US equity futures and global stocks rebounded on Thursday as traders took a break from selling stocks and pumping money into safe-haven bonds and the dollar, awaiting the latest headlines in the ongoing trade war.

With just two days left in what has so far been the most turbulent month of the year, investors are busy squaring up positions, shaken by a violent escalation in trade war which has left many traders dazed and confused and the S&P back under 2,800 but above its 200 day moving average for now.

US equity futures drifted higher in the overnight session, while Europe’s Stoxx 600 advanced, with tech among the biggest gainers, a day after posting its biggest drop in nearly three weeks. European stocks nudged 0.2%-0.5% higher having lost a third of the 15% gain they had been carrying into May, the major currencies paused, while German Bund yields climbed for the first time in four days having hit record lows.

Asian stocks were little changed, with MSCI’s index of Asia-Pacific shares ex-Japan slipping to a fresh four-month low before finding a bit of traction to edge up 0.1% into the close. Japan, Hong Kong and Shanghai falling while South Korean, Indian and Indonesian equities advanced as gains in the technology sector were offset by declines in health care and consumer staples. The Topix gauge fell 0.3% to its lowest level since January, led by Japan Communications Inc. and Avant Corp while the Nikkei slumped 0.5%. The Shanghai Composite Index dropped 0.3% after the PBOC’s latest liquidity injection was a sharp dip from Wednesday’s 250bn yuan, with China Life Insurance Co. contributing the most to the index decline.

Elsewhere in Asia, Australian stocks shed 0.85% as local miners suffered the worst month for copper prices since 2016 having slumped over 9%. Indian equities advanced for a fourth day in five amid continued optimism that Prime Minster Narendra Modi will adopt more policies to support economy.

As usual traders were focused on the war of trade, tech and words between Washington and Beijing. “We oppose a trade war but are not afraid of a trade war,” Chinese Vice Foreign Minister Zhang Hanhui said on Thursday in Beijing, when asked about the tensions with the United States. “This kind of deliberately provoking trade disputes is naked economic terrorism, economic chauvinism, economic bullying.”

“The equity markets are in the midst of pricing in a long-term trade war, with participants shaping their portfolios in anticipation of a protracted conflict,” said Soichiro Monji, senior strategist at Sumitomo Mitsui DS Asset Management.

“The upcoming G20 summit could provide the markets with relief, as the United States and China could use the event to begin negotiating again over trade,” he added, referring to the June 28-29 gathering of leaders in Japan.

In rates, the 10-year Treasury yield was at 2.27% after falling to a nearly two-year low of 2.21% Wednesday, with the 3M-10Y yield curve staying deep in inverted territory, most recently at -10bps.

“What’s going on in Treasury markets is ultimately a repricing of growth expectations,” JPMorgan’s John Bilton said on Bloomberg TV. “We don’t see a recession coming in the next 12 months even allowing for the yield-curve inversion we’ve seen, typically that’s a signal that has a long lead time.”

In FX, the dollar traded at a five-month high ahead of first-quarter revised GDP due later that could give clues on the direction of U.S. interest rates. The dollar was little changed at 109.68 yen after bouncing back from a two-week low of 109.150 and the euro steadied at $1.1132 following three successive days of losses. “The strength in the dollar is surprising given that markets are now expecting multiple rate cuts by 2020,” Commerzbank FX strategist Ulrich Leuchtmann said.

In commodities, oil prices rose modestly following volatile trading on Wednesday, when oil prices fell to near three-month lows at one point as trade war fears gripped the commodity markets. WTI futures were up 0.66% at $59.20 per barrel after brushing $56.88 the previous day, their lowest since March 12. Brent crude added 0.37% to $69.71 per barrel. Trade worries have weighed on oil but supply constraints linked to the Organization of the Petroleum Exporting Countries’ output cuts and political tensions in the Middle East have offered some support.

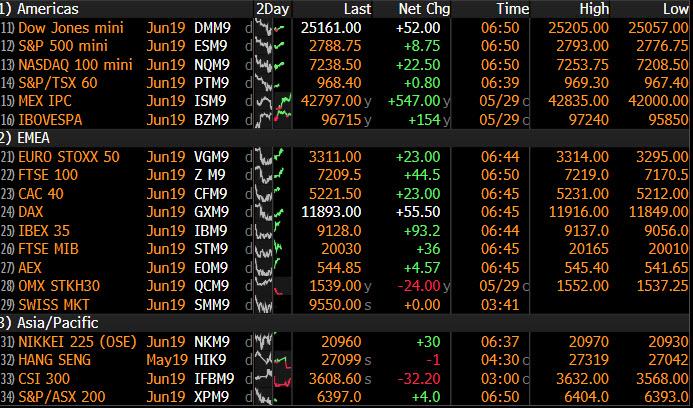

Market Snapshot

- S&P 500 futures up 0.4% to 2,790.50

- STOXX Europe 600 up 0.4% to 371.84

- MXAP down 0.09% to 152.43

- MXAPJ up 0.2% to 498.00

- Nikkei down 0.3% to 20,942.53

- Topix down 0.3% to 1,531.98

- Hang Seng Index down 0.4% to 27,114.88

- Shanghai Composite down 0.3% to 2,905.81

- Sensex up 0.9% to 39,853.99

- Australia S&P/ASX 200 down 0.7% to 6,392.13

- Kospi up 0.8% to 2,038.80

- German 10Y yield rose 1.9 bps to -0.16%

- Euro up 0.05% to $1.1137

- Italian 10Y yield fell 4.1 bps to 2.269%

- Spanish 10Y yield rose 0.9 bps to 0.742%

- Brent futures down 0.2% to $69.34/bbl

- Gold spot down 0.3% to $1,276.30

- U.S. Dollar Index little changed at 98.16

Top Overnight News from Bloomberg

- A succession of domestic dilemmas on both sides of the Atlantic threaten to frustrate efforts at a U.S.-EU trade pact before they’ve even begun. It’s been 10 months since talks have gone anywhere meaningful with European officials frustrated with a Trump administration that’s distracted by the breakdown in talks with China and also issues with Japan

- China’s grip on the global market for rare-earth metals gives it the ability to target American weaponry in its trade war with the U.S. Rare earths have been thrust into the spotlight by a series of media reports in China signaling Beijing is gearing up to use the minerals as a counter in its trade battle with Washington

- Ray Dalio, the billionaire founder of investment management firm Bridgewater Associates, said Wednesday that he viewed the U.S.-China conflict as more than a “trade war” and that increasing export controls would be a major escalation

- A second referendum is preferable to a general election to resolve Brexit, according to U.K.’s Chancellor of the Exchequer Philip Hammond. Candidates to succeed Theresa May are honing their pitches amid deep divisions over whether to leave the European Union without a deal in October

- Italy will tell the European Commission that any budget tightening this year would jeopardize a sluggish economic recovery, pushing back in its reply to a demand from Brussels to explain the nation’s increasing debt load, newspapers reported Thursday

- The U.K. will need interest-rate increases if Brexit goes ahead smoothly, according to Bank of England Deputy Governor Dave Ramsden. His comments echo those of BOE Governor Mark Carney, who spent much of his last press conference making the case for faster rate hikes than money markets imply

- Australia’s GDP growth will slow to a decade low despite cushioning provided by de-synchronized movements in house prices and commodity prices, Fitch Ratings says in a new report. Australia 1Q business investment falls the most since Sept. 2016

- The slump in global yields as investors seek out trade-war havens is increasing speculation in Tokyo that the Bank of Japan may cut bond purchases again in June. The central bank could lower the target purchase range for 10-25 year maturities in its monthly plan on Friday, according to Naomi Muguruma, senior market economist at Mitsubishi UFJ Morgan Stanley Securities

- Oil rebounded to climb back above $59 after the release of an industry report showing a much bigger than expected drop in U.S. crude stockpiles

- Israeli Prime Minister Benjamin Netanyahu failed to form a government by Wednesday’s deadline, opting instead for new elections that thrust both his future and the Trump administration’s peace plan into question

Asian equity markets mostly tracked the declines of their counterparts on Wall St where all majors extended on losses amid little in the way of catalysts to inspire a rebound and as participants looked ahead to upcoming US GDP and PCE inflation. Furthermore, trade uncertainty lingered, and technical selling was at play in which the DJIA briefly slipped below the 25K level and the S&P 500 tested its 200DMA to the downside. As such, ASX 200 (-0.7%) and Nikkei 225 (-0.3%) were subdued following the weak lead from their global peers with only the telecoms sector bucking the trend in Australia, while sentiment in Tokyo continued to be hampered as USD/JPY remained at a sub-110.00 level. Hang Seng (-0.4%) and Shanghai Comp. (-0.3%) were negative amid no signs of trade tensions abating as China’s Global Times Editor suggested US is shifting from protecting its interest to destroying China in its crackdown on Huawei. Finally, 10yr JGBs were lower as they tracked the pullback in T-notes but with downside stemmed by support around the 153.00 level and after improved results at the 2yr auction.

Top Asian News

- Sakurai’s Caution on Stimulus Signals Diverging Opinions at BOJ

- Short Seller Aandahl Targets China Apparel-Maker Anta Sports

- Anta Slumps Most in 15 Months as Blue Orca Recommends Short

- Singapore Minister Bats Away Criticism Over GIC, Temasek Pay

Major European Indices [Euro Stoxx 50 +0.5%] opened, and have remained, positive; diverting from the poor performance seen overnight in Asia-Pac indices which were largely subdued in sympathy with Wall St. As such, sectors are predominantly in the green with some outperformance in Energy names, although the sector has been weighed on by the recent sell off in oil prices, with Brent currently in negative territory. While the defensive utilities and healthcare sectors are underperforming given the broad risk-on sentiment this morning. In spite of the positivity across bourses, notable individual movers are sparse. Axel Springer (+21.3%) have moved substantially higher following reports that KKR are to make a bid to take the Co. private, with the Co. having been valued at EUR 4.9bln. Separately, Daily Mail & General Trust (+9.6%) have printed higher this morning post results, where they stated FY outlook is currently in-line with guidance. Also, post-earnings, but at the bottom of the Stoxx 600 are Johnson Matthey (-4.1%). Finally, Wirecard (1.3%) are at the top of the DAX (+0.6%) after announcing a strategic partnership with XBN relating to international e-commerce.

Top European News

- Italy Set to Warn Against Budget Tightening in Reply to EU

- U.K. Will Need Hikes If Brexit Goes Smoothly, BOE’s Ramsden Says

- ECB Seen Offering Generous Loans to Banks to Boost Feeble Growth

- Watches of Switzerland Gains After London Share Offering

In FX, the broad Dollar and the index trades relatively flat thus far, albeit still north of the 98.000 level, as participants await a barrage of tier 1 US data in the form of Q1 GDP (2nd estimate), Core PCE, advances goods trade balance and initial jobless claims. DXY fluctuated between a reasonable 98.08-24 band for now, ahead of some mild resistance around the 98.37-40 mark. US-China news-flow has consisted of MOFCOM reiterations wherein the Chinese noted that tariffs will not solve trade imbalance and will not accept a deal which hurts sovereignty and pride. Nonetheless, focus of today will remain on the aforementioned US data with expectations for the GDP figure to be revised marginally lower (3.1% vs. Prev. 3.2%) whilst the Core PCE Q1 prelim figure is expected to be unchanged at 1.3% (FOMC noted that the recent dip in PCE is transitory) and initial jobless claims are expected to tick slightly higher to 215k from 211k. Elsewhere, Citi’s month-end FX hedge rebalancing model indicates moderate buying of the USD at month end, with the signal (ex-USD/JPY) measuring just over +0.5 historical standard deviations across all crosses.

- AUD,NZD,CAD – A firmer risk appetite or perhaps some consolidation from yesterday’s decline sees the risk currencies on a firmer footing this morning. AUD/USD has shrugged off the dismal Building Approval figures overnight ahead of the much anticipated RBA meeting next week. UBS believes the AUD is “too short for its own good” heading into the weekend, adding that “only a complete equity meltdown could drive the Aussie lower at this stage”. In terms of technicals, AUD/USD trades within a relatively tight 0.6917-36 range ahead of resistance at 0.6940. Meanwhile, the Kiwi is largely moving in tandem with its Aussie counterpart after showing little reaction to the NZ budget, in which it sees the 2018/19 cash balance at -2.785bln vs. the Prev. forecast of -4.993bln. NZD/USD also remains within a tight range with the antipodeans eyeing Chinese NBS Manufacturing PMI following the aforementioned US data. Elsewhere, the Loonie nurses some of yesterday’s post-BOC loses, with the aid of rising oil prices amid a much wider than expected build in crude stocks reported by APIs last night. In terms of technical, USD/CAD hovers around the 1.3500 mark having moved in a 1.3493-3520 range, with support flagged at 1.3490. Looking ahead for the CAD, current account data is due at 1330BST whilst BoC’s Wilkins is due to give a speech around 1930BST.

- EUR,GBP – Little changed and trading mostly at the whim of the Greenback amid tentative newsflow. EUR/USD remains within a tight 20 pip range (1.1125-45) with support flagged at 1.1125 and 1.1105. In terms of upside, resistance levels are noted at 1.1155 ahead of 1.1170 (with 1bln in option expiries at strike 1.1175-85). Similarly, the Pound has done little on the day thus far and GBP/USD remains within a 1.2612-39 band with little new to report on the Brexit front. Meanwhile, EUR/GBP is currently flat on the day around within a 0.8810-25 with resistance around 0.8845-50.

- CHF,JPY – Both safe haven currencies are marginally weaker vs. the Buck amid the rebound in risk sentiment in early EU trade. USD/JPY remains above 109.50, having tested the level overnight, with resistance flatted at 109.80-85, whilst USD/CHF eyes 1.01 to the upside as it flirts around the top of today 1.0072-94 range.

- EM – Lira remains the outperformer amongst its EM counterpart as the US-Turkey does not seem to be detreating as (fast as) expected, following a phone call between the two President yesterday in which they agreed to meet on the side-lines of the G20 summit in June. USD/TRY is not back below the 6.00 figure and closer to 5.95, ahead of President Erdogan’s presentation of his judicial reform strategy programme at the presidential palace at 1200BST following by a meeting of the National Security Council at 1300BST.

In commodities, WTI (+0.3%) and Brent (-0.8%) futures are mixed with the former relatively flat whilst the latter has failed to hold onto its post-API gains in which US crude stocks showed a wider-than-forecast drawdown (-5.27mln vs. Exp. -0.9mln). This mornings downside in Brent was exacerbated as 69.0/bbl was taken out to the downside, with Brent currently trading around 68.80/bbl. News-flow for the complex has been light, although amidst the little clarity in regard to the OPEC/OPEC+ meeting schedule, the Azeri Energy Minister noted that the meeting will likely take place in early July (touted dates include July 3rd/4th). As a reminder, the DoEs will be release later today at 1600BST amid US’ market absence on Monday. Elsewhere, gold prices (-0.2%) are marginally pressured amid the improvement in the risk tone. Meanwhile, copper prices remain near 4-month lows due to a weak performance in China. Further for the red metal, supply side disruptions are to keep an eye on after Chile’s CODELCO mine workers voted in favour of a strike in the Chuquicamata mine which is the largest open-pit copper mine in the world.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 3.0%, prior 3.2%; Personal Consumption, est. 1.2%, prior 1.2%; Core PCE QoQ, est. 1.3%, prior 1.3%

- 8:30am: Initial Jobless Claims, est. 214,000, prior 211,000; Continuing Claims, est. 1.66m, prior 1.68m

- 8:30am: Advance Goods Trade Balance, est. $72.7b deficit, prior $71.4b deficit

- 8:30am: Retail Inventories MoM, est. 0.2%, prior -0.3%; Wholesale Inventories MoM, est. 0.1%, prior -0.1%

- 9:45am: Bloomberg Consumer Comfort, prior 60.3

- 10am: Pending Home Sales MoM, est. 0.5%, prior 3.8%; NSA YoY, est. 0.1%, prior -3.2%

DB’s Jim Reid concludes the overnight wrap

Today sees the start of the cricket World Cup here in England. A massive event for a large part of the global population and a complete nonevent for an even bigger part of the global population. I’ve mentioned this before so apologies if you remember the story but the last time it was hosted in England 20 years ago I was on the brink of pop stardom as I sang on the Barmy Army’s (England’s supporters club) “Come on England” pop song. We were lined up to appear on all the major UK TV current affairs and pop shows the week of the release. I was extremely excited. However, the problem was we delayed the release of the single to the start of the knockout stages to ensure maximum publicity. The flaw in the plan that no-one considered at the time was that England might get knocked out in the group stages. Sadly they did, one day before the song was released and the knockout stages begun. So the wave of publicity shrivelled up and died just as record shops got their deliveries. In all fairness, it did shoot into the national charts that week at a very respectable no.45, which at least allows me to say I’ve sung on a top 50 single. For those who want to see the awful video, please feel free to see the link on my Bloomberg page header or email me and I’ll send it to you. I appear for a few frames throughout with the first glance at 22 seconds. It was a low budget affair with the theme being based on “goodies” versus “baddies” from history as that’s what the prop team had in their cupboard. The star turn was Faye from pop band Steps who was captain of the goodies from history for some reason. Joining her were the likes of Winston Churchill. On the baddies side Saddam Hussein was captain. It has a few celebrities in it but in reality it’s truly awful. Anyway good luck to England over the next 6 weeks!!

Unlike England in 1999, there’s no doubt that the global risk sell-off has gathered momentum this week but as we’ll see later risk assets did bounce off their lows after Europe went home last night. The next big event will be the latest Chinese PMI early tomorrow morning, which is expected to dip from 50.1 to 49.9 and below the psychologically important 50 level, which normally indicates contraction. In reality, the relationship isn’t quite that simple but there’s no doubt that recession fears are rising across markets. As for other imminent events to look out for, I was speaking to DB’s man in Washington (Frank Kelly) last night and he pointed out that US VP Pence will give a very important speech on US-China relations on Tuesday (June 4th), which is the 30th anniversary of the Tiananmen Square incident. Frank was of the opinion that it could be pretty hawkish given the signs out of Washington and his previous speeches on the matter. So watch this space.

Back to the recession fears and two of the Fed’s preferred yield curve measures – the 3m10y and 18m3m 3m – hit new lows yesterday at -9.5bps (-1.1bps on the day) and -50.1bps (-7.6bps), respectively. Both have now eclipsed their March lows and in fact you have to go back to the depths of the financial crisis to find the last time they were lower. A quick look at our screens now shows that all measures of 3m, 6m and 1y curves from 1y to 10y are inverted. The 2y curve is inverted at 3y and 5y but marginally positive at 2y7y (at 5.1bps) while the closely followed 2y10y is at 15.2bps and in fact was marginally steeper on the day yesterday (+1.4bps). This still remains our favourite recession indicator as we discussed in our “Yield Curve 101” note here . Indeed ahead of the last 9 recessions, this measure of the curve has always inverted beforehand with the earliest inversion to recession timing being 8 months and the average being nearer 12-18 months. As mentioned in our spread forecasts update, I think we still have a minimum of 12 months left in this US cycle (outside of a complete and sudden meltdown in global trade) but my confidence of an extended cycle beyond that is low given we’re close to an inversion and with other indicators we have previously discussed suggesting we are quite late cycle. So my views of a sell-off this summer are trade oriented at the moment rather than end of cycle oriented. However, the economic worries are building.

The broad curve flattening (with the exception of 2y10y) came despite fairly small eventual moves in cash treasuries, where the 10-year yield fell -0.5bps and the 2-year yield fell -1.8bps. That still took the 10-year to a new 20-month low, but it was well off the intraday trough of being -5.8bps on the day. Bunds also hit -0.1797% intraday yesterday – before closing at -0.1788% – and as a reminder the low mark back in July 2016 was -0.189%. So we’re only a sneeze away from those levels now. The rest of the European sovereign market rallied as well,including -4.2bps rally for BTPs despite the risk-off, and a -6.8bps rally in Portugal. The S&P 500 (-0.69%), DOW (-0.87%) and NASDAQ (-0.79%) all ended in the red, though they all rallied off their lows. Counterintuitively, cyclical sectors, including materials, financials, and industrials, actually outperformed, with losses instead concentrated in defensives and real estate. In Europe, the STOXX 600 (-1.43%) had its worst day in nearly 3 weeks – albeit partly as a result of playing catch up to the moves in the US late Tuesday. The move in rates also saw European Banks fall -1.56%, which puts them down now -15.77% from the April highs. For comparison, US Banks are down -7.60% from the recent highs. Meanwhile, the VIX rose +0.4pts to 17.87 yesterday, while EM FX and equities ended up +0.21% and +0.65%, respectively.

WTI oil prices initially fell as much as -3.82% before rallying back as investors first digested the news that Russia is pushing back against holding an OPEC+ meeting on June 25-26, pushing instead for July 3-4. This seemingly routine discussion has been interpreted by some as a tacit signal that Russia does not want to renew the December 2018 supply agreement. However, prices bounced back to end the day only -0.6% lower and are up +0.7% in Asia after a bigger fall than expected in US inventories.

This morning in Asia markets are trading on the softer side with the Nikkei (-0.85%), Hang Seng (-0.28%) and Shanghai Comp (-0.83%) all lower while the Kospi (+0.33%) is up. Elsewhere, futures on the S&P 500 are up +0.18% continuing a little of the late rally back from last night. In other news, negative rhetoric around the US-China trade war continues with China’s Vice Minister of Foreign Affairs Zhang Hanhui saying at a briefing today that deliberately provoking trade disputes is economic terrorism, economic hegemony and economic chauvinism. Note that it’s Ascension Day across parts of Europe today so there will be some countries out on holiday.

Back to yesterday and in truth there wasn’t a great deal of new news. The price action more appeared to reflect some of the fallout from recent reports of China potentially cutting exports of rare earth materials, adding to the long line of evidence that de-escalation is no nearer. The move below 2,800 on the S&P 500 was also seen as an important technical break at the same time as curves flattened. Meanwhile, Bloomberg reported that the US had warned Europe that its Iran ‘workaround’ could face sanctions. Elsewhere, it’s worth noting that yesterday’s BoC meeting – while not hugely interesting – was the first G7 central bank meeting since the recent trade escalation period. However, the comments on trade were fairly balanced, with the BoC noting that “the recent escalation of trade conflicts is heightening uncertainty about economic prospects. In addition, trade restrictions introduced by China are having direct effects on Canadian exports. In contrast, the removal of steel and aluminum tariffs and increasing prospects for the ratification of CUSMA will have positive implications for Canadian exports and investment.”

Turning to US politics, where attention was dominated by Special Counsel Robert Mueller’s first public comments in almost two years. He said that “under long-standing department policy, a president cannot be charged with a federal crime while he is in office,” though “if we had had confidence that the president clearly did not commit a crime, we would have said so.” President Trump greeted the remarks by tweeting “Nothing changes from the Mueller Report (…) The case is closed!” On the other hand, leading Democratic Presidential candidate Joe Biden said via a spokesman that impeachment “may be unavoidable.” It is likely that this drama will continue to linger over the coming months.

In European politics, the EU Commission formally sent Italy a letter confirming that the country risks disciplinary action unless it takes remedial actions. This was a legal requirement under the EU’s governing treaties, and Italy now has two days to respond. The more interesting item to watch will be Italy’s 2020 budget, due by end of September, which could include fiscally costly items like the flat tax and no VAT, which is more likely to spark a substantive confrontation with the Commission.

In other news, it was a quiet day for data yesterday with the only release in the US being the Richmond Fed manufacturing index, which rose +2pts to 5 in May, albeit below expectations for a 7 reading. That’s unlikely to move the dial much for expectations for next week’s ISM print. Prior to this in Europe we saw the May CPI reading in France rise only +0.2% mom (vs. +0.3% expected) while unemployment in Germany in May unexpectedly rose one-tenth to 5.0%. That’s the first time unemployment has ticked higher since November 2013; however, it appeared to be mostly down to a technical reclassification. Swedish GDP printed at 0.6% qoq, compared with expectations for 0.2%, but the details of the report showed a deterioration in consumption and investment, with the outperformance driven almost entirely by net exports.

Looking ahead to the rest of today, we’ll have to wait until this afternoon for the main data highlights with the second reading of Q1 GDP due in the US. Following a stronger than expected +3.2% qoq saar preliminary reading, the consensus expects a small downward revision to +3.0%; however, our economists note that in light of last week’s downward revisions to core durable goods orders and the latest quarterly services survey, it is possible that Q1 growth slips below 3%. Also due out this afternoon will be the latest claims reading, April advance goods trade balance, April retail and wholesale inventories and April pending home sales. Away from that, we’re due to hear from Fed Vice Chair Clarida at 5pm BST when he speaks to the economic club of New York, while US Secretary of State Pompeo is due to travel to meet German Chancellor Merkel in Berlin.

via ZeroHedge News http://bit.ly/2HKwbjZ Tyler Durden