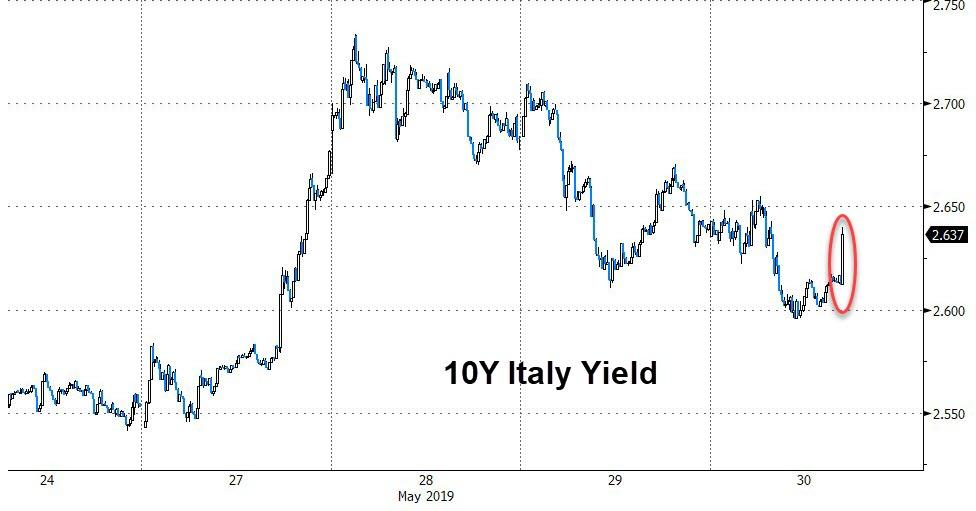

Clearly emboldened by the EU Parliamentary results, where the League won a plurality of the vote in Italy, Matteo Salvini on Thursday sent BTP yields higher by threatening to crash the Italian government if the Five Star Movement doesn’t back his tax-cut plan.

BTP yields have been moving higher over the past two weeks as Salvini has brushed off Europe’s threats to fine Italy up to €4 billion over its refusal to rein in its debt and deficit-spending plans. This would be the first time the European Commission has fined a member state over violations of its fiscal rules.

But Salvini, who is now indisputably the most powerful political figure in Italy, isn’t backing down. He has remained defiant, even as Italy braces for the EU to initiate another excessive debt proceeding on Wednesday, when reviews of member states’ fiscal compliance are expected.

As the Telegraph’s Ambrose Evans-Pritchard pointed out in a column yesterday, Salvini has revived threats to initiate an Italian parallel currency – the so-called “mini-BOT” Italian Treasury bills that a Forbes columnist once warned was the “biggest threat to the future of the eurozone.”

And with Salvini adding to the political chaos by taking the first tentative steps toward ousting Five Star from the ruling coalition, Italian bond holders will have only themselves to blame if they don’t anticipate more market-rattling political chaos, and position accordingly.

via ZeroHedge News http://bit.ly/2HJ3W5b Tyler Durden