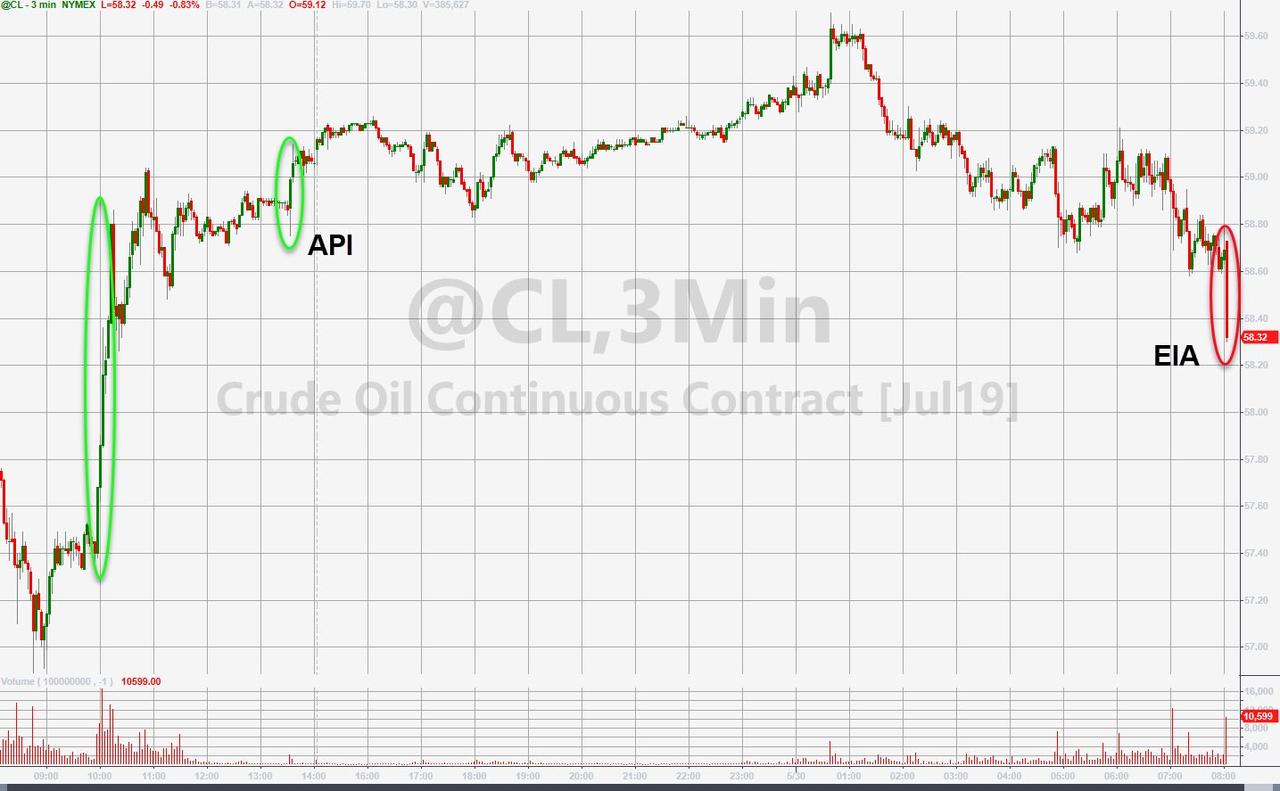

Oil prices have slipped lower this morning after popping following API’s reported bigger-than-expected crude inventory draw

U.S. crude inventories were expected to fall for the first time in three weeks, with investors will focus on refinery consumption, which dropped unexpectedly in last EIA report.

“As those refiners come back in, we’re probably going to see demand really rip higher in the U.S.,” says Michael Loewen, a commodities strategist at Scotiabank in Toronto.

As Bloomberg also notes, heavy rains and flooding in the Midwest and Great Plains last week meant that a number of refiners had to pull back from their typical summer demand pick-up plans.

API

-

Crude -5.265mm (-500k exp)

-

Cushing -176k

-

Gasoline +2.711mm

-

Distillates -2.144mm

DOE

-

Crude -282k (-1.4mm exp)

-

Cushing -16k

-

Gasoline +2.204mm

-

Distillates -1.615mm

Following last night’s solid crude draw, EIA reported a tiny 282k draw (well below expectations) and at the same time gasoline stocks rose notably for the 2nd week in a row…

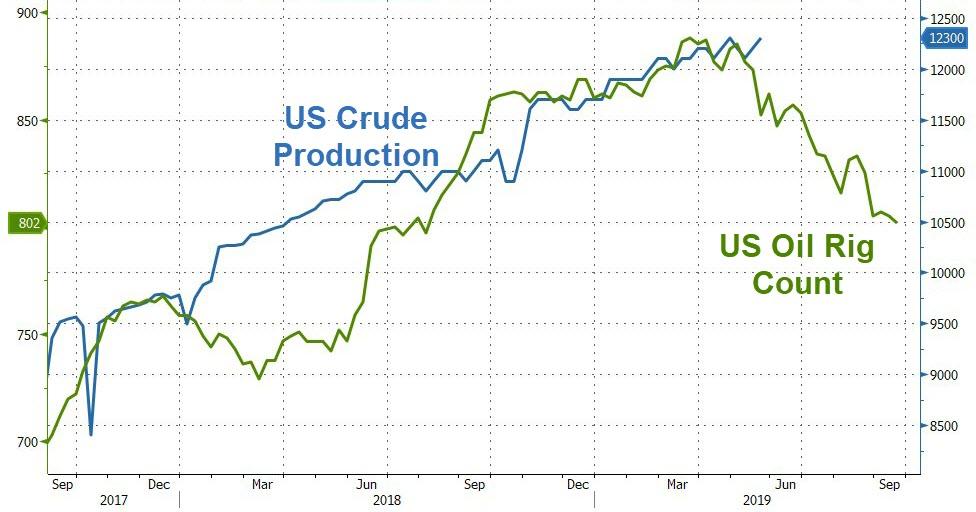

US Crude production continues to hover near record highs, rebounding modestly last week…

WTI fell back below $59 ahead of the EIA data (after rallying overnight following the API data) but slipped on the lower than expected EIA draw…

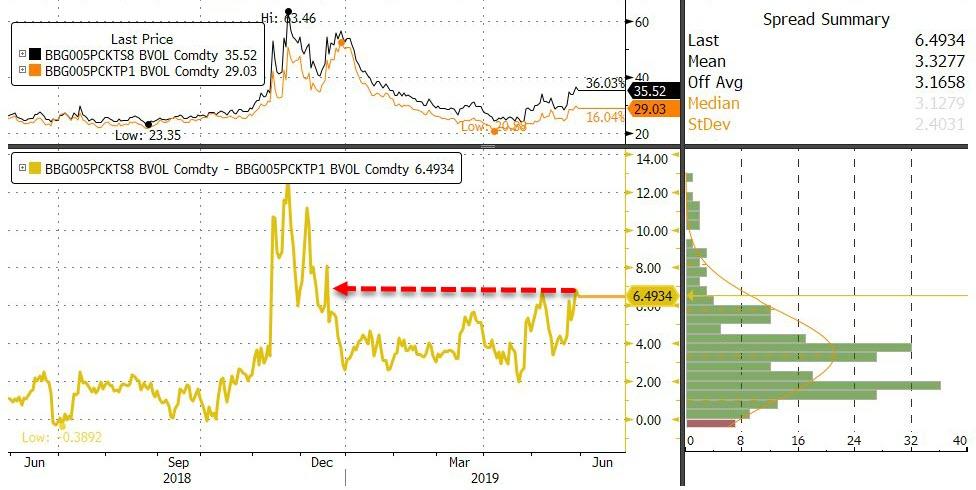

Finally, as Bloomberg reports, the WTI put skew grew to the most bearish since mid-December on Wednesday, while gauges of volatility for both the U.S. benchmark and global equivalent Brent swelled

Bloomberg Intelligence Senior Energy Analyst Vince Piazza cpncludes:

“The market is coalescing around our view of softer global demand growth affecting the petroleum value chain, with WTI retreating below $60. We highlight sustained U.S. crude output, despite waning growth. Prolonged periods above $60 in the U.S. would likely invite an acceleration in well completions, even amid pressure for capital discipline. Indecision among OPEC and its partners about capacity curbs, along with geopolitical turmoil, clouds the fundamental backdrop.”

via ZeroHedge News http://bit.ly/2QCA1Pg Tyler Durden