On Sunday, Bank of America had just one rhetorical question, seemingly in response to Larry Fink: “Dude, where’s my melt up gone?” One day later, the market did its best to answer clearly and concisely with a plunge in the S&P that culminated with the second biggest selloff of 2019 as trade war between the US and China was solidly back.

Still, some failed to receive the message, so in case the market’s response wasn’t convincing enough, on Tuesday morning Nomura’s Charlie McElligott wrote that the recent melt-up “grab” in US Equities Index/ETF options has been fully purged via market price action, resulting in a plunge in both consolidated delta and gamma.

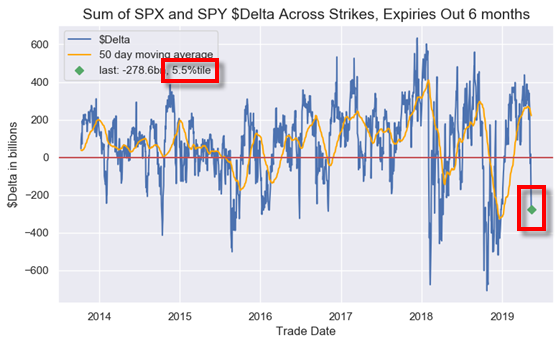

First, here is a look at the S&P and SPY Greeks, courtesy of McElligott starting with Delta which plunged the most this year, sliding to a 5.5%-ile print:

SPX/SPY consolidated Gamma also collapsed to 6.8%ile:

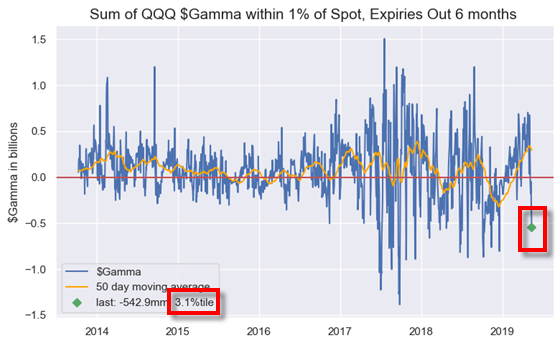

The result, the “negative gamma” feedback loop , or what we called the “GammAvalanche” is now fully in play as consolidated gamma is now firmly in the red for both the S&P….

… and the Nasdaq.

And confirming what JPMorgan Nick Panagirtzoglou also wrote over the weekend, pointing out that net exposure for both institutions and retail had surged, McElligott notes that from an exposure perspective, we have now done a full U-turn, and “clearly witnessed a major GASHING of “Nets” over the past week (Longs sold, Shorts pressed)”, as follows:

- “Longs”—HF Top 50 Names -3.0% 5d return; Momentum Longs -4.4% 5d return; HF Overweights -4.9% 5d return; HF Longs -5.7% 5d return

- “Shorts”—1Y Momentum Shorts -4.9% 5d return; 2018 Worst Performers -5.0% 5d return; Most Shorted -6.9% 5d High Short Interest -7.0% 5d return

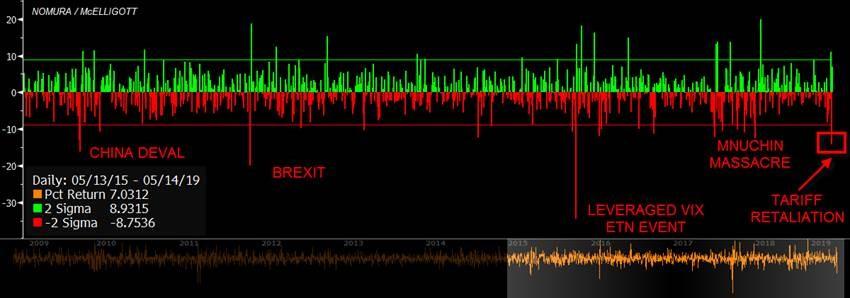

Meanwhile quants are getting carted out feet first as a result of the “absolute MTD “nuke job” on what until last week was the factor mkt-neutral leadership for US stocks, which according to McElligott looked like a local “max out” yesterday as well:

- Beta Factor -4.1% yday / -7.4% MTD; Volatility Factor -3.7% yday / -7.7% MTD; Cash / Assets (Growth vs Value proxy) -3.0% yday / -4.9% MTD; Analyst Coverage (Crowding / Popularity) -2.1% yday / -4.8% MTD; PEG (Growth) -1.4% yday / -4.3%; R&D / EV (Growth) -1.7% yday / -5.4% MTD

This culminated in a wholesale purge of positions:

But wait, there’s more, because while the below the surface carnage in stocks will result in devastating hedge fund P&Ls for May, it isn’t nearly over as the VIX futures curve remains inverted this morning, even though the entire term structure is lower DoD off the back of said “generic” relief rally overnight, while the Nomura strategist predicts that VVIX too will reset lower after yesterday’s renewed bout of tail hedge “grab”, which is consistent with the sequence of volatility transmission that McElligott has noted previously: VVIX first as “patient zero” indicator, then the VIX complex, then “delta one.”

And speaking of VVIX, which we said to keep a close eye on last week, the VVIX/VIX ratio just enjoyed its biggest one-day move since the February VIXtermination event, and the 4th largest since 2015.

It’s not all bad news though, because once the “obvious deleveraging from both Systematics- and Asset Manager “Longs” begins to thin and Vol Target-type mechanical selling slows—now we are in “no man’s land,” with further de-leveraging levels meaningfully below spot from here”, McElligott expects that with the benefit of fresh Shorts which have been piled-into over the past week and half, risking a squeeze, there is now the possibility of a sharp, market bounce over the coming days. All the more so, because based on history, following a “Two VIX +25% prints in either 1w- or 2w-” period, what is observed is “a near-term SPX squeeze, then again fade for next 1month, before finally seeing a powerful move higher in SPX/move lower in VIX out 3m- 6m- 12m- horizon” according to Nomura.

In other words, expects an “equities squeeze over next one- to two- weeks with “short fodder” added and positioning purged, chop-to-lower out 1 month again as squeeze fatigues, then higher again from there.”

Of course, whether this optimistic take is accurate will depend entirely on what Trump tweets next.

via ZeroHedge News http://bit.ly/2HiCTgS Tyler Durden