Just a few days after Morgan Stanley’s chief equity strategy, Michael Wilson, warned that “volatility is about to rise… a lot“, the executive director of Morgan Stanley’s institutional equity trading group, Chris Metli, has sent out an ominous warning of his own, cautioning the bank’s clients that “this week has been one of those markets where something just doesn’t feel right.”

What prompted this concern.

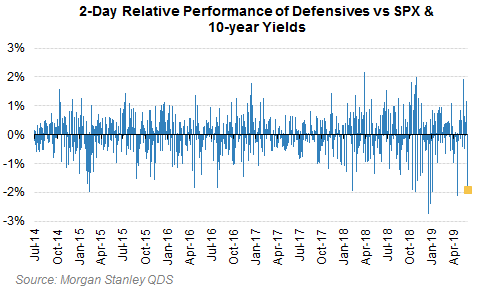

As Metli explains, “the underperformance of defensives in a down tape and with bonds bid is unusual, and this week defensives have posted the worst P/L relative to SPX and bonds of the last 5 years outside of December 2018 and the Healthcare selloff in April 2019 (using Staples/Utes/Real Estate/Healthcare for defensives).”

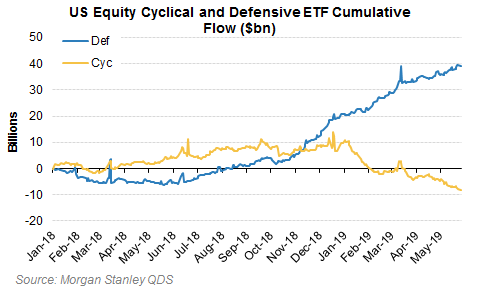

On one hand this could just be a little profit taking in Defensive areas, the MS strategist observes. There has been a strong rotation into Defensive sectors as well as Low Vol and High Div funds and out of Cyclicals and Value products.

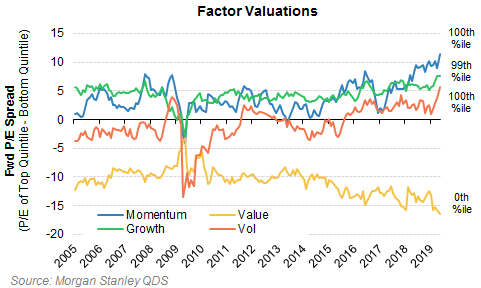

And valuation spreads are extreme in the factor space – Low Vol stocks have never been cheaper relative to High Vol stocks, while the opposite is true of Value.

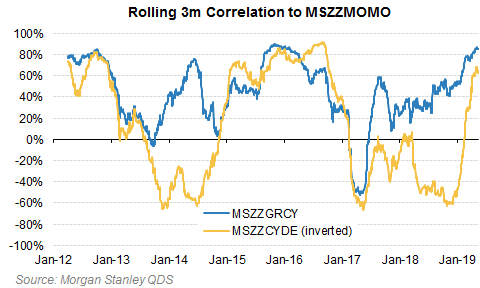

The above shows that Momo and Growth are also rich, as they are the HF version of the ‘defensive’ rotation.

Momentum has tracked Growth over Cyclical performance nearly one-for-one over the last month as investors have fled cyclicals and sought the ‘safety’ of secular growth.

According to Metli, the above positioning could easily unwind on a positive stimulus, and that trades to play that outcome are pretty clear – i.e. if trade dispute is resolved, equities and bond yields go higher, cyclicals rally, defensives and growth stocks are a source of funds, etc. What is less clear is why these rotations would be happening in a down equity market. There are two possible explanations:

- Equities are finally catching up to what the bond market has been saying for months – that growth is weak, and there is a limit to how bid defensive sectors can get in a negative growth environment. Investors are selling their passive holdings (which have a defensive bias).

- This is the end of the defensive rotation and the beginning of a pro-cyclical / pro-growth rotation.

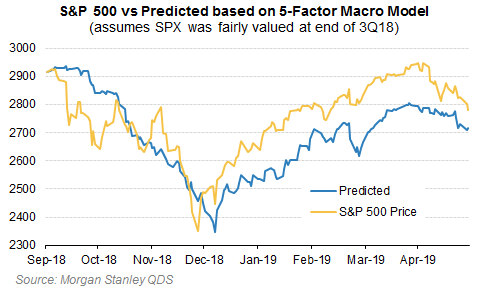

And this is where things get unpleasant, because according to the Morgan Stanley strategist, the former is more likely, in which case equities have further downside per a regression of SPX versus a “predictive” model based on 5 macro factors.

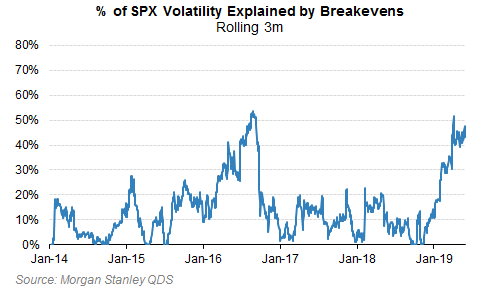

In this scenario the well owned Growth names and the long side of Momentum are most at risk going forward. That said the signals are still mixed – for example breakevens are up (modestly) and that same regression suggests SPX should be up 30 bps today, as breakevens have been explaining ~50% of SPX volatility over the last 3 months.

As Morgan Stanley concludes, “the future will tell which way it goes, but recent price action does suggest markets are at a turning point.“

via ZeroHedge News http://bit.ly/2WeJh1V Tyler Durden