In its highly anticipated first quarterly report as a public company, Uber Technologies reported a $1.034 billion loss from operations, more than double the $478 million loss a year ago despite a 20% rise in revenue, posting results that slightly beat forecasts, yet underscoring the challenges the ride-hailing service faces to become profitable one day.

Uber’s revenue of $3.1 billion, up from $2.58 billion a year ago, was in line with high end of the range Uber forecast for the quarter, while the loss of $1.0 billion compared with the company’s forecast of $1.0 billion to $1.11 billion.

“Our Q1 2019 results were at or near the high end of the ranges we shared last month in our IPO prospectus,” said CFO Nelson Chai. “Our investments remain focused on global platform expansion and long-term product and technology differentiation, but we will not hesitate to invest to defend our market position globally.”

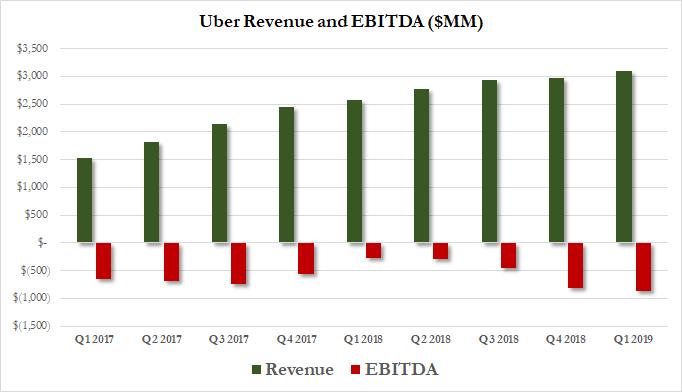

Chai also said the company had begun to see “less aggressive pricing” by rivals, although one wouldn’t know it looking at the company’s EBITDA, because in the quarter revenue hit an all time high, cash burn was a record high ($869) million, more than 3x greater than Q1 2018. In fact, as shown in the chart below, the greater Uber’s revenue, the greater the more negative the EBITDA.

With its share price trading more than 10% below its IPO price of $45, CEO Dara Khosrowshahi has an uphill climb in convincing investors Uber can turn a profit, given its reliance on rider incentives and competition in all parts of its business, from ride hailing to food delivery to freight.

According to Reuters, the results indicate that while the newly public company was able to hit its own financial targets, markets still need to be convinced that the long-term business model can generate cash flow especially with Uber’s take rate declining. Indeed, costs went up 35% in the quarter, as the company spent heavily in the run-up to its IPO earlier this month.

Additionally, gross bookings, a measure of total value of rides before driver costs and other expenses, rose 34% from a year ago to $14.6 billion. However, in a troubling sign that the business is slowing, bookings were up only 3.4% from the previous quarter, showing the difficulty of recruiting new riders in saturated markets.

Uber also faces increased regulation in several countries and fights with its drivers over wages.

Uber said its monthly active users rose to 93 million globally, from 91 million at the end of the fourth quarter. Uber previously said it expected first-quarter revenue in the range of $3.04 billion to $3.1 billion while seven analysts polled by Refinitiv IBES on average expected revenue of $3.04 billion

The market was confused at first, rewarding the company initially by pushing its stock higher in the after market, before dragging it back down to session lows as concerns about the slowing growth rate appeared to dominate market sentiment.

via ZeroHedge News http://bit.ly/2VZnOVD Tyler Durden