A day after equities suffered their worst selloff of 2019, the S&P rebounded even as world stocks hovered near two-month lows on Tuesday, following more optimistic comments from U.S. and Chinese officials on trade which brought some comfort.

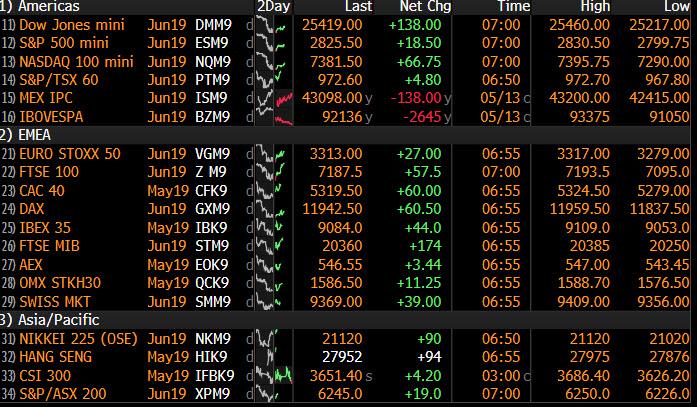

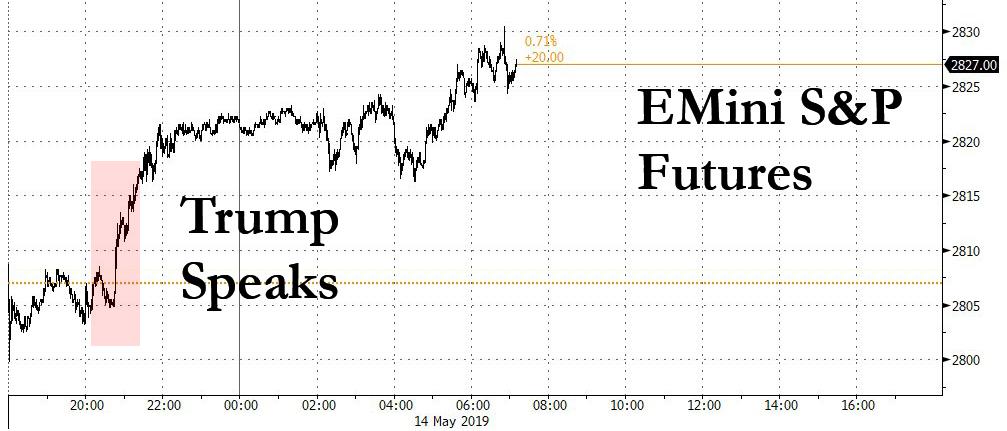

The rebound started just after 8pm EDT on Monday night, with the S&P trading just above 2,800 when President Trump said he believed discussions with China “will be very successful,” with the outcome expected in three or four weeks.

Responding to Trump, who said he was optimistic about resolving the trade dispute, the Chinese government’s top diplomat said China and the United States both have the “ability and wisdom” to reach a trade deal that is good for both.

Of course, it is quite possible that the market’s overly optimistic interpretation of Trump’s take may have been premature, considering that on Tuesday morning Trump has had a barrage of no less than 7 tweets on the topic of trade war, with the highlight so far his claim that “when the time is right we will make a deal with China. My respect and friendship with President Xi is unlimited but, as I have told him many times before, this must be a great deal for the United States or it just doesn’t make any sense.” In second tweet, Trump says deal must make up some of “tremendous ground we have lost to China on Trade since the ridiculous one sided formation of the WTO. It will all happen, and much faster than people think!”

Hardly the stuff of an imminent deal, but for now the algos are ignoring it and focusing on the glimmers of optimism, which has paved the way for a positive start for European stocks with stock markets in London, Frankfurt and Paris 0.6% to 0.9% higher, while U.S. stock futures rallied.

The Stoxx Europe 600 Index climbed as much as 0.8%, bouncing from the previous session’s selloff, with all sectors but real estate in green, amid renewed hopes for a U.S.-China trade deal. Trade-sensitive sectors including luxury, miners lead gains, while energy also rose as BP gained 2%, Shell rose 1.1% after Brent oil jumped after Saudi Arabia reported drone attacks on pumping stations, the latest escalation in Middle East tensions.

“The trade war is driving markets at the moment,” said Rory McPherson, head of investment strategy at Psigma Investment Management in London. “Markets were prone to a selloff after a good start to the year on expectations of policy easing from central banks and no escalation of trade tensions, and it’s this latter pillar that has come away.”

Earlier, Asian shares took another beating on Tuesday catching up to the Monday US rout, but closed off their lows, following the more upbeat tone from U.S. and Chinese officials.

MSCI’s index of Asia-Pacific shares ex-Japan fell over 1% to its lowest level since Jan 30, leaving MSCI’s world equity index stuck near its lowest levels in around two months. Japan’s Nikkei stock index fell to its lowest since mid-February, while broader Asian markets were dragged down by a selloff in Chinese shares.

The rebound in optimism was perplexing as just one day earlier China said it would impose higher tariffs on $60 billion of U.S. goods in retaliation against the U.S. tariff hike, and at least some analysts remained quite skeptical. ING economist Prakash Sakpal said the current volatility showed how a “180-degree” turn in U.S. rhetoric on trade negotiations had spooked markets. “We don’t see any quick end to this state of the markets until we see some resolution, constructive dialogue and something very solid in terms of deals. But the hopes for that are a bit misplaced currently,” he said.

Judging by the markets’ reaction so far today, Prakash’s take is in the minority, and signs of stability in global stock markets took the shine off safe-haven assets for now.

As a result, yields on 10-year German government bonds were about 2bps higher on the day at minus 0.06% and off six-week lows hit on Monday when investors flooded into safe havens; U.S. 10-year Treasury yields also rose away from Monday’s six-week lows, rising back above three-month bill yields after the yield curve inverted on Monday for the second time in less than a week. That latest inversion raised recession worries and concerns about the economic impact of a trade war, given a sustained inversion of this part of the yield curve has preceded every U.S. recession in the past 50 years.

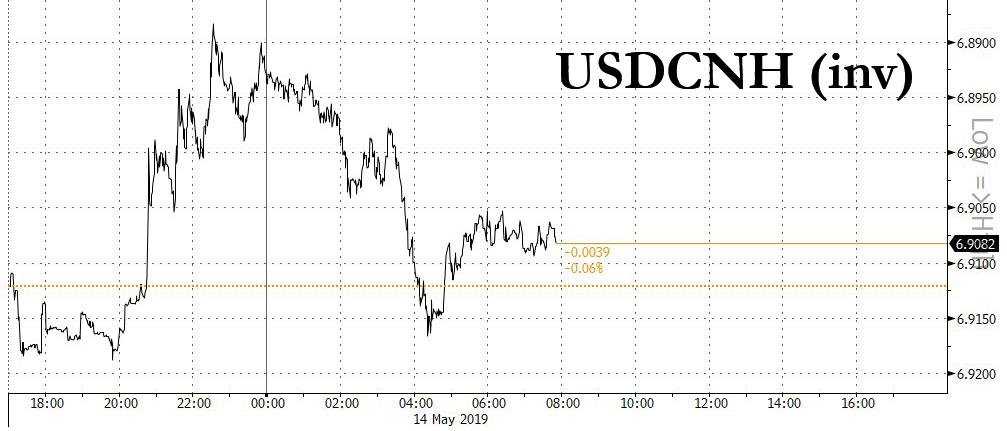

In FX, the safe-haven yen too lost some ground as the mood improved, with the dollar strengthening 0.4% against the Japanese currency to 109.74. The euro firmed 0.12% at $1.1235. However, China’s offshore yuan hit a fresh 2019 low in Asian trade before rebounding to trade at 6.8989 per dollar, up 0.2%, only to erase gains on Tuesday afternoon to trade at 6.9123 per USD, after earlier rising the most since April 17.

Its onshore counterpart strengthened slightly to 6.8731 per dollar after the four-month lows touched on Monday sparked speculation Beijing was letting the currency weaken amid the intensifying trade war.

For those who care, in the latest Brexit news, PM May is said to be considering definitive votes on different Brexit options in an attempt to break the Brexit deadlock, while reports added she is expected to ask MPs to rank different outcomes in order of preference. The report suggested that the government appears to be willing to go ahead with their plan for definitive votes regardless of support from the Labor Party. In other news, conservatives are reportedly preparing a new offer on a post-Brexit customs union; however, a source states that this offer has not been agreed with the Labour party.

In geopolitical news, a US defense official presented an updated military plan to the Trump administration which involves deploying 120k troops to the Middle East if Iran attacks US forces. Additionally, North Korea said US seizure of its ship is in direct violation of June 12 summit agreement, while it added US should return the ship immediately and that it will keep a close eye on US actions going forward. And finally, a large military operation was undertaken against Saudi targets, and seven drones undertook attacks on key Saudi installations., according to Yemen’s Hothi-Run television citing Military Officials.

On today’s calendar, expected data include NFIB Small Business Optimism Index. Ralph Lauren, Agilent, and Aurora Cannabis are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.4% to 2,817.50

- STOXX Europe 600 up 0.4% to 373.88

- MXAP down 0.9% to 154.35

- MXAPJ down 0.9% to 507.15

- Nikkei down 0.6% to 21,067.23

- Topix down 0.4% to 1,534.98

- Hang Seng Index down 1.5% to 28,122.02

- Shanghai Composite down 0.7% to 2,883.61

- Sensex up 0.7% to 37,354.89

- Australia S&P/ASX 200 down 0.9% to 6,239.91

- Kospi up 0.1% to 2,081.84

- German 10Y yield rose 1.0 bps to -0.06%

- Euro up 0.2% to $1.1239

- Italian 10Y yield rose 1.6 bps to 2.326%

- Spanish 10Y yield rose 0.7 bps to 0.998%

- Brent futures down 0.2% to $70.12/bbl

- Gold spot down 0.2% to $1,297.73

- U.S. Dollar Index little changed at 97.33

Top Overnight News

- The U.S. is prepared to hit China with new tariffs even as President Trump says he’ll meet his Chinese counterpart at next month’s G-20 summit, an encounter that could prove pivotal in a deepening clash over trade. China may release more retaliatory trade measures: Global Times

- Prime Minister Theresa May will meet with her cabinet Tuesday as she comes under increasing pressure to pull out of Brexit talks with the opposition Labour Party and set a date for her departure. The latest in a series of cross- party meetings aimed at ending the parliamentary deadlock over leaving the European Union broke up without substantive progress Monday evening, according to a person familiar with the discussions

- A gauge of Australian employment slumped to the lowest level in more than three years, according to a closely watched survey of businesses sentiment, in a possible harbinger of interest-rate cuts ahead. National Australia Bank Ltd.’s April employment index dropped to -1 in April from 6 in March, the weakest reading since January 2016

- U.S. Secretary of State Michael Pompeo made scant progress persuading European Union counterparts to take a harder line toward Iran during a quick visit to Brussels, with the EU standing behind the nuclear accord abandoned by Washington — and warning of a potential military conflict

- In principle Japan will work toward making it easier to raise the sales tax, rather than delaying it, Finance Minister Taro Aso says. Right now Japan isn’t thinking about additional fiscal spending Aso tells reporters

- Oil held a loss as an escalating U.S.-China trade war jeopardized the demand outlook, while the rising risk that geopolitical tension in the Middle East will disrupt crude flows prevented further declines

- Data in the U.K. showed strong wage growth in the first quarter while the jobless rate hit a 44-year low

- Japanese funds have piled $29 billion into French bonds in the space of a month, almost as much as they spent on the debt for the rest of the year.

Asian equity markets were mostly lower as global risk sentiment remained pressured by the escalating US-China trade tensions, which resulted to substantial losses on Wall St. and the worst performance of the S&P 500 in more than 4 months. This followed the tit-for-tat between the world’s 2 largest economies in which China announced its retaliatory tariffs affecting over 5000 US products at a rate of between 5%-25% despite US President Trump’s warnings, while the USTR office later posted details of potential duties on the approximate remaining USD 300bln of Chinese goods. ASX 200 (-0.9%) and Nikkei 225 (-0.6%) were both negative with the declines in Australia led by continued underperformance in its largest weighted financials sector and amid losses in energy names after a retreat in oil prices, while Japanese exporters felt the brunt of the recent flows into JPY. Hang Seng (-1.5%) and Shanghai Comp. (-0.7%) were weaker with Hong Kong playing catch up on return from the extended weekend, although the mainland bourse briefly recovered as participants found some encouragement from a CNY 200bln MLF announcement, as well as comments by US President Trump who suggested we will know the result of trade talks in 3-4 weeks and that he feels talks will be very successful. Finally, 10yr JGBs were uneventful amid a similar lacklustre tone in T-note futures and as the improved results in in the 30yr JGB auction also failed to spur prices.

Top Asian News

- Hong Kong Stocks Catch Up With Global Rout as Trump Softens Blow

- Biggest U.A.E. Bank Slumps as MSCI Verdict Deals Blow to Stock

- A Spat Over FamilyMart China Is Brewing After Its Success

- Nissan Is Said to Mull Buying Stake in Chinese Electric Carmaker

European stocks have nursed some losses from yesterday’s sell-off [Eurostoxx 50 +0.6%] in what seems to be (for now) a turn-around from the down-beat Asia-Pac session. Sectors are mostly in the green with defensive sectors underperforming, in-fitting with the “less risk off” tone in the markets. DAX (+0.3%) marginally underperforms its peers as heavyweight Bayer (-2.7%) stumbled after the Co. lost a third trial related to claims its Roundup weed killer causes cancer and the jury awarded USD 2bln in punitive damages. Elsewhere, Renault (-2.5%) shares took a hit after its alliance partner Nissan cut operating profit forecasts whilst also slashing dividend. Sticking with autos, Volkswagen (-1.4%) shares were buoyed amid reports that the company decided to IPO Traton before the Summer break this year. Finally, as the European Q1 earnings season approaches its end, HSBC notes that from the 85% of EU companies that have reported, 55% topped estimates and the results are off the lows seen in Q4 2018 (49% beat). “Though the re-emergence of US-China trade tension remains a concern, we see limited downside to European earnings from here” says HSBC, whilst citing continuing improvement in earning revisions. Furthermore, The bank’s top-down model points to 2019 EPS growth of around 5.3%, marginally above expectations. Despite this, HSBC is underweight on Europe as US companies have outpaced its European counterparts and the “expected 2019 EPS growth forecast for Europe (c.5%) is lower than our [HSBC’s] EPS growth estimates for the US (7%) and global equities (8%)”, the bank concludes.

Top European News

- Strong U.K. Wage Growth Continues Amid Tight Labor Market

- Krona Becomes Hard to Fathom for Strategists as Trade Woes Mount

- VW, Thyssenkrupp, AB InBev Look Past Market Turmoil to Plan IPOs

- ECB’s Villeroy Says Recent Data Don’t Refute Economic Forecasts

- ECB High-Flier Coeure Risks Third Time Unlucky in Presidency Bid

In FX, It’s too early to talk in terms of a turnaround Tuesday, but the risk pendulum has changed direction to the benefit of high beta currencies that were hit hard yesterday and to the detriment of safe-havens. The catalyst appears to be some respite in US-China trade anxiety as President Trump holds off on additional tariffs and remains optimistic that the 2 sides will reach an agreement down the line. The part reversal in sentiment has also helped the DXY recover some poise, albeit indirectly as a firm rebound in Usd/Jpy and Cable retreat combine to nudge the index back up from near 97.000 lows into a 97.270-390 range.

- NZD/EUR/CAD – The Kiwi is leading the comeback from Monday’s depths and is hovering just under 0.6600 vs its US peer, as NZ Finance Minister Robertson pledged to reallocate Nzd1 bn budget expenditure given that Brexit and the US-China tariff spat are both compounding risks faced by the nation’s exporters. Meanwhile, the single currency is holding above 1.1200 and outperforming Sterling near 0.8700 on renewed Brexit angst, with resistance not far above the big figure at 0.8722, and the Loonie has rebounded ahead of 1.3500 into a 1.3487-57 range. Back to Eur/Usd, a decent 1.2 bn option expiries at 1.1240 may influence direction into the NY cut as the pair meanders between 1.1244-20.

- JPY/CHF/GBP/AUD – As noted above, the Yen and Franc have lost their safe-haven allure, or at least some appeal, with shorts caught in Usd/Jpy as 109.00 support held and the headline pair squeezed back up to 109.77. Note, 109.50 was a double bottom and 109.23 a key Fib that was breached, but not on a closing basis and this exacerbated the snap back, along with similar tech and stop-fuelled retracements in Yen crosses, like Eur/Jpy and Aud/Jpy according to market contacts. Meanwhile, Cable finally relinquished 1.3000+ status, 100 and 200 DMAs (at 1.3011 and 1.2959 respectively) on the way down to a fresh mtd base (sub-1.2930) before paring some losses and largely shrugging off mixed UK jobs and earnings data. Similarly, the Aussie is lagging either side of 0.6950 following a downbeat NAB business sentiment survey overnight.

- SEK/TRY – Some respite for the Swedish Krona and Turkish Lira on top of the less risk averse environment in general as Swedish inflation eclipsed consensus to underscore the Riksbank’s view that it is broadly in line with target, while Turkish IP fell less than expected and latest reports suggest that its planned S-400 purchase from Russia may be shelved until 2020. Eur/Sek now closer to 10.7700 vs 10.8200+ at one stage and Usd/Try nearer 6.0500 than 6.1120 at the earlier high.

In commodities, WTI (+0.4%) and Brent (+0.7%) futures trended lower for much of the session, but have subsequently reverted into positive territory following reports that two Saudi Aramco oil pumping stations have been attacked; for reference, This pipeline replaces the passage of oil through the Hormuz Strait, and as such a failure of this pipeline may increase Iran’s influence of oil flow in the region, as according to Energy Economist Anas Alhajji. Up until this Saudi update, news-flow had been light for the sector, although the OPEC Monthly report is due later today ahead of the API crude stocks report, with the headline expected to build by 2.8mln barrels. Elsewhere, Gold is relatively uneventful and holding onto most its gains just under the USD 1300/oz level, whilst copper prices are just off lows after the red metal tested USD 2.70/lb to the downside amid the heightened US-Sino trade tensions.

US Event Calendar

- 8:30am: Import Price Index MoM, est. 0.7%, prior 0.6%; YoY, est. 0.3%, prior 0.0%

- 8:30am: Export Price Index MoM, est. 0.6%, prior 0.7%; YoY, prior 0.6%

DB’s Jim Reid concludes the overnight wrap

Morning (or actually evening from the previous night) from the US West Coast where I’ll be speaking to CFOs/CEOs of major tech companies at a DB conference over the next couple of days. It also gives me a chance to escape from any heart thumping middle of the night encounters at home with the rat colony that our building work seems to have stirred. We’re still a bit shell shocked from that experience although I wish I’d have videoed me with a golf club in hand and my wife shouting to a rat that we were calling the police when we heard loud noises in the next room as we investigated the noise at 2.30am last week. Like with our nerves it’s been a bruising few days for the tech sector given last week’s trade war developments so no doubt that will dominate discussions.

Indeed, since around the middle of last week it’s become clear that it would be hard to quickly de-escalate this latest US/China trade spat as the war of words and actions on both sides became incrementally more entrenched. As such risk assets were clearly vulnerable. As we discussed yesterday the weekend news continued on this theme and markets yesterday caught up to the reality of an extended battle that will likely continue to pressure risk assets. The only good news is that the two sides continue to talk with meetings planned and that Mr Trump and President Xi Jinping’s relationship hasn’t been obviously scarred yet – at least not in public.

The awaited China retaliation was the focus yesterday as they announced the raising of tariffs on a number of US goods from June 1st. To be fair it was hard to really say that the retaliation was much of a surprise however the rubber stamping perhaps confirmed that any hopes for de-escalation were out of the window for now. In addition to that and compounding the pain for markets were the comments from the editor of China’s Global Times Hu Xijin (who has quickly become a must follow on Twitter for his perceived connections) which grabbed equal if not more attention.Not long after the tariff news hit, Xijin tweeted “China may stop purchasing US agricultural products and energy, reduce Boeing orders and restrict US service trade with China. Many Chinese scholars are discussing the possibility of dumping US Treasuries and how to do it specifically”. Hardly the sort of message that implies China is willing to let this pass by then or attempt to compromise. The Treasury comment in particular started to raise alarm bells even if risk-off moves ensured 10yr rallied -6.6bps yesterday. DB’s Alan Ruskin did suggest yesterday that a much more likely approach is a slow structural bleed in China’s US bond holdings, as opposed to a dumping. So should China gets to the point of making real steps to reduce US financial holdings, it’s more likely to come in baby steps to test the waters, rather than any quick rash decisions, not least because China will try to calibrate any global impact, and its rebounding impact on themselves. The possible beneficiaries of such a move, including the yen, the euro, and gold, all rallied sharply after the story broke, outperforming the US dollar.

Not to be outdone, President Trump had already tweeted yesterday that there “is no reason for the US consumer to pay the tariffs” and that “China has taken advantage of the US for so many years that they are well ahead. Therefore, China should not retaliate – will only get worse”. Another tweet by the President said “I say openly to President Xi and all of my many friends in China that China will be hurt very badly if you don’t make a deal because companies will be forced to leave China for other countries”. Risk assets did stage a small attempt at a comeback in the afternoon after Trump said that he plans to meet with President Xi at the G20 next month and that he had not yet decided about when or if to implement the next tranche of tariffs on around $300bn more of Chinese imports. That followed comments from Secretary Mnuchin, who stated that negotiations with China are currently ongoing. Ultimately though, the market seems to be getting a bit more nervous of the more positive comments and rallying much less off the lows than it did last week.

The end result for markets yesterday was the second worst day of the year (behind the January 3rd plunge) for the S&P 500 and DOW, falling -2.41% and -2.38%, respectively. Only utilities (+1.11%) survived at a sector level with tech (-3.71%), consumer discretionary (-2.95%) and financials (-2.87%) seeing the biggest falls. At a stock level, 457 of the 505 stocks in the S&P closed lower. The NASDAQ however tumbled -3.41% for the biggest decline since December 4th last year. Even worse was the performance by the NYSE FANG index, which tumbled -4.40% for its worst day since October 24th, as Apple (-5.81%) shed $52.7bn in value alone yesterday and therefore putting it down -12.29% in just the last 10 days.Apple is acutely exposed to further trade escalation, both because it has a large exposure to China and because it has largely been spared any direct tariff pain so far in this trade war. The same applies, to a lesser extent, to the broader semiconductor industry, with the Philly semiconductor index down -4.73% yesterday and -10.30% over the last ten sessions. To put a cap on a rough day for tech, Uber stock traded down another -10.39% yesterday, meaning it has now shed -17.56% since its IPO on Friday.

After US markets closed yesterday, the USTR announced the timeline for the next tranche of tariffs, should the US decide to implement them. They will take written comments for the next month before holding a public hearing on June 17.The list of products to be tariffed includes a range of consumer technology products, including cell phones and televisions, justifying the earlier market moves in the tech sector. Industry groups are likely to increase their pressure on the US administration for fear of further disruptions, while the stakes are also raised for China. Trump told reporters at the White House early this morning that “we’ll let you know in about three to four weeks whether or not it (talks) was successful…but I have a feeling it’s (talks) going to be very successful”.

It appears that Trump’s comments have done enough to help markets stage a mini rebound overnight in Asia. The Nikkei for example is back to -0.65% after trading down as much as -2.07%, while there are also much more muted declines for the Shanghai Comp (-0.36%) and CSI 300 (-0.18%). The Kospi (+0.11%) has just turned positive also. The Hang Seng (-1.58%) has seen a heavier fall albeit partly playing catch up after being closed on Monday. In FX the CNH has also strengthened this morning by +0.26%, putting it at 6.894 having touched as high as 6.919, while EM FX more broadly is flat. Temporary respite then however it wouldn’t be a great surprise to see risk assets struggle once Europe walks in again.

Back to yesterday, where, in fairness, Europe looked almost calm in comparison.The STOXX 600 slumped a more palatable -1.21% although it is now back to the lowest level since March 8th. The DAX was down -1.52% while in EM land the MSCI EM index was hit to the tune of -3.33% and is now back to the lowest level since January 14th. In fact, the year-to-date gain for EM equities is now just +3.89%. Unsurprisingly vol climbed with the VIX finishing up +4.5pts and closing above 20 for the first time since January 8th. The V2X rose a more modest +0.9pts to 19.5.

It wasn’t much better for EM FX which is back into negative territory for the year following a -0.65% decline yesterday.The South African Rand (-1.20%), Turkish Lira (-1.25%), and Chilean Peso (-1.01%) saw the biggest moves over the last 24 hours. In contrast the Yen (+0.59%) and Swiss Franc (+0.54%) have earned their status as safe-haven currencies. The same is true for Treasuries (-6.6bps) as discussed earlier with 10yrs hitting 2.387% yesterday before closing at 2.402%, the lowest since March 28th. The front end really took off however with 2y yields rallying -8.2ps, making the curve +1.6bps steeper at 21.3bps. That being said, the 3m10y slope is now inverted again (only the sixth inversion at the close in nearly 11 years – the other five days being in March) while the 18m3m forward minus spot 3m – a favourite of the Fed – is back down at -34bps and approaching the March lows. A Fed cut by year-end is also now 76% priced in.Bunds (-2.5bps) also dropped to -0.072% – still a couple of basis points off the March lows – while the periphery struggled as a result of the wider risk off move, with BTPs spreads up +4.2bps to their widest level since February at 277bps. As for credit, US HY spreads were +19bps wider yesterday to 436bps, which puts the month to date move at +38bps. For some context, at the wides in early January spreads hit 537bps. In commodities Gold (+1.08%) was the obvious beneficiary while soybeans (-1.32%) and more notably cotton (-3.61%) got hit.

Yesterday our China economists put a 60% indicative probability that the two sides cannot reach a deal in May and tariffs will be imposed on the remaining Chinese exports, including mostly consumer goods.The team do expect the two sides to reach a deal eventually (possibly at the G20 in late June), however note that this could take a few months, meaning further weakening in the CNY is likely. See their report here .

Another negative geopolitical risk getting some renewed airtime yesterday was Brexit, with the situation continuing to deteriorate.Last week’s European Parliament poll showed a further drop in support for the Conservative party, who now poll in sixth place. That’s likely to make Tory MPs less willing to stomach a general election but also raises the pressure on PM May to resign. Separately, Labour party leaders said that they are unlikely to accept a compromise deal which does not include a second referendum. That crosses a red line for the Conservatives, so a cross-party deal is looking less and less likely. Elsewhere, BBC’s Laura Kuenssberg tweeted late last night that “Brexit talks are not in good health, but not dead yet, Olly Robbins is heading to Brussels tomorrow to talk about how, and how long it might take to change the political declaration IF there were to be an agreement”. We’re approaching crunch time here, so unless a deal can get finalized this week, the pressure on May will likely rise over the near term.

Economic data understandably took a backseat to the trade developments and sharp market moves, and to be fair there wasn’t a lot of important data regardless. The Bank of France’s business industry sentiment survey fell 1 point to 99, indicating below-average levels of optimism, which was actually the lowest since October 2016. Other than that, Bloomberg released the results of their latest European economic surveys. The only major change was to Italian growth, which consensus now forecasts to be 0.1% this year, which would be the lowest pace of growth since 2014.

To the day ahead now, which this morning kicks off in Germany with the final April CPI revisions (no change from the +1.0% mom flash reading expected). Shortly after that we’re due to get March and April employment data in the UK where the consensus is for no change in the unemployment rate of 3.9% and a small decline in weekly earnings to +3.3%. Also due out this morning is the March industrial production print for the Euro Area and the May ZEW survey in Germany. In the US today we’re due to get the April NFIB small business optimism reading and April import price index print. Away from the data the Fed’s Williams is due to speak at 8.15am BST this morning followed by George (5.45pm BST) and Daly (11pm BST) this evening. The ECB’s Villeroy is also scheduled to speak this morning.

via ZeroHedge News http://bit.ly/2WK2N2n Tyler Durden