Authored by Tsvetana Paraskova via OilPrice.com,

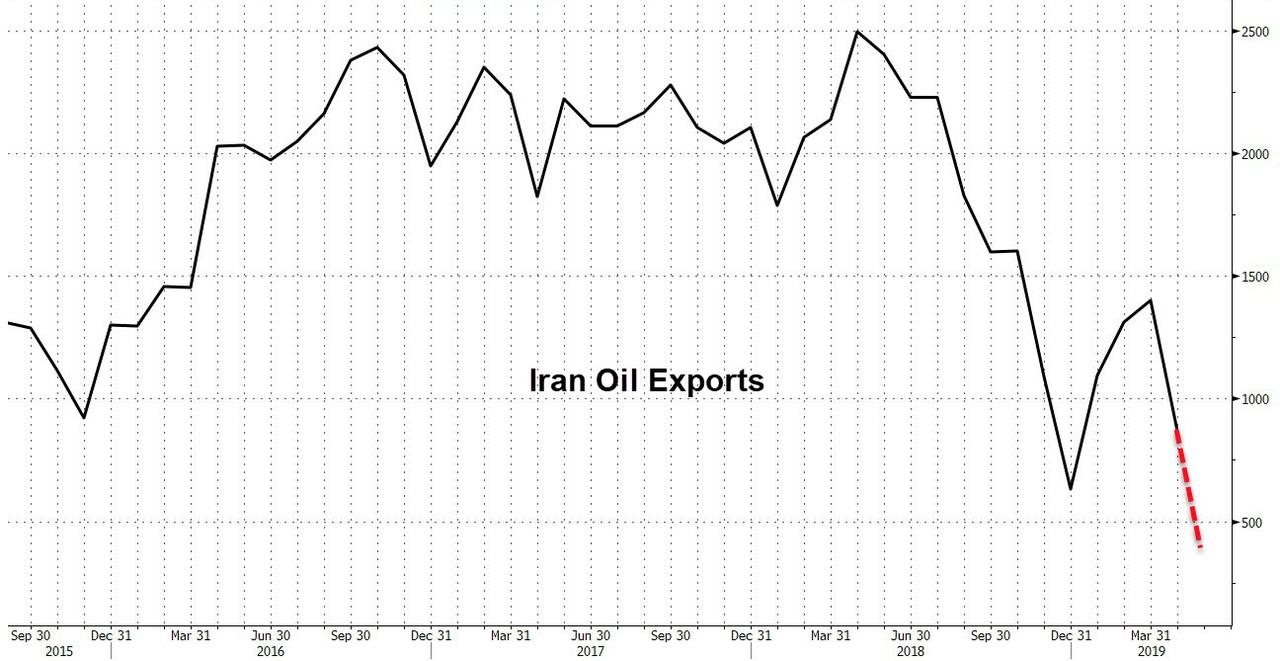

After the U.S. ended all sanction waivers for Iranian oil customers on May 2, Iran’s crude oil exports have been significantly down this month compared to April and more than 2 million bpd off their 2.5-million-bpd peak in April 2018, just before the U.S. withdrew from the Iran nuclear deal and moved to re-impose sanctions on Iran’s oil industry.

According to industry sources and tanker-tracking data cited by Reuters on Wednesday, Iran’s oil exports this month have plummeted to 400,000 bpd, which is less than half of Iranian oil exports last month.

The United States had given eight countries six-month waivers to continue buying oil from Iran after the U.S. re-imposed sanctions on the Iranian oil industry in November. The United States, however, pursued a maximum pressure campaign against Iran last month and put an end to all sanction waivers for all Iranian oil buyers, beginning in May.

Most of the Iranian oil shipments are going this month to Asia, according to tanker tracking data from Refinitiv Eikon and to two industry sources.

One of the sources told Reuters they expected Iran’s average oil shipments this month to be around 400,000 bpd, but the other source noted that exports could hit 500,000 bpd.

Some of Iran’s oil exports are believed to have been already under the radar as Iran is said to have increased the use of the ‘switch-off-the-transponder’ tactic, which makes tracking its exports via the AIS systems increasingly difficult and opaque.

Earlier this month, Iran was spotted resuming illicit shipping of oil to Syria, with a million barrels of oil arriving in early May, for a first such delivery since the start of this year. Experts believe that Iran will be re-opening and using more of its illicit oil channels to keep oil trade and continue getting some revenues from its most precious export commodity.

The inability to fully track Iran’s oil supply is making OPEC and allies’ task to asses global supply to the market increasingly difficult, as opaque data about Iran adds to mounting uncertainty over oil supply disruptions elsewhere, clouding OPEC’s outlook on global supply for the rest of this year.

via ZeroHedge News http://bit.ly/2I8RTNE Tyler Durden