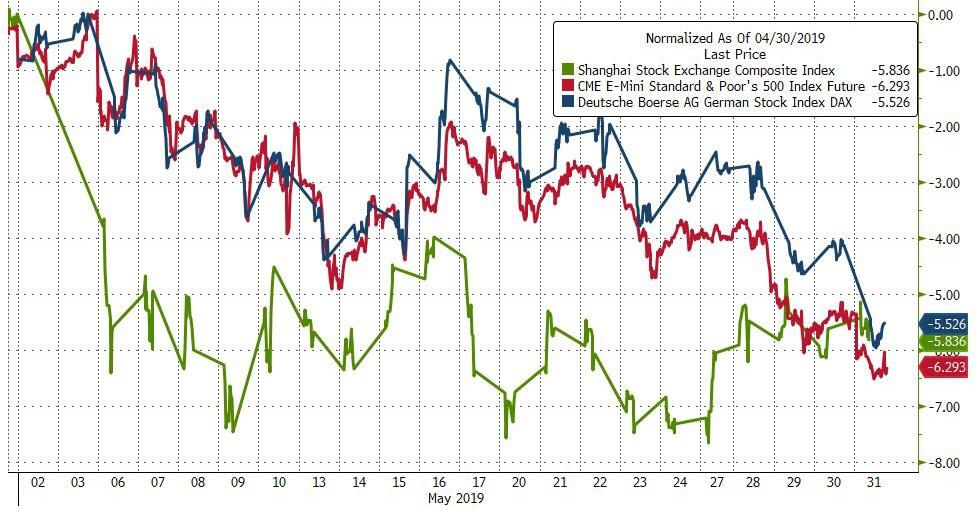

Global Equity markets lost almost $5 trillion in May, more than they did in December!

Everything was going so great too…

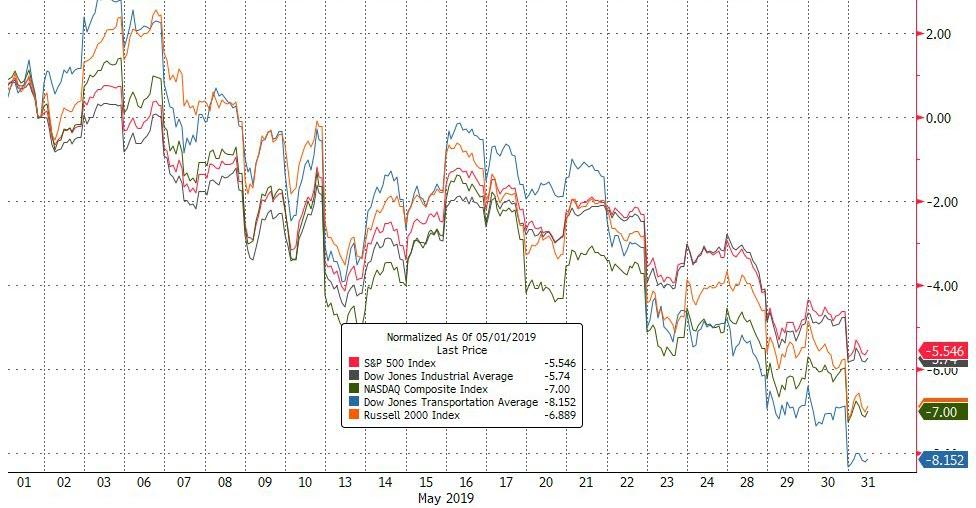

All major US equity markets were ugly in May…

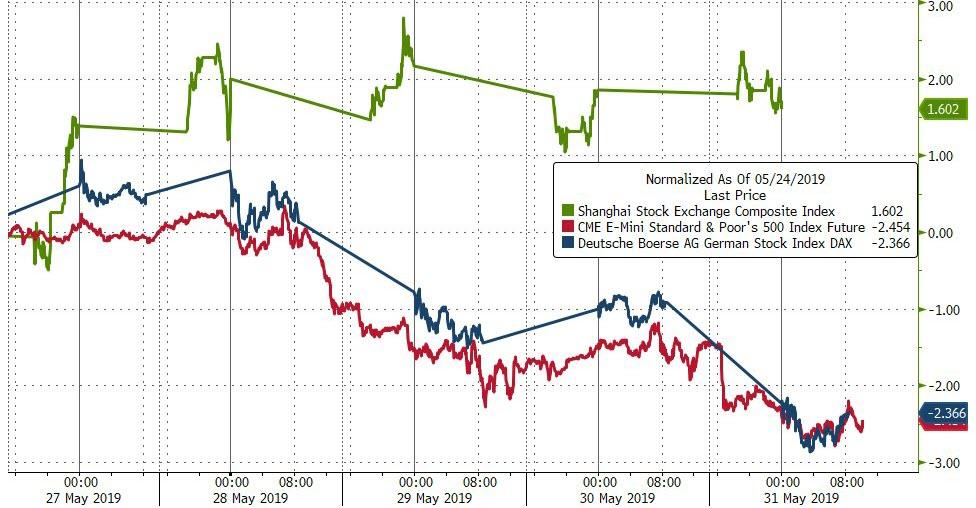

But, on the week, spot the odd one out…

Big week for China, thanks to a huge PBOC-panic liquidity injection…

Europe’s worst month since early 2016…

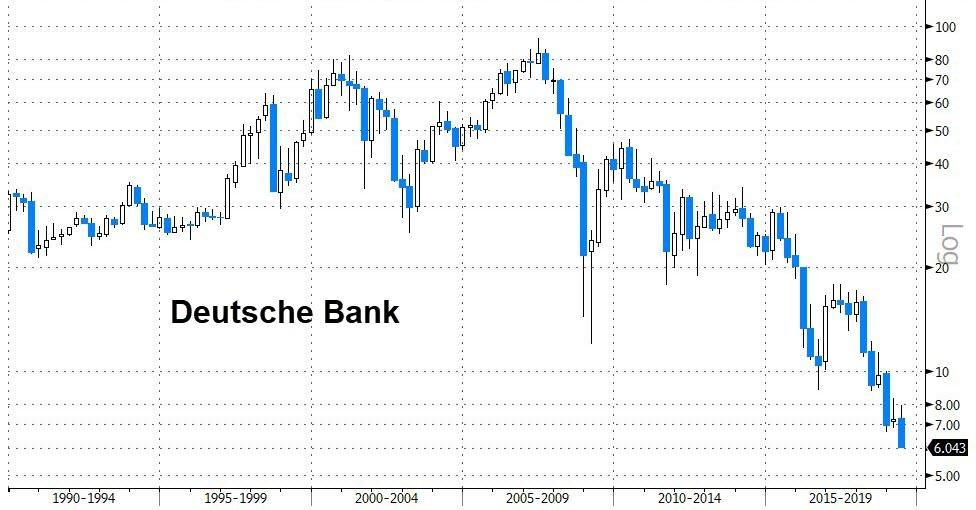

Not helped by Deutsche Bank closing at record lows…

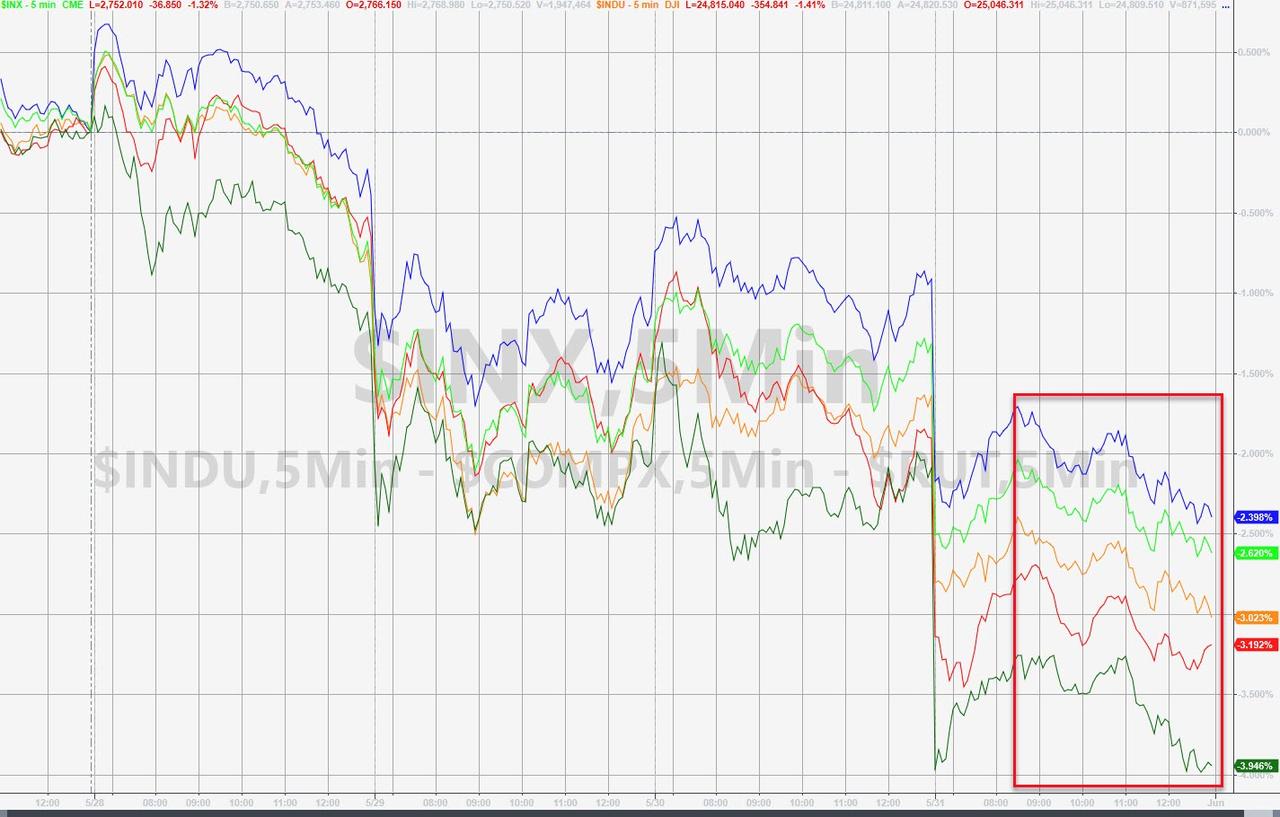

All major US equity indices were down this week, led by Trannies and Small Caps… (today was a one-way street lower after Europe closed)

Biggest weekly drop for the S&P 500 since December

US equity markets had an ugly month – the first losing month of the year and worst May since 2012…

This was the Dow’s 6th straight weekly loss (longest losing streak in 8 years)

But still remain comfortably green on the year…

All the major US equity indices are back below their 200DMAs…

The S&P broke below the key 2800 level…

Semis suffered their worst month since Nov 2008…

As the broad S&P tech sector tumbled…

S&P Energy sector plunged…

Credit markets blew wider in May (led by HY) and for now, VIX is holding in (even with its curve inversion)

HY Spreads are shouting their warning that something is up…

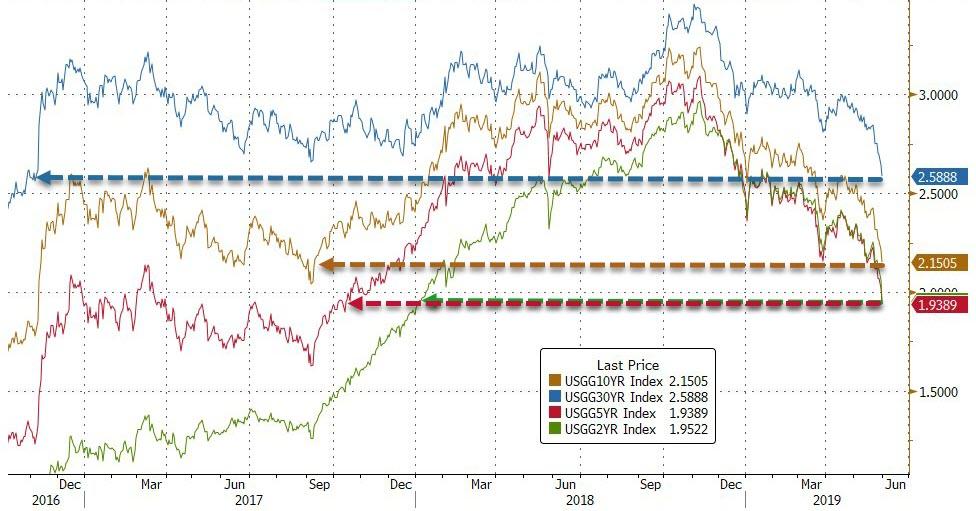

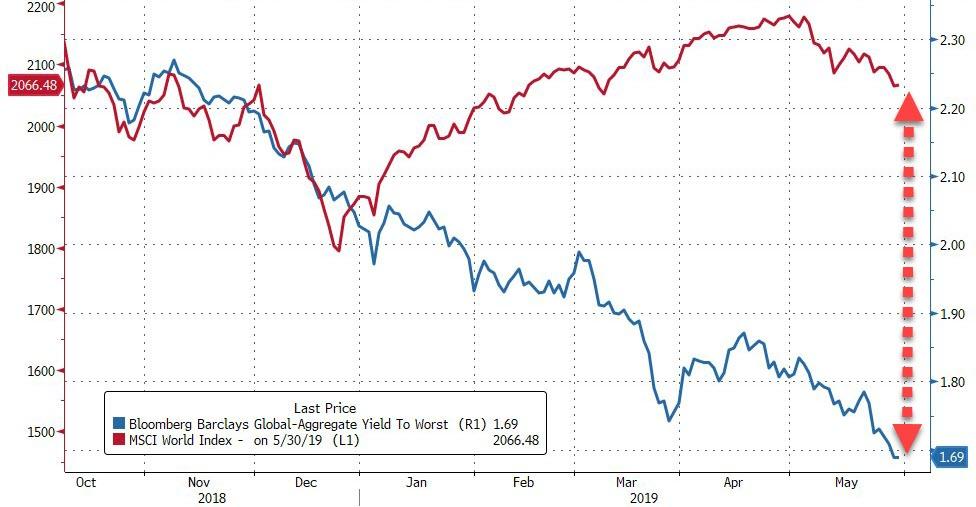

Treasury yields collapsed around 35bps on the month and accelerated lower this week despite talking heads claiming pension rebalancing would bid stocks and offer bonds into month-end…

This is the biggest May drop in yields since 2010, slamming yields to their lowest in years…

10Y hit 2.13% intraday as the yield plunge accelerated…

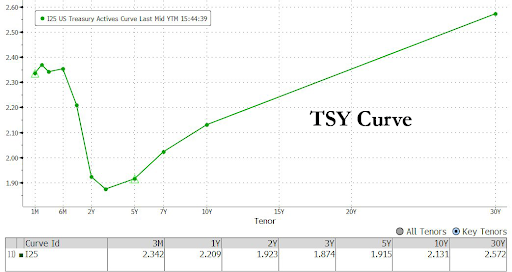

The yield curve crashed in May, inverting out to around the 15Y maturity…

With 3m10Y plunging to -22bps…

Inflation breakevens collapsed – the biggest monthly drop since December…

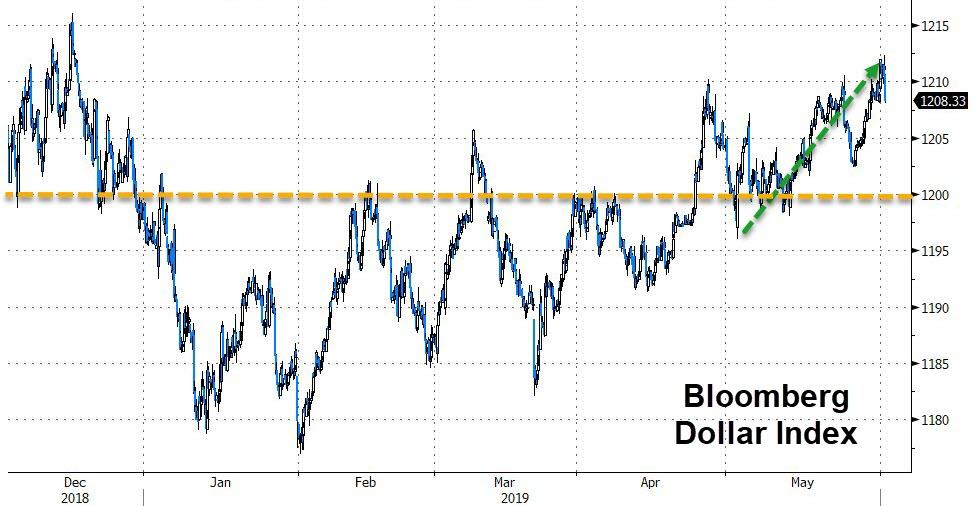

The Dollar Index rose for the 4th month in a row

And as the Dollar surged, EM FX cratered…

Cryptos managed to hold on to the week’s gains after yesterday’s ugliness…

This was Cryptos best month since August 2017…

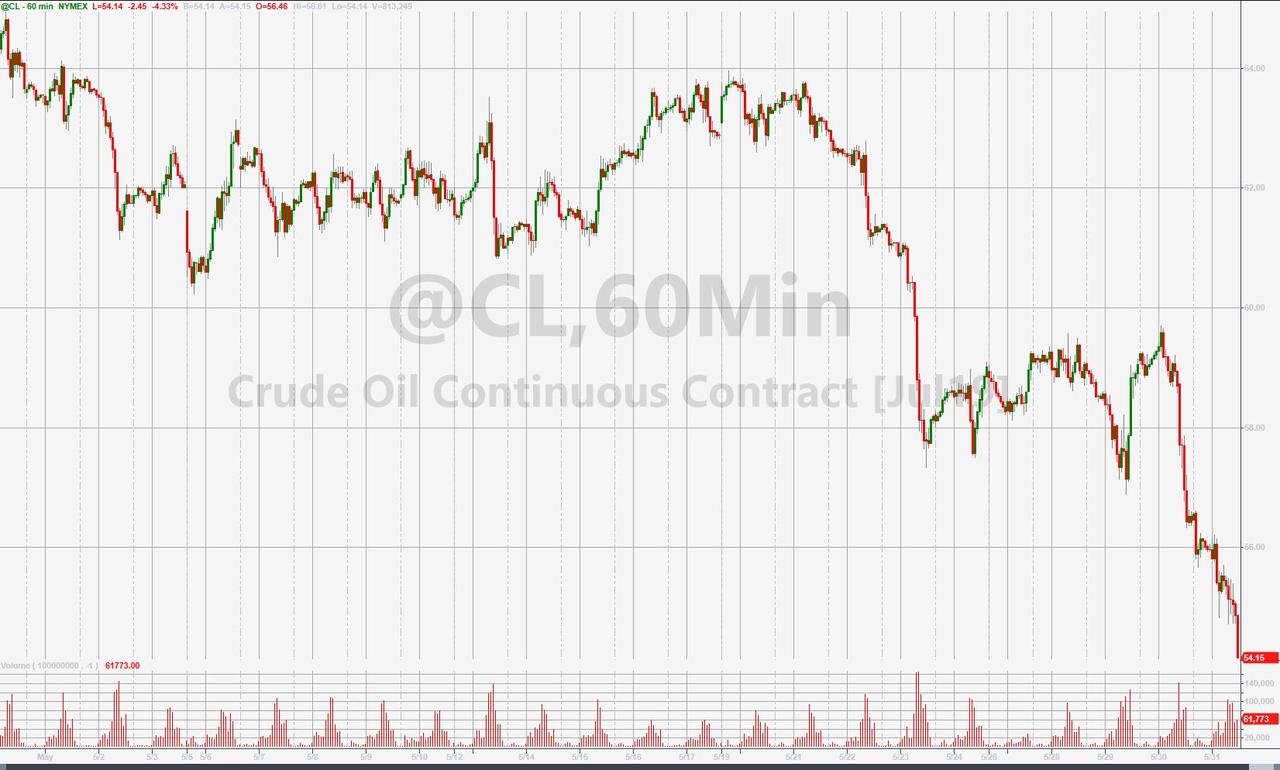

Ugly week for commodities broadly with crude getting crushed but gold managed solid gains…

And Gold managed gains on the month as WTI collapsed…

WTI’s worst month since November, tumbling back below $54…And worst May since 2012

Gold’s best month since January, soaring back above $1300…

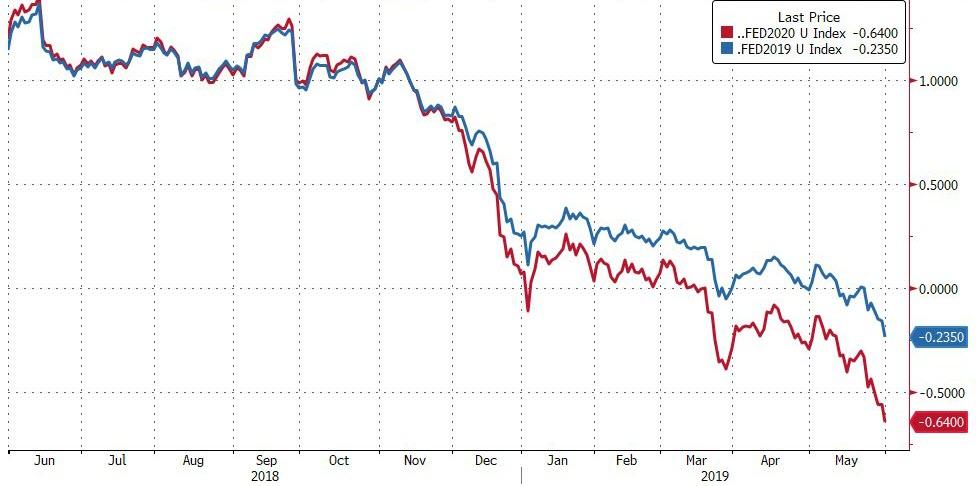

And finally, the market is pricing in 1 rate-cut in 2019 and 2.5 rate-cuts by the end of 2020…

Stocks will have to sink considerably for those expectations to come true…

via ZeroHedge News http://bit.ly/2EL9TNs Tyler Durden