Two months ago, analysts at Bank of America proclaimed that “spring is coming” for the European economy after it slipped into a mild recession late last year. Unfortunately, a massive stimulus injection from Beijing has failed to spark a global reflationary wave, and on Wednesday, Germany – the largest and most important constituent of the European economy – revealed that its labor market had hit a major pothole, the latest sign that the economic pain on the Continent may have only just begun.

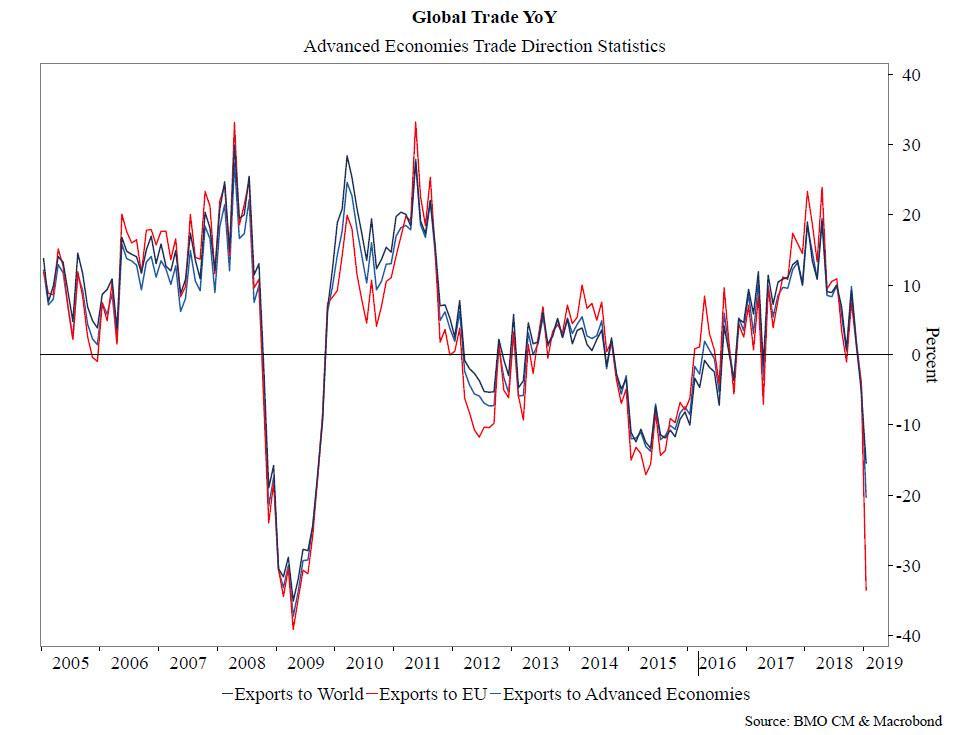

With global trade in free fall…

…And with slumping sales already weighing on the global auto industry, a critical engine (no pun intended) of Europe’s industrial economy, EU bureaucrats now find themselves in the uncomfortable position: They’re at the mercy of Washington and President Trump, who has been threatening to open up another front in his trade war by slapping ‘Section 232″ national security tariffs on imports of cars and car parts (with exceptions for USMCA partners Canada and Mexico).

But ironically, President Trump’s decision to delay his decision by six months to allow more time for negotiations with Europe and Japan might not make much of a difference: Because, with a leadership change coming in October, Brexit still unresolved and a strong showing by populist parties in the EU Parliamentary vote, Europe simply isn’t in a good position to negotiate

“You’re seeing an EU that is fighting fires on so many fronts that I just don’t think they are going to be confident and able to negotiate that deal” with the U.S., said Heather Conley, head of the Europe program at the Center for Strategic and International Studies.

As Bloomberg explains, Trump’s auto-tariff deadline will hit just as the new European Commission takes over from the body led by Jean Claude Juncker, who successfully negotiated a trade truce with Trump last year during a meeting at the White House. With the current Commission now entering a lame duck phase, its mandate to negotiate will be severely weakened.

Adding another layer of complication, France and Germany have competing priorities that could make it more difficult to reach a final deal.

France’s Emmanuel Macron led some EU member states in resisting U.S. efforts to include agriculture in any transatlantic discussions, something the EU insists Trump gave away last July as part of the Rose Garden truce. Though many in Washington, including Senate Finance Committee Chairman Chuck Grassley, have said any deal that didn’t include agriculture wouldn’t get through Congress.

Germany, which exported 27.2 billion euros of cars and car parts in 2018, is more concerned about Trump’s threat of automobile tariffs than protecting European agricultural interests. The home of Mercedes-Benz, BMW and Porsche generated a surplus of 22 billion euros in automotive trade with U.S. last year.

In a discouraging sign of things to come, trade talks in Washington and Paris this month made little progress, which leaves more muddling or a sharp escalation as the most likely paths.

Brussels’ best hope for averting more tariffs would be Trump’s decision to risk angering auto workers in South Carolina and other key states by moving ahead with the auto tariffs, which American car makers like GM and Ford vehemently oppose.

But as the market fallout from the China trade spat has showed, Trump has increased tolerance for painful decisions. So that’s hardly something Europe can bank on.

via ZeroHedge News http://bit.ly/2XheNJ0 Tyler Durden