To those who sold in May, congratulations. To everyone else, we hope you are enjoying the bloodbath.

US stock futures, global markets and sovereign bond yields tumbled on Friday as investors feared President Donald Trump’s shock threat of tariffs on Mexico – a 5% tariff from June 10, which would then rise steadily to 25% until illegal immigration across the southern border was stopped – risked tipping the United States, and maybe the whole world, into recession.

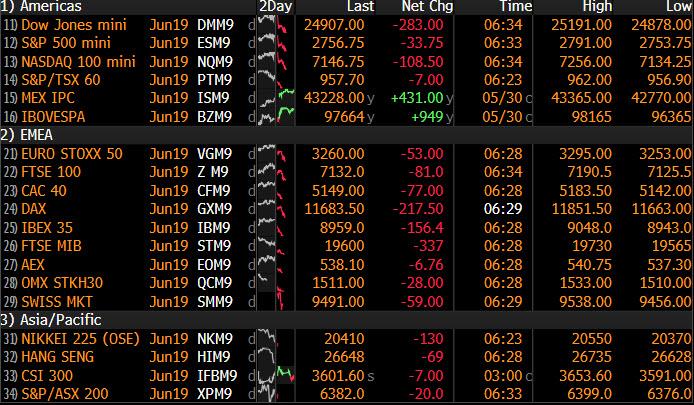

The rout, which sent the Dow below 25,000 and the S&P below its 200 DMA, will break the S&P’s unbroken monthly streak in 2019, with May set for the first monthly loss since the December rout. In fact, May will be the third worst month since the US downgrade in August 2011.

Trump announced the decision on Twitter late Thursday, catching markets completely by surprise.

“The mercurial President Trump has signalled via Twitter this morning that his mindset is shifting ever farther from reaching trade deals,” warned Saxo’s Eleanor Creagh. “It seems now that market participants are finally realising that the narrative of an H2/19 recovery is fast dissipating,” she added. “As escalating trade tensions across the globe cause growth expectations to be recalibrated, risk off sentiment will remain and volatility will increase.”

“We are seeing a Trump who is going all-out,” said Kay Van-Petersen, global macro strategist at Saxo Capital Markets Pte. “This raises the bar not just for Mexico and Canada, but also for China.”

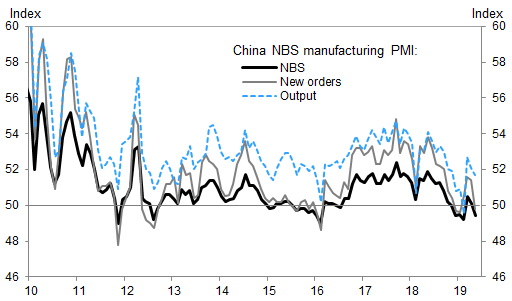

After Trump’s announcement, investor mood hit pitch black when China’s May manufacturing PMI printed not only below expectations, but below the lowest expectation, raising questions about the effectiveness of Beijing’s stimulus steps. The official NBS manufacturing PMI fell to 49.4 in May, from 50.1 in April. Sub-indexes suggested lower price inflation and weaker trade growth in May. Trade indicators worsened further – the imports sub-index declined to 47.1, from 49.7, and the new export order index went down to 46.5, vs. 49.2 in April. Inventory indicators rose – the raw material inventories index was 0.2pp higher at 47.4, and the finished goods inventory index rose to 48.1 in May.

With traders throwing in the towel, global markets moved aggressively to price in deeper rate cuts by the Federal Reserve this year, while bond yields touched fresh lows and curves inverted further in a warning of recession.

With markets tumbling, traders flooded into the safety of bond market and the dollar, with yields on the 10-year Treasury note quickly fell to a fresh 20-month low of 2.17%, while the dollar jumped 1.7% on the Mexican peso. In the US, all Treasury tenors from 2Y to 5Y were now trading below 2.0%, while the 3M-10Y was inverted as much as 21bps. Bonds extended their bull run with 10-year Treasury yields now down a steep 33 basis points for the month and decisively below the overnight funds rate. Such an inversion of the yield curve has presaged enough recessions in the past that investors are wagering the Fed will be forced to ease policy just as “insurance”.

Yet Treasuries were hardly alone in rallying, with bond yields across Europe either at or near record lows. Yields in Australia and New Zealand have also hit an all-time trough on expectations of rate cuts there. Bund yield falls 4bps to -0.213%, below the previous all-time low touched in July 2016, as core bonds outperformed semi-core, and German provincial CPI numbers are weaker than economists estimated.

As if that wasn’t enough, stocks extended declines on reports that China will establish a list of “unreliable” entities to target firms it says damage the interests of domestic companies.

The Stoxx Europe 600 Index fell, with all industry sub indexes down, led by autos and basic resources.European shares extend losses, alongside U.S. futures, as China announces it is preparing for retaliation by implementing a list of “unreliable” entities in order to target firms it says damage the interests of domestic companies. Stoxx 600 Index falls 1.4%. European shares set for largest monthly drop since January 2016; Stoxx Europe 600 Index down 6.2% in May, with the biggest pain felt again by Deutsche Bank shareholders, as DBK tumbled to new all time lows.

Asian shares fell at first, only to draw month-end bargain hunting having endured a torrid few weeks. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.3%, though it was still down a whopping 7.3% for the month.

China’s blue chip index held steady, partly on talk Beijing would now have to ramp up its stimulus, but again was nursing loses of 6.8% for May. Japan’s Nikkei fell 1.3%, dragged down by big falls in car makers, which left it off 7.1% for the month.

There was one silver lining: Apple suppliers rose in Taipei Friday, boosting the Taiex index, after China said it would protect foreign businesses’ legitimate rights. The comments from China’s commerce ministry official Thursday was interpreted as an indication that Beijing doesn’t intend to retaliate against Apple and other American firms doing business on the mainland, according to Concord Securities assistant vice president Allan Lin, although that may be over as soon as today.

Another silver lining: investors clearly felt encouraged that opening a new front in the trade wars would pressure central banks everywhere to consider new stimulus. On Thursday, Fed Vice Chair Richard Clarida said the central bank would act if inflation stays too low or global and financial risks endanger the economic outlook.

“What the Clarida’s comments have done is clarify in many people’s minds the answer to the questions of whether low inflation proving more than transitory would itself be enough to get the Fed to ease – the answer appears to be ‘yes’,” said Ray Attrill, head of FX strategy at National Australia Bank. “That served to reinforce prevailing market expectations that the Fed will be easing in the second half of this year.”

Not surprisingly, in FX the DXY dollar index ramped to new two-year highs against a basket of currencies at 98.115. The euro was huddled at $1.1129, having shed 0.7% for the month. The safe-haven yen fared better as the dollar lost 0.6% on the day to a three-month low of 108.94. Sterling was poised for the biggest monthly drop in a year as the imminent departure of Theresa May as prime minister deepened fears about a chaotic divorce from the European Union. The pound was last at $1.2611 and nursing a 3.2% loss for the month so far.

In commodity markets, spot gold firmed 0.4% to $1,293.33 per ounce. Oil prices fell to their lowest in almost three months on fears a global economic slowdown would crimp demand. U.S. crude was last down 55 cents at $56.04 a barrel, while Brent crude futures lost 91 cents to $65.96.

Expected data include personal income and University of Michigan Sentiment Index. Big Lots is reporting earnings.

Market Snapshot

- S&P 500 futures down 1.1% to 2,759.25

- STOXX Europe 600 down 1% to 368.54

- MXAP down 0.04% to 152.22

- MXAPJ up 0.2% to 498.43

- Nikkei down 1.6% to 20,601.19

- Topix down 1.3% to 1,512.28

- Hang Seng Index down 0.8% to 26,901.09

- Shanghai Composite down 0.2% to 2,898.70

- Sensex down 0.3% to 39,707.10

- Australia S&P/ASX 200 up 0.07% to 6,396.85

- Kospi up 0.1% to 2,041.74

- German 10Y yield fell 2.7 bps to -0.202%

- Euro up 0.2% to $1.1148

- Italian 10Y yield rose 1.4 bps to 2.283%

- Spanish 10Y yield fell 1.8 bps to 0.746%

- Brent futures down 3.3% to $64.70/bbl

- Gold spot up 0.7% to $1,297.30

- U.S. Dollar Index down 0.1% to 98.00

Top Overnight News from Bloomberg

- Trump vowed to impose tariffs on Mexican goods until that country stops immigrants from entering the U.S. illegally, jeopardizing a new North American trade agreement. The tariff would take effect on June 10 and has major implications for American automakers and other companies with production south of the border

- U.S. Senate Finance Committee Chairman Chuck Grassley (R-Iowa) calls President Trump’s Mexico tariff Plan a “misuse” of authority. “Following through on this threat would seriously jeopardize passage of USMCA.” Mexican President Andres Manuel Lopez Obrador says in letter to Trump posted to Twitter “from start, I express that I don’t want confrontation.”

- China has prepared the steps it will take to use its stranglehold on the critical minerals in a targeted way to hurt the U.S. economy, people familiar said. The measures would likely focus on heavy rare earths, a sub-group of the materials where the U.S. is particularly reliant on China

- China will establish a list of so-called “unreliable” entities in order to target firms it says damage the interests of domestic companies, according to an announcement carried by state media on Friday

- Mitsubishi UFJ Financial Group Inc., Japan’s largest bank, is preparing major job cuts in London, offering voluntary redundancy packages to about 500 directors and managing directors in London, according to an emailed statement. That’s roughly a quarter of its workforce in the city

- India’s Prime Minister Narendra Modi picked leaders with experience for key portfolios as he began a second five-year term facing an economic slowdown and global headwinds

- The outlook for China’s manufacturing sector deteriorated more than expected in May, as weakness in the domestic economy combined with escalation in the trade standoff with the U.S.

- Federal Reserve Vice Chair Richard Clarida says “if the incoming data were to show a persistent shortfall in inflation below our 2% objective or were it to indicate that global economic and financial developments present a material downside risk to our baseline outlook, then these are developments that the committee would take into account in assessing the appropriate stance for monetary policy

- Mitsubishi UFJ Financial Group Inc., Japan’s largest bank, is preparing major job cuts in London, offering voluntary redundancy packages to about 500 directors and managing directors in London, according to an emailed statement. That’s roughly a quarter of its workforce in the city

- India’s Prime Minister Narendra Modi picked leaders with experience for key portfolios as he began a second five-year term facing an economic slowdown and global headwinds

Asian equity markets traded mixed heading into month-end with early pressure seen after US President Trump announced to place 5% tariffs on all goods from Mexico from June 10th, which will increase to as much as 25% by October 1st and remain there until Mexico addresses the illegal immigration inflows to the US through its territory. The announcement pressured US equity futures to give back the prior session’s gains in which the Emini S&P breached its 200DMA to the downside and the DJIA briefly slipped below the 25K level, with Wall St on track for its worst monthly performance YTD. ASX 200 (Unch.) was lower for most the session with tech and energy the underperformers although strength in gold and other mining names stemmed the downside in the index, while Nikkei 225 (-1.6%) suffered from currency flows and with automakers spooked by fears of a trigger-happy ‘Tariff Man’. Hang Seng (-0.8%) and Shanghai Comp. (-0.2%) were mixed as participants digested varied Chinese PMI data in which Manufacturing PMI fell short of estimates and slipped into contractionary territory but Non-Manufacturing PMI printed inline, and although the PBoC refrained from open market operations, its efforts this week resulted to a total net injection of CNY 430bln. Finally, 10yr JGBs followed suit to the upside in T-notes as Trump’s announcement spurred safe-haven demand, while the BoJ were also present in the market for JPY 680bln of JGBs in the belly to super long-end.

Top Asian News

- Anta Jumps After Fighting Back on ‘Misleading’ Short Sell Attack

- BOJ Paves Way to Buy Fewer Bonds as Growth Worries Sink Yields

- Apple Suppliers Rise as China Shows No Intention to Retaliate

- Philippine Central Bank Governor ‘Promises’ More Rate Cuts

European Indices trade firmly in negative territory this morning [Euro Stoxx 50 -1.7%] as sentiment took a hit as US President Trump revisited his ‘Tariff Man’ persona by announcing the placement of 5% tariffs on all goods stemming from Mexico as of June 10th; which may increase by up to an additional 20% by October 1st. Currently eight automakers including Volkswagen (-3.6%) and Fiat Chrysler (-4.6%) operate plants in Mexico, as such the Stoxx 600 Auto Sector (-2.8%) is significantly lagging its peers with the Dax (-1.6%) the underperforming bourse due to automakers/parts having around a 14% weighting in the Dax. Auto names aside, other companies with exposure to Mexico have been significantly affected by President Trump’s announcement with the likes of Tenaris (-4.7%) afflicted due to the Co. operating one of the world’s largest manufacturing centres for steel tubes in Mexico. Elsewhere, Italian banks are at their lowest level since November 2016 due to the ongoing internal political tensions as well as the potential for Italy to face EU disciplinary procedures in the form of a EUR 3.5bln fine. Other notable movers this morning include Wirecard (-11.3%) who are lagging the Stoxx 600 after reports that several public prosecutors are said to see the Co. as the central payment processor for the fraudulent trading site Option888. Bucking the risk-off sentiment and at the other end of the Stoxx 600 are Whitbread (+1.9%) after the Co’s board decided that the second phase in their three phase capital programme is a GBP 2bln tender offer.

Top European News

- Brexit Delay Boosts U.K. Mortgage Lending, Consumer Borrowing

- German Yields Set New Sub-Zero Record as Haven Seekers Rush In

- Visco Says Italy’s Debt Load Is ‘Severe Constraint’ on Economy

- Europe Car Stocks Sink to Five-Month Low on Trump’s Mexico Plan

In FX, the broad Dollar and Index are on the backfoot this morning with DXY now back below 98.000, albeit marginally. The Buck awaits key US data in the form of April PCE prices as traders look for any clues if the “dip in inflation was transitory” as the Fed stated at its most recent meeting. On a technical front, to the downside DXY sees its 50 DMA just under the 97.50 level at 97.47 ahead of clean air down to 97.00.

- MXN, CAD – The clear underperformers today, more-so the Peso after President Trump dampened USMCA hopes by taking aim at Mexico. The Peso immediately saw downside and continued that trajectory throughout the session, with USD/MXN spiking higher from around 19.1500, through its 50 WMA (19.2766) and 200 DMA (19.3360) to a high of 19.7360. Meanwhile, from Canada’s side, the potential ramifications on the USMCA deal, coupled with lower energy prices sent USD/CAD higher to around 1.3550 from a low of around 1.3494 ahead of a barrage of Canadian data including Q1 GDP.

- JPY, CHF – The Yen stands as the clear G10 outperformer this morning amid the overall risk aversion in the market with downside vs. the USD exacerbated as Trump spills his trade war into Mexico. USD/JPY cleanly broke below the 109.00 figure and continues to lose ground below the level, having traded within a wide 109.62-108.76 band, with buyers reported at 108.75 ahead of the Jan 28 low just above 108.50. Following the latest developments, Morgan Stanley believes that a breach below 109.00 support opens downside potential to 107.70. Meanwhile, the Swiss Franc also posts gains, albeit to a lesser extent, with traders speculating potential SNB intervention to keep the CHF strengthening further. USD/CHF currently rests just above the 1.0050 mark ahead of its 100 DMA at 1.0037.

- EM – The EM space is weaker across the board amidst the Trump-sparked collapse in the Mexican Peso, albeit the TRY has shown some resilience as it consolidates following yesterday’s stellar performance. However, geopolitical risks for the Lira remain as the Turkish Foreign Ministry spokesperson has dismissed reports that the Russian S-400 delivery will be delayed, which comes after US pressured the country to dump the USD 2.5bln deal with Russia, which contradicted prior reports that the Russian system will be delivered ahead of scheduled. Either way, markets are looking at any potential US sanctions on Turkey if the delivery does go through, which Turkey noted was “a done deal”

- AUD, NZD, EUR, GBP – All marginally firmer against the Greenback (ex-GBP), albeit more due to a pullback in the USD than individual factors. The Antipodeans were little fazed by the overnight miss in the Chinese NBS manufacturing PMI as currencies await the Caixin release next week alongside the RBA’s “live” rate decision and Aussie GDP. Elsewhere, the expectations for a post-Easter collapse sees the EUR largely shrugging off the downticks in German state inflation numbers, as markets gear up for the national release at 1300BST. EUR/USD resides closer to the top of today’s 1.1126-54 band with resistance reported at 1.1155 ahead of 1.1170. Meanwhile, the Pound has lost some ground in recent trade, particularly vs the EUR with some citing RHS demand and EUR/GBP bids at 0.8850 as factors.

Commodities are mixed with the energy markets plumbing the depths as risk sentiment further deteriorates amid trade war escalations coupled with rising US crude production. WTI (-2.1%) straddles around the USD 55/bbl level, having already dipped below the figure whilst its Brent (-2.5%) counterpart follows the same trajectory as it hovers around USD 64.50/bbl. Furthermore, some geopolitical risk premium may have also unwound in the oils amid reports that US has delayed tougher sanctions Iran’s petrochemical sectors in an attempt to dial back tensions. Elsewhere, gold (+0.6%) benefits from the risk aversion and the receding USD as it creeps closer to the USD 1300/oz level, whilst copper extends its decline below the USD 2.600/lb level amid the soured risk tone coupled with disappointing Chinese PMI data.

US Event Calendar

- 8:30am: Personal Income, est. 0.3%, prior 0.1%; Personal Spending, est. 0.2%, prior 0.9%

- 8:30am: PCE Deflator MoM, est. 0.3%, prior 0.2%; PCE Deflator YoY, est. 1.6%, prior 1.5%

- 9:45am: MNI Chicago PMI, est. 54, prior 52.6

- 10am: U. of Mich. Sentiment, est. 101.5, prior 102.4; Current Conditions, prior 112.4; Expectations, prior 96d

DB’s Jim Reid concludes the overnight wrap

The final day of May probably couldn’t come soon enough for most given the change in tide driven by a 102-word tweet from President Trump 26 days ago. Well, somewhat fittingly, the month was bookended by another surprise tweet from the US President last night, this time announcing a set of tariffs on imports from Mexico. According to Trump, the US will institute a 5% tariff on imports from Mexico effective June 10, with the rate set to rise by 5% every month until it reaches 25% in October. However, the new duties will be removed on Mexico if “illegal migrants coming through Mexico, and into our country, STOP” as per his tweet. For reference, the US imports around $30bn of goods from Mexico each month, and around 30% of those are autos. Tariffs at 25% on that flow of goods, in addition to the duties on China, would start having a significant and potentially crippling impact on US industry, so it’s possible that this move is aimed at pushing the US Congress to act on either the USMCA deal or on an immigration package. So far Mexico has stated that they will not retaliate until talking with the US, however the damage is likely to be already done to US-Mexico relations which since President AMLO was elected, had been improving. As for markets, the Mexican Peso has weakened -2.14% as we go to print, S&P 500 futures are down -0.65%, 10y Treasuries are down -3.1bps at 2.182% and WTI oil is down -1.15%. So, June starts right where May finished with tweet/tariff-induced selloffs.

As we’ve been arguing, these tweets have the potential to change the dynamics of global markets and it now seems like we could get a serious trade escalation that wasn’t likely at the start of last month, especially as it had appeared Trump had looked like he wanted to get a deal done in 2019. The landscape has changed dramatically and it could be an interesting summer ahead. The reality also is that with it being the first day of June tomorrow, tariffs will officially kick in between the US and China with the US applying 25% tariffs on $200bn of China exports to the US, while China will apply 5-25% tariffs on $60bn of US exports to China.

Needless to say, this also means economic data will be closely scrutinized as to the impact that the trade escalation has had, with next week’s final PMIs and ISM report top of that list. In the meantime this morning we’ve already had the final official May PMIs in China, which slid more than expected. The manufacturing print came in at 49.4, and the new orders and new export orders sub indexes were notably soft at 49.8 and 46.5. The non-manufacturing print came in at 54.3 as expected, bringing the composite PMI to 53.3 and slightly lower versus April. Equity markets in China initially opened in the red, however have since recovered with the Shanghai Comp (+0.01%) and CSI 300 (+0.06%) now pretty much unchanged. The Nikkei (-0.70%) and Hang Seng (-0.19%) are in the red, however markets do appear to be holding their own for the most part given both this data and the tariff news and it’s the same with Asia FX which has been broadly stable. That said it’s worth noting that the auto sector has borne the brunt of the pain, with Japanese automakers currently down -2.60%. To add to the headline risk the moves this morning also come despite China announcing that it is prepared to restrict exports of rare earths to the US if needed as per Bloomberg.

The overnight newsflow is clearly the main story and in any case it follows a mostly dull session on Wall Street yesterday prior to the latest tariff announcement. The good news is that risk assets did stage a rebound – albeit a modest one – with the S&P 500 rising +0.21%, however it still did close below the 2,800 level. Overnight, Binky Chadha published a timely note (available here ) estimating that the trade war has cost around $5 trillion in forgone equity gains, equal to 12-years’ worth of the bilateral trade deficit with China. Meanwhile the NASDAQ ended +0.27% while in Europe the STOXX 600 rose +0.42%. Volumes were however well below average across most markets, though markets did experience some late-session volatility after Vice President Pence said that the US can “more than double” tariffs on China if needed. As we highlighted yesterday, speculation also continued to swirl about a planned Pence speech next week which could be used to announce new sanctions on specific companies (per CNBC).Equities slipped into the red but ultimately closed higher, while bonds yields fell more persistently. Indeed 10y Treasuries rallied -4.9bps, though Bunds had already closed flat near their all-time lows at -0.177% before the rally. The US 2s10s was steady at 14.9bps while the 3m10y curve slid another -6.7bps to -15.9bps, its lowest level since May 2007. The VIX (-0.6pts) closed at 17.3, though high yield credit spreads in the US finished +3bps wider. HY spreads were flat in Europe.

Away from trade it’s worth noting that Italy could be a talking point again today with the government expected to respond to the EU’s request for an explanation of the violation of the debt rule for 2018. However, our economists have pointed out that there are more arguments for not opening a procedure right now. In particular they flag Italy’s deteriorating growth outlook, for which corrective measures could prove to be pro-cyclical. They also highlight different estimations of the output gap between Rome and Brussels, conciliatory steps adopted by Italy and the potential impact of the European election. Yesterday, Italian press reports – including from Il Messaggero and Il Corriere della Sera – claimed that Italy will argue that a corrective measure will be counterproductive and result in further growth deterioration. In any case, one to potentially watch. We should note that Italian assets underperformed yesterday with the FTSE MIB down -0.24% and 10y BTPs up +1.6bps in yield (compared to -4.3bps at the lows) following headlines suggesting that Deputy PM Salvini is ready to end the coalition government should he not get backing for his flat tax plan and other priority measures.

Elsewhere, though it didn’t end up moving markets, Fed Vice Chair Clarida’s comments yesterday did get some attention, since he was one of the key officials who initiated the pivot away from hikes earlier this year. He said that the economy is in a “very good place” and that the “current stance of policy remains appropriate.”He thinks policy should remain patient, which “means that we should allow the data on the US economy to flow in and inform our future decisions.” When asked about the yield curve’s recent flattening, Clarida seemed relatively sanguine, citing global and financial factors as the main drivers. He said that the curve is roughly flat right now, but that he would only be worried if it inverted more deeply and more persistently.

As for the data yesterday, where the second reading for Q1 PCE was revised down three-tenths to +1.0% qoq. So a fairly dovish print, however we should flag that the details did show that the revisions were mostly in financial services and insurance – a category that was already known to be weak in Q1 and is still expected to bounce back. Looking ahead, it’s worth noting that today we’ll get the April PCE reading which is expected to print at +0.2% mom for the core. Our US economists are forecasting a +0.3% reading which in their view would provide evidence that at least some of the recent weakness in the Fed’s preferred measure was likely transitory.

Meanwhile the second reading for Q1 GDP in the US was revised down to +3.1% qoq saar, marginally better than expected.However it didn’t go unnoticed that corporate profits were down -2.8% qoq, the second quarterly decline and biggest fall since Q4 2015. Elsewhere, claims printed at 215k, a small uptick on the week prior but more or less in line with expectations, while the April advance goods trade balance showed a deficit of $72.1bn compared to $71.9bn in March. Retail and wholesale inventories rose +0.5% mom and +0.7% mom respectively while April pending home sales fell -1.5% mom (vs. +0.5% expected).

To the day ahead now, which this morning kicks off in Germany where we’ll get April retail sales data, followed by the final Q1 GDP revisions in Italy, April money and credit aggregates data in the UK, and preliminary May CPI readings for Italy and Germany. In the US the big focus will be on that April PCE data, while personal spending and income data for April, the May Chicago PMI and final May revisions for the University of Michigan survey. Away from the data the Fed’s Visco is due to speak this morning while this afternoon the Fed’s Bostic is due to moderate a discussion on the global economy, while the Fed’s Williams speaks this evening on the topic of monetary policy theory and practice. Expect the fallout from the latest tariff announcement to be the big talking point however.

via ZeroHedge News http://bit.ly/2ELkEPL Tyler Durden