long-term investment goals.

Here are my reasons having cash is important.

1) We are not investors, we are speculators. We are buying pieces of paper at one price with an endeavor to eventually sell them at a higher price. This is speculation at its purest form. Therefore, when probabilities outweigh the possibilities, I raise cash.

2) 80% of stocks move in the direction of the market. In other words, if the market is moving in a downtrend, it doesn’t matter how good the company is as most likely it will decline with the overall market.

3) The best traders understand the value of cash. From Jesse Livermore to Gerald Loeb they all believed one thing – “Buy low and Sell High.” If you “Sell High” then you have raised cash. According to Harvard Business Review, since 1886, the US economy has been in a recession or depression 61% of the time. I realize that the stock market does not equal the economy, but they are somewhat related.

4) Roughly 90% of what we’re taught about the stock market is flat out wrong: dollar-cost averaging, buy and hold, buy cheap stocks, always be in the market. The last point has certainly been proven wrong because we have seen two declines of over -50%…just in the past two decades! Keep in mind, it takes a +100% gain to recover a -50% decline.

5) 80% of individual traders lose money over ANY 10-year period. Why? Investor psychology, emotional biases, lack of capital, etc. Repeated studies by Dalbar prove this over and over again.

6) Raising cash is often a better hedge than shorting. While shorting the market, or a position, to hedge risk in a portfolio is reasonable, it also simply transfers the “risk of being wrong” from one side of the ledge to the other. Cash protects capital. Period. When a new trend, either bullish or bearish, is evident then appropriate investments can be made. In a “bull trend” you should only be neutral or long and in a “bear trend” only neutral or short. When the trend is not evident – cash is the best solution.

7) You can’t “buy low” if you don’t have anything to “buy with.” While the media chastises individuals for holding cash, it should be somewhat evident that by not “selling rich” you do not have the capital with which to “buy cheap.”

8) Cash protects against forced liquidations. One of the biggest problems for Americans currently, according to repeated surveys, is a lack of cash to meet emergencies. Having a cash cushion allows for working with life’s nasty little curves it throws at us from time to time without being forced to liquidate investments at the most inopportune times. Layoffs, employment changes, etc. which are economically driven tend to occur with downturns which coincide with market losses. Having cash allows you to weather the storms.

Importantly, I am not talking about being 100% in cash. I am suggesting that holding higher levels of cash during periods of uncertainty provides both stability and opportunity.

With the fundamental and economic backdrop becoming much more hostile toward investors in the intermediate term, understanding the value of cash as a “hedge” against loss becomes much more important.

Given the length of the current market advance, deteriorating internals, high valuations, and weak economic backdrop; reviewing cash as an asset class in your allocation may make some sense. Chasing yield at any cost has typically not ended well for most.

Besides, what’s the worse that could happen?

via ZeroHedge News http://bit.ly/2JhTBPM Tyler Durden